SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Торговый баланс и потребительское кредитование.

- 07 февраля 2017, 16:13

- |

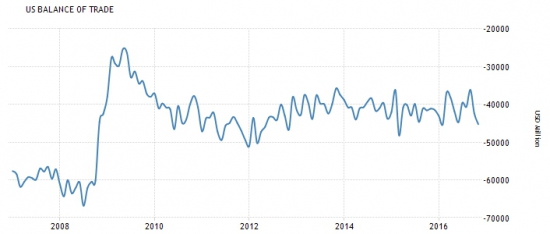

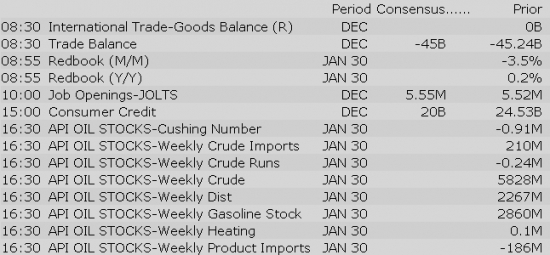

Торговый баланс Америки находится внизу пятилетнего коридора:

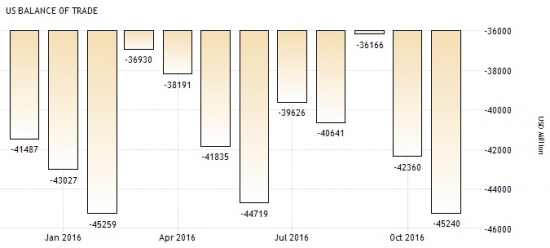

Аналитики прогнозируют дальнейшее увеличение разрыва к отметке $-45,4 млрд.:

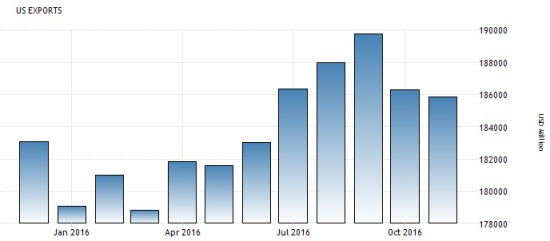

Экспортная составляющая своё падение замедляет:

Разрыв увеличивается за счёт импорта, находящегося на максимальных годовых отметках:

Технический потенциал для дальнейшего движения ещё не исчерпан и ближайшее время импорт может выйти на показатели 2014-го года:

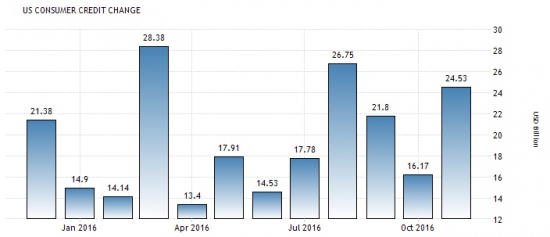

Потребительское кредитование продолжает плавно расти, новое значение ожидается на отметке $19 млрд.:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

27 |

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market updates:

US Econ Data

Equity indices in the Asia-Pacific region ended Tuesday on a mostly lower note, but trading ranges were fairly narrow. Japan's Nikkei (-0.4%) saw a modest downtick while the yen began retreating at the end of the Tokyo session. The yen is currently down 0.6% against the dollar at 112.43, erasing the bulk of yesterday's advance. The Reserve Bank of Australia made no changes to its policy stance, keeping its key rate at 1.50%, as expected. Elsewhere, Reserve Bank of New Zealand Governor Graeme Wheeler said he plans to retire at the end of his term in late September.

