SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Текущий баланс и красная книга.

- 21 марта 2017, 15:09

- |

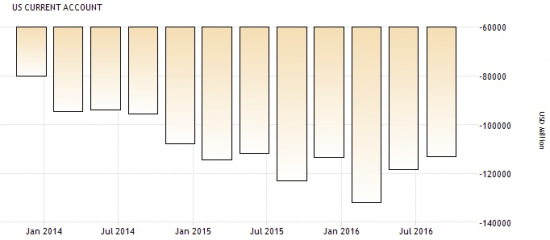

Значительных календарных новостей сегодня не выходит. Текущий баланс прогнозируется на отметке -$120 млрд.:

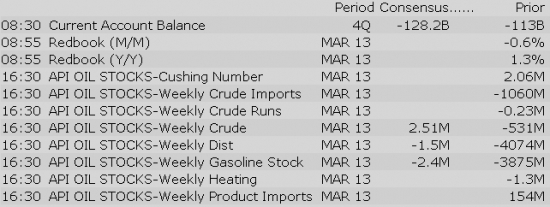

И красная книга ожидается выше единицы:

В 11:00 NY и после закрытия рынка ожидаются речи от представителей Федеральной Резервной Системы.

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

240

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market Updates:

US Econ Data

Equity indices in the Asia-Pacific region ended Tuesday on a mostly higher note. The Reserve Bank of Australia released its latest policy minutes, showing a discussion about rising property prices and slower wage growth. The Australian dollar saw some movement against the greenback, but is now back to little changed at 0.7735. The overall risk sentiment saw an uptick after the French presidential debate ended and an Elabe poll showed that Emmanuel Macron was the most convincing candidate.

---Equity Markets---

---FX---

Gapping up:

Gapping down:

Major European indices trade near their flat lines while Italy's MIB (+1.1%) outperforms. Last evening, five French presidential candidates squared off in a debate that focused mostly on policy. Emmanuel Macron, who was seen as the most convincing candidate by an Elabe poll, spoke in favor of boosting French military spending. Despite last night's showing, a tight vote is still expected in the first round of voting on April 23. Elsewhere, economic data from the UK showed hotter than expected inflation.

---Equity Markets---

French Presidential Debate Leads to Market Relief

Upgrades:

Downgrades:

Miscellaneous:

After a slightly disappointing start to the week, equity futures point to a modestly higher open for Tuesday's session. The S&P 500 futures trade four points above fair value.

Crude oil has contributed to the positive sentiment amid reports that OPEC members increasingly favor an extension of their original six-month supply cut agreement as a way to combat stubbornly high U.S. inventories. Additionally, crude oil is receiving a boost from the U.S. dollar, which has slipped in early action. The energy component currently trades 0.7% higher at $49.26/bbl while the U.S. Dollar Index (99.65, -0.51) is down 0.5%.

The greenback has lost 0.6% against the euro (1.0808) this morning after opinion polls suggested that Emmanuel Macron had the upper hand on his main rival Marine Le Pen in last night's French presidential debate. This has been construed as a positive for the European Union given Marine Le Pen's anti-EU rhetoric.

U.S. Treasuries are also down this morning, giving back nearly all of Monday's modest gains. The benchmark 10-yr yield trades two basis points higher at 2.48%.

Tuesday's lone economic report, fourth quarter Current Account Balance (Briefing.com consensus -$128.2 billion), will cross the wires at 8:30 ET.

In U.S. corporate news:

Reviewing overnight developments:

Interfile is a provider of BPO services and solutions for the banking and financial services sector in Brazil.

Gilts and Bunds Slide

Gapping up

In reaction to strong earnings/guidance:

Select EU financial related names showing strength:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

The S&P 500 futures trade four points above fair value.

Just in, the current account deficit for the four quarter totaled $112.4 billion while the Briefing.com consensus expected the deficit to hit $128.2 billion. The third quarter deficit was revised to $116.0 billion from $113.0 billion.

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments: