Блог компании DayTraderClub | Америка сегодня. ВВП, Мичиган и заказы на товары длительного пользования.

- 27 января 2017, 16:40

- |

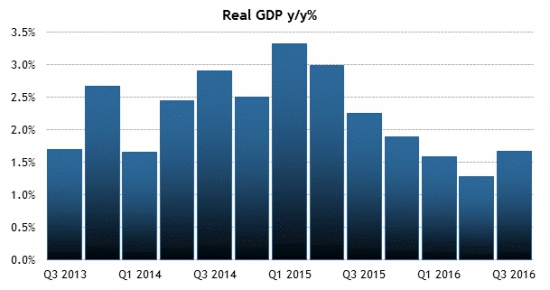

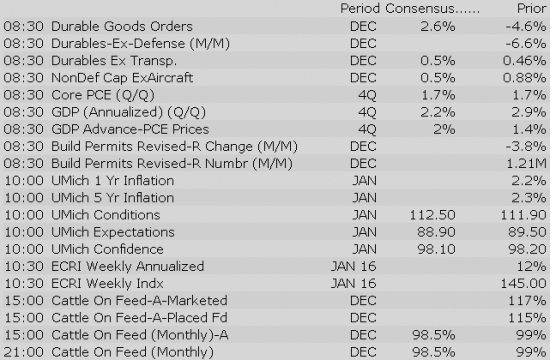

После предыдущего восхитительного квартала, показавшего рост ВВП на 3,5%, в данных за последний квартал 2016-го года аналитики настроены менее оптимистично и прогнозируют рост на уровне 2,2%:

Дальнейший потенциал роста ВВП является открытым и ближайшие несколько кварталов ожидается его продолжение:

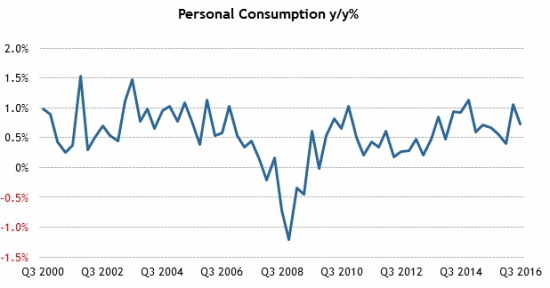

Потребительские расходы при этом подтверждают общий оптимизм, люди склонны тратить больше, когда вокруг всё хорошо и расходы растут:

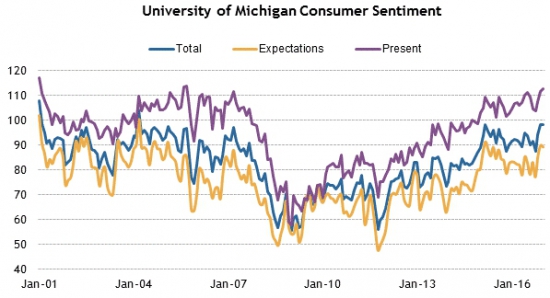

Также оптимизм подтверждается индексом доверия университета Мичиган, который находится и прогнозируется вблизи своих максимальных отметок:

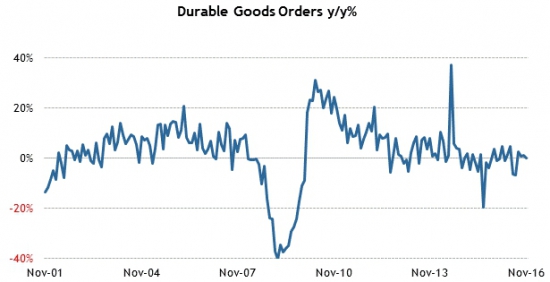

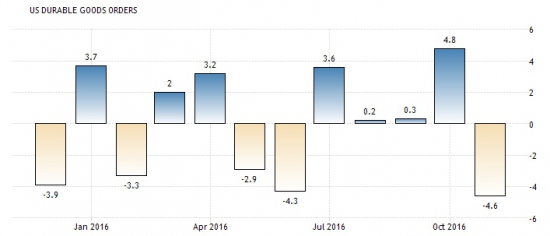

Под влиянием общего оптимизма также ожидается рост в заказах на товары длительного пользования:

Всплеск заказов ожидается к отметке в диапазоне 2.6 — 4%, на уровне прошлогоднего зимнего показателя:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

The European Medicines Agency's Committee for Medicinal Products for Human Use (CHMP) recommended eight medicines for approval at its January meeting.

Gapping down: ATHX -27%, WKHS -13.5%, ANY -5.9%, JNPR -5.5%, RHI -4.9%, APD -4.6%, PFPT -4.3%, SBUX -3.8%, ERIC -3.6%, CS -3.3%, FLEX -3.3%, CAFD -3.1%, UBS -3%, SWFT -2.7%, DCIX -2.5%, MSCC -2.4%, GOOG -1.6%, PUK -1.4%, PYPL -1.4%, DB -1.3%, BBVA -1.3%, BCS -1.2%, CLS -1.2%, HON -1.2%, CLS -1.2%, BP -1.1%, SDRL -1%, ABX -0.8%, FFHL -0.6%, RDS.A -0.6%, FFIN -0.6%, KEYW -0.6%, FB -0.5%

Major European indices trade in the red, but losses have been limited. The euro is higher by 0.1% against the dollar at 1.0688 while the pound has slid 0.4% to 1.2551. French Finance Minister Michel Sapin cautioned that time to reach an agreement on the next installment of the Greek bailout is running out. Greek officials have reportedly been asked to implement more austerity measures past 2018, but there has been pushback from the Greek side. On a separate note, British Prime Minister Theresa May is scheduled to meet with US President Donald Trump to discuss trade policy and the current state of NATO.

---Equity Markets---

Treasuries Edge Lower Ahead of U.S. GDP Report

Equity futures trade relatively flat this morning as investors digest a batch of earnings reports and eye a wave of influential economic data. The S&P 500 futures trade two points (+0.1%) above fair value.

U.S. Treasuries have given back yesterday's modest gains early this morning, with the 10-yr yield sitting one basis point higher at 2.52%. For the week, Treasuries reside in negative territory, having yet to recoup the big losses suffered on Tuesday and Wednesday.

Crude oil has slipped 0.7% this morning as the hike in U.S. production has outweighed OPEC/non-OPEC production cut efforts. WTI crude trades at $53.41/bbl.

Today's economic data will include advance fourth quarter GDP (Briefing.com consensus 2.2%) and December Durable Orders (Briefing.com consensus 3.0%) at 8:30 am ET, with the final reading of the Michigan Sentiment Index for January following at 10:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

Gapping up

In reaction to strong earnings/guidance:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness in sympathy with UBS earnings:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness in sympathy with UBS earnings:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

European Yields See Mixed Results Ahead of U.S. GDP Report

Filings:

Offerings:

Pricings:

The S&P 500 futures trade two points (0.1%) above fair value.

Equity indices in the Asia-Pacific region ended the week on a mostly higher note, but participation was reduced due to holiday closures in China, Singapore, and South Korea. The Japanese yen (115.07) is lower by 0.5% against the dollar after slipping in reaction to the Bank of Japan's announcement, indicating purchases of Japanese Government Bonds with maturities between five and ten years will be increased to JPY450 billion from JPY410 billion.

---Equity Markets---

Major European indices trade mixed, with the UK's FTSE (+0.1%) showing relative strength. The euro is higher by 0.1% against the dollar at 1.0688 while the pound has slid 0.4% to 1.2551. French Finance Minister Michel Sapin cautioned that time to reach an agreement on the next installment of the Greek bailout is running out. Greek officials have reportedly been asked to implement more austerity measures past 2018, but there has been pushback from the Greek side. On a separate note, British Prime Minister Theresa May is scheduled to meet with US President Donald Trump to discuss trade policy and the current state of NATO.

---Equity Markets---

Postponed IPOs:

Investors have not been particularly active on Friday morning, as the S&P 500 futures trade two points (+0.1%) above fair value.

A batch of high-profile technology names reported between Thursday's close and Friday's open, including Alphabet (GOOGL 855.00, -1.98), Microsoft (MSFT 65.10, +0.81), and Intel (INTC 37.89, +0.33). Microsoft and Intel are both up in pre-market trade after beating on their top and bottom lines, adding 1.4% and 0.9%, respectively, while Alphabet has slipped 0.2% after the company missed earnings expectations.

Starbucks (SBUX 56.25, -2.21) also reported quarterly results, dropping 3.8% after the coffee retailer reported disappointing revenues. Chevron (CVX 113.49, -3.13) is also down in pre-market trade, losing 2.7%, after the company missed top and bottom line estimates.

U.S. Treasuries have hit their overnight highs in recent action, with the 10-yr yield two basis points lower at 2.49%. The recent uptick came in the wake of the latest economic reports, which came in worse than expected.

