SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Предварительные данные по доверию потребителей и цены на экспорт-импорт.

- 10 февраля 2017, 16:21

- |

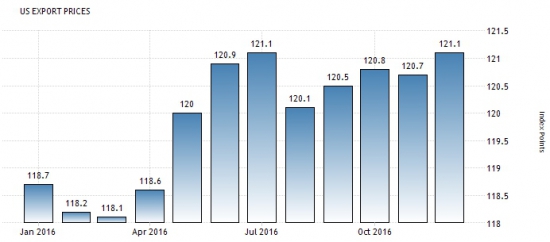

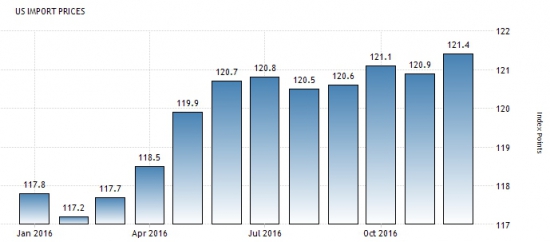

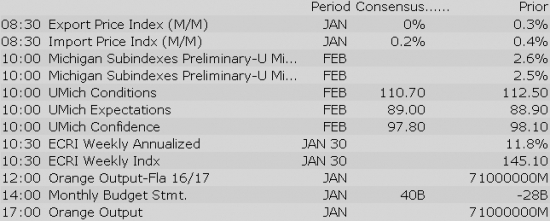

Индексы цен на экспорт и импорт в Америке продолжают развитие годового растущего тренда. Рост индекса импортных цен выглядит более уверенно, в экспорте наблюдаются небольшие перепады. Прирост в индексе цен на экспорт ожидается 0.1% против 0.2% в индексе цен на импорт:

Аналитики с большей уверенностью начинают рассматривать эти движения как новую растущую волну десятилетних циклов:

В потребительском секторе ожидается, что предварительные данные по доверию потребителей от университета Мичиган подтвердят сложившуюся оптимистичную пятилетнюю картину:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market Updates:

US Econ Data

Equity indices in the Asia-Pacific region ended the week on a higher note with Japan's Nikkei (+2.5%) setting the pace. The Bank of Japan stepped up its bond purchases by JPY20 billion in order to curtail rising longer-term yields. Prime Minister Shinzo Abe will be meeting with President Donald Trump this weekend. On a separate note, better than expected trade data from China also contributed to the upbeat sentiment.

---Equity Markets---

---FX---

Stocks with favorable mention: ACC, AGCO, AGN, ALK, CMI, COST, DOW, FB, GOOGL, HON, JPM, LUV, MMM, PEP, REVG, SAP, SHOP, THO, THS

Stocks with unfavorable mention: ADM, EMR, KNOP, KO, NAK, TWTR

Major European indices trade in mixed fashion with Italy's MIB (-0.9%) showing relative weakness. The first half of today's session has been shaky, even though Reuters reported that IMF and eurozone officials have agreed on a common stance on Greece. According to the report, Greece will be asked to assume EUR1.80 billion in new measures until 2018, followed by another EUR1.80 billion after 2018. Greece's 10-yr yield has fallen 38 basis points to 7.33%.

---Equity Markets---

Gapping down: RSYS -15.3%, ONVO -15.1%, TCON -12.4%, YELP -9.1%, BTX -9%, NDLS -9%, UBNT -8.1%, CATM -7.3%, MX -6.6%, IPAS -6.3%, CLF -6.2%, SGEN -5.6%, MCFT -5%, CYBR -4.4%, CERN -4.1%, ZNGA -4%, ZAYO -3.9%, APTI -3.2%, SANW -3.2%, MPWR -2.6%, ALDW -2.6%, EGAN -2.4%, CS -1.8%, P -1.8%, TBBK -1.7%, TWTR -1.6%, DB -1.5%, CARB -1.4%, MHK -1.3%, LYG -1.2%, NVO -1.1%, NBIX -0.8%, TEVA -0.8%

Stifel notes expectations of every possible benefit in the world had seemingly been modeled in and discounted over no time at all. This had come at a time when many, if not all truckload carriers had been griping about shorter and shallower peak season volumes moving into 4Q16 earnings season. Nonetheless, earnings expectations looked fairly generous. To date, 9 of the truckload carriers have reported 4Q16 results. On average EPS was down over 30% y/y, against a 4Q15 comparable which was already reflecting weakness in the truckload market. Analysts across the Street for each of these cos have adjusted ests down a couple of additional notches on top of the already downwardly revised ests. So, as expected, despite analysts and investors not expecting much, for the most part, each of the truckload names failed to overcome their expectations for a difficult 4Q16.

Names which move to Hold from Sell: KNX, WERN, MRTN, CGI, LSTR, HTLD

Treasuries Slip as European Data Surprises on Upside

After the major U.S. averages finished at record highs yesterday, most global markets and U.S. futures have maintained the positive posture this morning. The S&P 500 futures trade four points (+0.2%) above fair value.

U.S. Treasuries have extended Thursday's losses this morning. The benchmark 10-yr yield is two basis points higher at 2.41%.

Meanwhile, crude oil is up 1.6% at $53.83/bbl amid reports that initial OPEC supply cut compliance reached a record high. The 11 OPEC members with production targets under the deal complied with a record 92.0% of the targeted volume in January, according to Reuters.

On the data front, investors will receive January Export/Import Prices at 8:30 am ET, February Michigan Sentiment Index (Briefing.com consensus 97.9) at 10:00 am ET, and January Treasury Budget at 2:00 pm ET.

In U.S. corporate news:

Reviewing overnight developments:

January revenue per available seat mile was negatively impacted by ~5 points due to holiday placement and the impact of winter weather last year.

Shares of Yelp are trading ~9.9% lower in the pre-market

SKX shares are up ~10% at the 25.7 in after hours trading.

European Bond Yields Bounce Back

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

Firm notes Activision Blizzard reports better-than-expected 4Q results with non-GAAP EPS of $0.92 (vs. $0.83) which came in ahead of their $0.73 estimate, and consensus and guidance (implied) at $0.74. The company was able to overcome a disappointing Call of Duty: Infinite Warfare release, through a combination of digital momentum (+94%) and contributions from other franchises (i.e., Overwatch + World of Warcraft). They thought management's preliminary guidance for '17 was in line/slightly better vs. what they perceived to Morning Research Summary February 10, 2017 Page 32 be a very wide range of expectations, and thus they suspect #s will drift higher, and the shares see a positive response to this update.

Shares of ATVI are up ~10.2% in the pre-market

The S&P 500 futures trade four points (+0.2%) above fair value.

Just in, import prices excluding oil declined 0.2% in January after ticking down 0.1% in December (revised from -0.2%). Export prices excluding agriculture increased 0.1% in January after rising 0.4% in December.

Gapping down

In reaction to disappointing earnings/guidance:

Select financial related names showing weakness:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select financial related names showing weakness:

Other news:

Analyst comments:

ICHR shares are up ~4.5% at 17.5 in after hours trading.

Shares of Viacom are trading 0.3% higher in the pre-market

The S&P 500 futures trade four points (+0.2%) above fair value.

Equity indices in the Asia-Pacific region ended the week on a higher note with Japan's Nikkei (+2.5%) setting the pace. The Bank of Japan stepped up its bond purchases by JPY20 billion in order to curtail rising longer-term yields. Prime Minister Shinzo Abe will be meeting with President Donald Trump this weekend. On a separate note, better than expected trade data from China also contributed to the upbeat sentiment.

---Equity Markets---

Major European indices trade just above their flat lines with Italy's MIB (-0.8%) showing relative weakness. The first half of today's session has been shaky, even though Reuters reported that IMF and eurozone officials have agreed on a common stance on Greece. According to the report, Greece will be asked to assume EUR1.80 billion in new measures until 2018, followed by another EUR1.80 billion after 2018. Greece's 10-yr yield has fallen 38 basis points to 7.33%.

---Equity Markets---

— Shares of P +0.2% pre-market.

Filings:

Offerings:

Pricings:

The major averages are poised for an extension to new record highs this morning as the S&P 500 futures trade five points above fair value.

Conversely, U.S. Treasuries are under pressure amid the risk-on sentiment. The benchmark 10-yr yield is higher by three basis points at 2.42%.

NVIDIA (NVDA 120.55, +4.17) has jumped 3.8% in pre-market action after the company impressed with its fourth quarter earnings report following yesterday's close. NVIDIA justified its huge 55.8% Q4 gain by reporting better than expected earnings and revenues. In addition, the company provided upbeat first quarter guidance.

Cerner (CERN 50.75, -3.13), on the other hand, has slipped 5.8% after the company issued disappointing earnings guidance for the first quarter and all of 2017. Similarly, YELP (YELP 36.75, -4.74) has plunged 11.4% after below-consensus guidance overshadowed the company's better than expected earnings per share.

Also from the corporate front, shares of Sears Holdings (SHLD 7.77, +2.23) have spiked 40.3% this morning following the company's better than expected fourth quarter guidance, EBITDA improvement, and restructuring plans. SHLD has returned to its pre-2017 level after losing over 39.0% since the start of the year.

Released earlier this morning, import prices excluding oil declined 0.2% in January after ticking down 0.1% in December (revised from -0.2%). Export prices excluding agriculture increased 0.1% in January after rising 0.4% in December.

Investors will also receive the preliminary Michigan Sentiment Index for February (Briefing.com consensus 97.9) at 10:00 am ET, and January Treasury Budget at 2:00 pm ET.

Equity indices hold modest gains this morning to extend Thursday's record levels. The S&P 500 is currently up 0.2%.

All six cyclical sectors trade in the green with energy (+0.8%) leading the advance. The material sector (+0.6%) follows closely while the top-weighted technology and financial spaces hold gains of 0.1% apiece.

On the countercyclical side, consumer staples (-0.1%), real estate (-0.1%), and utilities (unch) all trade in negative territory. Meanwhile, the influential health care space (+0.2%) performs in line with the benchmark index.

Economic Data Summary:

Upcoming Economic Data:

Other International Events of Interest

The tech sector — XLK — trades mostly in-line with the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.45%. Within the SOX index, QCOM (+1.15%) outperforms, while CRUS (-2.26%) lags. Among other major indices, the SPY is trading 0.29% higher, while the QQQ +0.29% and the NASDAQ +0.54% trade modestly higher on the session. Among tech bellwethers, ACN (+1.36%) is showing relative strength, while TMUS (-0.71%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings Monday morning:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Rumor Activity was slow to close out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Footwear names are higher following Sketchers (SKX) earnings: BOOT +2.6%, SHOO +2.4%, NKE +1.9%, WWW +1.8%, SCVL +1.1%, DSW +0.8%, GCO +0.7%

- SHOS +5.5% DDS +1% are higher following Sears (SHLD) update.

In the news:- Leaders: MJN 5% (Mead Johnson Nutrition to be acquired by Reckitt Benckiser for $90 per share), TITN 1.1% (announces the implementation of a restructuring plan to consolidate certain dealership locations and a reorganization of its operating structure; expects $25 million in annual cost savings), RCKY 1.7% (expects to make an internal hire for open CFO role by early March), AMZN 0.7% (WSJ detail that Amazon plans to start selling specialized woman's apparel)

- Laggards: BBBY -0.9% (provides update, discloses that its Board is considering modifications to the Company's governance and executive compensation plans)

- Women's apparel brand J.Jill files for $100 mln IPO, expects shares to trade on the NYSE under the symbol JILL

Analyst related:Looking ahead:

The Industrials sector (XLI) is trading +0.6% higher today, higher than the broader market (SPY +0.3%). In the Industrial Sector, JetBlue (JBLU -1.6%) reports January traffic and UK's Serious fraud office confirms probe of ABB Ltd. (ABB +0.4%).

