marat_tmr

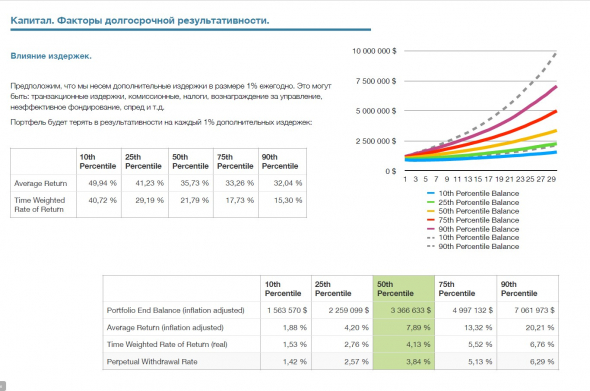

Влияние издержек на результативность. Edge.

- 24 апреля 2020, 00:35

- |

На длинной дистанции, за счет compound эффекта разница в результатах становится огромной.

Для справки, в среднем цель брокера по клиенту — 2-3% в год комиссий.

13% от gain — налог.

В сумме — получается очень большое снижение результативности.

Намного большую эффективность показывает: Портфель (качество, без ребалансировок — без налогов и комиссий) + Хеджирование (очень низкие комиссии и редкость операций). Таким образом мы избавляемся от издержек и математически, без поиска альфы, можем аутперформить активные фонды.

- комментировать

- 3.3К | ★2

- Комментарии ( 4 )

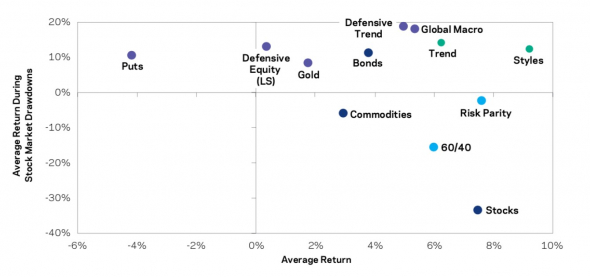

Эффективность защитных стратегий в период рецессии.

- 22 апреля 2020, 23:18

- |

Источник: https://blackpointcap.com/documents/Recession%20Review.pdf

Rolling returns

- 21 апреля 2020, 22:32

- |

Еще один показатель, который интуитивно более понятен, но не используется. Обычно его используют в таблице и в процентах. Визуальное представление — наша идея, по крайней мере подобный способ представления нигде не встречался. Итак, описание:

Альтернативный метод анализа класса активов и стратегий.

Существует множество метрик для оценки активов и стратегий (St.Dev, Sharp, Sortino, alfa, beta, R2, Correlation и т.д.), используемых специалистами. Но абстрактные математические коэффициенты и переменные не всегда интуитивно понятны и поэтому не всегда используются для принятия взвешенного решения владельцами капитала.

Предлагаемый нами метод позволяет быстро и в интуитивно понятной форме анализировать как классы активов, так и стратегии.

На рисунке представлены Rolling returns и Средние годовые доходности для 4 активов. Rolling returns — это доходности, которые были получены при инвестициях на 1, 3, 5, 7, 10 и 15 лет за 40 летнюю историю.

Каждый актив или стратегия имеет внутреннюю Среднюю годовую доходность, которую они вырабатывают на длинной дистанции. Чтобы получить эту доходность, владелец актива должен пройти через первоначальный период турбулентности. После чего Средняя доходность стабилизируется в относительно узком диапазоне.

Читается: При инвестиции в SP500 на 7 лет средняя годовая доходность будет попадать в диапазон 1,3—11,9% годовых (тело бара). В редких случаях (10% вероятности) — доходность попадет в диапазон 11,9—13,9% (верхняя тень бара) или -0,7—1,3% (нижняя тень бара). Средняя годовая доходность — 6,5% годовых (ориентир, если проинвестированы все периоды). Медиана — 6,4% (ориентир, если проинвестированы избирательно часть периодов).

