SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 24 июня

- 24 июня 2013, 17:06

- |

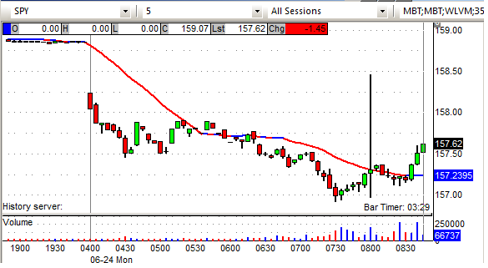

Спайдер понижается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

M&A related: VHS +65.7% and THC +7.4% (Vanguard Health Systems to be acquired by Tenet Healthcare for $21 per share in cash), KEYN +47.2% (Keynote Systems to be acquired by Thoma Bravo for $20.00 per share).

Other news: UAMY +69.4% (reports it has a lease on the San Jose Antimony Mines (Wadley) in San Luis Potosi, Mexico), OCZ +16.8% and FIO +3.1% (following STEC / WDC news), SBLK +9.2% (commences backstopped equity rights offering, discloses rehabilitation proceedings may have a negative impact on financial results), SKS +3.1% (still checking, Jennifer Aniston Announced as EIF Ambassador to Saks Fifth Avenue's 2013 Key to the Cure Campaign), THRX +1.8% (FDA approves Vibativ for hospitalized patients with bacterial pneumonia), JOSB +1.7% (confirms that it has been seeking potential acquisitions).

Analyst comments: SCHW +1.7% (upgraded to Buy from Neutral at Citigroup), FSLR +1.5% (initiated with a Overweight at JP Morgan), CBOE +0.9% (upgraded to Buy from Neutral at Goldman)

Gapping down:

Financial names showing weakness: DB -2.8%, SAN -2.6%, BBVA -2.4%, BCS -2.4%, ING -2.4%, CS -2.4%, BAC -1.5%.

Metals/mining stocks trading lower: GOLD -4.8%, AUMN -3% (announces suspension of production), MT -2.9%, IAG -2.8%, GDX -2.8%, RIO -2.7% (Rio Tinto has canceled sale of its $1.3 bln diamond business, according to reports), BBL -2.6%, BHP -2.4%, GG -2.4%, ABX -2.3%, SLV -2.2%, AU -2.2%, FCX -2% (announces Resumption of Open Pit Operations at PT Freeport Indonesia), GLD -1.6%, HL -1.4%.

Select oil/gas related names showing early weakness: SDRL -2.6%, STO -2.5%, RDS.A -1.9%, TOT -1.8%, BP -1.5%.

Large cap drug names under pressure: SHPG -2.9%, SNY -2.6% (reports positive Phase 3 data for once-daily lixisenatide for Type 2 Diabetes), AZN -2.4% (AstraZeneca and Bristol-Meyers (BMY) present Phase IIa study assessing safety and tolerability of dapagliflozin after 14 days as add-on to insulin in adult patients with Type 1 Diabetes; AstraZeneca is considering alliance with another company for drug development, according to reports), NVS -2.3%

A few telecom names are lower: PT -3.2%, BT -2.6%, TEF -2.2% ( disclosed earlier that it has reached an agreement with Hutchison Whampoa Group for the sale of its 100% participation in Telefonica Ireland for EUR850 mln), VOD -1% (announced its intention to acquire Kabel Deutschland in a transaction delivering Kabel Deutschland shareholders EUR 87 per share in cash; is expected to be accretive to EPS and FCF per share from the first and second full year post completion respectively)

Other news: CTIC -10.7% (FDA alerts CTIC that a partial clinical hold has been placed on Tosedostat), ALU -5.2% and NOK -3.3% (still checking for anything specific), FB -1.3% (indicated that a data breach exposed 6 mln users, according to reports), MON -1.2% (has indicated that GMO find in white wheat is suspicious, according to report out Friday afternoon), AAPL -1.1% (Wal-Mart has lowered price of AAPL iPhone 5 to $129 from $189, according to reports), MW -1.1% (Men's Wearhouse ticking lower following cautious mention in Barron's), AMZN -1.1% (GOP and states spilt over future of internet sales tax bill, according to reports)

Analyst comments: DEG -4.8% (downgraded to Neutral from Buy at Citigroup ), AGN -4% (downgraded to Hold from Buy at Deutsche Bank, downgraded at Leerink), BUD -3.5% (AB InBev downgraded to Hold from Buy at Societe Generale), HOV -3.4% (resumed with a Sell at Goldman), PHM -3.2% (resumed with a Sell at Goldman), DE -2.4% (downgraded to Underweight from Neutral at JP Morgan), DEO -1.9% (downgraded to Hold at Liberum), WAG -1.5% ( downgraded to Hold at Cantor Fitzgerald; tgt $49)

Торговые идеи NYSEи NASDAQ:

VHS– арбитражный лонг с целью 21.00 (покупка компании)

THC– шорт ниже 44.00

Оригинал статьи:http://shark-traders.com/blog/analitika-na-24-iyunya/

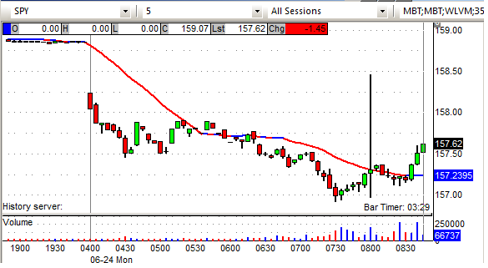

- Европейские индексы на отрицательной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

M&A related: VHS +65.7% and THC +7.4% (Vanguard Health Systems to be acquired by Tenet Healthcare for $21 per share in cash), KEYN +47.2% (Keynote Systems to be acquired by Thoma Bravo for $20.00 per share).

