Павел Дерябин

Выкуп акций Уралкалий

- 24 апреля 2015, 11:33

- |

Выкуп акций УРАЛКАЛИЙ

3,2 доллара это 160 рублей по курсу 50 (по рынку-нет стимула для роста)

Выводы: шортить бумагу категорически нельзя, ее выгодно использовать в качестве актива, под который можно брать займ.

Долгосрочно-рост котировок

Забавно, IPO Уралкалий проходило под знаменем объем размещения на 1 млрд долларов. Правда цена была в 10 раз дешевле

Уралкалий утвердил программу buyback на сумму до $1,5 млрд во II квартале

Цена выкупа составит $3,2 за акцию и $16 за GDR.

В рамках программы планируется приобрести не более 15,97% уставного капитала компании.

- комментировать

- Комментарии ( 2 )

Загадка Фосагро

- 22 апреля 2015, 18:38

- |

Ниже я представил подробные данные об этой достаточно непрозрачной компании, с менеджментом, который ранее как то не сильно озадачивался проблемами капитализации компании и ее инвестиционной привлекательности.

Но какие изменения последовали в результате санкций! Я иногда даже думаю, что санкции стоило бы немного усилить, чтобы отечественные компании навсегда стали честными, прозрачными и щедрыми.

А то проходили десятилетия на нашем рынке акций, когда воровство было выгоднее, чем делится с акционерами результатами деятельности.

Фосагро? Да! Его однозначно нужно иметь в портфеле, планы у менеджмента грандиозные, на уровне мировых стандартов

Чистая прибыль «Фосагро» в 2014 г. увеличилась почти в 30 раз, до 27,585 млрд рублей, говорится в отчете компании по РСБУ .

Выручка за год выросла в 8,6 раза, до 38 млрд руб. Себестоимость продаж увеличилась с на 18,1%, до 658,2 млрд руб. Прибыль до налогообложения возросла в 124 раза, до 25 млрд руб.

28 апреля намерен заслушать предложения менеджмента компании по снижению долговой нагрузки и изменению дивидендной политики, предусматривающей увеличение объема чистой прибыли, распределяемой на дивиденды, говорится в сообщении компании.

( Читать дальше )

Как инвестировать в Китай уже сейчас

- 21 апреля 2015, 16:31

- |

Но только российские участники фондового рынка по прежнему не могут, не знают, не понимают как же можно дотянуться до Китая.

Ну во первых, часть акций из Китая торгуется на Нью-Йоркской фондовой бирже. К примеру AliBABa.

Во вторых, разбираться в деятельности каждой компании из Китая вовсе не обязательно. Для грамотного подсчета ее справедливой стоимости и перспектив развития потребуется около двух дней. Понятно, что пока будут подсчитаны все 700 компаний, время для инвестирования будет упущено. По крайней мере для спекуляций.

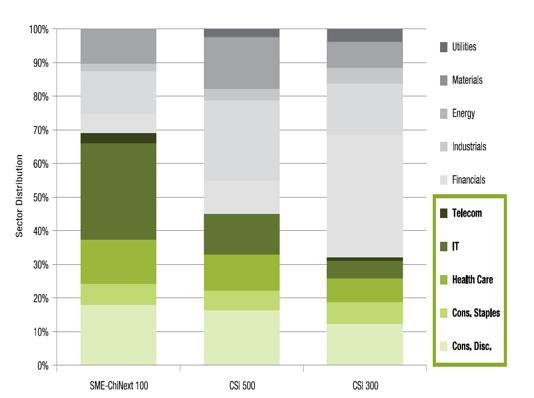

Поэтому существует такой вариант. Инвестировать через ETF.

Итак, у нас есть 3 больших ETF для Китая.

Market Vectors ChinaAMC SME-ChiNext ETF

( Читать дальше )

Tesla чуть было не продали Google в 2013 г

- 20 апреля 2015, 16:13

- |

www.bloomberg.com/news/articles/2015-04-20/elon-musk-had-a-deal-to-sell-tesla-to-google-in-2013

Это было до впечатляющего отчета компании в мае 2013г, после которого стало ясно, что Tesla может продавать автомобили с высокой маржой и они будут пользоваться спросом.

Но Google повезло, и повезло больше, чем нынешним акционерам компании, которые еще долго будут рассчитывать вероятность выживания компании. Не всегда понятно, кто и как делает такие вбросы информации, но явно, что такая новость отразится на котировках обеих компаний.

Сейчас, в 2015году, спор не ведется о выживании Tesla, он скорее направлен в плоскость как долго еще компания будет не самоокупаемой. А вот тогда будущее представлялось в ином свете

Почему не хожу на конференции СмартЛаба

- 19 апреля 2015, 22:21

- |

Считаю, что такие «конференции» проще проводить за кружкой пива в баре.

Мыслей будет больше, идеи лучше, КПД будет приближаться к 100%

Самое важное, что голос обычного заурядного игрока как всегда не будет услышан. Обычный трейдер опять будет сидеть в амфитеатре и слушать выступления «гуру». Хотя, вполне возможно, ему есть что сказать. Есть, чем поделиться. Вполне вероятно, что в голове такого трейдера может родится идея, которая сделает его миллионером. Но эту идею он никогда не сможет высказать, потому что толпа пришла слушать тех, кого она и так читает каждый день.

На конференцию никогда не придет тот, кто двигает рынком, кто проводит скупку компаний ради контроля блокирующего пакета акций. Ее обходят стороной как раз те из за кого котировки акций не скатились к нулю.

Так стоит ли тратить время на обсуждение «торговых стратегий», на которые автор тратит 10 тыс долларов, на «графики», где эксперты-художники видят «сигналы на покупку», а при этом не способны повлиять ни на один пипс… Я бы пошел на конференцию, если бы там были управляющие, трейдеры, инвесторы, которые могли бы поделится опытом успешных инвестиций за 5, за 10, за 15 лет. Только вот где они?

Греф и Сбербанк

- 17 апреля 2015, 19:07

- |

Ну неужели в огромном банке Сбербанк не могут спланировать выступления ее руководства? И при этом Греф считается человеком либеральных взглядов, оппозиционер Путину, прогрессивный менеджер на фоне серого и молчаливого управленческого аппарата.

Как то не в первый раз я замечаю по истине х а м с к о е отношение к акционерам, как будто руководство банка мстит им за некие грехи.

Откуда такое барское отношение, как его лечить, и что с ним делать

Размер дивидендов Сбербанка снижен из-за необходимости поддержки достаточности капитала — Греф

Как будто нельзя было заранее просчитать, подготовить инвесторов к мысли, что у банка есть желание направить деньги на развитие, на повышение качества работы и т.д. Получите и распишитесь.

Минус 8% упала цена привилегированных акций и 5% обыкновенных.

Вторая новость:

Собрание акционеров Сбербанка в мае рассмотрит вопрос продления полномочий главы банка — Греф

Он пояснил, что другие кандидатуры собрание акционеров рассматривать не будет, планируется продлить полномочия Г.Грефа.

почему, собственно, и нет?

Историческое IPO в США

- 16 апреля 2015, 19:30

- |

Впервые в истории человеческой цивилизации на бирже размещается компания, работающая в сфере высокочастотной торговли. VIRT. Сразу после IPO ее акции выросли в цене на 20 процентов. Бизнес модель компании в отдельных чертах чем то схожа с той компанией, в которой я работаю. IT Invest.

Пока сложно говорить, насколько долго компания сможет показывать положительные результаты, одно можно сказать заранее, что финансовые результаты, производимые торговыми роботами, будут… прогнозируемыми. Ну и ли скажем более прогнозируемыми, чем интернет — компаниями, только что вышедшими на биржу. Даже у Facebook дела шли не сразу удачно, и только грамотное продвижение рекламы через мобильные телефоны позволило Facebook резко увеличить выручку.

Что касается маржинальности бизнеса тут есть повод задуматься, потому что производство грамотных роботов стоит не так дорого, скорее это «удача» или «прозрение» придумать везучего робота. Вопрос в том, какие стратегии будут использовать для заработков в этой компании.

Вобщем, взвесим все за и против, я решил рискнуть и… купить первую алготрейдинговую фирму. Будь что будет. В америке хоть что то происходит, хоть какие то идеи реализуются, хоть как то движется прогресс, в отличие от загадок финансового мира России.

Второе IPO сегодня в США прошло более успешно.

