SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 3 мая.

- 03 мая 2013, 16:43

- |

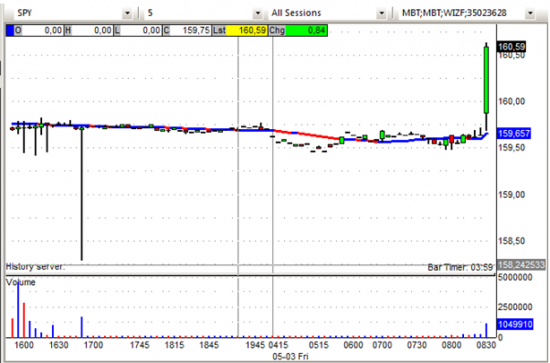

Спайдер торгуется выше уровня 160.00 перед открытием торгов на NYSE.

SPY (внутридневной график) рост на премаркете. Сопротивление: 159.75 Поддержка: 159.50

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: PKT +21.8% (also receives multi-million dollar order from North American MSO to deliver network intelligence), BCOR +13.6%, INVN +11.8%, WTW +8.7%, FLT +7.8%, MASI +4.7%,(light volume), YY +4.1% (light volume), REGN +3.8% ( Acquires Full Rights to Two Novel Ophthalmology Development Programs; co will pay Sanofi (SNY) $10 mln upfront, up to $40 mln in development payments, and royalties on sales with respect to PDGF antibodies ), AIG +2.8%, MHK +2.3%, FLR +2.2% (light volume), KRFT +1.9%, UEIC +1.6% (light volume), PCOM +1.3% (light volume), AXL +1.2%, ATHN +1% (light volume).

Metals/mining stocks trading higher: BHP +3.7%, RIO +3.2%, BBL +2.6%, SLV +1.3%, SLW +1.3%, ABX +1.3%, GG +1.1%, NEM +1%, VALE +0.8%, GLD +0.8%, FCX +0.5%.

Select oil/gas related names showing strength: TOT +0.7%, RDS.A +0.6%, BP +0.6%, RIG +0.4%.

Other news: GENE +20% (executes agreement with nationwide provider network), AGN +2.7% (FDA Advisory Committee unanimously recommended JUVEDERM VOLUMA XC as a safe and effective treatment option for cheek augmentation to correct age-related volume deficit in the mid-face), DDD +2.9% (still checking), BBRY +1.9% (higher on reports of Dept of Defense usage approval ), CCL +1.2% (still checking), MBI +0.8% (announces settlement with Flagstar Bank (FBC) of $110 mln in cash and other consideration), AAPL +0.4% (may launch low cost iPhone in small volumes, according to reports ).

Analyst comments: BZH +1.6% (upgraded to Overweight from Neutral at JPMorgan, upgraded to Market Perform from Underperform at JMP Securities), ACT +1.4% (tgt to $118 from $105 at Bernstein), ALL +0.1% (added to Conviction Buy List at Goldman), FSLR +0.1% (tgt to $60 from $45 at Lazard )

Gapping down:

In reaction to disappointing earnings/guidance:VCRA -27.7% (also downgraded to Market Perform from Outperform at Leerink), ZAGG -27.3% (also downgraded by multiple analysts), GUID -20.2% (also downgraded to Hold from Buy at Benchmark), ARNA -14.3%, TDC -10.3%, LNKD -8.9%, AGNC -7.6%, HMA -6.9% (light volume), SKUL -6.2%, RBS -6%, ACTV -5.3% (light volume), RTEC -4.9% (light volume), HAIN -3.7% (announces strategic acquisition of Ella's Kitchen Group; expected to be accretive in 2014 by $0.05-0.08 per share), MYL -3.6%, TPX -3.1%, QLGC -2.9% (light volume), ONNN -2.7%, ADNC -2.5% (light volume), DOLE -2.4% (light volume), NILE -2.2%, WFT -2.2% (light volume), ARR -2%, SPWR -1.9% (following late spike on early earnings release), KOG -1.9%, OPEN -1.7%, IMPV -1.1%, (light volume).

Mortgage related names showing weakness:WMC -3.6%, MTGE -3.5%, TWO -2.8% (announced acquisition of company with certain MSR approvals), HTS -2.5%, NYMT -2.4%, ANH -1.8%, MITT -1.7%, ACAS -1.1%, CYS -0.7%, IVR -0.4%, CIM 0.3%.

