SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Рынки труда и недвижимости.

- 23 марта 2017, 15:23

- |

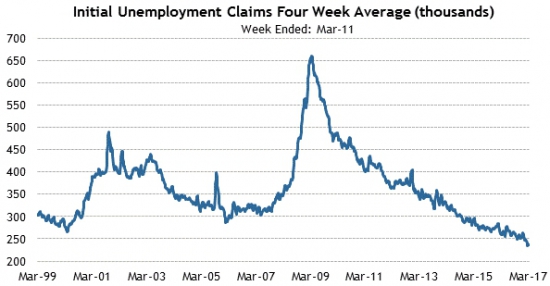

Рынок труда продолжает наращивать рабочие места, количество обращений за пособиями сокращается:

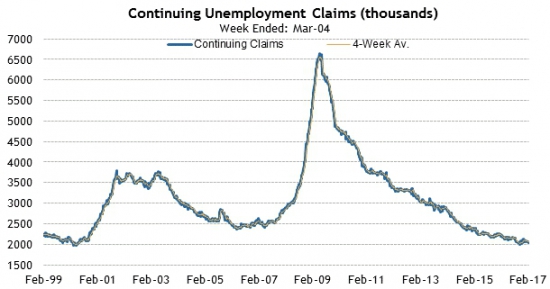

Повторных обращений за пособиями также становится меньше:

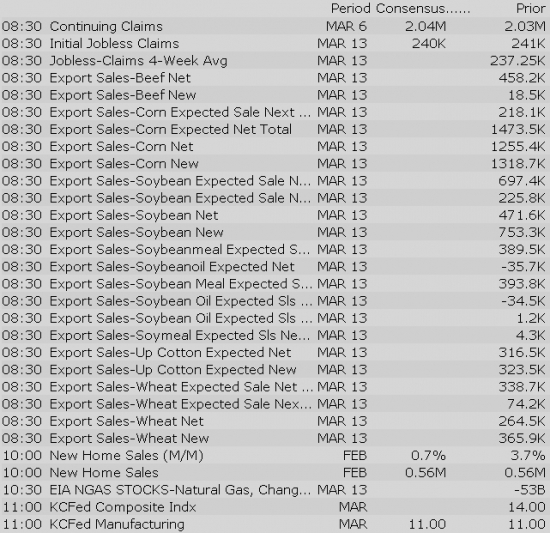

На рынке недвижимости после крошечного спада ожидается продолжение подъема, новое значение прогнозируется на уровне 567 тыс.:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

710 |

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Stocks with favorable mention: ADBE, DEO, DLR, EQIX, FLEX, HSY, PPG, PVH, SAN, SBUX

Stocks with unfavorable mention: FRT, KIM, SHLD, SPG, TWX

Market updates:

US Econ Data

Buys: COG $30 tgt, CRK $14 tgt, EQT $63 tgt, GPOR $26 tgt, RICE $32 tgt

Hold: AR $26 tgt

Gapping up:

Gapping down:

Major European indices trade in the green with Italy's MIB (+0.7%) showing relative strength. British Prime Minister Theresa May said her country «will never waver in the face of terrorism» following yesterday's Westminster attack that left four dead and resulted in more than 40 injuries. Staying in the UK, today's economic data showed better than expected retail sales, giving a modest boost to the pound, which is up 0.2% against the dollar at 1.2510.

---Equity Markets---

Treasuries Start Unchanged

Equity futures point to a relatively flat open this morning as investors display caution in front of today's House vote on the American Health Care Act. The S&P 500 futures trade two points above fair value.

Passage of the GOP health care bill looked doubtful yesterday as many members of the House Freedom Caucus, a group of the most conservative Republicans, still withheld their support. However, after continued negotiations on Wednesday night, the leader of the House Freedom Caucus said that he was «encouraged» by the willingness of the White House and GOP leadership in making improvements to the bill. The exact timing of the vote remains unclear, but it will likely happen this evening in overnight hours.

Crude oil has reclaimed its modest Wednesday loss in early action as it hovers 0.5% above its flat line at $48.29/bbl. A win today would break the commodity's three session losing streak.

U.S. Treasuries trade just below their unchanged marks as investors eye this morning's speech from Fed Chair Janet Yellen, which will take place at 8:45 ET. Minneapolis Fed President Kashkari (FOMC voter) and Dallas Fed President Kaplan (FOMC voter) are also scheduled to speak today at 12:30 ET and 19:00 ET, respectively. The benchmark 10-yr yield currently trades one basis point higher at 2.41%.

On the data front, investors will receive Initial Claims (Briefing.com consensus 239,000) at 8:30 ET and February Existing Home Sales (Briefing.com consensus 560,000) at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

FIVE is currently trading up ~7% around the 41 level in extended hours trading.

European Government Debt Mostly Higher

— Shares of GST +4% pre-market.

Upgrades:

Downgrades:

Miscellaneous:

The S&P 500 futures trade three points above fair value.

Just in, the latest weekly initial jobless claims count totaled 258,000 while the Briefing.com consensus expected a reading of 239,000. Today's tally was above the revised prior week count of 243,000 (from 241,000). As for continuing claims, they declined to 2.000 million from the revised count of 2.039 million (from 2.030 million).

The operation manufactures certain Bayliner and Sea Ray boat models for the South American market. Moving forward, this demand will be fulfilled through Brunswick's remaining global boat manufacturing footprint.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade one point above fair value.

Equity indices in the Asia-Pacific region ended Thursday on a higher note, advancing modestly after Wednesday's slump. The Reserve Bank of New Zealand made no changes to its policy, keeping its key rate at 1.75%, as expected. The central bank's policy statement did show increased concern over housing inflation.

---Equity Markets---

Major European indices trade mostly in the green with Italy's MIB (+0.5%) showing relative strength. British Prime Minister Theresa May said her country «will never waver in the face of terrorism» following yesterday's Westminster attack that left four dead and resulted in more than 40 injuries. Staying in the UK, today's economic data showed better than expected retail sales, giving a modest boost to the pound, which is up 0.1% against the dollar at 1.2500.

---Equity Markets---