In economic data:

---Equity Markets---

---FX---

Gapping down: GIGA -26.6%, KTOV -24.3%, AUPH -8.1%, KORS -6.7%, YRCW -4.8%, FMC -4.4%, KN -4.3%, ALLT -3.4%, ARWR -3.2%, BP -3.2%, MAC -2.9%, HLI -2.6%, TEVA -2.5%, LMNX -2.4%, KGC -2.2%, AM -2.1%, AUY -2%, TLLP -2%, STO -1.9%, BMI -1.8%, AU -1.7%, CLLS -1.6%, ABX -1.4%, HMY -1.4%, GFI -1.4%, ING -1.4%, NEM -1.2%, CS -1.1%, GAIN -1.1%, GDX -1%, EBAY -0.9%, GOLD -0.8%, SLV -0.7%, AG -0.7%, FOXA -0.7%

Major European indices trade in the green with the UK's FTSE (+0.6%) showing relative strength. The IMF commented on Greece, but the remarks were similar to what the Fund has said in the past. The Fund noted that Greece has made progress towards unwinding imbalances, but non-performing loans need to be reduced and tax evasion still needs to be addressed.

In economic data:

---Equity Markets---

Upgrades:

Downgrades:

Miscellaneous:

Gapping up

In reaction to strong earnings/guidance:

Other news:

Analyst comments:

Treasuries Slip as Dollar and Stocks Rebound

After finishing Monday's session with a modest decline, equity futures are recouping yesterday's loss and pointing to a modestly higher start this morning. The S&P 500 futures trade four points above fair value.

The risk-on sentiment has led to a downtick in the Treasury market this morning. The benchmark 10-yr yield currently sits one basis point higher at 2.42%.

Crude oil also trades lower amid a 0.7% uptick in the U.S. Dollar Index (100.54, +0.70). The energy component is down 0.5% at $52.73/bbl.

Today's economic data will include December Trade Balance (Briefing.com consensus -$45.0 billion) at 8:30 am ET, December Job Openings and Labor Turnover Survey at 10:00 am ET, and Consumer Credit (Briefing.com consensus $19.4 billion) at 3:00 pm ET.

In U.S. corporate news:

Reviewing overnight developments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness in sympathy with BNP Paribas (-5% in France after earnings):

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness in sympathy with BNP Paribas (-5% in France after earnings):

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Acquired Prior to IPO:

Upcoming IPOs:

The S&P 500 futures trade four points above fair value.

Equity indices in the Asia-Pacific region ended Tuesday on a mostly lower note, but trading ranges were fairly narrow. Japan's Nikkei (-0.4%) saw a modest downtick while the yen began retreating at the end of the Tokyo session. The yen is currently down 0.7% against the dollar at 112.45, erasing the bulk of yesterday's advance. The Reserve Bank of Australia made no changes to its policy stance, keeping its key rate at 1.50%, as expected. Elsewhere, Reserve Bank of New Zealand Governor Graeme Wheeler said he plans to retire at the end of his term in late September.

In economic data:

---Equity Markets---

Major European indices trade mostly in the green with France's CAC (unch) showing relative weakness. The IMF commented on Greece, but the remarks were similar to what the Fund has said in the past. The Fund noted that Greece has made progress towards unwinding imbalances, but non-performing loans need to be reduced and tax evasion still needs to be addressed.

In economic data:

---Equity Markets---

Filings:

Offerings:

Pricings:

The equity market is on track for a higher open on Tuesday as the S&P 500 futures trade four points above fair value.

A handful of notable names reported earnings results between yesterday's close and today's open, including General Motors (GM 36.08, -0.75), Twenty-First Century Fox (FOXA 31.05, -0.01), and Michael Kors (KORS 36.20, -5.08), among others. GM and KORS are down 2.0% and 12.4%, respectively, in the earnings aftermath while FOXA trades flat.

U.S. Treasuries have given back some of Monday's gains this morning amid the uptick in equity futures. The benchmark 10-yr yield is currently two basis points higher at 2.43%.

Earlier this morning on the data front, the December trade balance showed a deficit of $44.3 billion while the Briefing.com consensus expected the deficit to hit $45.0 billion. The previous month's deficit was revised to $45.7 billion from $45.2 billion.

Tuesday's economic data will also include December Job Openings and Labor Turnover Survey at 10:00 am ET and Consumer Credit at 3:00 pm ET.

— Shares of GWPH -2.0% pre-market.

Between 2016 and the first few weeks of 2017, the Company acquired 8 Natuzzi Italia stores in the US (7 in Florida, 1 in Pennsylvania), 3 in Mexico, as well as 5 Divani & Divani by Natuzzi stores in Italy. This focus and continued investment is part of Natuzzi's objective to boost branded sales, controlling the entire value chain. In line with this strategy the group announced the creation of a new Natuzzi division headed by Nazzario Pozzi.