Other news:DCTH -53.2% (confirms FDA Advisory Committee voted 16-0 that the benefits of treatment with co's Melblez Kit do not outweigh the risks; also multiple downgrad

Отчетыкомпаний:

Вчера после закрытия:

ABTL ACTV ACUR ADNC ADUS AGII AGNC AHS AIG AIV ALSK ARCI AREX ARSD ATHN ATRC AVD BAGL BBG BCOR BERY BKH BODY BRKR CALD CARB CATM CBI CCO CEC CHEF CHMT CIA CPT CTIC CUB DCT DMRC DNB DOLE DRIV EBS ED EIHI ELON ELX EPAY ESC EVC FBHS FDUS FFG FLR FLT GEOS GHDX GILD GMED GSIT GST GTY GUID HAIN HAYN HCCI HI HIL HMA HME HPOL HTGC IMMR IMPV INVN IRIX KMPR KOG KRFT KRG KTEC LNKD LPTH LTRX MASI MCC MCHP MCHX MERC MFLX MHK MOVE MRC MTD MTZ MYL NAVG NBIX NCMI NILE NSR OGXI ONNN ONVI OPEN OPLK PAMT PCCC PDM POWI PRO PRSS PTIX PWER QLGC RM RP RSE RTEC RWT SAAS SCOR SEM SKUL SPF SPWR SWN TDC THOR TPC TPX TSYS TTMI UEIC UIL VCRA WEBM WEYS WFT WRLS WTW WWWW XL ZAGG

Сегодня перед открытием:

ABR ADP AXL BBEP BPL CBM CBOE COWN DUK DW FBN FBP FRM GBDC GTXI HNR HST ICFI IEP JOUT KOP KVHI LNT LRN MCO MSG NCT NFP NGLS NRF NVE NWL PNW POM REGN RUTH SE SEP SHEN SMP SUP TDS TREX TRGP UPL WCG XLS YRCW ZEUS

Торговые идеи NYSEи NASDAQ:

PKT– лонг выше 14.50, ниже 13.50 смотрим акцию в шорт.

WTW– шорт ниже 46.00

FLT– лонг выше 84.00

ARNA– лонг выше 7.25

TDC– лонг выше 48.00, шортим ниже уровней постмаркета.

AGNC – лонг выше 31.00

TPX– шорт ниже 46.00

WMC– лонг выше 21.50

Оригинал на сайте

- Европейские индексы на положительной территории.

- Nikkei -0,76%

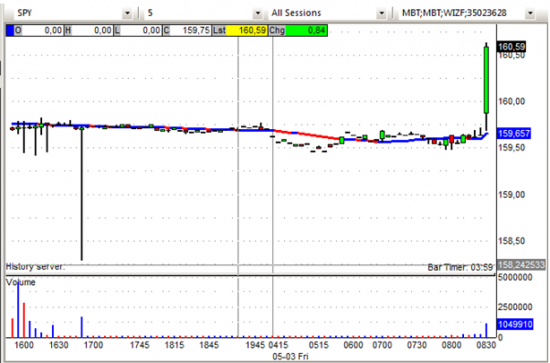

SPY (внутридневной график) рост на премаркете. Сопротивление: 159.75 Поддержка: 159.50

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: PKT +21.8% (also receives multi-million dollar order from North American MSO to deliver network intelligence), BCOR +13.6%, INVN +11.8%, WTW +8.7%, FLT +7.8%, MASI +4.7%,(light volume), YY +4.1% (light volume), REGN +3.8% ( Acquires Full Rights to Two Novel Ophthalmology Development Programs; co will pay Sanofi (SNY) $10 mln upfront, up to $40 mln in development payments, and royalties on sales with respect to PDGF antibodies ), AIG +2.8%, MHK +2.3%, FLR +2.2% (light volume), KRFT +1.9%, UEIC +1.6% (light volume), PCOM +1.3% (light volume), AXL +1.2%, ATHN +1% (light volume).

Metals/mining stocks trading higher: BHP +3.7%, RIO +3.2%, BBL +2.6%, SLV +1.3%, SLW +1.3%, ABX +1.3%, GG +1.1%, NEM +1%, VALE +0.8%, GLD +0.8%, FCX +0.5%.

Select oil/gas related names showing strength: TOT +0.7%, RDS.A +0.6%, BP +0.6%, RIG +0.4%.