( Читать дальше )

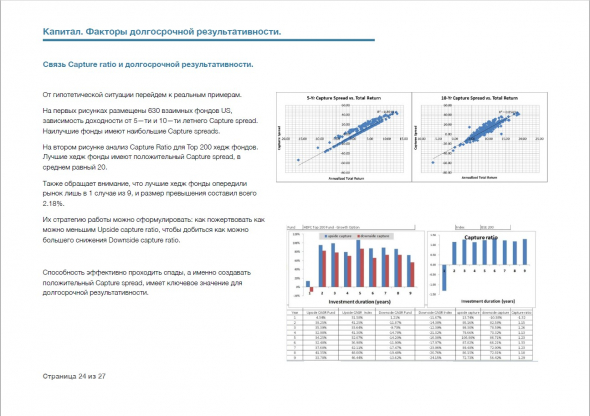

Capture spread

- 21 апреля 2020, 00:50

- |

Один из немногих показателей, который имеет устойчивую корреляцию с долгосрочной успешностью — Capture spread. Тем не менее, он совсем не используется при оценке фондов / ДУ / управляющих. Взято с https://blackpointcap.com/documents/Capital%20Review.pdf с разрешения авторов.

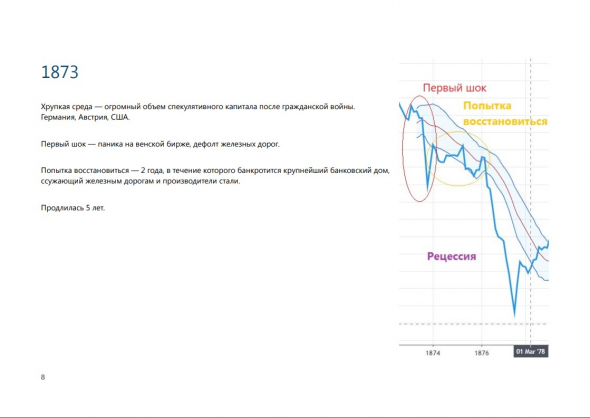

Summary of the study of 33 recessions over 150 years.

- 20 апреля 2020, 11:38

- |

Анатомия рецессий, и примеры.

blackpointcap.com/documents/Recession%20Roadmap.pdf

Добрый вечер,коллеги. Думаю,с этим вопросом сталкивался любой,у кого несколько счетов. Вопрос: с помощью чего вы дублируете действия между квиками?

- 29 мая 2017, 20:02

- |

Bloomberg Brief

- 18 января 2017, 21:06

- |

Banks begin quantifying the size of their post-Brexit exit plans, publisher Pearson's shares crash, and it's day two at Davos.

Brexit

With economists questioning U.K. Prime Minister Theresa May's Brexit plan outlined in a speech yesterday, major banks are starting to quantify the effects on their London business. HSBC Holdings Plc Chief Executive Officer Stuart Gulliver said that operations generating about 20 percent of revenue may have to move to Paris, while Andrea Orcel, UBS Investment Bank president, said the bank will have to move employees from London following the U.K.'s exit from the EU. In other European bank news, Deutsche Bank Chief Executive Officer John Cryan apologized unreservedly as the bank agreed to pay $7.2 billion in a final settlement with the U.S. Justice Department over its handling of mortgage-backed securities before 2008.

Pearson crash

Shares in publishing company Pearson Plc tumbled as much as 28 percent in trading this morning after the company cut its profit forecast in an unscheduled announcement. The company, which is the seventh most-shorted stock in the U.K.’s FTSE 100 Index, said it would sell its stake in the Penguin Random House book business. There was better news for Burberry Group Plc as the company reported better than expected results as the essential Asian market returned to growth.

Davos, day two

The Davos play is missing its prince, as conversations there are dominated by the absent President-elect Donald Trump. While attendees have expressed nervousness about Trump's populist policies, many are excited about fresh opportunities for business under his administration. The lone attendee from his incoming administration, hedge fund manager Anthony Scaramucci, described the PEOTUS as an “unbelievable strategist.” Bloomberg Television will continue to carry live coverage and interviews throughout the event.

