SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Заявки на пособия и объемы товарных запасов.

- 09 февраля 2017, 16:16

- |

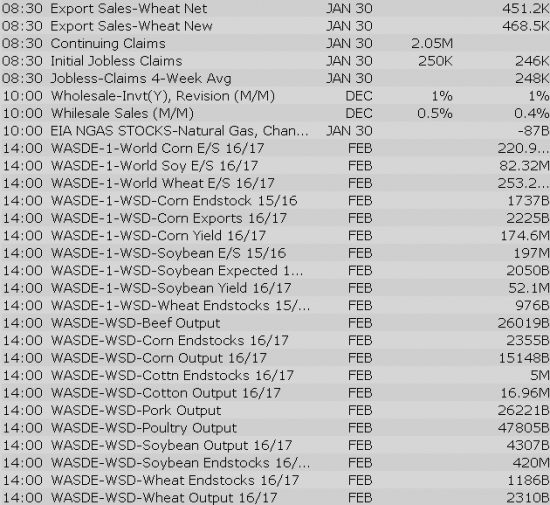

Объемы товарных запасов на складах продолжают увеличиваться. Аналитики прогнозируют сохранение темпов с небольшим замедлением к 0.9%:

Двадцатилетняя картина показывает, что товарные запасы подходят к критическим уровням и ближайшие несколько месяцев наступит смена тенденции:

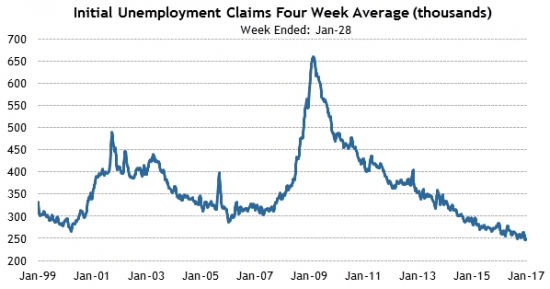

Первичные заявки на пособия по безработице продолжают оставаться на своих минимальных значениях:

После часа дня по NY градус волатильности рынка будет задавать речь Эванса по процентной ставке.

Аналитики прогнозируют новый показатель на уровне 247 тысяч, вблизи предыдущего значения:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Equity indices in the Asia-Pacific region ended Thursday on a mostly higher note while Japan's Nikkei (-0.5%) underperformed. The index responded to an uptick in the yen during yesterday's Wall Street session, but the Japanese currency (112.36) has retraced the bulk of yesterday's advance, trading lower by 0.4% against the greenback. The People's Bank of China decided to forego reverse repurchase operations for the fifth consecutive session while the Reserve Bank of New Zealand left its key interest rate at 1.75%, as expected.

---Equity Markets---

---FX---

Jones Energy's year-end 2016 proved reserves based on SEC pricing and definitions were 105.2 MMBoe, of which 59% were classified as proved developed reserves.

Co has established an initial capital budget of $275 million for 2017, comprised of $232 million drilling and completion capital expenditures and the remainder allocated to workovers, leasing and field maintenance projects.

Co produced 1.8 MMBoe (~19,200 Boe/d) in 4Q16 and an estimated 7.0 MMBoe (~19,200 Boe/d) for the full year.

Stocks with favorable mention: AAPL, AGN, AMZN, BLK, CSCO, DIS, GE, GOOGL, PLAY, PNRA, TTWO

Stocks with unfavorable mention: AUO, ELY, PFE

Upgrades:

Downgrades:

Miscellaneous:

Major European indices trade higher across the board even though Greece-related concerns have returned to the surface in recent days. The International Monetary Fund has maintained that debt relief for Greece will be needed, but European officials remain against reducing the troubled country's debt burden. Yesterday afternoon, German Finance Minister Wolfgang Schaeuble said Greece would have to leave the euro in order to win a debt cut. Greece is due to make its next debt payment in July, but will be unable to do so if it doesn't receive the next installment of its bailout from the eurozone. The disbursement of the bailout tranche will not occur until the Troika completes a review of the Greek fiscal situation, which has been delayed.