Компания ETSY-онлайн продавец предметов искусства выросла в цене на 100%)))

www.marketwatch.com/story/etsy-shares-more-than-double-in-their-trading-debut-2015-04-16

Купить ее не решился, но добавил ее в модельный портфель, чтобы отслеживать по ней новости и котировки

Спред BRENT LIGHT

- 15 апреля 2015, 19:28

- |

LIGHT 55,63

20% спред испарился, словно его и не было. Довольно интересно то, что в именно LIGHT выглядел очень слабым все прошедшие 4 месяца, сланцевая революция и все такое. А по факту оказалось, что сланцы начали как будто в Европе разрабатывать.

Как всегда самые большие суммы теряются на попытке сыграть на спреде light-brent, под впечатлением его справедливости, правильности, размера, обоснованности и т.п. Кто знает, вариант возврата к состоянию, когда brent будет стоить дешевле light нельзя сбрасывать со счетов. Пусть даже и по другим ценам. (более низким или наоборот)

В потоке новостей как то слышишь горькие предсказания о том от EIA, что США скоро станет чистым экспортером нефти как 50-е годы прошлого века. Осталось ждать 15 лет. Я все время пытаюсь все это осознать через призму «страшилок», которые я слышал еще в школе, что капитализм загнивает, а нефть кончится через 20 лет.

( Читать дальше )

Выступил в программе РБК Рынки. Видео

- 14 апреля 2015, 16:42

- |

Людей все больше беспокоит укрепление рубля. Вопросы задаются по теме, почему я что то там в акцих купил, а они падают. И если раньше рублевая котировка зависила от результатов компании, то теперь это просто… результат торговли рубль доллар. Кстати, рубль с 72 укрепился за полтора месяца на 51. Это 30% как никак.

В будущем машины будут без водителя. В акции разработчиков можно вложиться уже сейчас

- 10 апреля 2015, 19:14

- |

Рекомендую внимательно почитать статью!

Машины начинают парковаться сами, снижать скорость сами, скоро мы увидим, как ехать в машине с помощью робота это дешевле и безопаснее. Жалко только таксистов, поэтому я не совсем понимаю, кто вкладывается в стартап UBER. Если чуть ли не завтра все поедут без водителя, зачем нужно такси? Оно просто исчезнет.

Уже сейчас можно купить акции компаний, которые разрабатывают в тайных подземных лабораториях США неведомые простому разуму технологии, которые позволят делать умные машины, машины без водителя, автопилоты. Рынок производителей этих технлогий практичеси удвоится в ближайшие три года.

В статье упомянуты компании, которые учавствуют в разработке технологий. Меня заинтересовала только одна компания,

Delphi Automotive PLC. DLPH

( Читать дальше )

теги блога Павел Дерябин

- AMZN

- Apple

- Brent

- DAX

- DXY

- GTL

- herbalife

- IT Invest

- S&P500

- tesla

- tesla motors

- USA

- WTI

- акции

- американский рынок

- атон

- АФК Система

- баффет

- Безос

- биотехнлогии

- Биотехнологии США

- биржа

- биткоин

- биток

- богатство

- брокеры

- бррррр

- Будушее

- будущее

- буль буль

- бум

- Ванюта

- Вася

- Вебенар

- вебинар

- война

- вопрос

- ВТБ

- Газпром

- герчик

- ГМК НорНикель

- дивиденды

- Дно

- доллар

- евро

- еда

- ЕЦБ

- загадка

- золото

- Иволга Капитал

- индекс доллара

- КАМАЗ

- Китай

- Кризиз

- кризис

- криптобиржа

- криптовалюта

- Лукойл

- медведев д.а

- Миллардеры

- нефть

- облигации

- опек+

- оффтоп

- прогноз

- Путин

- работа

- ралли

- РБК эфир

- РЖД

- Риски

- Роснефть

- рост

- РТС

- Рубль

- РУСАЛ

- РФ

- санкции

- сбербанк

- система

- смартлаб

- сургут преф

- Сургутнефтегаз

- сша

- торговые сигналы

- Трамп

- Транснефть

- трейдинг

- ужас

- УжасоПортфель

- Украина

- Уоррен Баффет

- уфа

- Финам

- форекс

- Фосагро

- ФСК Россети

- шорт

- Яндекс