( Читать дальше )

Bloomberg Brief

- 17 января 2017, 22:44

- |

Theresa May is expected to set out her vision for a hard Brexit in a speech this morning. The dollar is weakening against all its G10 peers, and Saudi Arabia says that OPEC production cuts can end in June.

Brexit details

U.K. Prime Minister Theresa May is due to give a speech at around 6:45 a.m. ET in which she will outline plans for Britain to pull out of the European Union. She will say that she has no interest in “anything that leaves us half-in, half-out,” according to extracts released by her office. The pound, which weakened following press reports about the speech over the weekend, was trading at $1.2174 by 5:00 a.m. ET, a level close to Friday's close. Inflation data released this morning showed consumer-price growth increased to 1.6 percent in December, the highest level in over two years, and ahead of economists' expectations for a 1.4 percent increase.

Weakening dollar

The dollar declined against all of its Group of 10 peers and dropped against the yen for the seventh day, with that currency trading as high as 113.01 to the greenback. The acceleration in selling came after a Wall Street Journal story cited President-elect Donald Trump as saying the dollar was already too strong. The move has also seen gold rise to $1214.39 an ounce by 5:13 a.m. ET, its highest level since Nov. 23.

Saudi's plan early exit

Saudi Arabia says the agreed OPEC cuts can end by mid-year, as the market rebalances. According to Bloomberg calculations, removing the production curbs when the current deal expires in June would not be enough to eliminate the entirety of the global stockpile-overhang. Saudi Arabia’s Energy Minister Khalid Al-Falih said that many countries are “going the extra mile” in making deeper production cuts. A barrel of West Texas Intermediate for February delivery was trading at $53.28 by 5:22 a.m. ET.

( Читать дальше )

Bloomberg Brief

- 13 января 2017, 14:41

- |

Fiat shares recover some losses as CEO says it is not Volkswagen. China is trying to stop currency outflows, and Yellen says everything's all right, for now.

Fiat defends itself

Shares in Fiat Chrysler Automobiles NV are recovering some of yesterday's more-than 18 percent plunge after Chief Executive Officer Sergio Marchionne dismissed the U.S. Environmental Protection Agency allegations that it violated pollution laws as «unadulterated hogwash.» He described the situation as entirely different to the case which cost Volkswagen AG more than $20 billion. Despite yesterday's setback, shares in Fiat have gained more than 40 percent since the election of Donald Trump.

PBOC balancing act

China has stepped up efforts to restrict yuan outflows by asking some banks to stop processing cross-border payments until they're balanced on both sides, according to people familiar with the matter. Data released overnight showed that the country's exports remain tepid, with overseas shipments dropping 6.1 percent while imports rose 3.1 percent, leaving a $40.8 billion trade surplus.

Yellen bullish?

Federal Reserve Chair Janet Yellen said that she sees no serious short-term obstacles to the U.S. economy and that inflation is «pretty close» to policy makers' 2 percent target. She also defended the 2010 Dodd-Frank act, which the incoming administration have said they will seek to dismantle. On Wall Street today, all eyes will be on bank earnings with JPMorgan Chase & Co., Bank of America Corp., Wells Fargo & Co. and BlackRock Inc. all announcing results.

Markets rise

Overnight, the MSCI Asia Pacific Index fell less than 0.1 percent, while Japan's Topix index added 0.6 percent, with airbag maker Takata gaining 16 percent as it nears a settlement with the U.S. In Europe, the Stoxx 600 Index was 0.5 percent higher at 5:26 a.m. ET and carmakers and health-care stocks recovered. S&P 500 futures gained 0.1 percent.

Big data day

( Читать дальше )

теги блога marat_tmr

- 2020

- Bloomberg Brief

- cashflow

- cornerstone

- crisis

- edge

- Hello

- performance

- performance metrics

- portfolio management

- portfolio managment

- recession

- success

- аналитика

- вопрос

- газодобывающая промышленность США

- доверетильное управление

- Инвестиции в недвижимость

- индустрия

- Квик

- кризис

- кризис 2020

- лось

- несколько счетов

- олень

- покер

- рецессия

- степан демура

- стратегии

- трейдер

- трейдинг

- трек-рекорд

- уран

- экономика