— Shares of GPK +1.9%.

The stock market opened Tuesday's session by recouping Monday's modest loss. The S&P 500 currently holds a 0.2% gain.

Eight of the eleven sectors are higher as financials (+0.3%) and industrials (+0.5%) lead the small advance. Conversely, materials (-0.3%) and energy (-0.3%) sit at the bottom of the leaderboard in early action, with the latter space suffering from a 1.3% downtick in crude oil. The commodity currently trades at $52.32/bbl.

Treasuries continue to hold their pre-market losses. The benchmark 10-yr yield is two basis points higher at 2.43%.

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.61%. Within the SOX index, NVDA (+2.65%) outperforms, while TSM (-0.78%) lags. Among other major indices, the SPY is trading 0.24% higher, while the QQQ +0.39% and the NASDAQ -0.56% trade opposite on the session. Among tech bellwethers, ACN (+1.16%) is showing relative strength, while ORAN (-1.36%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.74… VIX: (11.16, -0.21, -1.9%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Michael Kors (KORS -15%) disappointing earnings is weighing on accessory focused retailers: FOSL -4.2%, TIF -0.7%, KATE -0.6%, COH -0.5%

- Asbury Automotive +7% after topping Q4 estimates on top and bottom lines — auto vehicles, parts & service retailers higher in sympathy: MPAA +2.8%, SAH +1.3%, LAD +1.3%, PRTS +1.2% are all expected to report earnings this month, GPI +1.3% reported earnings last week… while auto manufacturers are lower following GM earnings: FCAU -4.2%, DDAIF -1.4%, POAHY -1%, F -0.9%, VLVLY -0.7%, VLKAY -0.3%, TM -0.2%

In the news:- Leaders: BWLD 0.9% (Buffalo Wild Wings responds to Marcato; will review the nomination notice and present its formal recommendation in its definitive proxy materials), EBAY 0.7% (shaking off yesterday's after hours pullback from disclosing material weakness in its internal control over financial reporting and filing mixed securities shelf offering), HAS 2.8% and MAT 3.2% (Hasbro for Mattel chatter), COKE 0.6% and KO 0.5% (Coca-Cola Bottling Co. signs a non-binding LOI w/ The Coca-Cola Company to expand the Company's distribution territory in northern Ohio)

- Laggards: PERY -1.6% (appoints David Rattner as Chief Financial Officer), KR -0.6% (Kroger has purchased the equity of Murray's Cheese, as well as its flagship location; Financial terms of the merger were not disclosed)

Other notable trends:- Homebuilders are under pressure: LGIH -2.1%, CHCI -2%, MTH -1.3%, KBH -1.3%, TPH -1%, TMHC -0.8%, LEN -0.8%, TOL -0.7%, BZH -0.6%, MHO -0.5%, MDC -0.3%, DHI -0.2%, CAA -0.2%

Analyst related:Looking ahead:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Treasury Auction Preview

Stocks that traded to 52 week lows: ACET, ACUR, AOBC, APDN, BONT, CERS, CHKE, COSIQ, CRI, DCTH, DMTX, DRWI, DXLG, FCEL, GBSN, GNC, HGG, ICLD, IRMD, KEP, KORS, MFIN, MYGN, NAO, NH, OCRX, OHRP, PLUG, RH, SABR, SBOT, SCOR, SHIP, SHLD, SOL, SPWH, SQBG, SQQQ, SSI, ULTR, VFC, VMEMQ, VNCE, VNR, VRA, WKHS, XCOMQ

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ACFC, AIQ, AUBN, BBGI, BCBP, CDI, CFCO, DNI, ESLT, ESXB, EVBS, FCFP, HBK, HFBC, ITEQ, MGCD, MNDO, MRLN, ONEQ, PGC, PKBK, PRCP, QQXT, QYLD, RMR, SAR, SNOA, TRCB, UBFO, UNTY, VALX, VONG, WBKC

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: AXSM, CDNA, CGG, CRWS, FXCM, SRSC, TANH, USAK