Advance fourth quarter GDP pointed to an expansion of 1.9%, while the Briefing.com consensus expected a reading of 2.2%. The fourth quarter GDP Deflator came in at 2.1%, which is what the Briefing.com consensus expected.

December durable goods orders declined 0.4%, while the Briefing.com consensus expected a 3.0% increase. The prior month's reading was revised to -4.8% (from -4.6%). Excluding transportation, durable orders rose 0.5% (Briefing.com consensus +0.5%) to follow the prior month's revised gain of 1.0% (from 0.5%).

Today's last economic report, the final reading of the Michigan Sentiment Index for January (Briefing.com consensus 98.0), will cross the wires at 10:00 am ET.

— Shares of KLAC +3.3% pre-market.

General Commentary: The materials sector is trading lower by 0.5% which is under-performing the S&P 500 (-0.1%). Oil is trading lower by 0.2% in today's session. Gold prices are lower by 0.6%, while copper is down +0.0%. There is no notable M&A news in the sector today.

Earnings:

Gainers

Decliners:

News

Gainers

Decliners:

Analyst Actions

Gainers:

The S&P 500 opened Friday's session flat with its sectors split pretty evenly between green and red. The Nasdaq has an early edge on the benchmark index, up 0.1%.

Sector standings indicate a mild risk-off tone as most cyclical sectors post losses while defensive spaces generally sit higher. The telecom services sector (+1.0%) has emerged as the early leader, with health care (+0.3%) and technology (+0.3%) also outperforming the broader market.

Treasuries are up modestly, with the benchmark 10-yr yield down one basis point at 2.50%.

The tech sector — XLK — trades ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.86%. Within the SOX index, TER (+2.50%) outperforms, while NVDA (-0.45%) lags. Among other major indices, the SPY is trading 0.17% lower, while the QQQ -0.10% and the NASDAQ -0.99% also trade down on the session. Among tech bellwethers, INFY (+1.81%) is showing relative strength, while FB (-1.20%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings Monday morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.80… VIX: (10.77, +0.14, +1.3%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Economic Data Summary:

Upcoming Economic Data:

Other International Events of Interest

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Casino/gaming names are rebounding following WYNN earnings (group was pressured yesterday after LVS earnings). LVS +2%, PENN +1.9%, BYD +1.3%, PNK +1.3%, MPEL +0.9%, MGM +0.5%, BJK +0.1%, ISLE +0%, CZR +0.3%

- Starbucks (SBUX -4%) is weighing on food/restaurant related names. FRSH -2.5% (announces 2017 development incentive programs), NDLS -2.3%, TACO -1.7%, RRGB -1.6%, FRGI -1.7%, BWLD -1.5% (downgraded to Negative at OTR Global), HABT -1.4%, TAST -1.2%, PBPB -1.1%, FOGO -1.1%, PNRA -1%, WEN -0.9%, DIN -1%, TXRH -1.1%, CMG -0.8%, ZOES -0.7%, SONC -0.6%, PLKI -0.6%, JACK -0.5%, BLMN -0.6%, CBRL -0.5%, WING -0.4%

In the news:Looking ahead:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

- Aurinia (AUPH +6.23%) Selects Worldwide Clinical Trials as its CRO for Phase 3 Lupus Nephritis Trial

- Immunomedics (IMMU +1.53%) issues a statement to stockholders and announced it has filed an investor presentation with the SEC titled «The Right Board and the Right Strategy to Maximize Stockholder Value»

Decliners on news:- Novan (NOVN -77.01%) announces mixed top-line results from its two Phase 3 trials for SB204 in the treatment of acne vulgaris

- Athersys (ATHX -29.61%) prices underwritten public offering of 19,802,000 shares of its common stock at $1.01/share

- K2M Group (KTWO -4.93%) announces offering of 4 mln shares of its common stock by Welsh, Carson, Anderson & Stowe XI, L.P. and certain related affiliates

Gainers on earnings:- C.R. Bard (BCR +5.47%) beats by $0.03, beats on revs; guides FY17 EPS above consensus, revs in-line

- Abaxis (ABAX +3.73%) misses by $0.01, reports revs in-line with 1/10/2016 pre-announcement

Decliners on earnings:- Select Medical (SEM -3.62%) sees Q4 revs $1.05 bln vs $1.05 bln Capital IQ Consensus Estimate; sees Q4 Adjusted EBITDA of $92-102 mln

- OpGen (OPGN -3.24%) sees Q4 revs of ~$1 mln vs $1.10 mln single analyst estimate, sees Q4 net loss in the range of approximately $4.6-5.1 mln

- AbbVie (ABBV -2.35%) reports EPS in-line, misses on revs; guides FY17 EPS in-line

Upgrades/Downgrades:Stocks that traded to 52 week lows: AKR, ANF, ATHX, BONT, CBR, CL, COYN, CRAY, DIN, DRWI, DRYS, GBSN, GEVO, GNC, ICLD, ITEK, JASO, JCP, KONA, LB, LN, MDGS, MFIN, MIK, NH, NK, PGLC, RAD, RCII, RGSE, RWLK, SFM, SHLD, SPI, SQQQ, SSI, STKS, TGT, TUES, VICL, VMEMQ, VSI, WKHS, XON

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: CEE, CELP, CFCB, CHFN, CVCY, DAX, ESLT, ESXB, FHY, FSBK, HBMD, HFBC, IPKW, LAND, LGI, MGCD, MLVF, MMAC, NCOM, NEFF, NWFL, PACEU, PBIP, PMD, QYLD, SFST, SGM, SYNL, SZC, TBNK, UBOH, UPLD, WEBK

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: ISIG

ETFs that traded to 52 week highs: AMJ, HYG, JNK, OEF, QQQ, REMX, RSX, SMH, SOXX, XLK

ETFs that traded to 52 week lows: NIB, VXX

Biggest point losers: APD 140.73(-8.08), CHTR 325.58(-7.57), AYI 205.87(-6.15), MIC 78(-4.84), RHI 45.1(-4.83), PFPT 78(-4.63), EEQ 21.87(-4.1), CL 64.14(-4.1), EEP 21.95(-3.95), WHR 170.47(-3.47), SRCL 77.85(-3.14), COST 161.21(-2.86), TSLA 249.7(-2.81), EMN 77.54(-2.75), MCK 135.82(-2.73), AZPN 53.48(-2.61), CVX 114.01(-2.54), PNRA 207.47(-2.53), MTZ 39.14(-2.41), HP 72.71(-2.4), GS 237.2(-2.38), AAL 47.23(-2.36), CLX 119.34(-2.31), VRTS 108.55(-2.15), SBUX 56.33(-2.13)

Today's top 20 % gainers

- Healthcare: SGYP (6.3 +8.06%), BCR (238.29 +5.18%), ABAX (49.28 +4.41%)

- Materials: RYAM (17.23 +7.35%), VVV (24.06 +6.98%), GSV (2.74 +5.38%), POL (34.55 +4.57%)

- Industrials: TWI (12.75 +7.96%), PRIM (25.1 +4.37%)

- Consumer Discretionary: LRN (19.34 +14.91%), WYNN (103.36 +8.23%)

- Information Technology: CLS (14.26 +11.67%), MXIM (44.94 +7.08%), VMW (88.64 +5.25%), KLAC (87.51 +5.12%), OSIS (77.34 +5.04%), DVMT (62.59 +5%)

- Financials: GNBC (16.98 +6.09%), ISBC (14.74 +4.54%)

- Telecommunication Services: GSAT (1.49 +4.93%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: BMY (11.34 mln +3.61%), PFE (9.86 mln +0.51%)

- Materials: FCX (16.52 mln +4.27%), AKS (12.46 mln -2.44%)

- Industrials: GE (10.68 mln -1.01%), JBLU (9.24 mln -4.27%)

- Consumer Discretionary: SBUX (13.68 mln -3.37%), F (12.92 mln +0.81%), JCP (12.86 mln -5.02%), SIRI (10.09 mln +0.21%)

- Information Technology: INTC (21.21 mln +1.73%), MSFT (21.05 mln +2.28%), AMD (14.31 mln +1.05%), PYPL (11.1 mln -3.61%), QCOM (9.05 mln +0.54%), FB (8.94 mln -0.12%)

- Financials: BAC (24.32 mln -0.38%)

- Energy: CHK (10.14 mln -1.97%)

- Consumer Staples: RAD (22.59 mln -7.08%), CL (9.11 mln -6.01%)

Today's top relative volume (current volume to 1-month average daily volume)The broader market is mostly lower at the moment, led to the downside by the S&P 500 which loses 2 points (-0.08%) to 2294, the Dow Jones Industrial Average is lower by less than a point (-0.00%) to 20100, and the Nasdaq Composite also sheds less than a point (-0.00%) to 5655. Action has come on lower than average volume (NYSE 306 vs. avg. of 331; NASDAQ 748 mln vs. avg. of 781), with decliners outpacing advancers (NYSE 112/5/1814, NASDAQ 1061/1603) and new highs outpacing new lows (NYSE 116/17, NASDAQ 187/14).

