Блог компании DayTraderClub | Америка сегодня. Персональные доходы/расходы. Расходы на строительство, индекс деловой активности и продажи автомобилей.

- 01 марта 2017, 16:29

- |

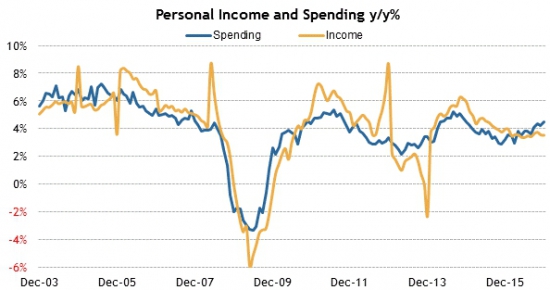

Данные по персональным доходам и расходам демонстрируют, что идёт этап насыщения. Рост доходов сопровождается неизменным уровнем расходов:

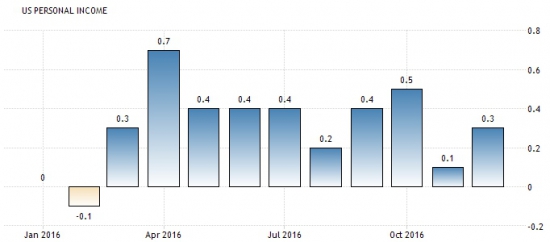

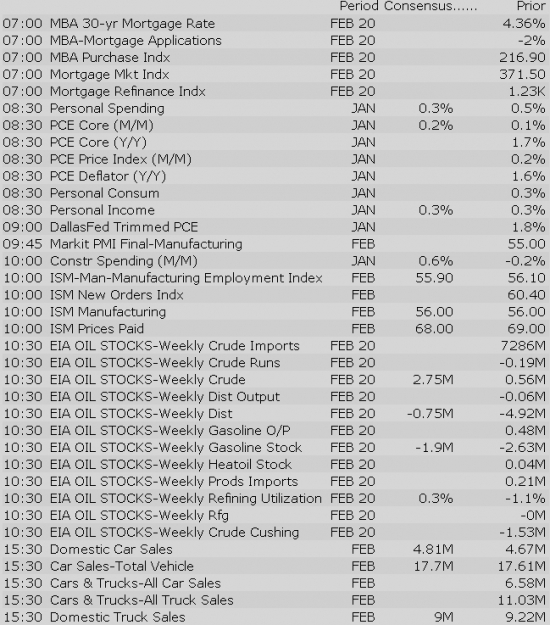

Такая же картина ожидается и в данных за январь, рост доходов прогнозируется на 0.3%:

А рост более волатильного показателя расходов ожидается на 0.2%:

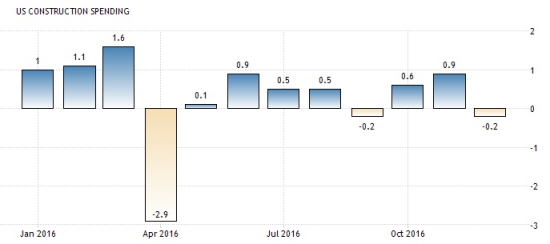

В данных по расходам на строительство происходит сезонный спад, но новое значение ожидается аналитиками выше нулевой отметки:

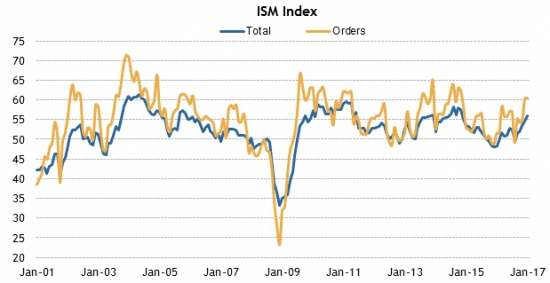

Локальный разворот ожидается аналитиками по индексу деловой активности. Новое значение осторожно прогнозируют на отметке 55.6, несмотря на мнения об акселерации бизнес-активности в 2017-м году:

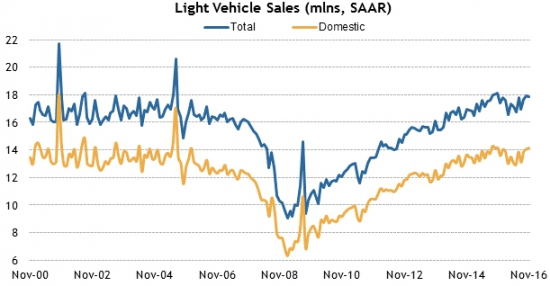

Продажи автомобилей продолжают бить рекорды и новый показатель по общемировым продажам более 18 миллионов за месяц подтвердит позитивные ожидания:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market updates:

US Econ Data

EVHC indicated down ~10% premarket

Equity indices in the Asia-Pacific region ended Wednesday on a higher note with participants bidding up stocks after President Donald Trump's first address to Congress went off without any big surprises. As expected, the president reiterated plans for infrastructure spending of $1 trillion and repeated his desire to reform the tax code. On a separate note, economic data from China and Australia was better than expected.

---Equity Markets---

---FX---

Major European indices trade higher across the board with Italy's MIB (+2.3%) setting the pace. In France, presidential candidate Francois Fillon vowed to continue his campaign even though he is expected to face charges for alleged misuse of public funds. The euro has spent the night in a slow retreat, trading lower by 0.5% against the dollar at 1.0525.

---Equity Markets---

Gapping down: PANW -19%, BW -15.2%, CYBE -12.8%, EVHC -12.1%, SRPT -10%, BBY -9.7%, IPXL -9.1%, NVDQ -7%, CFI -6.6%, SSW -6.3%, CLNS -6%, IBKC -5.6%, LQ -5.3%, ENPH -5%, AMBA -4.4%, CHUY -3.3%, CYBR -3.1%, QUMU -2.8%, BVN -2.4%, VSI -2.3%, CRM -2.1%, PTLA -2%, VEEV -1.9%, TSRO -1.8%, PFPT -1.7%, CHKP -1.6%, MXWL -1.6%, PRGO -1.5%, SFR -1.4%, GDX -1.4%, CBI -1.4%, CROX -1.4%, FTNT -1.3%, AG -1.2%, VOD -1.1%, ABX -1.1%, SYMC -1%, DRYS -1%, PBMD -1%, EGO -1%, AEM -1%, ETSY -1%, GG -0.9%, INTC -0.8%, GLD -0.8%, ROST -0.8%, HSY -0.8%, AIRM -0.7%, TASR -0.7%, HACK -0.6%, FEYE -0.5%

The NDA was granted Priority Review and has been given a Prescription Drug User Fee Act (PDUFA) action date of Aug. 30, 2017. Celgene completed the NDA submission in late December 2016. Enasidenib is part of Celgene's global strategic collaboration with Agios focused on cancer metabolism.

The Personal Income and Spending Report for January will be released at 8:30 a.m. ET. It is an important report that will factor directly into the first quarter GDP outlook; moreover, it will also factor directly into the Fed's monetary policy discussion since it includes the PCE Price Index, which is the Fed's preferred inflation gauge.

The Briefing.com consensus estimates for the key components of the report are as follows:

Income growth is expected to be suppressed somewhat by the weak wage growth seen in the January employment report. Personal spending, meanwhile, is expected to be somewhat modest due to the decline in unit motor vehicle sales and lower spending on utilities as unseasonably warm weather reduced demand for heating in January.

The ISM Manufacturing Index has been above 50.0% (the dividing line between expansion and contraction) for five straight months. With the release of the February ISM Manufacturing Index on Wednesday, that streak should be extended to six straight months.

According to the Briefing.com consensus estimate, the ISM Manufacturing Index is expected to check in at 56.1% for February. That would be little changed from the 56.0% reading registered in January, yet it would stand as the highest reading since November 2014.

