SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Затраты на производство и деловая активность.

- 03 января 2017, 16:49

- |

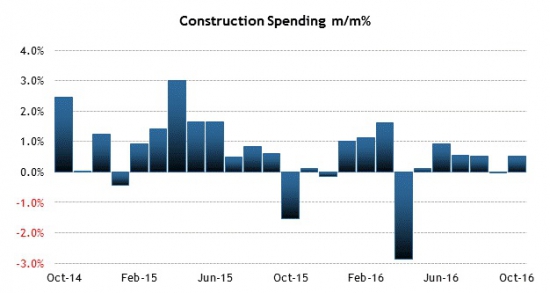

Затраты на производство ожидает новый восходящий цикл. Аналитики осторожны в своих оценках и дают консенсус-прогноз всего на уровне 0.5%:

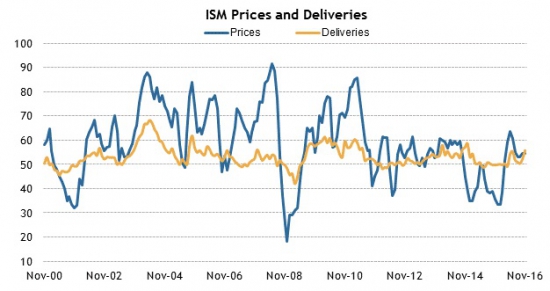

Более важный показатель ISM также демонстрирует восходящие ожидания:

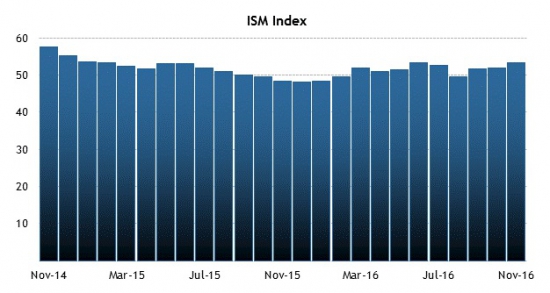

Несмотря на это, аналитики сходятся на прогнозе 52.8%, что является небольшим снижением относительно предыдущего показателя 53.6%:

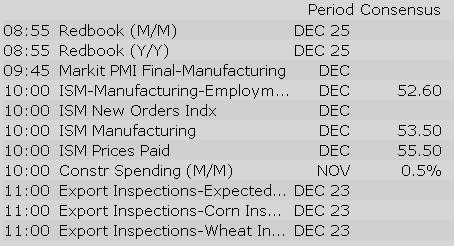

Весь список новостей:

Source: Briefing, Interactive and Public Sources.

27

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Gapping up, M&A related:

Gainers

Decliners

Upgrades

Downgrades

Calls:

Puts: