SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Показатели по рынкам труда и недвижимости.

- 19 января 2017, 16:28

- |

Еженедельный показатель заявок на пособия идёт в рост. Колебания показателя увеличиваются, наблюдается некоторая нестабильность на рынке труда:

Повторные заявки на пособия также находятся в краткосрочном восходящем тренде:

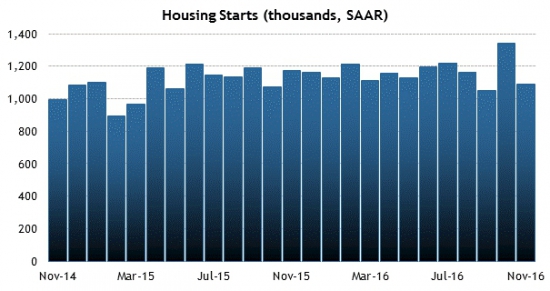

Объём строительства новых домов после разочаровывающего показателя в ноябре снова ожидается в рост к 1,2 млн.:

Также ожидается, что разрешений на строительство новых домов будет выдано также более 1,23 млн.:

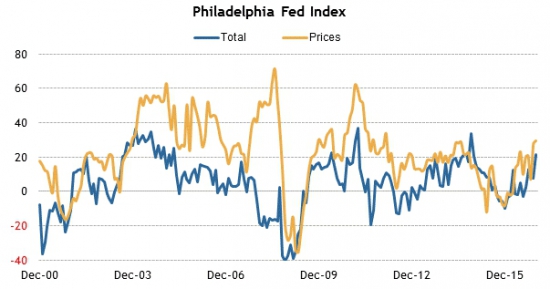

И завершающий показатель — индекс производственной активности ФРБ Филадельфии. Ожидается снижение к 16 базисным пунктам, что воспринимается аналитиками как хороший показатель:

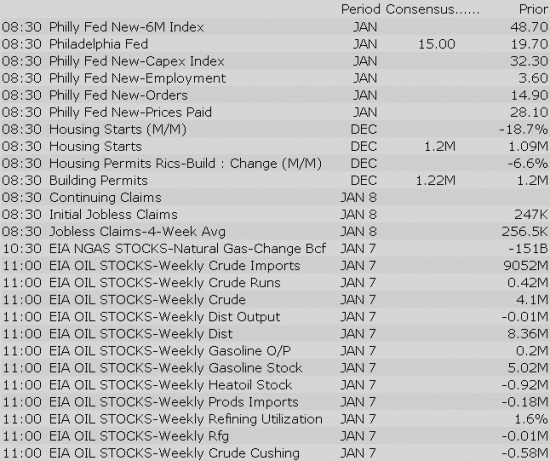

Все новости:

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market updates:

US Econ Data

Stocks with favorable mention: ASML, AVGO, BAC, BBT, CSX, EPD, FMC, HOG, NFLX, SPLK, SWKS, WHR

Stocks with unfavorable mention: AKAO, CMRE, GILD, M, PRGO, PSEC, TGT, WMT

Equity indices in the Asia-Pacific region ended Thursday on a mixed note. Japan's Nikkei (+0.9%) displayed relative strength, climbing as the yen held its ground after sliding during the Wednesday session on Wall Street. Employment data from Australia showed the third consecutive month of growth, but the pace of growth slowed down notably. Elsewhere, Nikkei discussed falling rents in Japan, which will make it more difficult for inflation to reach 2.0%.

---Equity Markets---

---FX---

Gapping down: AMDA -22.4%, RCII -12.7%, ZYNE -10.3%, VNOM -7.6%, KMI -4.6%, AAN -4.4%, HRTX -3.1%, HTGC -3%, EPE -2.9%, AKS -2.9%, GNC -2.6%, PLXS -2.3%, X -1.8%, ASML -1.6%, VALE -1.5%, FCX -1.2%, CP -1.2%, CP -1.2%, SBNY -0.9%, SBGL -0.8%, RDS.A -0.8%, ERIC -0.8%, PTC -0.8%, PTC -0.8%, SLM -0.8%, AA -0.5%

Major European indices trade close to their flat lines while the UK's FTSE (-0.5%) underperforms as the pound (1.2327) adds 0.6% against the dollar. The European Central Bank will release its policy statement shortly, but the market does not expect any dovish or hawkish surprises. However, as usual, participants will pay close attention to remarks from ECB President Mario Draghi, whose comments could lead to movement in the euro. The euro is currently up 0.3% at 1.0663 against the dollar.

---Equity Markets---

Treasuries Slip Ahead of ECB Decision

The S&P 500 futures trade three points below fair value as the U.S. and European equity markets digest the latest European Central Bank release, which left rates and stimulus programs unchanged, as was widely expected. ECB President Mario Draghi will host a press conference to discuss the outlook for policy at 8:30 ET, which is more uncertain and could lead to some market volatility.

Crude oil has bounced back from yesterday's decline after the International Energy Agency reported that global oil markets were constricting. The energy component has added 1.1% and currently trades at $51.64/bbl.

U.S. Treasuries have carried Wednesday's bearish trend into this morning. The benchmark 10-yr yield is near its overnight high, up five basis points at 2.44%.

Today's economic data will include Initial Claims (Briefing.com consensus 252,000), Housing Starts (Briefing.com consensus 1.193 million), and Philadelphia Fed (Briefing.com consensus 15.3). All three reports will cross the wires at 8:30 a.m. ET.

In U.S. corporate news of note:

Reviewing overnight developments:

Shares of NFLX hit all time highs ($146) in immediate reaction; Shares are up 7% in pre-market trade as it slips back to $143.75.

ECB Leaves Rates on Hold

Upgrades:

Downgrades:

Miscellaneous:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select Rail names showing strength after Hunter Harrison steps down as Canadian Pacific CEO to 'pursue opportunities involving other Class 1 Railroads':

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

Today's IPOs:

Upcoming IPOs:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select Rail names showing strength after Hunter Harrison steps down as Canadian Pacific CEO to 'pursue opportunities involving other Class 1 Railroads':

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade two points (-0.1%) below fair value.

Equity indices in the Asia-Pacific region ended Thursday on a mixed note. Japan's Nikkei (+0.9%) displayed relative strength, climbing as the yen held its ground after sliding during the Wednesday session on Wall Street. Employment data from Australia showed the third consecutive month of growth, but the pace of growth slowed down notably. Elsewhere, Nikkei discussed falling rents in Japan, which will make it more difficult for inflation to reach 2.0%.

---Equity Markets---

Major European indices trade close to their flat lines while the UK's FTSE (-0.4%) underperforms as the pound (1.2327) adds 0.6% against the dollar. The European Central Bank made no changes to its policy stance, keeping its Deposit Facility Rate and Main Refinancing Rate at a respective -0.4% and 0.0%, as expected. During his press conference, ECB President Mario Draghi struck a dovish tone, leading to a slide in the euro, which is currently down 0.2% at 1.0609 against the dollar.

---Equity Markets---

The S&P 500 futures trade one point below fair value after the European Central Bank decided to keep its current policy stance, as was widely expected. ECB President Mario Draghi made dovish-sounding remarks in his press conference following the ECB decision, leading to a retreat in the euro. The single currency is down 0.3% against the dollar at 1.0603.

U.S Treasuries remain in negative territory, but have seen an uptick in buying interest following the ECB decision. The 10-yr yield is up two basis points at 2.45%.

On the corporate front, Netflix (NFLX 142.35, +9.19) is up 6.9% in pre-market trade after reporting better than expected quarterly results and upside Q1 guidance. The company saw its largest ever quarter of net additions, driven by strong acquisition trends in both US and International segments.

Investors received a batch of economic data earlier this morning, with the Philadelphia Fed Survey deviating furthest from expectations. The report for January rose to 23.6 from a revised 19.7 (from 21.5) while economists polled by Briefing.com had expected a reading of 15.3.

