SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

GT Capital

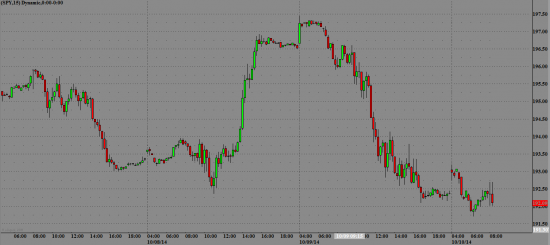

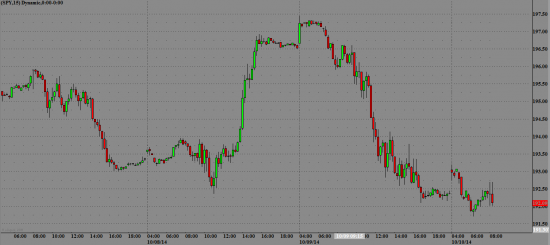

SPY продолжает падение этой недели

- 15 октября 2014, 16:50

- |

Ближайший уровень поддержки по SPY – 186.00 уровень сопротивления – 188.00

NTCT смотрим на покупку, возможен откат

GILD покупка выше 96, ниже продажа

KMP продажа ниже 84

AWI покупка при удержании 46

PSX, TK, BCEI смотрим на покупку, возможен откат

AET покупка выше 74

ERX продажа ниже 64

XEC продажа ниже 104

CVX продажа ниже 109

MMP продажа ниже 71

SLB продажа ниже 88

( Читать дальше )

NTCT смотрим на покупку, возможен откат

GILD покупка выше 96, ниже продажа

KMP продажа ниже 84

AWI покупка при удержании 46

PSX, TK, BCEI смотрим на покупку, возможен откат

AET покупка выше 74

ERX продажа ниже 64

XEC продажа ниже 104

CVX продажа ниже 109

MMP продажа ниже 71

SLB продажа ниже 88

( Читать дальше )

- комментировать

- 35

- Комментарии ( 0 )

SPY стоит на месте на премаркете

- 13 октября 2014, 17:03

- |

Ближайший уровень поддержки по SPY – 189.50 уровень сопротивления – 191.00

AVGO возможен откат вверх от 71

FFIV продажа ниже 107 выше 108 покупка

SVXY смотрим на откат вверх выше 62

SM при удержании 60,50 покупка

LRCX смотрим на покупку выше 66

CAVM следим за акцией

CPA продажа ниже 100,50

Gapping up/down: APL and ATLS +13% on M&A related news; Ebola related names trading higher, SPLK +2% on upgrade; LAD -10% and GY -3% after earnings, JCP and CLF -1% on dg's Price: null Change: null

Gapping up

( Читать дальше )

AVGO возможен откат вверх от 71

FFIV продажа ниже 107 выше 108 покупка

SVXY смотрим на откат вверх выше 62

SM при удержании 60,50 покупка

LRCX смотрим на покупку выше 66

CAVM следим за акцией

CPA продажа ниже 100,50

Gapping up/down: APL and ATLS +13% on M&A related news; Ebola related names trading higher, SPLK +2% on upgrade; LAD -10% and GY -3% after earnings, JCP and CLF -1% on dg's Price: null Change: null

Gapping up

( Читать дальше )

SPY продолжает вчерашнее падение

- 10 октября 2014, 16:38

- |

Ближайший уровень поддержки по SPY – 191.75 уровень сопротивления – 192.50

LAKE следим за недавним IPO

SRTY покупка выше 48

ERY покупка при удержании 20

SCO покупка выше 35.50

ERX смотрим на дальнейшее падение

APC ждем разворот выше 52

FSLR ниже 56 продажа, выше покупка

GPS продажа ниже 65.50

URI следим на открытии, возможен откат вверх

ROK покупка при удержании 103

CXO продажа ниже 109.50

EXP покупка при удержании 87

Gapping up/down: INFY +5% after earnings, EXAX +36% after positive CMS determination over Cologuard; MCHP -11%, MTW -9%, and JNPR -7% after earnings, Semis, oil and gold stocks trading lower Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: INFY +5.6%, HELE +3%, PLUG +2.7%

Other news: EXAS +35.8% (positive CMS determination over Cologuard), APT +26% (following 27% move higher yesterday with ongoing Ebola fears), SCMP +19.2% (Sucampo Announces Settlement Agreement That Resolves Patent Litigation in U.S. Related to AMITIZA), ALXA +16.8% (provided update on ADASUVE U.S. Commercial Progress; Alexza shipped 32,278 units in the third quarter, completing the ADASUVE initial product inventory stocking), CVEO +12.6% (Greenlight capital discloses 9.99% active stake in 13D filing), STV +6.9% (cont volatility pre-mkt), ISIS +5.3% (reports data from ISIS-SMN Rx Phase 2 studies in infants and children with spinal muscular atrophy), VNET +4.7% (establishes joint venture with Foxconn (FXCNY)), ARIA +3.7% (announced that Pharmacovigilance Risk Assessment Committee of EMA concluded review of Iclusig and has recommended that Iclusig continue to be used in Europe in accordance with its already approved indication), BX +2.7% (planning advisory spin-off, according to reports), ECOL +2.5% (to replace MEAS in the S&P SmallCap 600), OXLC +2.1% (adopted repurchase program of up to $35 mln worth of common stock), KGJI +1.6% (announces initial shipment of 24-karat gold jewelry product samples to Middle East)

( Читать дальше )

LAKE следим за недавним IPO

SRTY покупка выше 48

ERY покупка при удержании 20

SCO покупка выше 35.50

ERX смотрим на дальнейшее падение

APC ждем разворот выше 52

FSLR ниже 56 продажа, выше покупка

GPS продажа ниже 65.50

URI следим на открытии, возможен откат вверх

ROK покупка при удержании 103

CXO продажа ниже 109.50

EXP покупка при удержании 87

Gapping up/down: INFY +5% after earnings, EXAX +36% after positive CMS determination over Cologuard; MCHP -11%, MTW -9%, and JNPR -7% after earnings, Semis, oil and gold stocks trading lower Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: INFY +5.6%, HELE +3%, PLUG +2.7%

Other news: EXAS +35.8% (positive CMS determination over Cologuard), APT +26% (following 27% move higher yesterday with ongoing Ebola fears), SCMP +19.2% (Sucampo Announces Settlement Agreement That Resolves Patent Litigation in U.S. Related to AMITIZA), ALXA +16.8% (provided update on ADASUVE U.S. Commercial Progress; Alexza shipped 32,278 units in the third quarter, completing the ADASUVE initial product inventory stocking), CVEO +12.6% (Greenlight capital discloses 9.99% active stake in 13D filing), STV +6.9% (cont volatility pre-mkt), ISIS +5.3% (reports data from ISIS-SMN Rx Phase 2 studies in infants and children with spinal muscular atrophy), VNET +4.7% (establishes joint venture with Foxconn (FXCNY)), ARIA +3.7% (announced that Pharmacovigilance Risk Assessment Committee of EMA concluded review of Iclusig and has recommended that Iclusig continue to be used in Europe in accordance with its already approved indication), BX +2.7% (planning advisory spin-off, according to reports), ECOL +2.5% (to replace MEAS in the S&P SmallCap 600), OXLC +2.1% (adopted repurchase program of up to $35 mln worth of common stock), KGJI +1.6% (announces initial shipment of 24-karat gold jewelry product samples to Middle East)

( Читать дальше )

SPY немного снижается на премаркете

- 09 октября 2014, 16:57

- |

Ближайший уровень поддержки по SPY – 196.00 уровень сопротивления – 197.25

Поздравляем всех с началом сезона отчетов. Вчера после закрытия рынка отчиталась положительно Alcoa Inc. Инвесторы могут положительно настроиться на рост рынка в ближайшие дни.

Alcoa — американская металлургическая фирма, 3-ий по величине производитель алюминия. Трехмесячный результат о деятельности данной фирмы, кой выходит 8 октября окажет мощное воздействие на цену акций.

GILD продажа от 109

AMGN продажа от 140

SSO продажа от 117

GOLD продажа ниже 70

URI покупка выше 103

( Читать дальше )

Поздравляем всех с началом сезона отчетов. Вчера после закрытия рынка отчиталась положительно Alcoa Inc. Инвесторы могут положительно настроиться на рост рынка в ближайшие дни.

Alcoa — американская металлургическая фирма, 3-ий по величине производитель алюминия. Трехмесячный результат о деятельности данной фирмы, кой выходит 8 октября окажет мощное воздействие на цену акций.

GILD продажа от 109

AMGN продажа от 140

SSO продажа от 117

GOLD продажа ниже 70

URI покупка выше 103

( Читать дальше )

SPY продолжает смотреть вниз

- 08 октября 2014, 17:09

- |

Ближайший уровень поддержки по SPY – 193.25 уровень сопротивления – 194.00

CAMP продажа от 20

SRTY смотрим на лонг

URI смотрим на продажу

EMES продажа ниже 95

TCS покупка от 16.50

Gapping up/down: COST +2% and YUM +1% after earnings, COTY +4% after upgrade; SAVE -3% and MON -2% after earnings/guidance, SAP -3% after reports of Job freeze, GPRO -2% after dg Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: COST +2.4%, YUM +1.3%

M&A news: TST +5% (to acquire BoardEx for ~$21 mln), SYMC +3.4% (may consider splitting up security and storage units, according to reports), AGN +1.9% (VRX and Pershing Square intend to increase bid for co), VRX +1.4% (co and Pershing Square intend to increase bid for Allergan (AGN)

Select financial related names showing strength: NBG +2%, ING +1.4%, SAN +1.4%, UBS +1.1%, HSBC +0.9%

Select metals/mining stocks trading higher: HL +3%, GFI +2.2%, AUY +1.6%, ABX +1.4%, IAG +1.3%, SLW +1.3%, GOLD +1.2%, SLV +1%, GDX +0.9%

( Читать дальше )

CAMP продажа от 20

SRTY смотрим на лонг

URI смотрим на продажу

EMES продажа ниже 95

TCS покупка от 16.50

Gapping up/down: COST +2% and YUM +1% after earnings, COTY +4% after upgrade; SAVE -3% and MON -2% after earnings/guidance, SAP -3% after reports of Job freeze, GPRO -2% after dg Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: COST +2.4%, YUM +1.3%

M&A news: TST +5% (to acquire BoardEx for ~$21 mln), SYMC +3.4% (may consider splitting up security and storage units, according to reports), AGN +1.9% (VRX and Pershing Square intend to increase bid for co), VRX +1.4% (co and Pershing Square intend to increase bid for Allergan (AGN)

Select financial related names showing strength: NBG +2%, ING +1.4%, SAN +1.4%, UBS +1.1%, HSBC +0.9%

Select metals/mining stocks trading higher: HL +3%, GFI +2.2%, AUY +1.6%, ABX +1.4%, IAG +1.3%, SLW +1.3%, GOLD +1.2%, SLV +1%, GDX +0.9%

( Читать дальше )

SPY продолжает вчерашнюю коррекцию

- 07 октября 2014, 17:17

- |

Ближайший уровень поддержки по SPY – 195.00 уровень сопротивления – 196.00

LRCX продажа от 75

WLP покупка от 119

DWRE продажа ниже 58

Gapping up/down: SIMO +15% and CAMP +7% after earnings, FEYE +6% after new partnerships; GMCR +2% on upgrade at GS; SODA and TCS -15% after earnings/guidance; LVS -3% after dg Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: SIMO +14.9%, CAMP +7.2%, ISCA +4.9%, NLNK +1.9%, IDT +0.6%

Select Ebola related names showing strength: CMRX +3.9%, TKMR +3.4%, LAKE +2.8%

Select metals/mining stocks trading higher: IGLD +2.5%, IAG +0.8%, CDE +0.8%, SVM +0.6%

Other news: GTAT +15% (modest retracement following yesterday's massive decline), MAGS +15% (receives $8.2 mln of new orders; majority of the contracts are for expansions, changes and upgrades of existing homeland security installations in Israel), XCO +10.6% (announces sale of interests in Compass Production Partners), BCLI +9% (FDA grants fast track designation to NurOwn for the treatment of ALS), OXGN +8.3% (announced that data from the Phase 2 GOG186I study of fosbretabulin in combination with bevacizumab will be presented on November 9 at the International Gynecologic Cancer Society), GSAT +7.1% (issues statement in response to Kerrisdale Capital presentation), FEYE +5.8% (FireEye and SingTel partner to launch first managed defense solution; also, announced targeted attack protection for the Apple (AAPL) platform), BCRX +2.4% (announces late breaker presentation of OPuS-1 Phase 2 Trial results at the 23rd EADV Congress will be present Oct 11), ADHD +2.3% (after yesterday's 57% decline), ACHN +1.8% (disclosed it entered into a Master Security Agreement for a $1,000,000 Capital Expenditure Line of Credit), SBLK +1.6% (collected $8.016 mln from the sale of its claim against PAN OCEAN), REGN +1.3% (EYLEA (aflibercept) Injection received FDA approval for macular edema following retinal vein occlusion), PSTI +1.3% (wins cell therapy patent case in Europe; European Patent Office confirms validity of amended claims )

