SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Промышленное производство и индекс доверия потребителей.

- 17 марта 2017, 15:25

- |

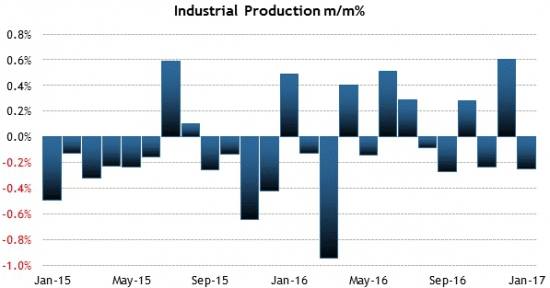

Данные по промышленному производству сегодня ожидаются выше нулевой отметки на значении 0.3%:

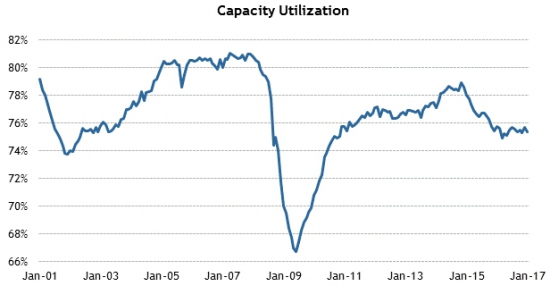

Показатель использования производственных мощностей продолжает находится в даунтренде, новое значение ожидается без значительных изменений на уровне 75.3:

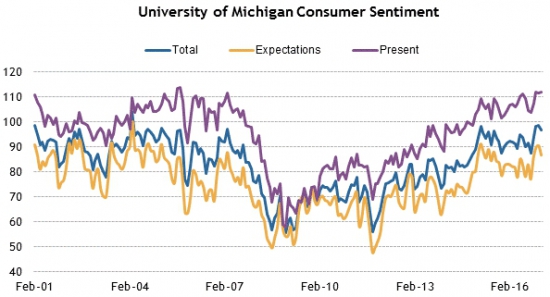

И новый поход к максимуму прогнозируется в индексе доверия потребителей от университета штата Мичиган. Выход нового значения ждут на отметке 97 и выше:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

197

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market Updates

US Econ Data

Stocks with favorable mention: AAPL, BHI, CCL, CSCO, DG, DIS, DPZ, FAST, GOOS, HD, INTC, MSFT, NFLX, NOV, ORCL, SIX, TJX, ULTA, WFC, WMT

Stocks with unfavorable mention: HCLP, INFN, SPH

The transaction will result in a combined company focused on the development of novel treatments for cancer.

Co will host a webcast to discuss on March 17, 2017, at 8:30 a.m. ET

Equity indices in the Asia-Pacific region ended the week on a mixed note. U.S. Secretary of State Rex Tillerson visited the demilitarized zone as part of his Asian trip. Mr. Tillerson said that 20 years of diplomacy have not produced any results and a different approach is needed. Elsewhere, the Chinese press reported that debt deleveraging has started in key economic sectors like steel, coal, non-ferrous metals, and real estate.

---Equity Markets---

---FX---

Gapping down: CMLS -19.8%, EXA -11.6%, STML -9.4%, CAL -8.6%, CSBR -7.9%, GSVC -7.5%, XONE -6.3%, BREW -5.5%, BIOA -4.5%, NYMT -4%, DRD -3.8%, VUZI -3.5%, QBAK -3.2%, RYN -3%, VRAY -3%, BDSI -2.5%, MNKD -1.9%, AFSI -1.8%, AFSI -1.8%, GOLD -1.1%, DB -0.8%, CNHI -0.7%, KINS -0.7%, LPLA -0.7%, GFI -0.6%

Major European indices trade near their flat lines, looking to cap an upbeat week. German Chancellor Angela Merkel will meet with President Donald Trump after their meeting on Tuesday was postponed due to inclement weather along the East Coast. Also of note, G20 finance ministers and central bank governors are meeting in Baden-Baden, Germany. It has been reported that protectionism and currency devaluations will be discussed at the gathering.

---Equity Markets---

ADBE +5% at all time highs premarket.

Treasuries Tick Higher Ahead of Industrial Production Report

Video game names to watch: EA, ATVI, TTWO, GME

Without any notable catalyst to move the stock market higher, investors will be relying on the «Luck of the Irish» to eke out some gains this St. Patrick's Day. However, that strategy hasn't panned out thus far as the S&P 500 futures trade flat, in line with fair value.

U.S. Treasuries hold modest gains in early action. The benchmark 10-yr yield trades one basis point lower at 2.53%, which leaves the yield five basis points lower than the level it took into the FOMC rate decision on Wednesday.

Crude oil trades in the green this morning, up 0.4% at $48.92/bbl, after Saudi Energy Minister Khalid Al-Falih floated the idea that OPEC may extend its supply cut agreement beyond June. The early gain extends WTI crude's week-to-date advance to 0.9%.

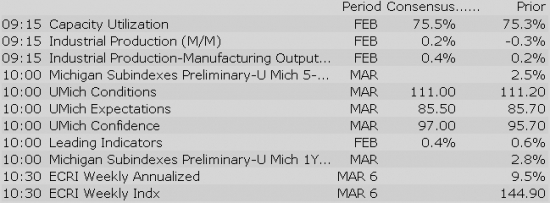

On the data front, investors will receive February Industrial Production (Briefing.com consensus 0.2%) at 9:15 ET, while February Leading Indicators (Briefing.com consensus 0.5%) and the University of Michigan Sentiment Index for March (Briefing.com consensus 96.8) will cross the wires at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

Upgrades:

Downgrades:

Miscellaneous:

DG reported earnings on Thursday morning and shares initially opened down ~1% at the 72 level. Shares traded up during the course of the day and were up as much as 3.5% at one point. Shares ended the day up ~0.5% at 73.20.

Italian and Spanish Yields Touch One-Year Highs at 10-Year Maturity

Wall Street is poised for a relatively flat open on Friday as the S&P 500 futures trade one point above fair value.

The international G20 forum is taking place today in Baden-Baden, Germany, marking Mr. Steven Mnuchin's first official appearance as Treasury Secretary of the United States. Free trade is likely to be a key item on the agenda given the protectionist rhetoric that has been circulating around the globe.

Also of note, German Chancellor Angela Merkel is scheduled to meet with President Donald Trump at the White House on Friday. The two leaders have been critical of each other's immigration policies, but will be looking to put their differences aside in favor of trade negotiations.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select shipping related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select shipping related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

The S&P 500 futures trade two points above fair value.

Equity indices in the Asia-Pacific region ended the week on a mixed note. U.S. Secretary of State Rex Tillerson visited the demilitarized zone as part of his Asian trip. Mr. Tillerson said that 20 years of diplomacy have not produced any results and a different approach is needed. Elsewhere, the Chinese press reported that debt deleveraging has started in key economic sectors like steel, coal, non-ferrous metals, and real estate.

---Equity Markets---

Major European indices trade near their flat lines, looking to cap an upbeat week. German Chancellor Angela Merkel will meet with President Donald Trump after their meeting on Tuesday was postponed due to inclement weather along the East Coast. Also of note, G20 finance ministers and central bank governors are meeting in Baden-Baden, Germany. It has been reported that protectionism and currency devaluations will be discussed at the gathering.

---Equity Markets---

Equity futures point to a relatively flat open for Friday's session as investors lack a catalyst to push things in either direction. The S&P 500 futures trade two points above fair value.

Just released, Industrial Production held steady in February (Briefing.com consensus 0.2%) while Capacity Utilization declined to 75.4% (Briefing.com consensus 75.4%) from a revised reading of 75.5% (from 75.3%) in January.

In U.S. corporate news, Adobe Systems (ADBE 128.51, +6.16) trades 5.0% higher in pre-market action after beating top and bottom line estimates and issuing upbeat earnings guidance. Similarly, Tiffany & Co (TIF 93.98, +4.00) has added 4.5% after reporting better than expected earnings and guiding results for fiscal 2017 towards the high end of expectations.

On the downside, Netflix (NFLX 143.06, -1.33) has slipped 0.9% after M Science expressed caution in light of the company's subscriber metrics.

Crude oil is up 0.8% at $49.16/bbl after Saudi Energy Minister Khalid Al-Falih floated the idea that OPEC may extend its supply cut agreement beyond June. The early gain extends the commodity's week-to-date advance to 1.4%, all of which has come in the wake of Wednesday's bullish EIA inventory report.

U.S. Treasuries also trade in the green as their prices continue to fluctuate following Wednesday's FOMC rate decision. The benchmark 10-yr yield is currently down two basis points at 2.52%, which leaves it six basis points lower for the week.

In addition to Industrial Production and Capacity Utilization, investors will receive February Leading Indicators (Briefing.com consensus 0.5%) and the University of Michigan Sentiment Index for March (Briefing.com consensus 96.8). Both reports will cross the wires at 10:00 ET.

Filings:

Offerings:

Pricings:

The S&P 500 opened Friday's session with a slim gain of 0.1%.