Separately, housing starts increased to a seasonally adjusted annualized rate of 1.226 million units in December, up from a revised 1.102 million units in November (from 1.09 million). The Briefing.com consensus expected starts to increase to 1.193 million units. Building permits decreased to a seasonally adjusted 1.210 million in December from an upwardly revised 1.212 million (from 1.201 million) for November. The Briefing.com consensus expected a reading of 1.217 million.

The latest weekly initial jobless claims count totaled 234,000 while the Briefing.com consensus expected a reading of 252,000. Today's tally was below the revised prior week count of 249,000 (from 247,000). As for continuing claims, they declined to 2.046 million from the revised count of 2.093 million (from 2.087 million).

Economic Data Summary:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The stock market opened Thursday flat as investors appear to have a wait-and-see mentality preceding Inauguration Day.

Industrials (+1.1%) have jumped out to an early lead with railroad stocks pacing the advance, while non-cyclical sectors populate the bottom of the leaderboard as four of the five are in negative territory.

Energy (-0.4%) has underperformed thus far despite an uptick in crude oil. The commodity currently hovers near its overnight high, up 1.2% at $52.51/bbl after the International Energy Agency reported that global oil markets were constricting.

Treasuries have bounced back from their overnight lows, but remain below their flat lines. The 10-yr yield is up three basis points at 2.46%.

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.80… VIX: (12.44, -0.04, -0.3%).

Tomorrow is options expiration — Tomorrow, January 20th is the last day to trade January equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.13%. Within the SOX index, AMD (+2.63%) outperforms, while MU (-1.52%) lags. Among other major indices, the SPY is trading 0.14% lower, while the QQQ +0.07% and the NASDAQ -0.07% trade opposite on the session. Among tech bellwethers, TMUS (+2.46%) is showing relative strength, while AMX (-0.89%) lags.

Notable gainers following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

- Biocept (BIOC +9.93%) Awarded Patent in Australia for the Use of Antibodies in Microchannels to Capture Circulating Tumor Cells and Other Rare Cells

- ViewRay (VRAY +13.99%) raised aggregate gross proceeds of approximately $26.1 million through a private placement of its common stock and warrants

- Catabasis Pharma (CATB +12.77%) announces the publication of Phase 1 data on Edasalonexent in adult subjects in the Journal of Clinical Pharmacology; data demonstrates that edasalonexent was safe, well tolerated, and inhibited activated NF-kB in adult

Decliners on news:- Amedica (AMDA -31.6%) prices public offering of common stock/warrants at $0.51 for one share of common stock and 0.45 warrants for gross proceeds of approx $4.5 mln

- Zynerba Pharma (ZYNE -14.56%) prices underwritten public offering of 2.8 million shares of its common stock at a price of $18.00 per share for proceeds of about $50.4 mln

- Can-Fite Biopharma (CANF -6.22%) announces $5 mln registered direct offering at $2.00/share

Upgrades/Downgrades:Biggest point losers: ALGN 90.99(-3.43), BIIB 280.36(-3.25), ZYNE 19.24(-3.22), GS 231.81(-2.48), SPG 184.23(-2.34), AGN 214.4(-2.16), ASML 120.81(-2.16), AAN 30.2(-2.11), X 32.84(-2.09), ALXN 133.82(-2.05), FUL 48.39(-2.04), FLT 150.43(-1.95), CELG 113.3(-1.92), PVH 91.63(-1.73), NUE 60.66(-1.73), SHPG 164.72(-1.69), TSO 79.98(-1.65), BIDU 174.98(-1.56), AMT 104.14(-1.53), NVS 70.42(-1.47), XOM 84.91(-1.37), MPET 11.95(-1.21), JBHT 96.83(-1.2), CCI 86(-1.2), STLD 36.08(-1.19)

Notable earnings/guidance:

- Trading higher following earnings/guidance: NFLX +5.4%, BSET +0.9%

- Lower following guidance: RCII -14.6% (Rent-A-Center sees Q4 EPS loss well below the consensus estimate)

In the news:- Leaders: LQ 0.6% (La Quinta Holdings says pursuing the separation of its businesses into two stand-alone publicly traded companies)

- Laggards: AAN -6.8% (RCII sympathy), INN -2.6% (appointed President and Chief Executive Officer, Daniel Hansen, to the additional post of Chairman of the Board), MDLZ -0.9% (Mondelez Int'l to sell most of its grocery business in Australia and New Zealand to Bega Cheese for A$460 mln), PIR -1.1% (Alden Global lowers active stake to 4.3%; continues to believe there is substantial upside), KORS -1.6% (lower despite renewed M&A chatter making the rounds)

- Nearly unchanged: AMZN (EU says welcomes steps taken by Amazon/Audible and Apple (AAPL) to improve competition in audiobook distribution)

Other notable trends:- QSR/restaurant names are under pressure: RUTH -3.3%, NDLS -2.3%, RT -2.3%, SONC -2.1%, FOGO -1.7%, TAST -1.8%, DFRG -1.7%, PBPB -1.7%, PLKI -1.8%, BWLD -1.6%, TXRH -1.4%, LOCO -1.4%, EAT -1.4%, DIN -1.3%, QSR -1.3%, BLMN -1.1% (downgraded to Neutral from Buy at Goldman), FRSH -1.1%, CAKE -1%, SHAK -1.1%, ZOES -0.8%, JACK -0.7%, FRGI -0.7%, RRGB -0.7%

Analyst related:Rumor Activity was very active today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

Stocks that traded to 52 week lows: AMDA, ANTH, AVGR, BONT, BPTH, CASC, COYN, DCTH, DIN, DRYS, ECYT, EMG, EVC, EYES, FIT, FLKS, GBSND, GMAN, GNC, HIMX, HOTR, ICLD, IPWR, JRJC, KONA, LTBR, MACK, MARK, RNVA, RXII, SQQQ, TWER, VLRS, VNCE, VSI, VSTO

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: CIVB, ENFC, FTCS, GFY, GRVY, GSH, LARK, MIND, NTIC, NVEC, OPOF, OVLY, OXBR, PACEU, PBBI, PBNC, PPSI, QQXT, RILY, RUSHB, SHI, UPLD, USAP

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: ATAI, CGG, DFBG, GSIH, SPI

ETFs that traded to 52 week highs: IWF, QQQ, SKYY, XLK

Today's top 20 % gainers

- Healthcare: TDOC (18.98 +11.62%), NVCR (6.8 +5.35%), MNK (48.99 +5.29%), HRTX (13.48 +5.27%),

- Materials: FBR (10.19 +4.84%)

- Industrials: CSX (43.42 +17.72%)

- Consumer Discretionary: XRS (79.39 +5.97%), NFLX (140.45 +5.4%)

- Information Technology: OCLR (9.29 +14.21%), CHKP (95.91 +7.02%), PTC (50.02 +5.57%), FNSR (30.39 +5.45%), DDD (16.9 +4.97%)

- Financials: FNBC (6.3 +9.57%)

- Energy: CCJ (11.74 +8.2%), PDS (5.84 +6.18%), LPG (10.99 +4.67%), UNT (26.79 +4.65%), CPLP (3.5 +4.57%), TGP (17.2 +4.24%)

Today's top 20 % losersToday's top 20 volume

- Materials: VALE (11.55 mln -1.31%), X (10.53 mln -5.95%), AKS (9.54 mln -6.16%), MT (8.43 mln -1.64%)

- Industrials: CSX (47.64 mln +17.72%), GE (11.35 mln +0%)

- Consumer Discretionary: NFLX (13.91 mln +5.4%), F (10.61 mln +0.21%)