( Читать дальше )

LRCX продажа от 75

WLP покупка от 119

DWRE продажа ниже 58

Gapping up/down: SIMO +15% and CAMP +7% after earnings, FEYE +6% after new partnerships; GMCR +2% on upgrade at GS; SODA and TCS -15% after earnings/guidance; LVS -3% after dg Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: SIMO +14.9%, CAMP +7.2%, ISCA +4.9%, NLNK +1.9%, IDT +0.6%

Select Ebola related names showing strength: CMRX +3.9%, TKMR +3.4%, LAKE +2.8%

Select metals/mining stocks trading higher: IGLD +2.5%, IAG +0.8%, CDE +0.8%, SVM +0.6%

Other news: GTAT +15% (modest retracement following yesterday's massive decline), MAGS +15% (receives $8.2 mln of new orders; majority of the contracts are for expansions, changes and upgrades of existing homeland security installations in Israel), XCO +10.6% (announces sale of interests in Compass Production Partners), BCLI +9% (FDA grants fast track designation to NurOwn for the treatment of ALS), OXGN +8.3% (announced that data from the Phase 2 GOG186I study of fosbretabulin in combination with bevacizumab will be presented on November 9 at the International Gynecologic Cancer Society), GSAT +7.1% (issues statement in response to Kerrisdale Capital presentation), FEYE +5.8% (FireEye and SingTel partner to launch first managed defense solution; also, announced targeted attack protection for the Apple (AAPL) platform), BCRX +2.4% (announces late breaker presentation of OPuS-1 Phase 2 Trial results at the 23rd EADV Congress will be present Oct 11), ADHD +2.3% (after yesterday's 57% decline), ACHN +1.8% (disclosed it entered into a Master Security Agreement for a $1,000,000 Capital Expenditure Line of Credit), SBLK +1.6% (collected $8.016 mln from the sale of its claim against PAN OCEAN), REGN +1.3% (EYLEA (aflibercept) Injection received FDA approval for macular edema following retinal vein occlusion), PSTI +1.3% (wins cell therapy patent case in Europe; European Patent Office confirms validity of amended claims )

( Читать дальше )

SPY отыграл гэп вниз на премаркете

- 02 октября 2014, 16:50

- |

Ближайший уровень поддержки по SPY – 194.25 уровень сопротивления – 195.00

MASI смотрим на продажу с открытия

EDZ покупка выше 37

GTLS покупка выше 53

Gapping up/down: GPN +5% after earnings, WLT +6% on M&A spec, DTV +1.5% after renewed Sunday Ticket deal, TWTR +2% on upgrade at JPM; CREE -13% and AGU -5.5% after earnings/guidance, JPM -1% after dg at UBS Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: GPN +5.4%, DRI +0.8%

M&A news: WLT +5.8% (may be an acquisition target by BHP (BHP), according to reports)

Select semiconductor stocks trading higher: UMC +2%, STM +1.6%, MU +1.4%, ASML +1.4%, AMD +1.2%

Other news: ESPR +33.4% (announces positive top-line Phase 2b results for ETC-1002, an investigational therapy for patients with hypercholesterolemia ), RLD +21.9% (Starboard raises stake to 9.9% and delivered a letter to the Board proposing to acquire the company for $12 per share), ARIA +10.2% (announces AP26113 has received Breakthrough Therapy designation by the FDA), LEU +8.8% (elects Williams as Chairman; begins process for CEO Transition; Chief Restructuring Officer John Castellano named interim CEO; John Welch to step down later this month), BTU +7% (WLT peer, may be in sympathy), DRL +6.2% (provided an update on status of its capital plan: co maintains readily available liquidity sources of ~$1 bln), SPEX +5.4% (cont momentum), GRMN +5% (announces Honda (HMC) has selected Garmin as the navigation provider for future Civic and CR-V models in Europe, Russia and South America), NBG +3.8% (still checking), TSLA +3.6% (Elon Musk tweets 'About time to unveil the D and something else'; suggesting Model D introduction on Oct 9), DTV +1.4% (Co and NFL extended and expanded DIRECTV's exclusive rights to carry NFL SUNDAY TICKET), ARG +1.3% (to increase argon prices by up to 15%, effective November 1 or as contracts permit), QIHU +1.1% (announces $200 mln Share Repurchase Plan), TKMR +1% (ebola play that was +18% yesterday)

