Wilson Trade

CME Futures Analysis 29.05.2022

- 29 мая 2022, 18:41

- |

Hello, traders! Let's look how amazing the second week in raw was with settled priorities and predictions.

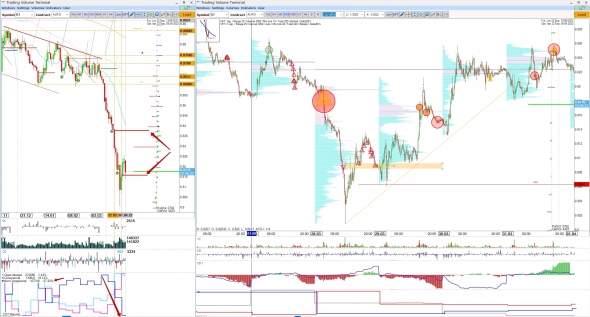

🔻 Look at S&P500 (ES)! During 5 days our target was absolutely achieved. The strong imbalance that occurred after the breakdown of the 3850 support level was greatly respected. For now, we observe new ask imbalances, which moved the price higher. I want you to measure the divergence of CD and CDQ on May 17. The quantitative delta +6,5K of market buys but at the same time the volume of CD was -13K shorts. It is often called advance purchases, which work like a magnet for future recovery and the price can go even higher. The second chance to enter longs was after returning to 3900 and stopping HFT volumes and hedging in Put options. The only way to enter with a high risk-reward ratio is to accept the local fear.

🔻 Our next target was 1.07 in Euro (6E) and it was violated no worse than the previous one1.06. And as I told you in my previous video, the levels on which we see huge block trades are very important for the price. And 1.075 was really respected this week. Also now we are in the zone of the least options payouts and the price came here and I think till July 3 it will stay near this zone.

All this movement before was thanks to funds, which accumulated 36K contracts long position, and we — swing traders can use this market inefficiencies to make our profit.

🔻 Only Oil (CL) gives us an opportunity according to the scenario which we predicted before. After the move to the upside we have a very very strong

( Читать дальше )

- комментировать

- Комментарии ( 3 )

CME Futures Analysіs + video

- 15 мая 2022, 18:12

- |

Hello, traders!

🔺 From the previous week, only Oil (CL) went strongly according to my view. The trendline was broken and the price fell down like a stone. Who trade volume profile mirror levels — sell entry point could be on level 108. I really did not find a clear entry point for myself, as expected one more impulse breakout with HFTs’, and so did not use this sweety movement.

Then we saw the sharp rejection of low prices, as always, after stop-loss hunting and involvement in shorts under level 100. And then 3 waves move back to 110 which is ended with new HFTs’ on top, and new Call options block trades at the same price level as the previous one. Of course, I don’t like such double tops for shorts, love to play more with one-touch levels. So I think not to fight with bulls in such cases. Rather, I would even buy in this situation from the level of 107 if there is a correction. (See)

🔺 Also from the previous priorities, I want to measure Nasdaq (NQ). The price removed many stops and made several involvements in shorts, but only the last one was worthy to be measured. Take attention that OI grew sharply the previous week during the drawdown, it is fuel for volatility, and I have no dought that the price will go higher next week. (See)

( Читать дальше )

COT reports

- 08 мая 2022, 23:43

- |

Hello, traders!

That week was crazy for movements. Priorities were not as helpful as the previous one. But I remember the words of Brent Donnelly:

«Good traders have a plan. They may not always stick to the plan but they always have one.»

By the way, if you want to read more quotes in English, you can simply put EN language on TVT and put the tick chart of ES, and upload 5 years of history))

Lets Start.

( Читать дальше )

COT reports

- 25 апреля 2022, 23:03

- |

Let's overview and discuss potential scenarios for the futures market.

The previous week was very powerful for predictions, especially on gold, silver, and Mexican peso. Let's see and try to find what to do next.

( Читать дальше )

COT reports

- 19 апреля 2022, 22:36

- |

Hello Traders!

It was a volatile but not so good week, eventually for me. My expectations about US Treasury Bonds, the Australian dollar have not been realized and the Japanese Yen made a hard rock falling, without any correction, because of the very dovish monetary policy of the central bank compared with FED.

🔺 But still, Ultra US Treasury Bonds (UB) can show us buying opportunities on this level

It was my plan and I traded it, of course, the most important thing is to manage your risk, not to be suffered very much because of unexpected movements.

🔺 Even the Mexican peso (6M) returned to breakeven. Of course, I expect a further continuation, but it is not the proper picture.

( Читать дальше )

COT reports

- 10 апреля 2022, 22:16

- |

Hello Traders!

As you are already used to, we will analyze what interesting had happened during the previous week. Also, as always, we make predictions and put priorities based on the tick data and key changes in COT positions.