The expected strength is tied in part to the strong readings seen in regional manufacturing surveys, including the Chicago Business Barometer released on Tuesday, as well as the Empire Manufacturing Survey and the Philadelphia Fed Index, the latter of which registered its highest reading in February (43.3) since November 1983.

The ISM Manufacturing Index report is watched closely given the sentiment it conveys about manufacturing activity on national level.

The report will be released at 10:00 a.m. ET.

Treasuries Slide Overnight on Hawkish Fed Speakers

Stocks with favorable mention: ATVI, CCL, CRM, DPZ, GOLD, HD, NFLX, NTAP, NVDA, PENN, SLB, TJX

Stocks with unfavorable mention: CDE, FGP, NCLH, OLN, OXY, RIG, SWN, TGT, TOO

Equity futures point to a solidly higher open on Wall Street this morning following President Trump's first address to Congress. The S&P 500 futures trade 13 points (0.6%) above fair value.

In his speech, the president reiterated his plans to boost infrastructure spending, cut taxes, repeal and replace the Affordable Care Act, bring down drug prices, and build up the military. And while the information didn't really provide investors with anything new, the pro-growth reminders have been enough to fuel a bullish sentiment this morning.

U.S. Treasuries are under pressure this morning after New York Fed President Dudley (FOMC voter) said that the case for raising interest rates has become «a lot more compelling» on Tuesday. The benchmark 10-yr yield currently trades four basis points higher at 2.44%.

Meanwhile, the U.S. Dollar Index (101.87, +0.54) trades at its seven-week high, up 0.5%, in the wake of Mr. Dudley's comments. The greenback has added 0.5% and 1.0%, respectively, against the euro and the Japanese yen.

Despite a strengthening U.S. dollar, crude oil holds a modest gain of 0.3% after the American Petroleum Institute (API) reported a build of 2.5 million barrels on Tuesday evening. WTI crude trades at $54.16/bbl ahead of today's Energy Information Administration (EIA) crude oil inventory report, which will be released at 10:30 am ET.

The weekly MBA Mortgage Applications Index, which was released earlier this morning, increased 5.8% to follow last week's 2.0% downtick.

Today's economic data will also include January Personal Income (Briefing.com consensus 0.4%) at 8:30 ET, January Construction Spending (Briefing.com consensus 0.6%) and February ISM Index (Briefing.com consensus 56.1%) at 10:00 ET, and the Fed's Beige Book for March at 14:00 ET.

Also of note, February Auto and Truck sales will be released throughout the day on Wednesday.

In U.S. corporate news:

Reviewing overnight developments:

Upgrades:

Downgrades:

Miscellaneous:

German Bunds See Worst Day Since January

The S&P 500 futures trade 17 points (0.7%) above fair value.

Just in, January personal income rose 0.4%, which is in line with the Briefing.com consensus. Meanwhile, January personal spending increased 0.2% while the Briefing.com consensus expected a reading of 0.3%. The December Personal Spending and Personal Income readings were both left unrevised at 0.5% and 0.3%, respectively.

Separately, Core PCE prices for January rose 0.3% (Briefing.com consensus 0.2%). The December reading was left unrevised at 0.1%.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength:

Select metals producers trading higher:

Select Gaming related names showing strength following release of Macau gaming revs rising 18% YoiY:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select Cyber Security related names showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength:

Select metals producers trading higher:

Select Gaming related names showing strength following release of Macau gaming revs rising 18% YoiY:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select Cyber Security related names showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

The S&P 500 futures trade 16 points (0.7%) above fair value.

Equity indices in the Asia-Pacific region ended Wednesday on a higher note with participants bidding up stocks after President Donald Trump's first address to Congress went off without any big surprises. As expected, the president reiterated plans for infrastructure spending of $1 trillion and repeated his desire to reform the tax code. On a separate note, economic data from China and Australia was better than expected.