Other news: GENE +20% (executes agreement with nationwide provider network), AGN +2.7% (FDA Advisory Committee unanimously recommended JUVEDERM VOLUMA XC as a safe and effective treatment option for cheek augmentation to correct age-related volume deficit in the mid-face), DDD +2.9% (still checking), BBRY +1.9% (higher on reports of Dept of Defense usage approval ), CCL +1.2% (still checking), MBI +0.8% (announces settlement with Flagstar Bank (FBC) of $110 mln in cash and other consideration), AAPL +0.4% (may launch low cost iPhone in small volumes, according to reports ).

Analyst comments: BZH +1.6% (upgraded to Overweight from Neutral at JPMorgan, upgraded to Market Perform from Underperform at JMP Securities), ACT +1.4% (tgt to $118 from $105 at Bernstein), ALL +0.1% (added to Conviction Buy List at Goldman), FSLR +0.1% (tgt to $60 from $45 at Lazard )

Gapping down:

In reaction to disappointing earnings/guidance:VCRA -27.7% (also downgraded to Market Perform from Outperform at Leerink), ZAGG -27.3% (also downgraded by multiple analysts), GUID -20.2% (also downgraded to Hold from Buy at Benchmark), ARNA -14.3%, TDC -10.3%, LNKD -8.9%, AGNC -7.6%, HMA -6.9% (light volume), SKUL -6.2%, RBS -6%, ACTV -5.3% (light volume), RTEC -4.9% (light volume), HAIN -3.7% (announces strategic acquisition of Ella's Kitchen Group; expected to be accretive in 2014 by $0.05-0.08 per share), MYL -3.6%, TPX -3.1%, QLGC -2.9% (light volume), ONNN -2.7%, ADNC -2.5% (light volume), DOLE -2.4% (light volume), NILE -2.2%, WFT -2.2% (light volume), ARR -2%, SPWR -1.9% (following late spike on early earnings release), KOG -1.9%, OPEN -1.7%, IMPV -1.1%, (light volume).

Mortgage related names showing weakness:WMC -3.6%, MTGE -3.5%, TWO -2.8% (announced acquisition of company with certain MSR approvals), HTS -2.5%, NYMT -2.4%, ANH -1.8%, MITT -1.7%, ACAS -1.1%, CYS -0.7%, IVR -0.4%, CIM 0.3%.

Other news:DCTH -53.2% (confirms FDA Advisory Committee voted 16-0 that the benefits of treatment with co's Melblez Kit do not outweigh the risks; also multiple downgrad

Отчетыкомпаний:

Вчера после закрытия:

ABTL ACTV ACUR ADNC ADUS AGII AGNC AHS AIG AIV ALSK ARCI AREX ARSD ATHN ATRC AVD BAGL BBG BCOR BERY BKH BODY BRKR CALD CARB CATM CBI CCO CEC CHEF CHMT CIA CPT CTIC CUB DCT DMRC DNB DOLE DRIV EBS ED EIHI ELON ELX EPAY ESC EVC FBHS FDUS FFG FLR FLT GEOS GHDX GILD GMED GSIT GST GTY GUID HAIN HAYN HCCI HI HIL HMA HME HPOL HTGC IMMR IMPV INVN IRIX KMPR KOG KRFT KRG KTEC LNKD LPTH LTRX MASI MCC MCHP MCHX MERC MFLX MHK MOVE MRC MTD MTZ MYL NAVG NBIX NCMI NILE NSR OGXI ONNN ONVI OPEN OPLK PAMT PCCC PDM POWI PRO PRSS PTIX PWER QLGC RM RP RSE RTEC RWT SAAS SCOR SEM SKUL SPF SPWR SWN TDC THOR TPC TPX TSYS TTMI UEIC UIL VCRA WEBM WEYS WFT WRLS WTW WWWW XL ZAGG

Сегодня перед открытием:

ABR ADP AXL BBEP BPL CBM CBOE COWN DUK DW FBN FBP FRM GBDC GTXI HNR HST ICFI IEP JOUT KOP KVHI LNT LRN MCO MSG NCT NFP NGLS NRF NVE NWL PNW POM REGN RUTH SE SEP SHEN SMP SUP TDS TREX TRGP UPL WCG XLS YRCW ZEUS

Торговые идеи NYSEи NASDAQ:

PKT– лонг выше 14.50, ниже 13.50 смотрим акцию в шорт.

WTW– шорт ниже 46.00

FLT– лонг выше 84.00

ARNA– лонг выше 7.25

TDC– лонг выше 48.00, шортим ниже уровней постмаркета.

AGNC – лонг выше 31.00

TPX– шорт ниже 46.00

WMC– лонг выше 21.50

Оригинал на сайте

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы