SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Пособия по безработице. Индекс цен на Экспорт / Импорт.

- 09 марта 2017, 16:31

- |

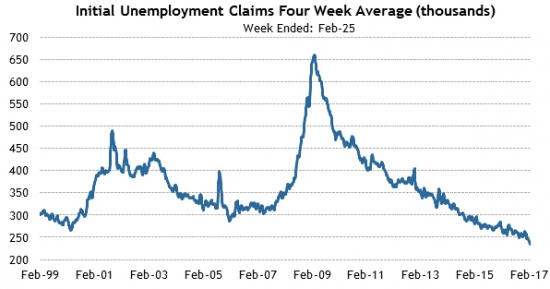

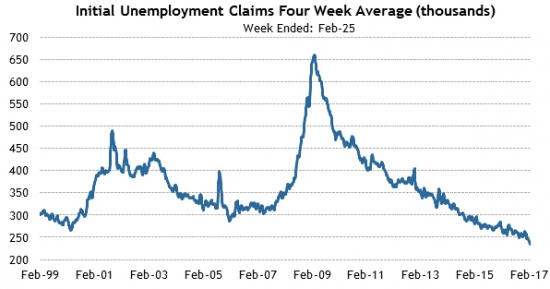

Первичные заявки на пособие по безработице продолжают устанавливать новые рекорды. На этой неделе ожидается небольшой разворот к значению 230 тысяч:

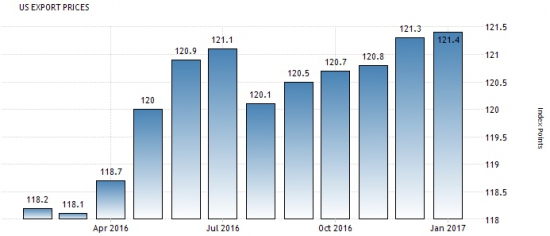

Рост индекса цен на импорт более плавный и тоже ожидается очередной максимум этого показателя:

Десятилетняя картина показывает уверенное развитие восходящего цикла в росте цен на импорт:

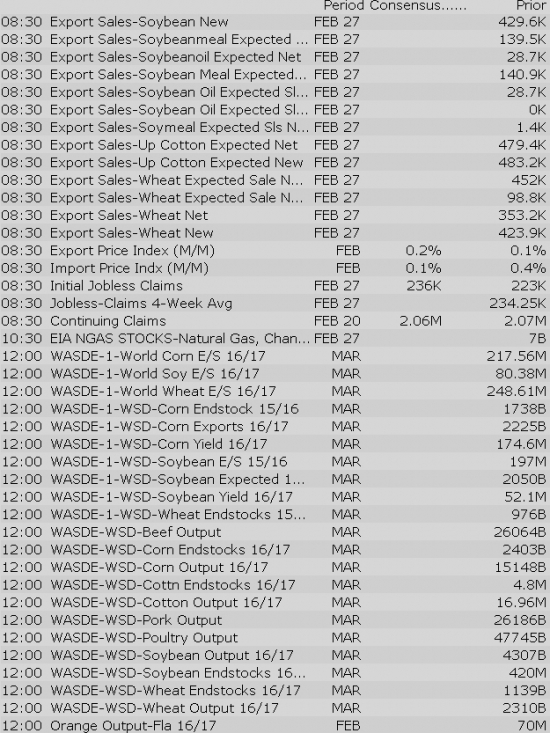

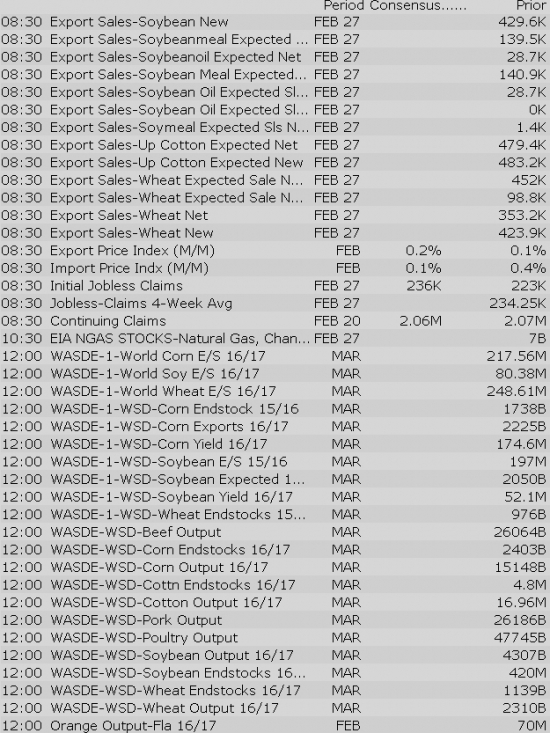

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

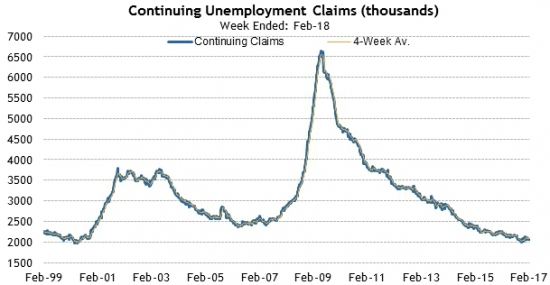

Разворот в повторных заявках на пособие уже более выраженный и он подтверждает ожидания аналитиков:

Но на длительном интервале эти перепады всё ещё слабо заметны:

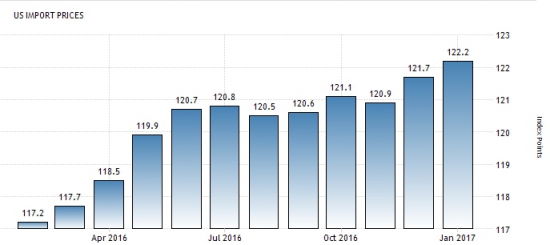

Рост индекса цен на импорт более плавный и тоже ожидается очередной максимум этого показателя:

Десятилетняя картина показывает уверенное развитие восходящего цикла в росте цен на импорт:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

46 |

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Equity indices in the Asia-Pacific region ended Thursday on a mostly lower note while Japan's Nikkei (+0.3%) bucked the trend thanks to an overnight retreat in the yen. The Japanese currency remains lower by 0.2% against the dollar at 114.56 after hitting 114.94 in early morning action. Participants received a solid dose of economic news, which showed a mixed inflation picture in China, as February producer prices increased a hotter-than-expected 7.8% year-over-year (expected 7.7%) while CPI increased 0.8% year-over-year (expected 1.7%; last 2.5%). Also of note, press reports from China indicate the non-performing loan ratio may climb to 1.8% in 2017 from last year's 1.7%.

---Equity Markets---

---FX---

ECB Decision on Deck

Major European indices trade mostly lower while Spain's IBEX (+0.4%) outperforms, extending to levels not seen since late 2015. The European Central Bank will release its policy stance shortly, but the market does not expect any major changes. The euro is up 0.2% against the dollar at 1.0560. Elsewhere, Greek government spokesman Dimitris Tzanakopoulos said the government hopes to have a staff-level deal in time for the Eurogroup meeting on March 20. Also of note, Scottish First Minister Nicola Sturgeon pointed to the fall as a likely time for a second Scottish independence referendum; however, a decision to call a second vote has yet to be made.

---Equity Markets---

Gapping down: TLRD -29%, HZN -21.9%, RATE -15.5%, NSYS -12.1%, CGNT -11.8%, SPPI -10%, WATT -6.9%, VNET -6.7%, CWH -4.8%, PCOM -4.6%, FRO -4.5%, BCRX -4.3%, HEAR -4.3%, TVIA -3.8%, PLNT -3.6%, FGP -3.4%, RIG -3.2%, SBGL -3.2%, CHK -2.8%, BETR -2.8%, SFS -2.8%, CDE -2.7%, CSTM -2.7%, NE -2.6%, TGTX -2.5%, VALE -2.5%, IGT -2.5%, ESV -2.4%, AU -2.3%, TNDM -2.3%, BBL -2.2%, FCX -2.2%, BHP -2.2%, X -2.1%, GFI -2%, COKE -2%, RDS.A -1.9%, SPLS -1.9%, RIO -1.8%, HMY -1.8%, MRO -1.8%, DVN -1.8%, CLF -1.8%, PBR -1.7%, RUN -1.7%, TOT -1.4%, AA -1.4%, XXII -1.1%

ECB Keeps Policy Unchanged, Draghi to Give Press Conference

The cautious sentiment that has defined the week thus far continues this morning as equity futures point to a lower open for Thursday's session. The S&P 500 futures trade three points below fair value.

Crude oil headlined Wednesday's action, plunging 5.3%, after the latest inventory report from the Energy Information Administration (EIA) showed a huge build of 8.2 million barrels (consensus +2.0 million). The bearish sentiment has carried over into Thursday morning with the energy component trading 2.3% lower at $49.13/bbl.

U.S. Treasuries trade relatively flat this morning after giving up some ground yesterday following the hotter than expected ADP National Employment Report for February (298,000 vs 188,000 est.), which provided further justification for the anticipated March rate hike. The benchmark 10-yr yield is unchanged at 2.56%.

Also of note, the European Central Bank just released its latest policy directive, leaving rates unchanged, as was widely expected. ECB President Draghi will hold a call at 8:30 ET.

On the data front, investors will receive February Export/Import Prices and Initial Claims (Briefing.com consensus 240,000) at 8:30 ET.

In U.S. corporate news:

Reviewing overnight developments:

Shares of SMTC are trading up ~6.4% in the pre-market at $36.50/share

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

The S&P 500 futures trade two points below fair value.

Just in, import prices excluding oil rose 0.3% in February after ticking down 0.1% in January (revised from -0.2%). Export prices excluding agriculture increased 0.3% in February after rising 0.2% in January (revised from +0.1%).

Separately, the latest weekly initial jobless claims count totaled 243,000 while the Briefing.com consensus expected a reading of 240,000. Today's tally was above the unrevised prior week count of 223,000. As for continuing claims, they declined to 2.058 million from the revised count of 2.064 million (from 2.066 million).

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

Upgrades:

Downgrades:

Miscellaneous:

Filings:

Offerings:

Pricings:

The S&P 500 futures trade in line with fair value.

Equity indices in the Asia-Pacific region ended Thursday on a mostly lower note while Japan's Nikkei (+0.3%) bucked the trend thanks to an overnight retreat in the yen. The Japanese currency remains lower by 0.3% against the dollar at 114.65 after hitting 114.94 in early morning action. Participants received a solid dose of economic news, which showed a mixed inflation picture in China, as February producer prices increased a hotter-than-expected 7.8% year-over-year (expected 7.7%) while CPI increased 0.8% year-over-year (expected 1.7%; last 2.5%). Also of note, press reports from China indicate the non-performing loan ratio may climb to 1.8% in 2017 from last year's 1.7%.

---Equity Markets---

Major European indices trade mostly lower while Spain's IBEX (+0.8%) outperforms, extending to levels not seen since late 2015. The European Central Bank released its latest policy directive earlier this morning, leaving rates unchanged, as was widely expected. The euro is up 0.2% against the dollar at 1.0564. Elsewhere, Greek government spokesman Dimitris Tzanakopoulos said the government hopes to have a staff-level deal in time for the Eurogroup meeting on March 20. Also of note, Scottish First Minister Nicola Sturgeon pointed to the fall as a likely time for a second Scottish independence referendum; however, a decision to call a second vote has yet to be made.

---Equity Markets---