Almost all of the sectors trade in the green, but the health care space (-0.6%) has demonstrated relative weakness as Amgen (AMGN 168.70, -11.45) leads biotech names lower with a loss of 6.5%.

Conversely, the energy sector (+0.4%) has shown relative strength as crude oil holds a gain of 0.7%. WTI crude trades at $49.10/bbl.

The tech sector — XLK — trades ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.03%. Within the SOX index, MPWR (+0.42%) outperforms, while MU (-1.31%) lags. Among other major indices, the SPY is trading 0.06% higher, while the QQQ -0.14% and the NASDAQ +0.27% trade opposite thus far on the session. Among tech bellwethers, MSFT (+0.31%) is showing relative strength, while IBM (-0.65%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

The Energy Sector (XLE, -0.2%) sees its losses outpaced by the decline of the broader market (SPY, -0.5%) in early afternoon trading. Crude oil (USO, -0.1%) futures are currently trading nearly flat with the prior session's close ahead of today's rig count data (recap of last week's data below). Lastly, natural gas (UNG, +0.9%) futures remain on track to close the week -3%, despite staging a notable morning rally following yesterday's sharp post-EIA decline of 2.3%.

Baker Hughes (BHI, +2%) rig count data will be released today at 1 pm ET.

Reminder: Crude briefly broke out above the $49.00/barrel resistance handle to session highs earlier in the morning on headlines indicating that the Saudi Oil Minister discussed OPEC is mulling over a potential production cut extension beyond June 2017.

Contributing factors affecting the price of natural gas:

Notable Gainers:

Notable Laggards:

In current trade:

Earnings/News

Broker Calls

The Industrials sector (XLI) is trading -0.1% lower today, lower than the broader market (SPX -0.0%). In a slow day for the Industrial Sector, Boeing (BA +0.7%) confirms that it and the U.S. government recently signed a five-year, $3.4 bln for the latest Apache attack helicopter, Cintas (CTAS +4.3%) annnounces its proposed G&K Services acquisition has been received with no divestiture requirements.

Earnings/Guidance

News

Broker Research

Upgrades

Downgrades

Other

- Threshold Pharma (THLD +18.82%) will merge with Molecular Templates in an all-stock transaction; Longitude Capital will invest $20 mln at the close of the transaction, including the receipt of additional equity financing commitments of $20 mln

- AveXis (AVXS +17.35%) misses by $0.19; reports topline results from the Phase 1 trial of AVXS-101 in SMA Type 1

- Arbutus Biopharma (ABUS +17.54%) licenses to Alexion Pharmaceuticals (ALXN) its proprietary lipid nanoparticle technology for exclusive use in one of Alexion's rare disease programs

Decliners on news:- Northwest Biotherapeutics (NWBO -33.15%) commences $7.5 mln direct offering of common stock at $0.26/share

- Editas Medicine (EDIT -7.87%) prices offering of 4 mln shares of common stock at $22.50 per share

- Zosano Pharma (ZSAN -4.94%) prices 17,000,000 share offering at $1.50/share

Gainers on earnings:- BioDelivery Sciences (BDSI +1.25%) misses by $0.06, misses on revs

- BioTime (BTX +5.81%) reports Q4 EPS of ($0.05) vs ($0.15) last year; revs -25.9% y/y to $1.08 mln

- Mannkind (MNKD +6.76%) reports Q4 (Dec) results, beats on revs

Decliners on earnings:- Innocell (INNL -26.5%) reports Q4 results; 'continues to explore strategic options'

- ChromaDex (CDXC -10.13%) reported Q4 EPS of ($0.06) vs ($0.01) single est; co reported Q4 sales of +29% YoY to $5.6 mln (no ests).

- Calithera Biosciences (CALA -9.49%) reports Q4 GAAP EPS of ($0.45), vs the ($0.48) Capital IQ Consensus Estimate

Upgrades/Downgrades:Biggest point losers: REGN 378.49(-14.1), AMGN 167.46(-12.65), MDCO 43.7(-8.88), VRTV 51.8(-7.05), ESPR 23.61(-6.04), AFSI 17.4(-4.21), CAL 27.52(-4.14), GS 244.34(-3.88), BIIB 275.52(-3.44), IBB 295.29(-3.3), AMP 131.53(-3.07), MOFG 34.34(-2.41), TSRO 151.02(-2.24), AAP 151.21(-2.2), EQIX 376(-2.17), GVA 48.71(-2.15), EDIT 22.84(-2.07), TROW 69.94(-2), KMX 61.54(-2), PCRX 47.15(-1.8), MTB 162.76(-1.73), ALNY 52.76(-1.72), SXCP 15.9(-1.7), SPGI 130.11(-1.64), SHPG 178.53(-1.6)