Relative Strength:

Russia-RSX +2.4%, Silver Miners-SIL +2.0%, Coffee-JO +1.3%, Silver-SLV +1.3%, Jr. Gold Miners-GDXJ +1.2%, Copper-JJC +0.9%, Copper Miners-COPX +0.9%, Semis-SMH +0.9%, Mexico-EWW +0.8%, Peru-EPU +0.7%, Israel-EIS +0.6%, Indonesia-IDX +0.5%, Poland-EPOL +0.4%, Hong Kong-EWH +0.3%.

Relative Weakness:

Greece-GREK -3.6%, US Nat Gas-UNG -2.7%, S. Africa-EZA -2.4%, US Diesel/Heating Oil-UHN -2.0%, US Oil-USO -1.9%, Cocoa-NIB -1.9%, Commodity-GSG -1.4%, US Home Constr.-ITB -1.4%, Oil Svcs.-OIH -1.3%, Sweden-EWD -0.9%, Japan-EWJ -0.7%, Canada-EWC -0.6%, Japanese Yen-FXY -0.6%, Pacific-VPL -0.6%.

Rumor Activity was active today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The Industrials sector (XLI) is trading -0.1% today, higher than the broader market (SPY -0.4%). In the Industrial Sector big names like Honeywell (HON +0.5%), General Dynamics (GD +4.7%), and American Airlines (AL -5.4%) report quarterly results.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: SRCL -3.3% RHI -8.8% BDC -2.3% MOG.A +3.8% SWFT -1.1% HTLD -2% ATSG +4.9% MRTN -0.6% CMRE +1.7% GLOP +2.9% KEYW -15.6%

News

Broker Research

Upgrades

Downgrades

Other

Thursday's wait-and-see attitude has translated into range-bound action thus far in Friday's session, with the major averages having yet to deviate from their flat lines. The S&P 500 currently shows a slim loss of 0.1%.

There is a semblance of caution in the air--cyclical sectors are underperforming and Treasuries are up--but the slight apprehension has had a minimal impact on the market. Conversely, some earnings reports have shaken things up today, with a batch of tech names reporting between yesterday's close and today's open, including Alphabet (GOOGL 850.23, -6.88), Microsoft (MSFT 65.72, +1.45), and Intel (INTC 38.09, +0.52).

The tech sector (+0.4%) has been able to overcome Alphabet's below-consensus earnings, thanks in part to Microsoft's and Intel's better than expected top and bottom lines. Additionally, Intel's 1.3% advance has underpinned its fellow chipmakers thus far, pushing the PHLX Semiconductor Index higher by 0.9%.

Conversely, the energy sector (-1.2%) started the trading session in the hole after Chevron (CVX 113.83, -2.73) reported worse than expected top and bottom lines earlier this morning. Crude oil has also worked against the sector, losing 1.7%, as an uptick in U.S. production has outweighed the optimism surrounding OPEC/non-OPEC production cuts. The energy component currently trades at $52.82/bbl.

All-in-all most sectors trade in the red, with health care (+0.8%) and telecom services (+0.3%) the only sectors accompanying technology in the green. In addition to energy, financials (-0.5%), consumer discretionary (-0.5%), consumer staples (-0.7%), and real estate (-1.0%) have contributed to today's modest retreat.

U.S. Treasuries sit near their overnight highs, with the 10-yr yield down one basis point at 2.50%. However, Treasuries remain in negative territory for the week, having yet to recoup the big losses suffered on Tuesday and Wednesday.

Today's economic data included advance fourth quarter GDP, December Durable Orders, and the final reading of the University of Michigan Sentiment Index for January:

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.94… VIX: (13.60, +0.98, +1.0%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Monday

Tuesday

Wednesday

Thursday

Friday

SPAR +9% and STS +5% are strong following comments from REV Group's (REVG) CEO on CNBC this morning, noting the acquisitive history of the company. Rev Group makes specialty vehicles, which seems to have sparked speculation around smaller auto supplier peers Spartan Motors (SPAR) and Supreme Industries (STS) after REVG's IPO.

Dollar Rallies Despite Soft GDP Report