SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Scorpio0

Сентимент SP500, WTI и GOLD - Нефть нейтральный сентимент!!!

- 08 марта 2017, 07:56

- |

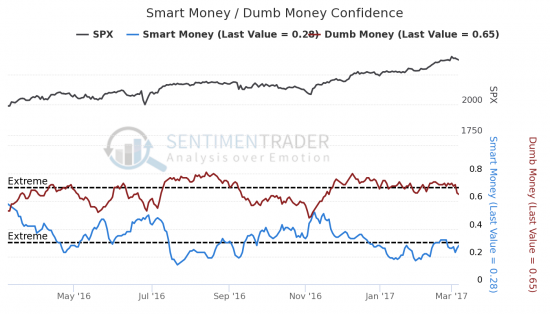

| Date | Smart Money | Dumb Money | SPX |

|---|---|---|---|

| 2017-03-07 | 0.28 | 0.65 | 2368.39 |

| 2017-03-06 | 0.26 | 0.66 | 2375.31 |

| 2017-03-03 | 0.23 | 0.72 | 2383.12 |

| 2017-03-02 | 0.27 | 0.71 | 2381.92 |

| 2017-03-01 | 0.26 | 0.73 | 2395.96 |

| 2017-02-28 | 0.26 | 0.72 | 2363.64 |

| 2017-02-27 | 0.27 | 0.73 | 2369.75 |

| 2017-02-24 | 0.32 | 0.71 | 2367.34 |

| 2017-02-23 | 0.32 | 0.73 | 2363.81 |

| 2017-02-22 | 0.32 | 0.72 | 2362.82 |

По акциям глупые деньги ушли под линию экстремума, если умные пройдут линию экстремума, то есть вероятность, что сейчас начало сильной коррекции.

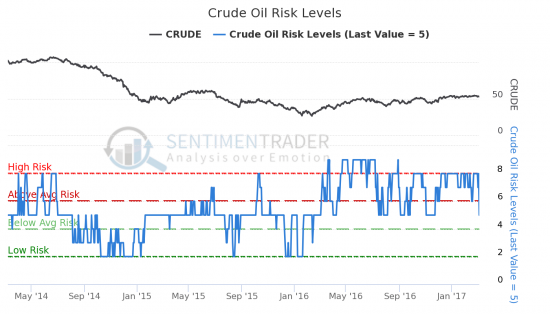

| Date | CRUDE | Risk Levels |

|---|---|---|

| 2017-03-07 | 52.79 | 5 |

| 2017-03-06 | 53.2 | 8 |

| 2017-03-03 | 53.33 | 7 |

| 2017-03-02 | 52.61 | 8 |

| 2017-03-01 | 53.83 | 8 |

| 2017-02-28 | 54.01 | 8 |

| 2017-02-27 | 54.05 | 8 |

| 2017-02-24 | 53.99 | 8 |

| 2017-02-23 | 54.45 | 8 |

| 2017-02-22 | 53.59 | 8 |

Нефть впервые за 3 месяца заняло нейтральный сентимент, да не просто, а резко с 8 уровня на 5.

Это серьёзный признак того, что цена на нефть может просесть.

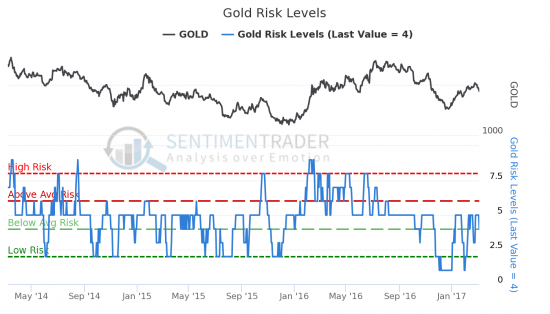

| Date | GOLD | Risk Levels |

|---|---|---|

| 2017-03-07 | 1215.86 | 4 |

| 2017-03-06 | 1225.29 | 5 |

| 2017-03-03 | 1234.81 | 5 |

| 2017-03-02 | 1234.25 | 5 |

| 2017-03-01 | 1249.69 | 5 |

| 2017-02-28 | 1248.44 | 5 |

| 2017-02-27 | 1252.73 | 5 |

| 2017-02-24 | 1257.19 | 3 |

| 2017-02-23 | 1249.56 | 3 |

| 2017-02-22 | 1237.44 | 3 |

Золото заняло медвежью позицию и цена падает.

---

Поздравляю с 8 марта, женщины! :)

76 |

Читайте на SMART-LAB:

Скидка 15% на нашу аналитику — только 72 часа!

Увеличь доходность своего портфеля с профессиональной командой аналитиков. Наши идеи уже принесли клиентам прибыль с начала года. Ты мог...

21 февраля 2026, 10:04

теги блога Scorpio

- 50

- 2017

- API

- Baker

- Baker Hughes

- Bitcoin

- Bloomberg

- brent

- CFTC

- Crude

- DOE

- Dow

- EIA

- GOLD

- Hughes

- light

- MICEX

- MOEX

- Oil

- RBOB

- Rigs

- S&P500

- USD

- usdrub

- VIX

- wti

- ZeroHedge

- Акции

- Бензин

- Буровые

- Вена

- волатильность

- вопрос

- Встреча

- Гусев

- Дистилляты

- Добыча

- доллар

- Евро

- ЕС

- Запасы

- Золото

- индекс доллара

- Ирак

- Италия

- Китай

- коррекция

- Кукл

- Курдистан

- Курс

- курс доллара

- Кушинг

- Ливия

- Лица

- ЛЧИ

- Маркидонова

- Минфин

- Михеев

- Москва

- Набиуллина

- нефть

- Новый год

- Обвал

- опек+

- опрос

- оффтоп

- Падение

- прогноз

- Путин

- Резервы

- референдум

- Роснефть

- Россия

- Рост

- рубль

- Русские

- РФ

- Санкции

- Саудовская Аравия

- Сделка

- Сенаторы

- сентимент

- Силуанов

- СмартЛаб

- Смешинка

- сокращение

- Ставка

- США

- Трамп

- Тренд

- Улюкаев

- Физические

- ФРС

- Фьючерс

- Хай

- Хакеры

- ЦБ

- Цена

- Шип

- Юридические

пароль 123

www.protectedtext.com/sentimentgold

пароль 123

www.protectedtext.com/sentimentsp500

Смарт-Лаб виснет когда ему пытаешься скормить большой массив данных. Пост больше 40 000 символов не создаёт.