Earnings/Guidance

Additional Industrials reporting earnings/guidance: VVI +4.10% BEAV -0.11% WTS -8.88% CPST -2.44% MCFT -0.20% ARCW -0.53%

News

Broker Research

Upgrades

Downgrades

Other

The Energy Sector (XLE, +1.0%) leads the broader market (SPY, +0.2%) higher for the 2nd consecutive session. Crude oil (USO, +1.8%) futures rally for the third day in a row on a bullish IEA report (summarized below) ahead of today's rig count data. Lastly, natural gas (UNG, -2.8%) futures gave up all of yesterday's post-EIA gains, on track to end the week down about 1.0%.

Mar crude oil futures remained on track to extend their rally into a third consecutive session following the release of the IEA's monthly oil market report.

Other notable highlights of the report include:

Reminder: Baker Hughes rig count data will be released today at 1 pm ET.

Notable Gainers:

Notable Laggards:

In Current Trade:

Earnings/News

Broker Calls

Stocks that traded to 52 week lows: ADVM, APDN, BSTG, COSIQ, DCTH, FCEL, FOSL, GALE, GBSN, HIMX, ICLD, NAO, OHRP, RELY, RGSE, RNVA, RWLK, SHIP, SOL, SQQQ, SRRA, STAF, TCON, TVIX, ULTRQ, VMEMQ, XOMA

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: AIQ, APPF, BBGI, BBP, BCBP, BOCH, BYBK, CAPX, CATH, CFA, CIVB, CNBKA, DAIO, DHG, DNI, EQFN, ESXB, EWZS, FAD, FBZ, FCE.B, FCFP, FEMS, FNY, FRBA, FTCS, FUSB, GCH, GGZ, IBUY, IPKW, KMDA, KRMA, KYO, LAWS, LCM, LFGR, LVHD, MILN, MPB, MRLN, MTLS, NBRV, ONEQ, OSB, OVLY, PCF, PKBK, PLSE, PNQI, QQXT, RFAP, RGT, SAL, SGF, SHBI, SNOA, SRV, SSBI, STN, VONE, VONG, VTHR, VTWG, WAYN, WEBK

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: NTWK, STLY

ETFs that traded to 52 week highs: AMJ, BKF, CROP, DBB, DIA, ECH, EEB, EPOL, EPP, EPU, EWA, EWC, EWT, IAI, IGN, IGV, IOO, ITA, IWF, IYF, IYG, JJC, KIE, MDY, OEF, QQQ, SKYY, SPY, UYG, VTI, XLK, XLY, XME

ETFs that traded to 52 week lows: NIB, VXX

Uranium stocks (URA +1.4%): URRE +3.5%, URG +3%, CCJ +2.7%, UEC +0.9% UUUU +0%

Gainers on news:

- Immunomedics (IMMU +23.57%) enters into exclusive global licensing agreement with Seattle Genetics (SGEN); agreement provides for potential payments of approximately $2 bln, SGEN to purchase 3 mln shares of IMMU common stock at $4.90/share

- Intercept Pharma (ICPT +6.42%) changed Phase 3 REGENERATE trial co-primary endpoints of 1) NASH resolution or 2) fibrosis improvement to an 'either or', de-riskingd the stud; mgmt remains confident in both primary endpoints

- Mead Johnson Nutrition (MJN +5.18%) to be acquired by Reckitt Benckiser (RBGLY) for $90 per share

Decliners on news:- Biostage (BSTG -40.9%) prices public offering with expected total gross proceeds of approx. $8.0 mln at $0.40/share

- Tracon Pharma (TCON -21.65%) reports top-line results from a randomized Phase 2 clinical trial of TRC105 in recurrent glioblastoma (GBM) funded and conducted by the Clinical Therapy Evaluation Program (CTEP) of the National Cancer Institute

- BioTime (BTX -8.64%) prices 6,481,482 shares of its common stock at a public offering price of $2.70/share

Gainers on earnings:- Sonoma Pharma (SNOA +10.77%) reported Q3 EPS from cont ops of $0.18 vs ($1.28) year ago on revs +35% y/y to $3.4 mln.

- Civitas Solutions (CIVI +3.63%) misses by $0.01 (GAAP), misses on revs; reaffirms FY17 guidance

- ICHOR Corporation (ICHR +3.47%) reports EPS in-line, revs in-line; guides Q1 EPS above consensus, revs above consensus

Decliners on earnings:- Organovo (ONVO -14.68%) beats by $0.01, misses on revs; lowers FY17 revs below consensus due to order

- Cerner (CERN -4.47%) reports EPS in-line, revs in-line; guides Q1 EPS below consensus, revs in-line; guides FY17 EPS below consensus, revs in-line

- Taro Pharm (TARO -1.7%) reports Q3 EPS of $3.42 vs $4.41 year ago; revs -14.7% to $220.395 mln (no estimates).

Upgrades/Downgrades:Today's top 20 % gainers

- Healthcare: IMMU (5.4 +25.47%), CPSI (27.43 +14.27%), FMI (27.3 +10.75%), ZLTQ (51.3 +8.96%), SPPI (5.57 +8.79%)

- Materials: HBM (8.86 +8.65%)

- Consumer Discretionary: SHLD (7.15 +29.06%), SKX (27.97 +20.15%), COLM (59.42 +11.5%)

- Information Technology: SWIR (23.55 +26.27%), INFN (11.83 +25.85%), QUOT (12.93 +18.58%), ATVI (46.9 +18.05%), ATEN (9.65 +12.21%), WEB (22.14 +12.1%), RPD (13.95 +11.07%)

- Energy: SDRL (1.96 +12.01%), NE (7.35 +10.86%), ERF (9.49 +7.66%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: IMMU (38.5 mln +25.47%)

- Materials: CLF (77.18 mln -3.43%), FCX (29.14 mln +4.16%), MT (17.67 mln +6.49%), AKS (15.12 mln -2.42%), VALE (13.22 mln +4.57%)

- Consumer Discretionary: F (11.38 mln +0.69%), JCP (11.34 mln -0.64%)

- Information Technology: TWTR (39.33 mln -4.48%), AMD (32.43 mln +0.45%), ATVI (30.47 mln +18.05%), NVDA (25.15 mln -1.61%), INTC (19.89 mln -0.45%), MU (11.69 mln -1.74%), INFN (10.24 mln +25.85%)

- Financials: BAC (34.6 mln -0.54%)

- Energy: SDRL (18.63 mln +12.01%), CHK (14.17 mln +1.66%), NE (11.77 mln +10.86%)

- Consumer Staples: MJN (39.67 mln +5.12%)

Today's top relative volume (current volume to 1-month average daily volume)Biggest point losers: UBNT 55.12(-9.01), YELP 35.8(-5.69), WTS 60.7(-5.2), CATM 45.86(-5.03), TSRO 182.24(-4.67), ORLY 270.79(-3.99), CSL 105.11(-3.47), ECOM 10.88(-3.38), CYBR 52.01(-3.32), BFAM 68.49(-2.98), ATHN 113.57(-2.84), CHTR 322.74(-2.33), SGEN 60.5(-2.32), CERN 51.7(-2.18), FET 22.3(-2), APTI 15.17(-1.87), UVV 76.1(-1.75), HUM 205.29(-1.74), EVHC 69.14(-1.74), ACIA 55.18(-1.5), SBAC 106.28(-1.35), SIG 72.3(-1.32), ABC 90.36(-1.29), DG 76.45(-1.26), AAP 163.62(-1.21)

The broader market is on pace to close with week with some decent gains on the Friday session, led higher by the Dow Jones Industrial Average which gains about 81 points (+0.40%) to 20252, the Nasdaq Composite is up about 17 (+0.30%) to 5732, and the S&P 500 adds about 7 (+0.30%) to 2314. Action has come on mixed average volume (NYSE 301 vs. avg. of 321; NASDAQ 837 mln vs. avg. of 778), with advancers outpacing decliners (NYSE 2026/939, NASDAQ 1694/1010) and new highs outpacing new lows (NYSE 178/0, NASDAQ 175/17).

Relative Strength:

Copper-JJC +4.5%, Copper Miners-COPX +3.9%, Steel-SLX +2.8%, Base Metals-DBB +2.7%, Mexico-EWW +2.3%, Latin Am. 40-ILF +2.2%, US Gasoline-UGA +2.1%, Greece-GREK +2.0%, Jr. Gold Miners-GDXJ +2.0%, Silver Miners-SIL +1.9%, Brazil-EWZ +1.9%, S. Africa-EZA +1.6%, Australia-EWA +1.4%, Taiwan-EWT +1.4%.

Relative Weakness:

US Nat Gas-UNG -2.4%, Cocoa-NIB -2.2%, Short-Term Futures-VXX -1.9%, Sugar-SGG -1.8%, Turkey-TUR -1.6%, Spain-EWP -0.9%, Social Media-SOCL -0.8%, Platinum-PPLT -0.7%, New Zealand-ENZL -0.6%, Italy-EWI -0.5%, Netherlands-EWN -0.4%, Belgium-EWK -0.3%, Israel-EIS -0.3%, Uranium/Nuclear Energy-NLR -0.3%.

Taking a look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.89… VIX: (10.62, -0.26, -2.4%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The major averages hover at fresh record highs at midday after spending the first half in a steady ascent. The S&P 500 (+0.3%) has extended its weekly gain to 0.8% while the Nasdaq (+0.4%) is set to end the week higher by 1.2%.

Today's modest uptick has been a continuation of yesterday's advance that was spurred by President Trump's promise to make a «phenomenal» tax-related announcement in the coming weeks. Mr. Trump didn't supply any specific details of the plan, but his statement did provide a psychological boost to push the stock market out of its recent sideways trend.

Energy (+1.1%) has provided solid sector leadership thanks to a 1.9% climb in crude oil. The commodity trades at $54.02/bbl following a bullish International Energy Agency report which showed a 90.0% OPEC compliance with agreed-upon production cuts and increased oil demand growth forecast for 2017.

The top-weighted technology (+0.2%) and financial (+0.1%) sectors haven't been able to keep pace with the benchmark index thus far. Financials trade mixed while technology has been weighed down by lackluster performance from Apple (AAPL 132.21, -0.21) and chipmakers. The PHLX Semiconductor Index trades flat as a solid gain in Qualcomm (QCOM 54.10, +1.22) has been counter-balanced by losses in Micron Technology (MU 24.00, -0.45) and NVIDIA (NVDA 114.96, -1.41).

NVIDIA's 1.0% loss has resulted from a sell-the-news response after the company justified its huge 55.8% gain in the fourth quarter by beating top and bottom line estimates and issuing upbeat first quarter guidance after yesterday's close.

The consumer discretionary sector was also represented on the earnings front, with Skechers (SKX 27.90, +4.62) and Yelp (YELP 36.25, -5.24) providing mixed results. SKX has spiked 19.7% after reporting above-consensus revenues and upbeat Q1 revenue guidance, while YELP has plunged 13.1% after issuing worse than expected first quarter revenue guidance.

On the countercyclical side, the influential health care space (+0.3%) trades just a tick below the broader market. On the other hand, the lightly-weighted utilities and real estate sectors outperform with gains of 0.6% and 0.5%, respectively.

Today's economic data has included January Export/Import Prices and the preliminary Michigan Sentiment Index for February:

Investors will also receive the January Treasury Budget at 2:00 pm ET.