Other news: UAMY +69.4% (reports it has a lease on the San Jose Antimony Mines (Wadley) in San Luis Potosi, Mexico), OCZ +16.8% and FIO +3.1% (following STEC / WDC news), SBLK +9.2% (commences backstopped equity rights offering, discloses rehabilitation proceedings may have a negative impact on financial results), SKS +3.1% (still checking, Jennifer Aniston Announced as EIF Ambassador to Saks Fifth Avenue's 2013 Key to the Cure Campaign), THRX +1.8% (FDA approves Vibativ for hospitalized patients with bacterial pneumonia), JOSB +1.7% (confirms that it has been seeking potential acquisitions).

Analyst comments: SCHW +1.7% (upgraded to Buy from Neutral at Citigroup), FSLR +1.5% (initiated with a Overweight at JP Morgan), CBOE +0.9% (upgraded to Buy from Neutral at Goldman)

Gapping down:

Financial names showing weakness: DB -2.8%, SAN -2.6%, BBVA -2.4%, BCS -2.4%, ING -2.4%, CS -2.4%, BAC -1.5%.

Metals/mining stocks trading lower: GOLD -4.8%, AUMN -3% (announces suspension of production), MT -2.9%, IAG -2.8%, GDX -2.8%, RIO -2.7% (Rio Tinto has canceled sale of its $1.3 bln diamond business, according to reports), BBL -2.6%, BHP -2.4%, GG -2.4%, ABX -2.3%, SLV -2.2%, AU -2.2%, FCX -2% (announces Resumption of Open Pit Operations at PT Freeport Indonesia), GLD -1.6%, HL -1.4%.

Select oil/gas related names showing early weakness: SDRL -2.6%, STO -2.5%, RDS.A -1.9%, TOT -1.8%, BP -1.5%.

Large cap drug names under pressure: SHPG -2.9%, SNY -2.6% (reports positive Phase 3 data for once-daily lixisenatide for Type 2 Diabetes), AZN -2.4% (AstraZeneca and Bristol-Meyers (BMY) present Phase IIa study assessing safety and tolerability of dapagliflozin after 14 days as add-on to insulin in adult patients with Type 1 Diabetes; AstraZeneca is considering alliance with another company for drug development, according to reports), NVS -2.3%

A few telecom names are lower: PT -3.2%, BT -2.6%, TEF -2.2% ( disclosed earlier that it has reached an agreement with Hutchison Whampoa Group for the sale of its 100% participation in Telefonica Ireland for EUR850 mln), VOD -1% (announced its intention to acquire Kabel Deutschland in a transaction delivering Kabel Deutschland shareholders EUR 87 per share in cash; is expected to be accretive to EPS and FCF per share from the first and second full year post completion respectively)

Other news: CTIC -10.7% (FDA alerts CTIC that a partial clinical hold has been placed on Tosedostat), ALU -5.2% and NOK -3.3% (still checking for anything specific), FB -1.3% (indicated that a data breach exposed 6 mln users, according to reports), MON -1.2% (has indicated that GMO find in white wheat is suspicious, according to report out Friday afternoon), AAPL -1.1% (Wal-Mart has lowered price of AAPL iPhone 5 to $129 from $189, according to reports), MW -1.1% (Men's Wearhouse ticking lower following cautious mention in Barron's), AMZN -1.1% (GOP and states spilt over future of internet sales tax bill, according to reports)

Analyst comments: DEG -4.8% (downgraded to Neutral from Buy at Citigroup ), AGN -4% (downgraded to Hold from Buy at Deutsche Bank, downgraded at Leerink), BUD -3.5% (AB InBev downgraded to Hold from Buy at Societe Generale), HOV -3.4% (resumed with a Sell at Goldman), PHM -3.2% (resumed with a Sell at Goldman), DE -2.4% (downgraded to Underweight from Neutral at JP Morgan), DEO -1.9% (downgraded to Hold at Liberum), WAG -1.5% ( downgraded to Hold at Cantor Fitzgerald; tgt $49)

Торговые идеи NYSEи NASDAQ:

VHS– арбитражный лонг с целью 21.00 (покупка компании)

THC– шорт ниже 44.00

Оригинал статьи:http://shark-traders.com/blog/analitika-na-24-iyunya/

14

Читайте на SMART-LAB:

Оперативная заметка с полей облигационной конференции для клиентов Mozgovik Research

Доброго дня, уважаемые читатели Mozgovik Research.

Для вас хотел коротко и оперативно поделиться основными идеями, которые успел услышать на...

17:22

МГКЛ на Smart-Lab & Cbonds PRO облигации 2.0 📍

Мы уже работаем на площадке и ждём вас на стенде МГКЛ — будем рады встрече и вопросам. 🕑 В 14:30 генеральный директор ПАО «МГКЛ» Алексей...

11:30

Обновление кредитных рейтингов в ВДО и розничных облигациях (ООО «АСПЭК-Домстрой» подтвержден BB-.ru, ООО «ПЗ «Пушкинское» понижен D|ru|, ООО «ЦЕНТР-РЕЗЕРВ» понижен С(RU))

🟢ООО «ФЭС-Агро»

Эксперт РА подтвердил рейтинг кредитоспособности на уровне ruBBB-, прогноз по рейтингу стабильный. ООО «ФЭС-Агро» входит в...

09:15

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы