Wilson Trade

According to COT fresh Data, I have never seen Small Traders have a such willingness to buy Nasdaq(NQ). They closed all their 30K short and opened 3K longs during 3 weeks. 😱

- 09 апреля 2023, 15:23

- |

Good evening, traders! 👋

Let's start our Sunday review.

▪️ According to COT fresh Data, I have never seen Small Traders have a such willingness to buy Nasdaq(NQ). They closed all their 30K short and opened 3K longs during 3 weeks. 😱 (Watch)

▪️ Next asset where small traders are so active — Soybeans (ZS). OI rises every week and they added longs by 20%. We can see involvement from the current mirror level and then move in the breakdown direction. (Watch)

( Читать дальше )

- комментировать

- 188

- Комментарии ( 1 )

The previous Sunday we observed Gold (GC), Crude Oil (CL), and the Australian dollar (6A), and all the assets went bullish as I expected. 👏

- 02 апреля 2023, 15:16

- |

Good day, traders! 👋

The previous Sunday we observed Gold (GC), Crude Oil (CL), and the Australian dollar (6A), and all the assets went bullish as I expected. 👏

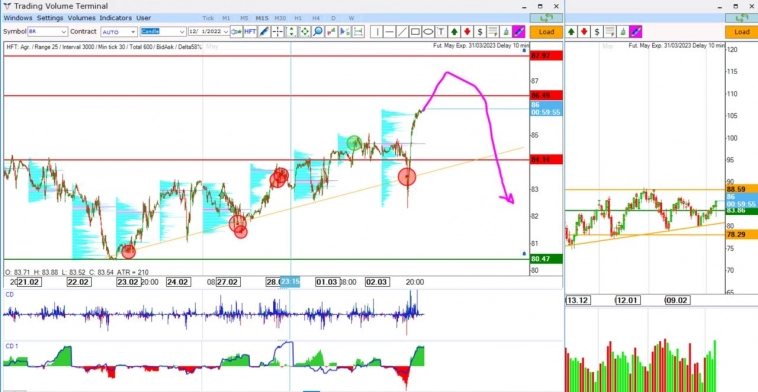

▪️ Gold showed signs of advanced purchases through the quantitative delta, then after Bid HFTs’ went to the upside to 2005$, where the reversal ask tick chain was created. (Watch)

▪️ The Australian dollar made good upside movement from the imbalance zone and achieved 0,675 price level. (Watch)

( Читать дальше )

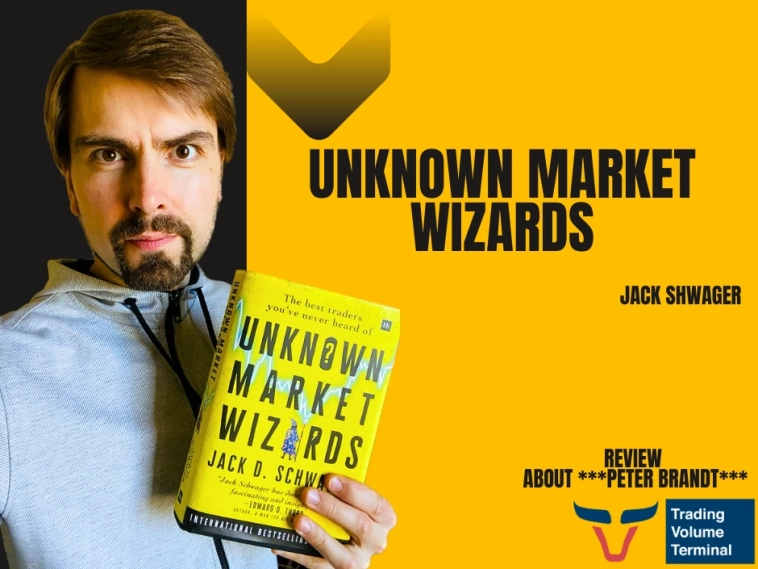

“Unknown Market Wizards” Jack Shwager review about ***Peter Brandt***

- 28 марта 2023, 12:49

- |

Hello traders 👋

Today I want to share with you a review of the first trader from the last book of Jack Schwager “Unknown Market Wizards”

His name is ***Peter Brandt***

27 years of trading experience till 2020 (when the book was published for the first time)

14 and 13 years in a row with 11 years of pause between 😱

Settled in this business as a trainee for a commodity broker in the year 1972. Started his own trading around 1976, and from 1981 had a track record.

His average annual return is 58% 🏋️

Sharp ratio = 1.11, Sortino ratio = 3.00 Gain to pain ratio = 2.81

Succeeds nonetheless because his average gain is much larger than his average loss.