( Читать дальше )

MASI смотрим на продажу с открытия

EDZ покупка выше 37

GTLS покупка выше 53

Gapping up/down: GPN +5% after earnings, WLT +6% on M&A spec, DTV +1.5% after renewed Sunday Ticket deal, TWTR +2% on upgrade at JPM; CREE -13% and AGU -5.5% after earnings/guidance, JPM -1% after dg at UBS Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: GPN +5.4%, DRI +0.8%

M&A news: WLT +5.8% (may be an acquisition target by BHP (BHP), according to reports)

Select semiconductor stocks trading higher: UMC +2%, STM +1.6%, MU +1.4%, ASML +1.4%, AMD +1.2%

Other news: ESPR +33.4% (announces positive top-line Phase 2b results for ETC-1002, an investigational therapy for patients with hypercholesterolemia ), RLD +21.9% (Starboard raises stake to 9.9% and delivered a letter to the Board proposing to acquire the company for $12 per share), ARIA +10.2% (announces AP26113 has received Breakthrough Therapy designation by the FDA), LEU +8.8% (elects Williams as Chairman; begins process for CEO Transition; Chief Restructuring Officer John Castellano named interim CEO; John Welch to step down later this month), BTU +7% (WLT peer, may be in sympathy), DRL +6.2% (provided an update on status of its capital plan: co maintains readily available liquidity sources of ~$1 bln), SPEX +5.4% (cont momentum), GRMN +5% (announces Honda (HMC) has selected Garmin as the navigation provider for future Civic and CR-V models in Europe, Russia and South America), NBG +3.8% (still checking), TSLA +3.6% (Elon Musk tweets 'About time to unveil the D and something else'; suggesting Model D introduction on Oct 9), DTV +1.4% (Co and NFL extended and expanded DIRECTV's exclusive rights to carry NFL SUNDAY TICKET), ARG +1.3% (to increase argon prices by up to 15%, effective November 1 or as contracts permit), QIHU +1.1% (announces $200 mln Share Repurchase Plan), TKMR +1% (ebola play that was +18% yesterday)

( Читать дальше )

SPY консолидируется на премаркете

- 30 сентября 2014, 16:48

- |

Ближайший уровень поддержки по SPY – 197.50 уровень сопротивления – 198.25

CLVS продажа от 49

CSC смотрим на продажу

AMBA покупка выше 44.50

ETP смотрим на продолжение роста

CVEO покупка от 13

Gapping up/down: WAG +2% after earnings, MOVE +37% after merger news, TASR +4% on London Police camera news, AA +1% on upgrade; DWA -9% on downplay of takeover chatter, miners trading lower, CRR -1% on dg Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: SNX +8.1%, (also initiates quarterly cash dividend of $0.125 per common share), SCOK +7.7%, WAG +2.3%, RBS +2.1%, CTAS +1.1%, HTGC +0.8%, (on track to achieve annual new commitments of approximately $700-$850 million for 2014)

M&A news: MOVE +37% (to be acquired by News Corp (NWSA) for $21 per share), DLIA +25% (announces review of strategic alternatives; received several inquiries from third parties regarding potential acquisition of the company), MAS +7.2% (announces strategic initiatives; Co to spin-off installation and other services segment, initiate share repurchase program and reduce corporate expense), SMPL +4.9% (HomeStreet to merge with Simplicity Bancorp; Simplicity stockholders to receive one share of HomeStreet common stock for each share of Simplicity common stock)

Other news: WYY +17.8% (received two new Task Orders from federal agencies under a recently awarded Federal Government Blanket Purchase Agreement), VIMC +13.8% (announces $12.4 mln contract win in Taiyuan City of Shanxi Province), CPRX +13.7% (announces positive top-line Phase 3 Data From Pivotal Firdapse clinical trial in patients with Lambert-Eaton Myasthenic Syndrome), ACST +11.5% (announces 'Positive' top-line Pharmacokinetic results), CRNT +10.8% (receives follow-on orders from a global Tier 1 operator serving 20 countries across Asia and Africa), CANF +9.6% (USPTO issues Can-Fite patent for CF102 in the treatment of liver regeneration and function following surgery), EBAY +8.9% (eBay to separate eBay and PayPal into independent publicly traded companies in 2015), BLDP +8.2% (receives ElectraGen fuel cell system order for deployments in Digicel network), CNET +7.8% (Co's Liansuo.com signs 12 new clients following Guangzhou Franchise Exhibition), HTZ +5.4% (still checking), TASR +3.9% (selected by the London Metropolitan Police Service to provide another 500 AXON cameras), PLUG +3.4% (move attributed to positive blog mention, also peer BLDP received large order), RWLK +2.9% (cont momentum post IPO), MCP +2.4% (announces that its expanded leach system has now been placed into service at its Mountain Pass, California Facility), CTRP +2.3% (Priceline (PCLN) disclosed a 5.84% active stake in 13D filing) MBLY +2.3% (still checking), RADA +2.2% (following yesterday's 35% move higher), GPRO +1.9% (following 11% upside move yesterday), HIMX +1.8% (cont momentum), EXXI +1.5% (provides operations update: Q1 production expected at mid-point of guidance; West Delta horizontal program continues to deliver with three new wells brought online ), Z +1.4% (MOVE peer), KR +1.2% (positive commentary on Monday's Mad Money), SDRL +1.1% (still checking, may be just bouncing — shares have sold off significantly in recent weeks), AAPL +0.8% (iPhone 6 & iPhone 6 Plus available in China on Friday, October 17)

( Читать дальше )

CLVS продажа от 49

CSC смотрим на продажу

AMBA покупка выше 44.50

ETP смотрим на продолжение роста

CVEO покупка от 13

Gapping up/down: WAG +2% after earnings, MOVE +37% after merger news, TASR +4% on London Police camera news, AA +1% on upgrade; DWA -9% on downplay of takeover chatter, miners trading lower, CRR -1% on dg Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: SNX +8.1%, (also initiates quarterly cash dividend of $0.125 per common share), SCOK +7.7%, WAG +2.3%, RBS +2.1%, CTAS +1.1%, HTGC +0.8%, (on track to achieve annual new commitments of approximately $700-$850 million for 2014)

M&A news: MOVE +37% (to be acquired by News Corp (NWSA) for $21 per share), DLIA +25% (announces review of strategic alternatives; received several inquiries from third parties regarding potential acquisition of the company), MAS +7.2% (announces strategic initiatives; Co to spin-off installation and other services segment, initiate share repurchase program and reduce corporate expense), SMPL +4.9% (HomeStreet to merge with Simplicity Bancorp; Simplicity stockholders to receive one share of HomeStreet common stock for each share of Simplicity common stock)

Other news: WYY +17.8% (received two new Task Orders from federal agencies under a recently awarded Federal Government Blanket Purchase Agreement), VIMC +13.8% (announces $12.4 mln contract win in Taiyuan City of Shanxi Province), CPRX +13.7% (announces positive top-line Phase 3 Data From Pivotal Firdapse clinical trial in patients with Lambert-Eaton Myasthenic Syndrome), ACST +11.5% (announces 'Positive' top-line Pharmacokinetic results), CRNT +10.8% (receives follow-on orders from a global Tier 1 operator serving 20 countries across Asia and Africa), CANF +9.6% (USPTO issues Can-Fite patent for CF102 in the treatment of liver regeneration and function following surgery), EBAY +8.9% (eBay to separate eBay and PayPal into independent publicly traded companies in 2015), BLDP +8.2% (receives ElectraGen fuel cell system order for deployments in Digicel network), CNET +7.8% (Co's Liansuo.com signs 12 new clients following Guangzhou Franchise Exhibition), HTZ +5.4% (still checking), TASR +3.9% (selected by the London Metropolitan Police Service to provide another 500 AXON cameras), PLUG +3.4% (move attributed to positive blog mention, also peer BLDP received large order), RWLK +2.9% (cont momentum post IPO), MCP +2.4% (announces that its expanded leach system has now been placed into service at its Mountain Pass, California Facility), CTRP +2.3% (Priceline (PCLN) disclosed a 5.84% active stake in 13D filing) MBLY +2.3% (still checking), RADA +2.2% (following yesterday's 35% move higher), GPRO +1.9% (following 11% upside move yesterday), HIMX +1.8% (cont momentum), EXXI +1.5% (provides operations update: Q1 production expected at mid-point of guidance; West Delta horizontal program continues to deliver with three new wells brought online ), Z +1.4% (MOVE peer), KR +1.2% (positive commentary on Monday's Mad Money), SDRL +1.1% (still checking, may be just bouncing — shares have sold off significantly in recent weeks), AAPL +0.8% (iPhone 6 & iPhone 6 Plus available in China on Friday, October 17)

( Читать дальше )

SPY падает на премаркете

- 29 сентября 2014, 16:54

- |

Ближайший уровень поддержки по SPY – 196.75 уровень сопротивления – 197.25

AGIO продажа ниже 64

NKE продажа от 89

LLL продажа от 114.75

IRM покупка выше 32

Gapping up/down: AMBI +88%, DWA +26%, ATHL +24%, TIBX +21% and AMAG +15% on M&A related news; HIMX +2% on upgrade; EU financials, select energy and metal names trading lower; AVY -1% on dg at JPM Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: RCON +7.2%, LAS +2.3%, KOOL +1.7%, CALM +1.2%, ADP +0.7%

M&A news: AMBI +87.8% (Daiichi Sankyo (DSNKY) to acquire Ambit Biosciences for $15 per share in cash through a tender offer), DWA +26.4% (Softbank (SFTBY) is in discussions to purchase DWA, according to reports, Variety discusses comments from sources that chances of Softbank (SFTBY) acquiring DWA are slim), ATHL +24.6% (Encana (ECA) to acquire all of the issued and outstanding shares of common stock of Athlon by means of an all-cash tender offer for $58.50 per share), TIBX +21% (to be acquired by Vista Equity Partners for $24.00 per share in cash), AMAG +15.4% (to acquire Lumara Health for $600 mln in cash and $75 mln in stock and additional contingent consideration of up to $350 mln)

Other news: EXEL +18.6% (announces positive results from Phase 3 pivotal trial of Cobimetinib in combination with Vemurafenib in patients with BRAF V600 Mutation-positive advanced melanoma), ALIM +16.6% (provides details on FDA approval Of ILUVIEN as the first long-term treatment for diabetic macular edema), ECYT +10.2% (Phase 2b TARGET trial results show improved survival in Adenocarcinoma non-small cell lung cancer patients treated with Endocyte's Vintafolide), PSDV +9.8% (reports approval of ILUVIEN for diabetic macular edema; triggers $25 mln milestone payment from Alimera Sciences (ALIM)), CYTR +7.9% (receives multiple FDA Orphan Drug designations for Aldoxorubicin for the treatment of Glioblastoma), PE +5.6% (still checking), ACST +4.1% (reports successful CaPre Phase II TRIFECTA results proving statistically significant improvements in triglycerides & non-HDL-C), ARIA +4% (announces updated clinical results for AP26113, study results show sustained anti-tumor activity), SGEN +3.9% (Seattle Genetics and Takeda (TKPYY) announce positive data from Phase 3 AETHERA clinical trial of ADCETRIS), KMDA +3.3% (announces second extension of Strategic Agreement with Baxter (BAX)), ISR +3.1% (still checking), DATE +3% (declared a special one-time cash dividend of $0.4467 per ordinary share, or $0.67 per American Depositary Share), WEX +1.4% (positive commentary on Friday's Mad Money)

( Читать дальше )

AGIO продажа ниже 64

NKE продажа от 89

LLL продажа от 114.75

IRM покупка выше 32

Gapping up/down: AMBI +88%, DWA +26%, ATHL +24%, TIBX +21% and AMAG +15% on M&A related news; HIMX +2% on upgrade; EU financials, select energy and metal names trading lower; AVY -1% on dg at JPM Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: RCON +7.2%, LAS +2.3%, KOOL +1.7%, CALM +1.2%, ADP +0.7%

M&A news: AMBI +87.8% (Daiichi Sankyo (DSNKY) to acquire Ambit Biosciences for $15 per share in cash through a tender offer), DWA +26.4% (Softbank (SFTBY) is in discussions to purchase DWA, according to reports, Variety discusses comments from sources that chances of Softbank (SFTBY) acquiring DWA are slim), ATHL +24.6% (Encana (ECA) to acquire all of the issued and outstanding shares of common stock of Athlon by means of an all-cash tender offer for $58.50 per share), TIBX +21% (to be acquired by Vista Equity Partners for $24.00 per share in cash), AMAG +15.4% (to acquire Lumara Health for $600 mln in cash and $75 mln in stock and additional contingent consideration of up to $350 mln)