Предварительно, вот такую страту чекнул: покупаем stoch(smart-dumb)>=90 и продаём когда падает ниже 10. Сильно отстаёт от индекса, больше похоже на random money. Там они не говорят, как эти данные нужно использвовать?)

Construction:

THIS DATA SERIES WAS UPDATED SEPTEMBER 21 IN ORDER TO ELIMINATE STALE SERIES AND ADD MORE ROBUST ONES. ALL HISTORICAL DATA HAS BEEN UPDATED.

The Smart Money Confidence and Dumb Money Confidence indices are a unique innovation that allows subscribers to see, in one quick glance, what the «good» market timers are doing with their money compared to what «bad» market timers are doing.

Our Confidence indices use mostly real-money gauges — there are few opinions involved here. Generally, we want to follow the Smart Money traders when they reach an extreme — we want to bet on a market rally when they are confident of rising prices, and we want to be short (or in cash) when they are expecting a market decline. The higher the confidence number, the more aggressively we should be looking for higher prices.

Examples of some Smart Money indicators include the OEX put/call and open interest ratios, commercial hedger positions in the equity index futures, and the current relationship between stocks and bonds.

In contrast to the Smart Money, we want to do the opposite of what the Dumb Money is doing when they are at an extreme. These traders have proven themselves over history to be bad at market timing. They get very bullish after a market rally, and bearish after a market fall. By the time the majority of them catch on to a trend, it?s too late — the trend is about to reverse. It tells us how confident we should be in selling the market.

Examples of some Dumb Money indicators include the equity-only put/call ratio, the flow into and out of the Rydex series of index mutual funds, and small speculators in equity index futures contracts. We also chart the spread between the Smart Money and Dumb Money. This gives us a quick view of the difference between the two groups of traders. Because the «dumb money» follows trends, and the «smart money» generally goes against trends, the «dumb money» is usually correct during the meat of the trend. So when the Dumb Money Confidence is higher than the Smart Money Confidence, that means sentiment is positive.

When it becomes too positive, however, then sentiment has reached an extreme, and stocks often run into trouble. This usually happens because the Dumb Money rises above 60%, and the Smart Money drops below 40%. That is a warning sign for stocks.

When the Dumb Money is below the Smart Money, then sentiment is negative and stocks are usually struggling. It's best to be defensive at times like this. However, when sentiment becomes too negative, then stocks are often poised to rally over the next 1-3 months. This usually occurs because the Dumb Money has dropped below 40% and the Smart Money has risen above 60%.

What is considered «smart» is simply based on an indicator's historical record at extremes. If an indicator is usually showing excessive pessimism near a market peak, and excessive optimism near a market bottom, then that indicator will be included in our Smart Money calculation. And if it consistently shows too much pessimism near a low and too much optimism near a high, it will be considered Dumb Money.

Confidence indices are presented on a scale of 0% to 100%. When the Smart Money Confidence is at 100%, it means that those most correct on market direction are 100% confident of a rising market?and we want to be right alongside them. When it is at 0%, it means that these good market timers are 0% confident in a rally, and we want to be in cash or even short when confidence is very low.

We can use the Dumb Money Confidence in a similar, but opposite, manner. For example, if the Dumb Money Confidence is at 100%, then that means that these bad market timers are supremely confident in a market rally. And history suggests that when these traders are confident, we should be very, very worried that the market is about to decline. When the Dumb Money Confidence is at 0%, then from a contrary perspective we should be concentrating on the long side, expecting these traders to be wrong again and the market to rally.

In practice, our Confidence Indexes rarely get below 30% or above 70%.

www.protectedtext.com/sentimentcrude

Construction:

The Correction Risk Level is a quick way to gauge what our indicators and studies are suggesting. The higher the risk, the more likely the market is to decline.

Another way to look at it is in terms of cash. If the Correction Risk Level is 0, then we would be more inclined to keep 0% of our portfolio in cash (i.e. we would be fully invested). But if the Correction Risk Level is 10, then we would be more inclined to keep 100% of our portfolio in cash (i.e. no exposure to stocks).

The Short-term Correction Risk Level is based heavily on the Short-term Indicator Score. The Intermediate-term Correction Risk Level is based heavily on the spread between the Smart Money and Dumb Money Confidence indexes.

In both cases, we take the overriding trend of the market into account. If the indicators are showing excessive amounts of bearish opinion, then the market is more likely to respond favorably to that if we're in a bull market, and the Correction Risk Level would be lower. But if we're in a bear market, then bearish sentiment extremes are less reliable, and the Correction Risk Level would be a bit higher.

We take our studies into account as well. So if the indicators are murky, but we have some very compelling studies suggesting the market should rally, then the Correction Risk Level might be lower than the indicators would suggest.

The default Correction Risk Level is 5, which is where it would be if there is no edge present among our indicators and studies.

на дистанции не обгоняем индекс, но близко к нему. Должен быть какой-то ключ)

как считается