---Equity Markets---

«We believe it's time for video data to move to the center of public safety records systems, with far richer and more transparent information than historic text-only systems,» said Rick Smith, CEO and co-founder of TASER. «Axon AI is focused on extracting usable information from these video records, automatically populating our new RMS system. AI will significantly streamline these business processes so officers can focus on what matters: their operational environment. Axon AI will also greatly reduce the time spent preparing videos for public information requests or court submission. This will lay the foundation for a future system where records are seamlessly recorded by sensors rather than arduously written by police officers overburdened by paperwork,» concluded Smith.

Gapping down: LPSN -15.2%, TWTR -10.8%, MTRX -10.6%, MB -10.5%, SNCR -10.3%, IRBT -9.9%, BGC -8%, QLYS -7.1%, SRRA -7%, OII -7%, CREE -5.7%, STRL -5.6%, FSC -5.5%, ECHO -5.3%, CDE -5.2%, LQDT -5.2%, ENSG -5%, TYL -4.8%, VSTO -4.8%, MXL -4.1%, GLUU -3.6%, TBI -3.6%, KS -3.4%, ENTA -3.3%, UHAL -3%, MC -3%, FISV -2.6%, SNN -2.5%, REGN -2.1%, FCX -2.1%, PPC -2.1%, REGN -2.1%, AMGN -1.9%, BANC -1.9%, GLAD -1.7%, AGTC -1.5%, WFM -1.4%, CTL -1.4%, PDS -1.3%, MCHP -1.1%, FSLR -1%, JE -1%, PYPL -0.9%, KR -0.9%, DNKN -0.9%

Treasuries Trade Down from Wednesday's Highs Ahead of Bond Auction

IMPV +9% at four month high premarket.

Equity futures point to a higher open on Thursday amid an uptick in global markets. The S&P 500 futures trade three points above fair value.

U.S. Treasuries have squandered most of yesterday's gains this morning. The benchmark 10-yr yield is three basis points higher at 2.35%.

Conversely, crude oil has extended Wednesday's uptick in the overnight session. The energy component is currently up 0.7% at $52.73/bbl.

Thursday's economic data will include Initial Claims (Briefing.com consensus 250,000) at 8:30 am ET and December Wholesale Inventories (Briefing.com consensus 1.0%) at 10:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

The S&P 500 futures trade three points above fair value.

Just in, the latest weekly initial jobless claims count totaled 234,000 while the Briefing.com consensus expected a reading of 250,000. Today's tally was below the unrevised prior week count of 246,000. As for continuing claims, they rose to 2.078 million from the revised count of 2.063 million (from 2.064 million).

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Greek 2-Year Yield Jumps Above 10%

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade two points above fair value.

Equity indices in the Asia-Pacific region ended Thursday on a mostly higher note while Japan's Nikkei (-0.5%) underperformed. The index responded to an uptick in the yen during yesterday's Wall Street session, but the Japanese currency (112.40) has retraced the bulk of yesterday's advance, trading lower by 0.4% against the greenback. The People's Bank of China decided to forego reverse repurchase operations for the fifth consecutive session while the Reserve Bank of New Zealand left its key interest rate at 1.75%, as expected.

---Equity Markets---

Major European indices trade higher across the board even though Greece-related concerns have returned to the surface in recent days. The International Monetary Fund has maintained that debt relief for Greece will be needed, but European officials remain against reducing the troubled country's debt burden. Yesterday afternoon, German Finance Minister Wolfgang Schaeuble said Greece would have to leave the euro in order to win a debt cut. Greece is due to make its next debt payment in July, but will be unable to do so if it doesn't receive the next installment of its bailout from the eurozone. The disbursement of the bailout tranche will not occur until the Troika completes a review of the Greek fiscal situation, which has been delayed.