He is a breakout trader.

Bad years 1988 🆘 (After nine good years I got sloppy. I would enter chart patterns too early. I would chase markets. I didn’t have orders where I should have.)

And in 2013 🆘 when he decided to accept other people's money (That messed up his trading. I was out of sync with my approach. I am not being disciplined. I am not being patient. I’m jumping the gun on trades. I am taking positions before the market confirms them. I am taking trades on inferior patterns.)

( Читать дальше )

⚡️ Let's measure the market situation after this volatile week.

- 19 марта 2023, 15:53

- |

Good Sunday, traders!

Let's measure the market situation after this volatile week.

▪️ Last time we expected falling in Euro. This occurred not on Monday-Tuesday, but on Wednesday we had a downside reaction on 400 futures points. But then the market again returned to balance and returned almost all weekly losses. (Watch)

I think that it will continue falling, but of course Till FED by the 22 of March the market will be in a state of uncertainty and low liquidity.

▪️ Opinion about the grain market, particularly Corn (ZC) (Watch)

( Читать дальше )

According to the latest news, next week will be hot for sure. 🔥

- 12 марта 2023, 17:27

- |

Hello, traders!

According to the latest news, next week will be hot for sure. 🔥

On Thursday we received on Euro (6E) the incredible uprising of open interest (+18K contracts) in “Put” options strike 1.04 (Watch prnt.sc/n_GEI456fpjG)

Amazing, before the technical support! 🤪

That was a big hedge before the bankruptcy of Silicon Valley Bank, someone understood that the time would come to withdraw dollar liquidity from the market.

All currencies, except the dollar DXY, will feel strong pressure from sellers and Indices of course next week.

Stronger, to my mind, will be the Grain market.

In continuation of the previous downside forecast for Сorn (ZC) (Watch prnt.sc/HHsH8uCit3sm)

( Читать дальше )

⚡️ Interesting forecasts were that week, and I am also shocked that the market shows everything according to plan. Is it chaotic⁉️

- 09 марта 2023, 12:44

- |

⚡️ Today I want to justify about 3 interesting pictures on the futures market.

- 05 марта 2023, 22:02

- |

Good evening, traders! 👋

Today I want to justify about 3 interesting pictures on the futures market.

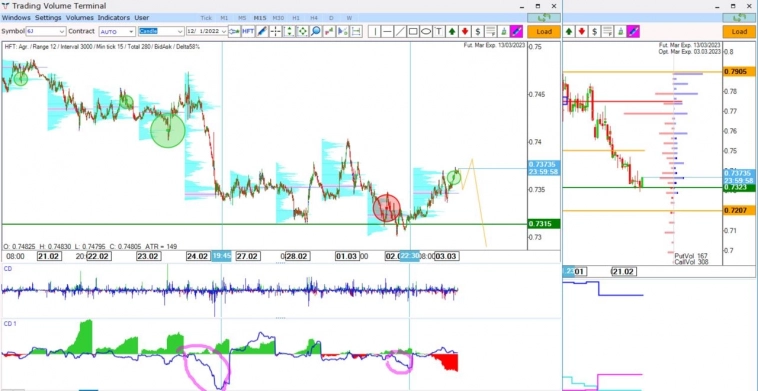

▪️ Japanese yen (6J) shows preparations to break the demand zone.

The quantitative cumulative delta was negative several times before the support. Bid HFTs were created near the level, and afterward, we can observe the involvement in buys. It is necessary to collect liquidity and then, break the demand level. If after the current Ask tick chain, the price stops growing it will be a good selling opportunity.

▪️ Brent Oil (BR) created a new uptrend line with the help of fast tick chains on it. Very often price return to such trendlines and break them.

( Читать дальше )

⚡️ Today I want to measure a Canadian Dollar (6C)

- 26 февраля 2023, 21:23

- |

Good evening, traders!👋

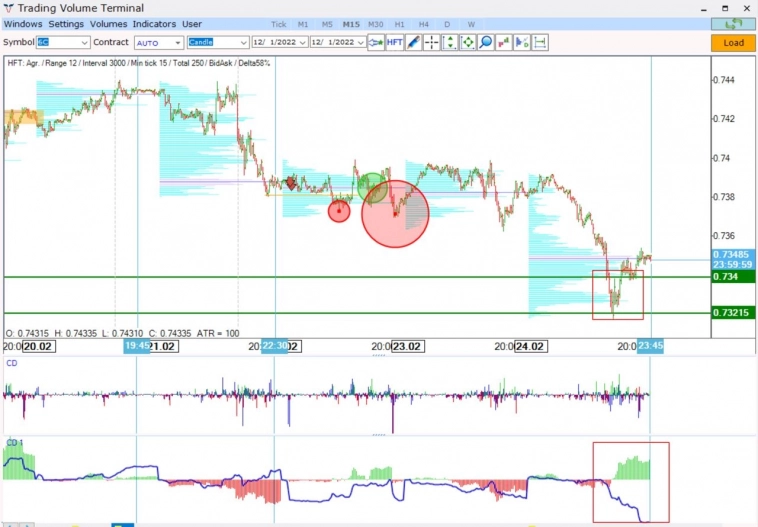

Today I want to measure a Canadian Dollar (6C).

▪️ So we see how the price came to the solid technical support on the daily chart. (watch)

But look at significant block trades on the options market passed on strike 0,74.

▪️ Moreover, on the 15M chart, we also came to double strong volumetric support zone. (watch)

( Читать дальше )

According to the latest news from CFTC, fresh reports on a regular 3 days delay basis we will receive only after the middle of March. ((

- 19 февраля 2023, 15:40

- |

Good Sunday, traders!

According to the latest news from CFTC, fresh reports on a regular 3 days delay basis we will receive only after the middle of March. ((

Until then they will recover for unreleased reports.

“Following the ION cyber-related incident, reporting firms are continuing to experience some issues submitting timely and accurate data to the CFTC. As a result, the weekly Commitments of Traders (CoT) report that normally would have been published on Friday, February 17, will be postponed.

“CFTC staff intends to resume publishing the CoT report as early as Friday, February 24, 2023. Staff will begin with the CoT report that was originally scheduled to be published on Friday, February 3, 2023. Thereafter, staff intends to sequentially issue the missed CoT reports in an expedited manner, subject to reporting firms submitting accurate and complete data. Staff anticipates that, pending the timely, accurate and complete submission of backlogged data by reporting firms to the CFTC, these missed CoT reports will be published by mid-March. After that, CoT report publication will resume its usual weekly schedule.”

For the next week, I don’t see some exciting pictures for today. Moreover, on Sunday we have Holyday in US and Canada.

Only Cocoa (CC) shows us interesting backgrounds for correction. (Watch)

We need more movements to discover something interesting the next week.

Have a good Sunday!

We still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated

- 12 февраля 2023, 22:47

- |

Good day traders, we still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated.

Multiple reporting firms continue to experience technical issues that prevent submission of timely and accurate data to the CFTC. As a result, the weekly CFTC Commitments of Traders report will continue to be delayed until the receipt and validation of all reportable data is completed.

I already started to miss this data, as it really gives a better market understanding.

Nevertheless, I want to share with you with few engaging scenarios which may realize in the next week.

Natural Gas (NG) has a chance to reach 3$ target per MMBtu (watch)

We see that all the cumulative delta is negative, but the price grows and fixed above 2.5 technical and round number structure.

But to my mind everything is too sweet, that's why I think that the market will activate the liquidity under the level and only then will go to fair value. (watch)

Such enforcement of QD on Friday is not an empty sound.

( Читать дальше )

теги блога Wilson Trade

- 6A

- 6B

- 6C

- 6E

- 6j

- 6N

- 6S

- analysis

- ask

- bid

- BR

- Brent Oil

- British pound

- CAD

- CC

- CL

- CME

- Cocoa

- corn

- COT

- CoT reports

- COT отчет

- COT отчеты

- Crude Oil

- DXY

- ES

- Euro

- futures

- GC

- Gold

- hft

- HG

- KC

- Larri Willams

- larry williams

- Market profile

- natural gas

- NG

- Oil

- PL

- Platinum

- S&P500

- SB

- SI

- Silver

- soybeans

- Sugar

- trade

- trader

- traders

- trading

- wheat

- YM

- ZC

- ZN

- ZS

- ZW

- автоуровни

- аналитическая статья

- бизнес

- биткоин

- газ

- Евро

- золото

- Иена

- Инвестиции

- канадский доллар

- китай

- корреляция

- Мазут

- медь

- на чем заработать

- нефть

- новая ниша бизнеса

- ОИ

- опционы

- открытый интерес

- оффтоп

- Палладий

- перспективы роста

- платина

- полезная информация

- серебро

- советы для начинающих

- СОТ

- СОТ отчеты

- стартапы

- сша

- торговые стратегии

- трейдер

- трейдинг

- трейдинг для начинающих

- уровни

- фонды

- форекс

- фрс

- Фунт

- фьючерс

- ФЬЮЧЕРСЫ