- Information Technology: AMD (21.03 mln +2.28%), OCLR (17.28 mln +14.21%), MU (16.66 mln -1.72%), AAPL (10.02 mln +0.02%)

- Financials: BAC (37.88 mln -0.15%), KEY (10.77 mln -1.79%), C (10.09 mln -1.06%), WFC (7.62 mln +0.06%), MS (7.2 mln -1.91%)

- Energy: CHK (22.82 mln -3.44%)

- Consumer Staples: RAI (11.17 mln +0.99%)

- Telecommunication Services: S (13.22 mln +2.52%)

Today's top relative volume (current volume to 1-month average daily volume)The broader market is breaking down at the moment, near lows of the session as the Dow Jones Industrial Average loses about 35 points (-0.17%) to 19770, the S&P 500 is lower by 4 (-0.16%) to 2268, and the Nasdaq Composite is down about 3 (-0.05%) to 5552. Action has come on lower than average volume (NYSE 264 vs. avg. of 345; NASDAQ 789 mln vs. avg. of 806), with decliners outpacing advancers (NYSE 700/2251, NASDAQ 804/1942) and new highs outpacing new lows (NYSE 63/14, NASDAQ 73/30).

Relative Strength:

US Nat Gas-UNG +2.2%, Sugar-SGG +1.2%, Brazil-EWZ +1.0%, Coffee-JO +0.9%, Philippines-EPHE +0.8%, Cotton-BAL +0.8%, Saudi Arabia-KSA +0.6%, New Zealand-ENZL +0.6%, Transportation-IYT +0.6%, Industrials-XLI +0.6%, Australia-EWA +0.5%, Shipping-SEA +0.5%, Latin Am. 40-ILF +0.4%, Australian Dollar-FXA +0.4%.

Relative Weakness:

Egypt-EGPT -4.9%, Cocoa-NIB -3.4%, Metals&Mining-XME -2.1%, Steel-SLX -2.1%, Rare Earth Metals-REMX -1.9%, Turkey-TUR -1.8%, Greece-GREK -1.6%, Silver Miners-SIL -1.3%, Retail-XRT -1.3%, Jr. Gold Miners-GDXJ -1.2%, Vietnam-VNM -1.1%, Thailand-THD -1.0%, Japanese Yen-FXY -0.9%, Russia-RSX -0.9%.

Today's session has been underpinned by a wait-and-see approach with investors unwilling to make a push in either direction before tomorrow's Presidential Inauguration. The mentality has left the major averages relatively flat with the S&P 500 down a modest 0.2%.

President-elect Trump's unexpected victory in the November 8th presidential election sent the stock market on a huge run as participants bought the promises of deregulation and increased infrastructure spending. However, after having a couple of months to price-in said promises, all investors can do is watch as only time will tell if the dream becomes a reality.

However, today's story had the potential to be a bit different as the European Central Bank made their latest policy decision earlier this morning. But all the hype was put to rest as the ECB left rates and stimulus programs unchanged and ECB President Mario Draghi struck a dovish tone in his post-decision press conference. The euro did slide a bit, and is currently down 0.1% against the dollar, trading near 1.0620.

On the sector leaderboard, industrials (+0.5%) have led the way since the opening bell with railroads giving the sector an extra push. CSX (CSX 44.03, +7.13)has spikedfollowing a Wall Street Journal report that Hunter Harrison will pursue changes at CSX after leaving Canadian Pacific (CP 152.54, +7.40). Telecom services (+0.3%) is the only other sector in positive territory.

At the bottom of the leaderboard is energy (-0.7%) amid the Energy Information Administration's report that crude oil inventories had a build of 2.3 million barrels while the consensus called for a draw of 0.342 million barrels. The energy component has fallen from its session high, but remains up 0.3% and $52.06/bbl.

Financials (-0.5%) and health care (-0.5%) are also notable movers with the latter suffering from a disappointing showing from its biotech components. The three largest biotech names, Amgen (AMGN 153.88, -1.88), Gilead Sciences (GILD 71.50, -0.63), and Celgene (CELG 113.64, -1.58) are all down between 1.0% and 1.5%.

U.S. Treasuries have resided in negative territory for the duration of today's action and currently hover near their session lows. The yield curve has steepened as the front end of the curve has held up a bit better than the back end; the 2-yr yield is one basis point higher at 1.23% while the 30-yr yield is up five basis points at 3.06%.

Today's data included Initial Claims, Housing Starts, and Philadelphia Fed Survey:

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.86… VIX: (12.53, +0.05, +0.4%).

Tomorrow is options expiration — Tomorrow, January 20th is the last day to trade January equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

General Electric (GE) is set to report Q4 results before the bell tomorrow (8:30am ET). Cap IQ Consensus estimates Q4 EPS of $0.46 (vs. $0.52 in 4Q16), w/revs of $33.67 bln ( +0.4% y/y).

Guidance

On the Q4 earnings call investors will be listening for additional color regarding the co's merger with Baker Hughes (BHI) that was announced on October 31st, updates on the co's 2017 plan to build a strong digital initiatives and plans regarding an invest in a GE Store, any new information regarding the co's accounting practices (the WSJ ran a story detailing how the SEC has been critical of GE's non GAAP accounting practices on 11/15, the SEC took no action), and the effect of a potential non-Bank SIFI designation for GE moving forward. Comments from the incoming Administration suggests Any potential new legislation would not allow the Financial Stability Oversight Council. Metlife (MET) won a federal court case to throw out its «too big to fail» label and this would benefit GE and other insurers.

Peers

Additional Highlights from December 14 Investor Presentation

Highlights from Last Quarter

Options Activity

Analyst Commentary

IBM (IBM) will report Q4 results tonight after the bell with a conference call scheduled to start at 5:00 p.m. ET. Usually, IBM reports within the first 10 minutes after the bell.

IBM will guide for FY17 in the press release.

On October 17, IBM reported Q3 EPS of $3.29 vs $3.23 Consensus Estimate on revs of $19.23 bln (down less than 1% Y/Y) vs $19.0 bln Consensus Estimate. The co also reaffirmed FY 16 EPS guidance.

Revs by segment in Q3: Cognitive Solutions — $4.2 bln, +4.5%; Global Business Services — $4.2 bln, -0.4% or -1.6% adj for currency; Tech Services & Cloud Platforms — $8.7 bln, +2.4% or +1.4% adj for currency; Systems — $1.6 bln, -21% or -21.5% adj for currency; Global Financing — $412 mln, -7.9% or -9.2% adj for currency

Other notables from Q3:

On January 12, Stifel raised its target to $192 from $165. Stifel notes, «It is difficult to attribute the outperformance (referring to the co's outperformance vs the S&P) to any one thing; however, it most likely reflects some combination of their ability to modestly exceed consensus rev and EPS ests for three consecutive quarters, while tracking to the high end of their annual FCF guide, IBM's commitment to the dividend despite the second consecutive year of earnings declines (8% increase late April, current dividend yield 3.3%), and a belief that the worst is behind them (rev and earnings compression)»

The Industrials sector (XLI) is trading +0.6% higheer today, higher than the broader market (SPY -0.3%). In the industrial sector, Canadian Pacific (CP +4.2%) and Union Pacific (UNP +2.5%) report Q4 earnings, Outgoing Canadian Pacific (CP +4.2%) CEO Hunter Harrison said to partner with an activist investor to push for changes at CSX (CSX +20.2%), and Icahn Enterprises (IEP +2%) completes tender offer for shares of Federal-Mogul (FDML -0.1%). Looking ahead, GE (GE -0.3%) and Rockwell Collins (COL -0.4%) report earnings tomorrow morning.

Earnings/Guidance

Additional Industrials moving on Earnings/guidance: CLC +0%, INN -1.6%, GATX +4.3%

News

Broker Research

Upgrades

Downgrades

Other