ETFs that traded to 52 week highs: DIA, EPU, IGN, IGV, IWF, KIE, OEF, QQQ, SKYY, SMH, SOXX, XLK

ETFs that traded to 52 week lows: NIB

Today's top 20 % gainers

- Healthcare: AKAO (18.56 +6.27%), CNC (67.5 +6.08%), OMER (10.47 +5.76%)

- Materials: CENX (16.18 +4.76%)

- Industrials: ALSN (37.75 +6.76%), WATT (16.57 +6.63%), MLI (42.21 +4.9%), TDG (242.07 +4.82%), EMR (62.72 +4.78%)

- Consumer Discretionary: FRED (15.14 +7.3%), ABG (68.05 +6.58%), WWW (22.33 +6.23%), ARMK (35.25 +5.29%)

- Information Technology: WUBA (29.32 +4.71%), CDW (55.91 +4.7%), LITE (40.6 +4.64%)

- Financials: GCAP (8.07 +5.49%)

- Energy: NOV (39.71 +6.01%)

- Consumer Staples: STKL (7.4 +5.71%), ELF (26.63 +5.17%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: TEVA (16.32 mln -4.51%)

- Materials: VALE (10.4 mln +2.41%), FCX (9.81 mln -1.75%), CLF (8.94 mln +2.09%)

- Consumer Discretionary: GM (21.31 mln -4.49%), F (14.75 mln -1.08%), KORS (14.75 mln -12.45%), FCAU (8.91 mln -4.04%)

- Information Technology: AMD (86.87 mln -0.59%), TWTR (16.46 mln +3.18%), AAPL (15.5 mln +1.21%), SABR (13.16 mln -10.68%), NVDA (9.94 mln +2.34%), ZNGA (8.58 mln -1.97%)

- Financials: BAC (34.88 mln -0.06%), RF (9.55 mln +0.99%)

- Energy: CHK (14.24 mln -2.19%), WFT (13.42 mln -2.6%), BP (11.02 mln -4.41%)

- Telecommunication Services: FTR (9.02 mln -0.9%)

Today's top relative volume (current volume to 1-month average daily volume)The broader market is in the midst of a decent advance at the moment, led higher by the Nasdaq Composite which adds about 19 points (+0.34%) to 5682, the Dow Jones Industrial Average follows closely, up 69 (+0.34%) to 20121, and the S&P 500 is higher by about 3 (+0.15%) to 2296. Action has come on mixed average volume (NYSE 294 vs. avg. of 322; NASDAQ 801 mln vs. avg. of 771), with advancers outpacing decliners (NYSE 1511/1427, NASDAQ 1389/1319) and new highs outpacing new lows (NYSE 121/11, NASDAQ 109/29).

Relative Strength:

Egypt-EGPT +3.1%, US Nat Gas-UNG +2.8%, Silver Miners-SIL +1.2%, Copper Miners-COPX +0.9%, Livestock-COW +0.8%, Global Timber-WOOD +0.8%, Peru-EPU +0.7%, US Broker/Dealers-IAI +0.7%, Consumer Staples-XLP +0.6%, Brazil-EWZ +0.5%, Vietnam-VNM +0.3%, United Kingdom-EWU +0.3%, Latin Am. 40-ILF +0.3%, Netherlands-EWN +0.3%.

Relative Weakness:

Sugar-SGG -2.5%, Oil&Gas E&P-XOP -2.5%, US Gasoline-UGA -2.1%, US Oil-USO -2.1%, Cocoa-NIB -1.7%, Lithium-LIT -1.7%, Oil Svcs.-OIH -1.6%, Turkey-TUR -1.5%, Greece-GREK -1.2%, S. Africa-EZA -1.1%, S. Korea-EWY -1.1%, Philippines-EPHE -1.0%, France-EWQ -1.0%, Mexico-EWW -0.9%, Saudi Arabia-KSA -0.8%.

- VBI Vaccines (VBIV +3.05%) announces the receipt of positive Scientific Advice from the Committee for Medicinal Products for Human Use of the European Medical Agency regarding the company's development path for its Sci-B-Vac vaccine in Europe

Decliners on news:- Alcobra (ADHD -7.69%) announces FDA meeting on its ADAIR product candidate defined a 505(b)(2) development path, to be funded with existing cash balance, and targeting a 2H 2018 NDA submission

- Teva Pharma (TEVA -4.83%) appoints Dr. Yitzhak Peterburg as Interim CEO succeeding Erez Vigodman and names Dr. Sol J. Barer as Chairman

Gainers on earnings:- Arrowhead (ARWR +7.98%) reports Q1 EPS of ($0.17) vs ($0.21) single analyst estimate; revs $4.365 mln vs $4.4 mln single analyst estimate

- Centene (CNC +6.16%) beats by $0.08, beats on revs; guides FY17 EPS in-line, revs in-line

- Catalent (CTLT +3.79%) beats by $0.01, beats on revs; guides FY17 revs in-line

Decliners on earnings:- Luminex (LMNX -7.16%) misses by $0.04, reports revs in-line; guides Q1 revs in-line; reaffirms FY17 guidance

- Steris (STE -6.86%) misses by $0.06, misses on revs; lowers FY17 EPS and rev guidance

- Mednax (MD -5.51%) misses by $0.06, misses on revs; guides Q1 EPS below consensus

Upgrades/Downgrades:The major averages have ticked down in recent action, with the S&P 500 (-0.1%) exchanging a slim gain for a slim loss. The Nasdaq (+0.1%) and the Dow (+0.2%) still hold a portion of their early gains, but have also given up some ground amid a recent uptick in the Treasury market.

Demand for U.S. Treasuries has picked up this afternoon, pushing the government-issued debt to a new session high. The benchmark 10-yr yield, which was up two basis points this morning, is currently lower by three basis points at 2.38%.

Sectors are divided fairly evenly with five posting gains and six holding losses. The consumer staples sector (+0.6%) has emerged as the day's leader, with the top-weighted technology sector (+0.4%) just a step behind. Apple (AAPL 131.85, +1.56) has underpinned the tech space's performance again, trading higher by 1.2%.

Industrials (+0.3%) are also in the mix for the top spot on today's leaderboard, with Emerson Electric (EMR 62.49, +2.63) leading the charge. EMR shares have jumped 4.4% after the company reported better than expected top and bottom lines this morning in addition to raising earnings guidance for 2017.

General Motors (GM 35.05, -1.76) also produced a positive earnings report this morning, beating earnings and revenue estimates. However, the earnings beat may have taken a back seat to the company's 3.8% year-over-year decline in January sales. Shares of GM trade lower by 4.9%.

The consumer discretionary sector (-0.1%) has been weighed down by GM and other automakers, joining materials (-0.7%) and energy (-1.6%) in negative territory. The energy space has suffered from a 2.0% loss from crude oil as an uptick in U.S. production, signs of slowing demand growth, and a 0.4% climb in the U.S. Dollar Index (100.20, +0.36) have weighed on the commodity. WTI crude currently trades at $51.92/bbl.

Although the U.S. Dollar Index continues trading in the green, it has backed away from its high. The index has cut its gain in half due to a recent rebound in the Japanese yen (111.90) and the euro (1.0693).

Economic data reported this morning included December Trade Balance and December Job Openings and Labor Turnover Survey:

The Consumer Credit report (Briefing.com consensus $19.4 billion), which will be released at 3:00 pm ET, will be the last economic report of the day.

Treasury Auction Results

Rumor Activity was active today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 1.22… VIX: (11.47, +0.10, +0.9%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Events and conferences of interest for tomorrow, February 8th include:

Conference in progress:

The Industrials sector (XLI) is trading +0.2% higher today, higher than the broader market (SPY +0.0%). In the Industrial Sector, Spirit Airlines (SAVE -2.8%) reports January traffic and Tata Motors (TTM -3.1%) reports January Jaguar Land Rover sales.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: LII +1.1% AGCO +1.1% SAVE -2.8% RBC +2.1% MLI +4.3% WJAFF -1.6% ATKR -0.3% AZZ -0.8% ASC -1.4% USAK -16.8%

News

Broker Research

Upgrades

Downgrades

Other

Dollar Reverses Big Gains