SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Предварительные данные по продажам недвижимости и запасы нефти.

- 29 марта 2017, 15:25

- |

В предварительных данных по продажам недвижимости ожидают рост на 0.5%:

Рынок недвижимости стал более плавным и прогнозируемым последний год, поэтому сюрпризов аналитики не ожидают:

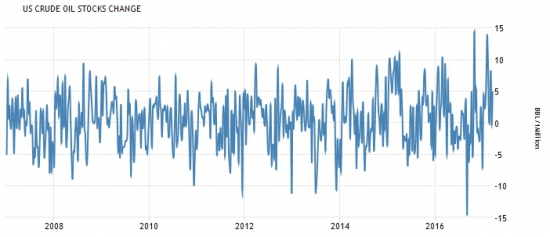

Нефтяные склады продолжают работать в режиме накопления, аналитики ожидают прирост 0,7 млн., что выведет показатель выше отметки 5млн.:

Это значение подходит к границам отсечек и в последующие недели начнут превалировать ожидания перехода нефтяных складов в режим распределения:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

1К

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Misc

Stocks with favorable mention: AAPL, CCL, DRI, EL, FLO, GIS, GM, PEP, PNRA, RHT, RTN, TSLA

Stocks with unfavorable mention: PFE, TWNK

Market updates:

US Econ Data

Equity indices in the Asia-Pacific region ended the midweek session on a mostly higher note after spending the day inside narrow ranges. Chinese banks displayed relative strength, benefitting from an uptick in interest rates and better than expected results from AgBank. Staying in China, Moody's warned about a property market adjustment following a recent spike in prices, coupled with higher interest rates and tighter liquidity management from the People's Bank of China.

---Equity Markets---

---FX---

South Carolina Electric & Gas Company, principal subsidiary of SCANA, and V.C. Summer Nuclear Station co-owner, Santee Cooper, contracted with WEC to build two Westinghouse AP1000 reactors in Fairfield County, S.C.

SCANA will host a call with financial analysts at 3:00pm Eastern Time on March 29, 2017, during which members of SCANA's management team will provide an update on the impact of WEC's bankruptcy on the new nuclear project.

Upgrades:

Downgrades:

Miscellaneous:

Gapping up:

Gapping down:

OLLI indicated higher premarket.

Major European indices trade in the neighborhood of their flat lines, taking the recent news from Brussels in stride. As expected, the British delegation met with European Council President Donald Tusk and presented him with a letter that triggers Article 50 of the Lisbon Treaty. An 18-month negotiation period is expected to follow. With all attention on the EU-UK relationship, Greek-related headlines have been cast to the backburner. However, it is worth noting that German Finance Minister Wolfgang Schaeuble voiced opposition to deferring Greek interest payments, saying this would be equivalent to a new loan. Greek officials have until April 7 to come to terms with EU representatives to avoid a funding shortage. That said, the Bank of Greece reportedly has more than EUR10 billion in funds that could be accessed to buy some additional time for negotiations.

---Equity Markets---

VRNT indicated near 42 premarket

U.K. Government Invokes Article 50

Equities have hit pause this morning in the wake of yesterday's unexpected climb that broke the Dow's longest losing streak since 2011 (eight days). The S&P 500 futures trade three points below fair value.

Crude oil holds a modest gain after an armed group of individuals shut down pipelines in Libya due to a wage dispute. The disruption is reducing output by an estimated 250,000 barrels per day. Also of note, the Energy Information Administration will release its weekly inventory report later this morning at 10:30 ET. WTI crude trades 0.5% higher at $48.61/bbl.

U.S. Treasuries trade just a tick above their flat lines this morning with the benchmark 10-yr yield one basis point lower at 2.41%.

On the data front, the weekly MBA Mortgage Applications Index, which was released earlier this morning, decreased 0.8% to follow last week's 2.7% downtick.

In addition, investors will receive February Pending Home Sales (Briefing.com consensus 2.4%) at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

Wall Street is poised for a slightly lower open on Wednesday as the S&P 500 futures trade two points below fair value.

Earlier this morning, the U.K. officially launched the Brexit process when Britain's ambassador to the European Union hand delivered the formal withdrawal notification to European Council President Donald Tusk. The two sides will now have 18 months to negotiate the specific terms of their relationship going forward.

The pound (1.0750) has held up relatively well against the U.S. dollar in the aftermath while the euro (1.0752) has tumbled 0.6% against the greenback. However, since the referendum on June 23, the pound has given up over 16.0% against the U.S. dollar.

European Yields Fall Sharply

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Shares of Dave & Busters are trading ~3.1% lower at $60.25/share in the pre-market

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness:

Other news:

Analyst comments:

The S&P 500 futures trade two points below fair value.

Equity indices in the Asia-Pacific region ended the midweek session on a mostly higher note after spending the day inside narrow ranges. Chinese banks displayed relative strength, benefitting from an uptick in interest rates and better than expected results from AgBank. Staying in China, Moody's warned about a property market adjustment following a recent spike in prices, coupled with higher interest rates and tighter liquidity management from the People's Bank of China.

---Equity Markets---

Major European indices trade in the neighborhood of their flat lines, taking the recent news from Brussels in stride. As expected, the British delegation met with European Council President Donald Tusk and presented him with a letter that triggers Article 50 of the Lisbon Treaty. An 18-month negotiation period is expected to follow. With all attention on the EU-UK relationship, Greek-related headlines have been cast to the backburner. However, it is worth noting that German Finance Minister Wolfgang Schaeuble voiced opposition to deferring Greek interest payments, saying this would be equivalent to a new loan. Greek officials have until April 7 to come to terms with EU representatives to avoid a funding shortage. That said, the Bank of Greece reportedly has more than EUR10 billion in funds that could be accessed to buy some additional time for negotiations.

---Equity Markets---

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

Investors have tapped the brakes this morning following yesterday's unexpected rally. The S&P 500 futures trade two points below fair value, indicating a slightly lower open for the stock market on Wednesday.

The pound (1.2418) has given up some ground against the U.S. dollar this morning, down 0.2%, after the U.K. triggered Article 50 to launch the Brexit process. The European Union and the United Kingdom will now have 18 months to negotiate the terms of their relationship going forward.

U.S. Treasuries continue to climb farther into positive territory this morning with the benchmark 10-yr yield now trading three basis points lower at 2.39%.

Crude oil clings to a slim gain, up 0.3% at $48.52/bbl. The API reported a larger than expected build of 1.9 million barrels on Tuesday evening, but the bearish news has been mitigated by a conflict in Libya that has cut into production. Also of note, the EIA will release its weekly inventory report later this morning at 10:30 ET.

In U.S. corporate news, Vertex Pharmaceuticals (VRTX 108.25, +18.58) has surged 21.0% in pre-market trade after reporting that an experimental cystic fibrosis drug improved lung function. Restoration Hardware (RH 44.20, +6.20) also trades solidly higher, up 16.3%, after reporting in-line results and issuing positive revenue guidance.

On the data front, investors will receive February Pending Home Sales (Briefing.com consensus 2.4%) at 10:00 ET.

The S&P 500 opens Wednesday's session with a slim loss of 0.1%.

Nearly all sectors trade in the red with the lightly-weighted utilities group (-0.7%) leading the retreat. On the flip side, the telecom services (+0.1%) and consumer discretionary (+0.1%) spaces have shown relative strength.

Amazon (AMZN 860.48, +4.48) has underpinned the consumer discretionary sector's outperformance. AMZN shares trade higher by 0.7%.

The tech sector — XLK — trades about in-line with the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.48%. Within the SOX index, AMD (+0.07%) outperforms, while MSCC (-1.06%) lags. Among other major indices, the SPY is trading 0.23% lower, while the QQQ +0.05% and the NASDAQ -0.71% trade opposite thus far on the session. Among tech bellwethers, GOOG (+0.62%) is showing relative strength, while DCM (-2.26%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.91… VIX: (11.48, -0.05, -0.4%).

April 21 is options expiration — the last day to trade April equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

U.S. crude oil imports averaged over 8.2 mln barrels per day last week, down by 83,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 8.0 mln barrels per day, 0.7% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 521,000 barrels per day. Distillate fuel imports averaged 115,000 barrels per day last week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 0.9 mln barrels from the previous week. At 534.0 mln barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 3.7 mln barrels last week, but are in the upper half of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories decreased by 2.5 mln barrels last week but are in the upper half of the average range for this time of year. Propane/propylene inventories fell 1.5 mln barrels last week but are in the middle of the average range. Total commercial petroleum inventories decreased by 3.9 mln barrels last week.

Total products supplied over the last four-week period averaged over 19.6 mln barrels per day, up by 0.7% from the same period last year. Over the last four weeks, motor gasoline product supplied averaged over 9.3 mln barrels per day, down by 1.0% from the same period last year. Distillate fuel product supplied averaged 4.2 mln barrels per day over the last four weeks, up by 13.1% from the same period last year. Jet fuel product supplied is up 12.1% compared to the same four-week period last year.

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Restoration Hardware (RH +13%) earnings strength is lifting furniture/home goods related retailers. TCS +4.8%, SHOS +4.9%, KIRK +3.4%, WSM +3.2%, PIR +3.3%, W +3%, ETH +1.7%, BBBY +0.9%

- Sonic (SONC +8%) is leading restaurant/QSR names higher: ZOES +4%, CMG +2.2%, RT +1.8%, SAUC +0.9%, SHAK +1.7%, BLMN +1.5%, TACO +1.5%, FRSH +1.4%, DAVE +1.2%, BJRI +1.2%, RRGB +1.1%, BWLD +1.1%, HABT +0.9%, DIN +0.9%, FRGI +0.9%, LOCO +0.9%, SBUX +0.8%, WEN +0.9%, QSR +0.7%, EAT +0.8%, CBRL +0.8%… A few names are lower following analyst downgrades: DRI -0.2% (downgraded to Neutral from Buy at BTIG Research), PNRA -0.1% (downgraded to Hold at Maxim Group)

In the news:Looking ahead:

treatment of PTSD as well.

Gainers on news:

- Vertex Pharma (VRTX +22.83%) confirms two Phase 3 Studies of the tezacaftor/ivacaftor combination treatment met primary endpoints with statistically significant improvements in lung function in people with cystic fibrosis

- Interpace Diagnostics (IDXG +6.16%) traders circulate European patent document for microRNA's as biomarkers for distinguishing benign from malignant thyroid neoplasms

- Tonix Pharma (TNXP +41.79%) to Present FDA Breakthrough Therapy-Designated PTSD Program at The MicroCap Conference

Decliners on news:- Ritter Pharma (RTTR -18.97%) announces lactose intolerance treatment RP-G28 demonstrated efficacy and clinically meaningful benefit in phase 2b/3 clinical trial; data supports further clinical development

- DepoMed (DEPO -3.83%) announces cooperation agreement with Starboard, names new CEO, sees Q1 revs below consensus

- Alliqua (ALQA -32.18%) prices 9.375 mln common stock offering at $0.40/share

Gainers on earnings:- Summit Therapeutics (SMMT +1%) FY17 EPS ($0.44) vs. ($0.56) consensus; rev $2.9 mln vs. 0.2 mln consensus.

Decliners on earnings:- Pernix Therapeutics (PTX -17.98%) reports Q4 adjusted EBITDA +49% to $12.5 million from $8.4 million in third quarter 2016 and 60% from $7.8 million in the prior year period; revs +3.7% y/y to $45.4 mln (no estimates).

- Quorum (QHC -15.23%) reports Q4 (Dec) results, misses on revs

- Delcath (DCTH -7.29%) reported FY16 EPS of ($10.59) vs ($14.56) last year.

Upgrades/Downgrades:Treasury Auction Preview

Stocks that traded to 52 week lows: ALQA, ARGS, ATOS, CCIH, CMLS, CNXR, DCTH, FENX, GBSN, IMNP, INVT, MDGS, MNKD, MOSY, NIHD, NVGN, ORIG, ORPN, SCG, SFUN, SRC, TNDM, TVIX, TWER, VMEMQ, XENE

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: AKO.A, APF, APPF, BOCH, CWAY, DXGE, GCH, GGZ, GRR, IBUY, IEUS, IIF, JOF, KF, LGI, MBCN, OFS, PAR, PSCH, RFDI, RFEU, RGT, SGM, SNOA, SWZ, SYX, TATT, TRR, TWN

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: CBAK, OPHC, SBSAA, VJET

ETFs that traded to 52 week highs: ECH, EPP, EWA, EWS

ETFs that traded to 52 week lows: VXX, VXZ

Today's top 20 % gainers

- Healthcare: VRTX (110.3 +23.01%), PACB (5.53 +14.02%), ADAP (4.99 +8.72%), PRTK (19 +8.26%), AKAO (25.66 +7.36%), KPTI (12.11 +7.07%)

