Блог им. st-travich

Bears grabbed the Dollar 😬 + video

- 31 июля 2022, 19:36

- |

Good day, Traders!

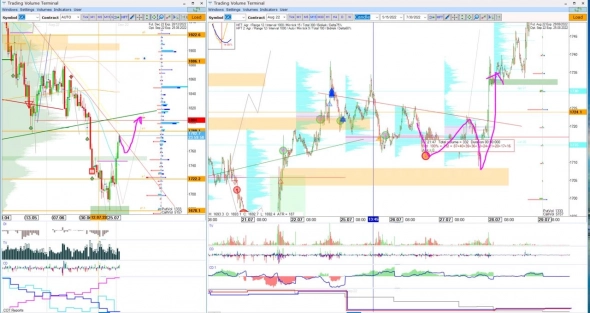

🔻 The dollar index (DX) really did a higher high of 107.30 on Wednesday, as I expected. The Bid HFTs’ on Tuesday with reaction to the upside informed us that MM took the position of big seller and needed to unload it, and only then the price could go to the downside. On Friday the asset was rejected from the commercial level 105.40, where hedgers closed their short position at a loss before. But I don’t expect uptrend continuation, as there is no fuel for new positions opening here. More likely it will be a descending sideways trend. (See)

🔻 Let's take a look at Nasdaq (NQ), what do we see?! HFT volumes on market close at 13 000 price level. At first glance, we can think that these are stop losses, but in fact, if we look inside, these are market buys. Hedge funds are active buyers despite expensive prices, they use bear liquidity due to very bad news of the official recession in the US and monetary tightening. And after MM unloads these buys and will make traders involved more in the market sales, from the strong resistance level, the price will go higher. (See)

🔻 As you remember in Euro (6E) we established 1.02725 — 1.03 as a strong supply zone. The price rejected it all week. And for today it is really hard to say what will be next. To my mind, we will make a breakout of this zone next week but after pullback. (See)

🔻 Gold (GC), after it was overbought the previous week, went down a bit, and after stops activation and involvement in shorts from the descending local channel, made a strong breakup and continued to rise. Now the price closed on the downtrend line on the daily chart and after some pullback also will go to break it out. Funds will continue to liquidate their strong short position which was accumulated from the march. (See)

🔻 Do you remember that we astablished that strong limit level of 8.208 on Natural gas (NG)? The effort was not enough and the price is fixed above it and went much higher after the retest. But now Gas returned to this magnet, so if it will be broken on Monday we have a good chance to fall more! Now we stay under commercial level. (See)

🔻 On Soybeans (ZS), we saw a huge tick chain near support of the uptrend line, as you remember this means that hedge funds sold into the liquidity, and the price for sure will go lower to the next volume level after its breakdown. (See)

🔻 And finally, Coffee (KC) is 100% according to my forecast. You can take a look at the previous video, maybe it will be helpful for you to get a better understanding of market behavior. (See)

📹 And tap the link to see the NEW 10-minute video ⬅️

If you will enjoy this review, please don’t forget to put the like button and subscribe to the NEW English youtube channel. Thank you for your attention!

Good Luck!

Sincerely, Taras Sviatun

Team Trading Volume Terminal

- 31 июля 2022, 21:39

теги блога Wilson Trade

- 6A

- 6B

- 6C

- 6E

- 6j

- 6N

- 6S

- analysis

- ask

- bid

- BR

- Brent Oil

- British pound

- CAD

- CC

- CL

- CME

- Cocoa

- corn

- COT

- CoT reports

- COT отчет

- COT отчеты

- Crude Oil

- DXY

- ES

- Euro

- futures

- GC

- Gold

- hft

- HG

- KC

- Larri Willams

- larry williams

- Market profile

- natural gas

- NG

- Oil

- PL

- Platinum

- S&P500

- SB

- SI

- Silver

- soybeans

- Sugar

- trade

- trader

- traders

- trading

- wheat

- YM

- ZC

- ZN

- ZS

- ZW

- автоуровни

- аналитическая статья

- бизнес

- биткоин

- газ

- Евро

- золото

- Иена

- Инвестиции

- канадский доллар

- китай

- корреляция

- Мазут

- медь

- на чем заработать

- нефть

- новая ниша бизнеса

- ОИ

- опционы

- открытый интерес

- оффтоп

- Палладий

- перспективы роста

- платина

- полезная информация

- серебро

- советы для начинающих

- СОТ

- СОТ отчеты

- стартапы

- сша

- торговые стратегии

- трейдер

- трейдинг

- трейдинг для начинающих

- уровни

- фонды

- форекс

- фрс

- Фунт

- фьючерс

- ФЬЮЧЕРСЫ