---Equity Markets---

Major European indices trade higher across the board with Italy's MIB (+2.2%) setting the pace. In France, presidential candidate Francois Fillon vowed to continue his campaign even though he is expected to face charges for alleged misuse of public funds. The euro has spent the night in a slow retreat, trading lower by 0.5% against the dollar at 1.0525.

---Equity Markets---

Filings:

Offerings:

Pricings:

Equity futures point to a solidly higher open for the stock market on Wednesday morning following President Trump's first address to Congress yesterday evening. The S&P 500 futures currently trade 18 points (0.7%) above fair value.

Mr. Trump's speech went smoothly last night as the president took a more traditional, toned-down approach. He reiterated his plans to boost infrastructure spending, cut taxes, repeal and replace the Affordable Care Act, bring down drug prices, and build up the military, but did not really provide any «new» information. Nonetheless, the reminder has been enough to excite the bulls this morning.

U.S. Treasuries are under heavy selling pressure this morning after New York Fed President Dudley (FOMC voter) said that the case for raising interest rates has become «a lot more compelling» on Tuesday.

In addition, the PCE Price Index for January came in a little better than expected, showing an increase of 0.3% (Briefing.com consensus 0.2%) and providing further support for a March rate hike. Also of note, January personal income rose 0.4%, which is in line with the Briefing.com consensus, while January personal spending increased 0.2% (Briefing.com consensus 0.3%).

The benchmark 10-yr yield trades six basis points higher at 2.46% while the U.S. Dollar Index (101.90, +0.58) hovers at its seven-week high, up 0.6%.

In corporate news, retailers have dominated the earnings front again this morning. Lowe's (LOW 81.06, +6.69) has spiked 9.0% in pre-market trade after reporting better than expected earnings and revenues and issuing upbeat guidance, while Best Buy (BBY 42.73, -1.40) has tumbled 3.2% after missing on the top line and issuing disappointing guidance.

Investors will receive a few more economic reports on Wednesday--January Construction Spending (Briefing.com consensus 0.6%) and February ISM Index (Briefing.com consensus 56.1%) at 10:00 ET and the Fed's Beige Book for March at 14:00 ET--while February auto and truck sales will be released throughout the day.

The S&P 500 opened Wednesday's session with a solid 0.8% gain.

Financials (+2.4%) have provided the early lead with bank heavyweights JPMorgan Chase (JPM 93.12, +2.47), Wells Fargo (WFC 59.47, +1.57), and Bank of America (BAC 25.40, +0.80) trading higher between 2.6% and 3.2%.

Countercyclical sectors lag with utilities (-1.3%) showing relative weakness amid an uptick in interest rates. The benchmark 10-yr yield, which moves inversely to the price of the 10-yr Treasury note, is six basis points higher at 2.45%.

Economic Data Summary:

Upcoming Economic Data:

Other International Events:

The tech sector — XLK — trades modestly behind the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.83%. Within the SOX index, TER (+2.39%) outperforms, while SIMO (-0.44%) lags. Among other major indices, the SPY is trading 1.10% higher, while the QQQ +0.78% and the NASDAQ +1.92% trade higher on the session. Among tech bellwethers, YHOO (+1.62%) is showing relative strength, while VOD (-0.61%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Notable earnings/guidance:

- Trading higher following earnings/guidance: WTW +23.1%, LOW +9.8%, BGFV +9.3%, LINC +4.8%, GTN +4.6%, ILG +3.2%, DLTR +1.6%, HSY 1% (Hershey Foods announces initiatives for futures sales/earnings growth; expects to reduce workforce by 15%, announces related charges, issues updated guidance; reaffirms sales guidance), CHUY +0.7%

- Auto names trading higher following monthly sales: GM +1.4%, F +1.3%, FCAU +1.1%, NSANY +0.7%

- Trading lower following earnings/guidance: APEI -16.8%, AEO -11%, BBY -3.8%, ROST -3.5%, CROX -2.3%

In the news:Looking ahead:

— Shares of XOM +1.6%.

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.63… VIX: (12.25, -0.67, -5.2%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Rumor Activity was active today

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term