Stocks that traded to 52 week lows: AFSI, AVGR, BIOA, BRFS, CHKE, CMLS, DRRX, ENT, EPRSQ, FALC, GBSN, GEC, IMNP, MARA, MN, NAO, NWBO, RTK, RUBI, SMSI, SPNE, SSH, SUNW, TROV, TVIX, TWER, XCOMQ

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: BKHU, CWAY, DAX, EEMA, EQFN, ESLT, FDTS, FPXI, FTCS, GFY, GHC, GRR, IEUS, IIF, IIN, ISTR, ITRN, MGIC, MRLN, NEU, NTZ, OCIP, POPE, QYLD, RFDI, RFEU, SBCP, SMCP, SWZ, VYMI

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: FESLQ, PERF, ROSG, XELB

ETFs that traded to 52 week highs: ECH, EFA, EPOL, EPP, EWN, EWY, EZU, FDN, IGV, IOO, IYK, SMH, VGK

ETFs that traded to 52 week lows: VXX, VXZ

The broader market is split at the moment, with the Nasdaq Composite up less than a point (+0.01%) to 5901 as the only gainer today, the S&P 500 is down less than a point (-0.01%) to 2381, and the Dow Jones Industrial Average sheds about 3 (-0.01%) to 20931. Action has come on higher than average volume (NYSE 609 vs. avg. of 315; NASDAQ 954 mln vs. avg. of 808), with mixed advancers and decliners (NYSE 1705/1254, NASDAQ 1360/1363) and new highs outpacing new lows (NYSE 103/12, NASDAQ 101/17).

Relative Strength:

Greece-GREK +1.8%, Mexico-EWW +1.0%, US Nat Gas-UNG +1.0%, Lithium-LIT +1.0%, Base Metals-DBB +0.9%, US Gasoline-UGA +0.9%, Russia-RSX +0.8%, Poland-EPOL +0.8%, Vietnam-VNM +0.7%, 20+ Yr. Treas. Bond-TLT +0.7%, Colombia-GXG +0.7%, Coal-KOL +0.6%, Indonesia-IDX +0.6%, Copper-JJC +0.6%.

Relative Weakness:

Sugar-SGG -4.5%, Jr. Gold Miners-GDXJ -2.9%, Brazil-EWZ -1.9%, Short-Term Futures-VXX -1.5%, Reg. Banking-KRE -1.1%, Insurance-KIE -1.1%, Banking-KBE -1.1%, Latin Am. 40-ILF -1.0%, Biotech-IBB -1.0%, India-INP -0.7%, China Lg. Cap-FXI -0.6%, Italy-EWI -0.5%, Austria-EWO -0.5%, Peru-EPU -0.4%.

Today's top 20 % gainers

- Healthcare: NH (6.09 +20.36%), AVXS (85.05 +16.86%), PEN (84.3 +8.7%), RGNX (21.35 +8.38%), NK (3.68 +5.44%)

- Materials: DDC (9.87 +11.9%), GSM (11.24 +11.57%), FF (14.17 +6.86%), MTL (5.21 +6.54%), RYI (12.5 +6.38%)

- Information Technology: IMOS (17.14 +7.87%), FIVN (17.83 +5.94%), ADBE (128.9 +5.35%), HIMX (8.59 +5.27%)

- Energy: WLB (13.75 +12.8%), SND (16 +10.19%), CIE (0.43 +7.54%), CLMT (3.9 +5.41%)

- Utilities: VSLR (2.98 +8.18%), WAAS (18.11 +5.51%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: VRX (20.92 mln -0.49%), PFE (11.78 mln +0.1%), AMGN (11.04 mln -6.8%)

- Industrials: GE (13.5 mln +0.42%)

- Consumer Discretionary: F (18.53 mln -1.57%), CMCSA (11.87 mln -0.74%)

- Information Technology: MSFT (23.06 mln +0.5%), AMD (17.28 mln -0.11%), ORCL (16.18 mln +0.31%), AAPL (15.13 mln -0.04%), INTC (13.03 mln -0.07%), CSCO (12.73 mln +0.02%), NMBL (11.9 mln -0.44%), MU (9.24 mln -1.11%)

- Financials: BAC (43.93 mln -1.32%), JPM (9.4 mln -0.77%)

- Energy: CHK (12.73 mln -1.28%)

- Consumer Staples: RAD (11.46 mln -2.58%)

- Telecommunication Services: FTR (22.82 mln +0%), T (10.29 mln +0.09%)

Today's top relative volume (current volume to 1-month average daily volume)