- Materials: EGO (3.44 +8.86%)

- Industrials: QUAD (24.49 +10.22%), TPIC (18.66 +7.24%)

- Consumer Discretionary: RH (43.02 +13.21%), CONN (9.03 +7.44%)

- Information Technology: EXAR (13 +22.41%), VRNT (43.25 +9.36%), CSC (74 +7.14%)

- Energy: CIE (0.48 +13.97%), BRS (14.71 +9.69%), DNR (2.64 +9.09%), EMES (13.72 +8.79%), CHK (5.79 +7.42%)

- Telecommunication Services: NIHD (1.2 +11.63%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: VRX (15.07 mln +3.84%)

- Materials: VALE (12.18 mln +2.11%)

- Consumer Discretionary: F (18.21 mln +0.47%), JCP (12.54 mln +3.71%)

- Information Technology: EXAR (18.11 mln +22.41%), AMD (15.7 mln +0.47%), AAPL (11.69 mln -0.19%), MU (9.73 mln -0.68%), HPE (8.48 mln +2.76%), OCLR (8.07 mln +1.04%)

- Financials: BAC (35.78 mln -0.13%), ATH (10.56 mln -0.8%), ITUB (9.6 mln +1.47%)

- Energy: CHK (27.1 mln +7.42%), ECA (10.3 mln +4.41%), PBR (9.78 mln +3.18%), SWN (9.29 mln +4.12%), MRO (9.13 mln +4.79%), SDRL (9.02 mln +1.64%)

- Telecommunication Services: FTR (11.66 mln -1.52%)

Today's top relative volume (current volume to 1-month average daily volume)Biggest point losers: FFIV 140.97(-6.16), FLT 152.6(-4.9), NTES 284.52(-4.83), BIIB 270.02(-4.09), TSRO 152.24(-2.66), CBIO 12.52(-2.49), LITE 52.4(-2.3), UNH 163.08(-2.27), FDS 162.59(-1.98), PLAY 60.36(-1.83), USG 31.95(-1.8), IIVI 37.95(-1.65), STMP 114.05(-1.55), ANET 132.45(-1.52), CRTO 49.6(-1.5), BRK.B 166.83(-1.48), GOLD 87.59(-1.48), SKX 28.58(-1.38), SCG 64.76(-1.38), EFX 134.93(-1.36), DNKN 54.8(-1.31), EXR 73.49(-1.27), GWW 237.93(-1.26), RCL 99.09(-1.24), NTNX 18.7(-1.22)

The co announced that the U.S. Food and Drug Administration's (FDA) Oncologic Drugs Advisory Committee (ODAC) voted unanimously (11 to 0) that the benefit-risk of rituximab/hyaluronidase for subcutaneous (under the skin) injection was favorable for the treatment of certain blood cancers, which include: previously untreated follicular lymphoma, previously untreated diffuse large B-cell lymphoma (DLBCL), relapsed or refractory low grade or follicular lymphoma, and previously untreated and relapsed or refractory chronic lymphocytic leukemia (CLL). This new co-formulation includes the same monoclonal antibody as intravenous Rituxan® (rituximab) and hyaluronidase, a molecule that helps to deliver medicine under the skin. The FDA is expected to make a decision on approval by June 26, 2017.

Rumor Activity was active today

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The broader market is split at the moment, led higher by the Nasdaq Composite which adds 14 points (+0.23%) to 5888, the S&P 500 also trades in the green, up now by about 2 (+0.07%) to 2360, while the Dow Jones Industrial Average loses about 41 (-0.20%) to 20660. Action has come on lower than average volume (NYSE 275 vs. avg. of 321; NASDAQ 733 mln vs. avg. of 809), with advancers outpacing decliners (NYSE 1841/1104, NASDAQ 1611/1115) and new highs outpacing new lows (NYSE 71/7, NASDAQ 76/28).

Relative Strength:

Oil&Gas E&P-XOP +2.3%, US Nat Gas-UNG +2.3%, US Gasoline-UGA +2.0%, US Oil-USO +1.9%, Brazil-EWZ +1.8%, US Diesel/Heating Oil-UHN +1.7%, Oil Svcs.-OIH +1.6%, Biotech-IBB +1.5%, Saudi Arabia-KSA +1.4%, Latin Am. 40-ILF +1.3%, Australia-EWA +0.8%, New Zealand-ENZL +0.8%, India-INP +0.6%, Pacific Ex-Japan-EPP +0.6%.

Relative Weakness:

Sugar-SGG -1.9%, Cocoa-NIB -1.4%, Spain-EWP -1.1%, Poland-EPOL -1.0%, Italy-EWI -0.9%, Taiwan-EWT -0.8%, Netherlands-EWN -0.7%, Philippines-EPHE -0.6%, US Healthcare Prov.-IHF -0.6%, Semis-SMH -0.5%, France-EWQ -0.5%, Financials-XLF -0.5%, Insurance-KIE -0.4%, Short-Term Futures-VXX -0.4%.

The Industrials sector (XLI) is trading -0.2% lower today, lower than the broader market (SPY +0.0%). In a slow day the industrial sector, Rockwell Collins (COL -0.3%) receives a $142 mln Navy contract and Siemens AG Medical Solutions (SIEGY -0.1%) unit awarded maximum $4,128,000,000 Defense Logistics Agency contract.

Earnings/Guidance

News

Broker Research

Downgrades

Other

There's been some action at the micro level in the first half of Wednesday's session, but it hasn't translated to much macro movement as the major averages hover in the neighborhood of their unchanged marks. The S&P 500 trades flat while the Dow (-0.3%) and the Nasdaq (+0.3%) are nestled on opposite sides of the benchmark index.

The energy sector (+1.1%) leads its peers by a relatively wide margin this afternoon following the latest crude oil inventory report from the Energy Information Administration. The EIA reading showed a smaller than expected build of 0.9 million barrels (consensus +1.4 million), which awoke the bulls in the crude oil futures market. The energy component trades 2.0% higher at $49.33/bbl, after being up around 0.5% prior to the EIA report.

To a lesser degree, the consumer discretionary (+0.4%), health care (+0.2%), and consumer staples (+0.1%) sectors have also propped up the broader market. Vertex Pharmaceuticals (VRTX 110.21, +20.55) has had a lot to do with the health care sector's outperformance, spiking 23.1%, after reporting that an experimental cystic fibrosis drug improved lung function. VRTX's jump has also left the iShares Nasdaq Biotechnology ETF (IBB 296.66, +4.65) higher by 1.6%.

On the other hand, the consumer discretionary and consumer staples groups have relied on retailers in today's session, evidenced by the 1.2% increase in the SPDR S&P 500 Retail ETF (XRT 42.24, +0.51). Large-cap XRT components like Amazon (AMZN 870.07, +14.11) and Wal-Mart (WMT 70.79, +0.46) have done their part in advancing the industry group by adding 1.6% and 0.7%, respectively.

The largest sectors by weight, financials (-0.5%) and technology (-0.1%), have limited the impact of the aforementioned groups. The remaining sectors--industrials, materials, utilities, telecom services, and real estate--trade with financials and technology in the red, but their losses have been held in check.

In the Treasury market, U.S. sovereign debt trades modestly higher with the benchmark 10-yr yield three basis points lower at 2.39%. It's worth noting that Boston Fed President Eric Rosengren said that he would like to see four rate hikes in 2017, which represents the most hawkish outlook that has been offered by a Fed official to date. However, the impact on the Treasury market was minimal as Mr. Rosengren doesn't have a vote on this year's FOMC.

On the data front, today's economic releases were limited to February Pending Home Sales and the weekly MBA Mortgage Applications Index:

Treasury Auction Results

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.78… VIX: (11.25, -0.28, -2.4%).

April 21 is options expiration — the last day to trade April equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Events and conferences of interest for tomorrow, March 30th include:

Dollar Bounce Continues

The Energy Sector (XLE, +1.3%) leading the broader market (SPY, +0.1%) higher after the weekly EIA Data. Crude oil (USO, +2.7%) trading higher. Lastly, natural gas (UNG, +2.9%) futures up for the second day in a row ahead of tomorrow's inventory data release. Today's EIA petroleum highlights are summarized below:

EIA petroleum highlights:

Upcoming data reminders:

Notable gainers:

Notable laggards:

Notable earnings & news

Notable broker calls

Treasuries Power Through Oil Rally to End Higher