On Friday evening we saw a perfect buying signal on US Treasury Bonds (ZB). A couple of divergences between CD and CDQ + HFT Volumes on the bottom. The first target is the previous red HFT and then we will see how healthy buyers will be there. I want to remind you, that hedge funds opened a big long position in ZB, that's why I am also are interested to play this game.

Japanese Yen (6J), it seems to me that this week we will see the same as in treasures — breakout the downtrend and move to commercial level 0,008150. Hope that we came to the lower boundary of the future range and now are ready to go to the upper one. Previous changes in COT data are minimal and do not influence the picture.

( Читать дальше )

СОТ отчёты

- 03 апреля 2022, 18:25

- |

Hello, Traders!

Let's speak about Key changes in COT positions and price changes that happened

previous week.

We took our attention to the Japanese Yen (6J), and we saw the strong pullback from the downtrend this week as we expected. But I have not got any signal to enter this position on the lower TF. It could happen on the bottom, after a big HFT volumes breakdown, but unfortunately not. Nevertheless we saw how informative put options trades can be for us to organize our decision making. Now the price makes retest of commercial level 0.00815 and then, I hope, will go to the area 0,0084 — next commercial level, where funds opened a big short.

Look at Coffee futures (KC)! Great longing opportunity was after stopping HFT volumes were created in our planned direction. Stops with involvement — that is what I like most of all! How we expected, it was a healthy effort to return to the uprising channel.

( Читать дальше )

СОТ отчёты

- 28 марта 2022, 18:40

- |

First of all I want to talk about Japanese yen (6J). The price went lower and provoked closing a huge put hedging position. I am waiting very much for stopping HFTvolume to enter the position. Good opportunities also come when the price retest POC as a mirror level. As we see a very huge rise: 22%of long positions by commercial traders, with the fact of OI rising to 19%. I am still waiting for the strong pullback from the downtrend next week.

In US treasuries (ZB) there was a good intraday longing opportunity, but the price did not achieve a bit to breakdown HFT level 150.4375. It flew further from downtrend line on 15M TF + the mirror technical level on daily TF.

( Читать дальше )

СОТ отчёты

- 14 марта 2022, 22:55

- |

Представляю вашему вниманию табличку по СОТ, которая дает возможность быстро просканировать и обратить внимание на ключевые изменения по самым ликвидным активам биржи СМЕ, ICE US.

*** Информация по СОТ содержит сделки фьючерсы+опционы

**** Не смотрите на линии на графике и не пытайтесь их интерпретировать, только стрелки соответствуют поставленному приоритету ранее или сегодня.

По СП500 (ES) мы приближаемся к экспирации (18 марта) и дальше видим распродажи логовых позиций фондами. Не смотря на это общий, ОИ к фьючерсам на американские индексы растет на 5%. Но это связано с тем, что инвесторы захеджировали свои портфели в новом контракте, а со старого еще не до конца вышли. Несмотря на падение цены, закрытие под техническим уровнем пока что не дает основания для шорт приоритета. Цена весьма бодро отскакивает от лимитных поддержек и скорее-всего продолжит это делать при каждом усилении продаж, когда у участников будут сдавать нервы и тут как тут к ним на помощь будет приходить маркетмейкер.

( Читать дальше )

теги блога Wilson Trade

- 6A

- 6B

- 6C

- 6E

- 6j

- 6N

- 6S

- analysis

- ask

- bid

- BR

- Brent Oil

- British pound

- CAD

- CC

- CL

- CME

- Cocoa

- corn

- COT

- CoT reports

- COT отчет

- COT отчеты

- Crude Oil

- DXY

- ES

- Euro

- futures

- GC

- Gold

- hft

- HG

- KC

- Larri Willams

- larry williams

- Market profile

- natural gas

- NG

- Oil

- PL

- Platinum

- S&P500

- SB

- SI

- Silver

- soybeans

- Sugar

- trade

- trader

- traders

- trading

- wheat

- YM

- ZC

- ZN

- ZS

- ZW

- автоуровни

- аналитическая статья

- бизнес

- биткоин

- газ

- Евро

- золото

- Иена

- Инвестиции

- канадский доллар

- китай

- корреляция

- Мазут

- медь

- на чем заработать

- нефть

- новая ниша бизнеса

- ОИ

- опционы

- открытый интерес

- оффтоп

- Палладий

- перспективы роста

- платина

- полезная информация

- серебро

- советы для начинающих

- СОТ

- СОТ отчеты

- стартапы

- сша

- торговые стратегии

- трейдер

- трейдинг

- трейдинг для начинающих

- уровни

- фонды

- форекс

- фрс

- Фунт

- фьючерс

- ФЬЮЧЕРСЫ