---Equity Markets---

Filings:

Offerings:

Pricings:

Thursday's session is on track for a slightly higher open as the S&P 500 futures trade three points above fair value.

Conversely, U.S. Treasuries are lower this morning, giving back nearly all of yesterday's gains. The benchmark 10-yr yield is currently three basis points higher at 2.36%.

On the earnings front, Coca-Cola (KO 41.27, -0.74) has slipped 1.9% in pre-market trade as disappointing guidance has outweighed the company's better than expected revenues. Twitter (TWTR 16.78, -1.94) is also lower in reaction to the company's latest earnings report. Shares of TWTR have plunged 10.0% after the company missed revenue expectations and issued below-consensus guidance.

Kellogg (K 74.50, +1.01), on the other hand, is up 1.4% this morning on better than expected earnings per share. CVS Health (CVS 78.69, +1.66), also from the consumer staples sector, is higher by 2.2% after beating earnings estimates and reaffirming 2017 earnings guidance.

Earlier this morning, the latest weekly initial jobless claims count totaled 234,000 while the Briefing.com consensus expected a reading of 250,000. Today's tally was below the unrevised prior week count of 246,000. As for continuing claims, they rose to 2.078 million from the revised count of 2.063 million (from 2.064 million).

Investors will also receive December Wholesale Inventories (Briefing.com consensus 1.0%) on Thursday. The report will cross the wires at 10:00 am ET.

The stock market opened Thursday's session slightly higher with the S&P 500 holding a gain of 0.2%.

Energy (+0.7%) has led five of six cyclical spaces higher, while three of the five countercyclical sectors--consumer staples (-0.3%), utilities (-0.3%), and real estate (-0.1%)--trade lower. The consumer staples space has been hit hard by soft drink names after Coca-Cola (KO 41.00, -1.09) issued below-consensus guidance earlier this morning.

The energy sector's uptick has come amid a 1.6% gain in crude oil. The energy component has surpassed its overnight high in recent action, up 1.6% at $53.16/bbl.

The tech sector — XLK — trades modestly behind the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.01%. Within the SOX index, AMD (+1.62%) outperforms, while CAVM (-0.56%) lags. Among other major indices, the SPY is trading 0.24% higher, while the QQQ +0.16% and the NASDAQ +0.61% trade modestly higher on the session. Among tech bellwethers, VOD (+1.72%) is showing relative strength, while NTES (-1.29%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Food processing names are higher following K / THS earnings: PF 1.3% KHC 1.2% CPB 1%

- Grocers strength coinciding with WFM reversal: SVU +3.7%, SFM +3.3%, WMK +2.5%, WFM +2.6%, KR +2%, NGVC +0.8%, UNFI +0.5%

- Homebuilders are in the red after BZH / CAA disappointing results:

- Beverage/soda names are underperforming after Coca-Cola reported in-line qtr with downside guidance: FIZZ -0.5%, DPS flat

In the news:- Leaders: PAG 0.8% (increases quarterly dividend), TUES 1.9% (CEO disclosed purchase of 200K shares worth total of $731.8K), SONC 2.5% (Sonic chief marketing officer Todd Smith will resign effective March 9; search is underway to fill the chief marketing position), ALV 0.4% (upgraded to Overweight from Sector Weight at KeyBanc Capital Mkts)

- Laggards: GRUB -2.4% (cont weakness following earnings), TWX -0.3% (downgraded to Hold from Buy at Drexel Hamilton)

Other notable trends:Looking ahead:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.87… VIX: (11.09, -0.36, -3.1%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Treasury Auction Preview

Rumor Activity was slow today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

Gainers on news:

- Jaguar Animal Health (JAGX +38.17%) to merge with Napo Pharmaceuticals; will host call February 9 at 9am ET

- Acorda Therapeutics (ACOR +15.69%) announces 'positive' Phase 3 data of CVT-301 'showing a statistically significant improvement in motor function in people with Parkinson's disease experiencing OFF periods'

- Peregrine Pharma (PPHM +9.91%) announces the publication of positive proof-of-concept data for a novel exosome-based cancer detection platform

Decliners on news:- Moleculin Biotech (MBRX -18.67%) prices a 3.71 mln unit underwritten public offering for gross proceeds of approx. $5 mln

- Apricus Biosciences (APRI -5.9%) notified that the Nasdaq has granted its request for continued listing pursuant to an extension through May 30, 2017

- Sierra Oncology (SRRA -4.9%) prices an underwritten public offering of 19.5 mln shares of common stock at $1.35/share for expected gross proceeds of approx $26.3 mln

Gainers on earnings:- OraSure (OSUR +25.37%) beats by $0.07, beats on revs; guides Q1 revs above consensus

- Medidata Solutions (MDSO +14.65%) beats by $0.06, reports revs in-line; guides FY17 revs in-line

- Array Biopharma (ARRY +11.21%) beats by $0.06, beats on revs

Decliners on earnings:- Ensign Group (ENSG -16.15%) misses by $0.07, reports revs in-line; guides FY17 EPS below consensus, revs in-line; announces buyback

- Invacare (IVC -3.04%) misses by $0.16, misses on revs

- Fluidigm (FLDM -1.77%) misses by $0.09, reports revs in-line; guides Q1 revs below consensus

Upgrades/Downgrades:Biggest point losers: DNB 102.84(-19.63), IRBT 53.98(-7.26), VSTO 20.29(-5.45), NTES 261.21(-4.31), SEE 46.08(-4.14), SNCR 31.59(-3.79), CHTR 322.23(-3.5), MTRX 18.1(-3.15), ENSG 16.92(-3.08), QLYS 34.68(-2.18), UFS 40.8(-2.02), CI 145.83(-2.01), GRUB 37.9(-1.96), AVGO 204.98(-1.91), SON 52.58(-1.88), GOLD 93.07(-1.87), TWTR 16.88(-1.84), MCHP 72.08(-1.72), CREE 26.27(-1.68), TRI 43.07(-1.61), COTY 18.44(-1.6), DTE 97.15(-1.58), OHI 31.02(-1.55), VRNS 28.7(-1.55), AMGN 166.61(-1.51)

Stocks that traded to 52 week lows: ADPT, AOBC, BSTG, COSIQ, COYN, DMTX, EMGC, ENSG, FCEL, FIT, FOSL, GBIM, GBSN, GEVO, GILD, ICLD, III, KTOV, LN, MBRX, MFIN, NAO, NCMI, OHRP, PLUG, RELY, RGSE, RNVA, SAEX, SBOT, SHIP, SHOS, SOL, SQQQ, STAF, TVIX, TWER, ULTRQ, VMEMQ, VNCE, VSTO, XCOMQ, XOMA

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ARL, ASND, BBGI, BBP, BCBP, BOCH, CFA, CFCO, CIVB, DNI, ENFC, ESLT, FAD, FEMS, FMK, FNY, FRBA, FTCS, FUND, FUSB, GGE, GGZ, HFBC, IBUY, KMDA, LAND, LFGR, MPB, MRLN, MSL, MTLS, ONEQ, OSB, OVLY, PBIP, PCF, PKBK, PLSE, PNQI, QQXT, SBCP, SGF, SLCT, SSBI, UCBA, USLB, VONE, VONG, VTHR, WAYN, WEBK, Y

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: LUB, NMRX, SRSC

ETFs that traded to 52 week highs: BKF, CROP, DBB, DIA, EPOL, EPP, IGN, IGV, IWF, KIE, OEF, PIN, QQQ, SKYY, SPY, VTI, XLK

ETFs that traded to 52 week lows: NIB, VXX

Today's top 20 % gainers

- Healthcare: OSUR (11.16 +26.05%), ACOR (23.55 +15.44%), MDSO (55.25 +15.1%), ARRY (11.81 +10.33%), ALNY (44.73 +10.09%)

- Materials: FTK (12.3 +16.59%), CLF (11.07 +16.28%)

- Industrials: PRLB (57.9 +12.21%)

- Information Technology: NSIT (43.9 +17.76%), ZEN (28.69 +16.96%), BLKB (71.11 +14.58%), PAYC (51.81 +14.47%), TYL (165 +13.02%), CRAY (20.22 +12.96%), FLT (166.78 +10.27%), TDC (33.13 +9.81%), IMPV (46.75 +8.97%)

- Financials: BANC (18.73 +16.3%)

- Consumer Staples: THS (84.32 +11.49%), PPC (20.46 +9.12%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: GILD (11.15 mln -1.73%)

- Materials: CLF (48.77 mln +16.28%), MT (19.01 mln +2.35%), AKS (16.38 mln +6.09%), X (15.1 mln +6.76%), FCX (14.48 mln -1.29%), VALE (9.97 mln +1.74%),

- Consumer Discretionary: F (10.18 mln +0.2%)

- Information Technology: TWTR (58.68 mln -10.1%), AMD (28.96 mln +2.06%), MU (13.85 mln +2.47%), AAPL (10.19 mln +0.32%), ISIL (10.14 mln -1.34%), MSFT (8.99 mln +1.45%)

- Financials: BAC (51.74 mln +1.85%)

- Energy: CHK (18.37 mln +2.12%), SDRL (10.21 mln +7.14%)

- Consumer Staples: KO (12.69 mln -2.2%), COTY (12.36 mln -7.83%)

- Telecommunication Services: FTR (10.58 mln -0.5%)

Today's top relative volume (current volume to 1-month average daily volume)RV suppliers: LCII +3.7%, PATK +2.7%… RVs: WGO +1.9%, THO +1.2%… retailer: CWH

The broader market surges into midday, led up now by the Dow Jones Industrial Average which gains 139 points (+0.69%) to 20193, the Nasdaq Composite is higher by 37 (+0.64%) to 5719, and the S&P 500 adds 14 (+0.62%) to 2308. As it were, all three major US indices have made new all-time highs today intraday. Action has come on mostly higher than average volume (NYSE 320 vs. avg. of 321; NASDAQ 821 mln vs. avg. of 775), with advancers outpacing decliners (NYSE 1994/988, NASDAQ 2035/692) and new highs outpacing new lows (NYSE 134/6, NASDAQ 160/23).

Relative Strength:

Reg. Banking-KRE +1.9%, Poland-EPOL +1.8%, Steel-SLX +1.7%, Banking-KBE +1.7%, US Broker/Dealers-IAI +1.7%, Oil&Gas E&P-XOP +1.6%, Turkey-TUR +1.5%, Russell 2K-IWM +1.5%, Retail-XRT +1.5%, China Lg. Cap-FXI +1.3%, Emrg. Mkts. M. East&Africa-GAF +1.3%, Mexico-EWW +1.1%, Spain-EWP +0.9%, Israel-EIS +0.8%.

Relative Weakness:

Silver Miners-SIL -3.1%, Gold Miners-GDX -2.2%, Jr. Gold Miners-GDXJ -2.2%, Short-Term Futures-VXX -1.6%, 20+ Yr. Treas. Bond-TLT -1.1%, Social Media-SOCL -1.1%, Japanese Yen-FXY -1.0%, Cocoa-NIB -1.0%, Swiss Franc-FXF -0.6%, Sweden-EWD -0.5%, Thailand-THD -0.5%, New Zealand-ENZL -0.4%, Australian Dollar-FXA -0.2%, British Pound-FXB -0.1%.

Equity indices have pushed through the cautious tone that has defined this week thus far to hit new record highs in the first half of Thursday's session. The S&P 500, the Nasdaq, and the Dow all hold a gain of 0.6% while the small-cap Russell 2000 index (+1.5%) outperforms.

The most notable factor driving the market higher today has been President Trump's announcement that he will release a major tax announcement in the next few weeks. However, it is important to note that a snowstorm on the East Coast has kept some participants away from their trading desks today, which makes it easier for the market to be pushed around.

The financial sector (+1.3%), which paced the post-election rally on promises of deregulation and tax reform, has provided solid sector leadership today following Mr. Trump's announcement. The space has also been aided by a steepening yield curve as short-term Treasuries have been able to resist selling pressure better than their longer-dated peers. The benchmark 10-yr yield is six basis points higher at 2.38% while the 2-yr yield is up only one basis point at 1.15%.

Energy (+0.8%) and industrials (+0.9%) have also outperformed the benchmark index, while the top-weighted technology sector (+0.3%) lags. The space's gains have been capped by a lackluster performance from Apple (AAPL 131.82, +0.35) and a bearish sentiment among chipmakers. The PHLX Semiconductor Index is lower by 0.3%.

Consumer staples (+0.2%) neighbor the technology sector following mixed earnings results from its components this morning. Coca-Cola (KO 41.02, -1.01) has slipped 2.4% after the company's disappointing guidance overshadowed above-consensus revenues. Meanwhile, CVS Health (CVS 76.60, -0.45) also trades lower, losing 0.6% after worse than expected revenues outweighed better than expected earnings. On the upside, Kellogg (K 76.50, +2.98) trades 4.1% higher after reporting above-consensus earnings per share.

The lightly-weighted utilities (-0.8%) and materials (unch) sectors are the only spaces trading in the red. Sealed Air (SEE 45.73, -4.47) has had its hand in pushing the materials space lower, plunging 8.9% in reaction to the company's disappointing guidance and lower than expected revenues.

Today's economic data included Initial Claims and December Wholesale Inventories:

Investors will not receive any more economic data on Thursday.

Treasury Auction Results

The Industrials sector (XLI) is trading +0.9% higher today, higher than the broader market (SPY +0.6%). In the Industrial Sector, airlines (JETS +1.9%) are leading the sector after President Trump meets with airline execs and repeats that airline regulations will be rolled back, and spoke about US need for fast transit systems.

Notable airlines moving today: DAL +2.6% LUV +2.3% AAL +2.9% UAL +1.6% ALK +1.3% JBLU +3.2% LFL +1.6% SAVE +2.2%

Earnings/Guidance

Additional Industrials reporting earnings/guidance: RLGT +10.7% TBI +1.9% STRL -4.6% DNB -16.49% ENS +1.8% EFX +4.2% UHAL +0.5% BGC +1.7% FWRD +6.6% HNI +1% AIN +2.8% GWW +0.1% ALLE +5.4% VSTO -21.9% MAS -3.3% DLAKY +2% LCII +3.2% CETX +10.8% HDNG +7.4% CETX +10.8% DNB -16.5%

News

Broker Research

Upgrades

Downgrades

Other

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.92… VIX: (11.04, -0.41, -3.6%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Events and conferences of interest for tomorrow, February 10th include:

Conference in progress:

— The dollar index was +0.4% around the 100.65 level.

General Commentary:

Earnings:

News:

Analyst Actions:

Dollar Trades near 8-Day High as Trump/Abe Meeting Looms

The Energy Sector (XLE, +1.3%) leads the broader market (SPY, +0.7%) higher as the last hour of the trading day draws near. Crude oil (USO, +1.0%) futures extend yesterday's surprise post-EIA gains, despite EIA reporting a notably larger-than-expected build in crude yesterday. Lastly, natural gas (UNG, +0.1%) futures closed pit trading modestly higher after EIA reported a draw in-line with expectations. The data is summarized below:

EIA natural gas highlights:

Baker Hughes (BHI, +0.5%) rig count data will be released tomorrow at 1 pm ET.

Factors affecting the price of oil:

Other factors to consider:

Notable Gainers:

Notable Laggards:

Closing Energy Prices:

Earnings/News

Broker Calls

Treasuries Take Losses as Trump Talks Taxes