Other news: EXEL +18.6% (announces positive results from Phase 3 pivotal trial of Cobimetinib in combination with Vemurafenib in patients with BRAF V600 Mutation-positive advanced melanoma), ALIM +16.6% (provides details on FDA approval Of ILUVIEN as the first long-term treatment for diabetic macular edema), ECYT +10.2% (Phase 2b TARGET trial results show improved survival in Adenocarcinoma non-small cell lung cancer patients treated with Endocyte's Vintafolide), PSDV +9.8% (reports approval of ILUVIEN for diabetic macular edema; triggers $25 mln milestone payment from Alimera Sciences (ALIM)), CYTR +7.9% (receives multiple FDA Orphan Drug designations for Aldoxorubicin for the treatment of Glioblastoma), PE +5.6% (still checking), ACST +4.1% (reports successful CaPre Phase II TRIFECTA results proving statistically significant improvements in triglycerides & non-HDL-C), ARIA +4% (announces updated clinical results for AP26113, study results show sustained anti-tumor activity), SGEN +3.9% (Seattle Genetics and Takeda (TKPYY) announce positive data from Phase 3 AETHERA clinical trial of ADCETRIS), KMDA +3.3% (announces second extension of Strategic Agreement with Baxter (BAX)), ISR +3.1% (still checking), DATE +3% (declared a special one-time cash dividend of $0.4467 per ordinary share, or $0.67 per American Depositary Share), WEX +1.4% (positive commentary on Friday's Mad Money)

( Читать дальше )

SPY отыграл гэп вниз на премаркете

- 22 сентября 2014, 17:17

- |

Ближайший уровень поддержки по SPY – 199.85 уровень сопротивления – 200.60

CNQR смотрим на падение

COL продажа от 80

CRR смотрим на покупку от 76

MGA покупка выше 104

Gapping up/down: SIAL +35% and VIAS +30% on M&A news, ALLT +1% after securring 3 new orders; metals and miners trading lower, MTL -34% after Russia's Economy Minister suggesting bankruptcy is most likely scenario, YHOO -3% after dg's Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: LCI +1%, (also announces launch of Oxycodone Hydrochloride Oral Solution)

M&A news: SIAL +34.9% (Germany's Merck KGaA (MKGAY.PK) to acquire SIAL for $140 per share in cash), VIAS +30.3% (TTM (TTMI) will acquire Viasystems for a combined consideration of $11.33 in cash and 0.706 shares of TTM common stock, or $16.46/share), VSI +2.7% (positive mention in Barron's suggesting the company as possible takeover target), CLX +2.7% (rejected takeover offer at 20% premium prior to news CEO will step down, according to reports), EMC +1.8% (may have had merger related discussions with HP (HPQ), according to reports)

( Читать дальше )

CNQR смотрим на падение

COL продажа от 80

CRR смотрим на покупку от 76

MGA покупка выше 104

Gapping up/down: SIAL +35% and VIAS +30% on M&A news, ALLT +1% after securring 3 new orders; metals and miners trading lower, MTL -34% after Russia's Economy Minister suggesting bankruptcy is most likely scenario, YHOO -3% after dg's Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: LCI +1%, (also announces launch of Oxycodone Hydrochloride Oral Solution)

M&A news: SIAL +34.9% (Germany's Merck KGaA (MKGAY.PK) to acquire SIAL for $140 per share in cash), VIAS +30.3% (TTM (TTMI) will acquire Viasystems for a combined consideration of $11.33 in cash and 0.706 shares of TTM common stock, or $16.46/share), VSI +2.7% (positive mention in Barron's suggesting the company as possible takeover target), CLX +2.7% (rejected takeover offer at 20% premium prior to news CEO will step down, according to reports), EMC +1.8% (may have had merger related discussions with HP (HPQ), according to reports)

( Читать дальше )

теги блога GT Capital

- alibaba

- amex

- DAS

- DAS Trader PRO

- DAX

- etf

- good_trade

- gt capital

- HFT

- iLearney

- ipo

- JPMorgan

- nasdaq

- nyse

- online

- Russel 2000

- smb capital

- sterling trader pro

- takion

- traanan

- акция

- аналитика

- анонс

- бесплатное обучение

- бонус

- брокер

- брокеры

- вебинар

- видео

- Вопросы от трейдеров

- выставка

- дейтрейдинг

- дилинговый зал

- запись

- Казахстан

- комиссия

- конкурс трейдеров

- лекции

- манипуляции

- ММВБ

- наушники

- новичкам

- Новости

- обзор рынка

- обучающий курс

- обучение

- обучение трейдингу

- опрос

- отчёт

- оффтоп

- психология

- риски

- роботы

- рынок США

- сделки

- сервис

- скальпинг

- статистика

- сша

- технический анализ

- торговая платформа

- торговые роботы

- трейдинг

- фильтр

- фильтр новостей

- фондовый рынок

- чат

- электронные деньги