SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 05.04.

- 05 апреля 2013, 16:38

- |

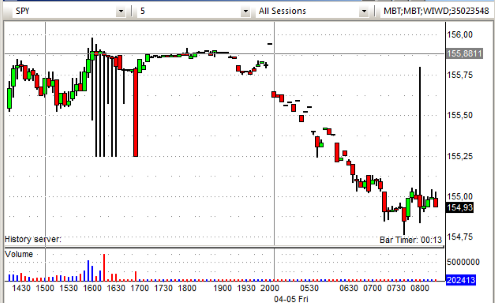

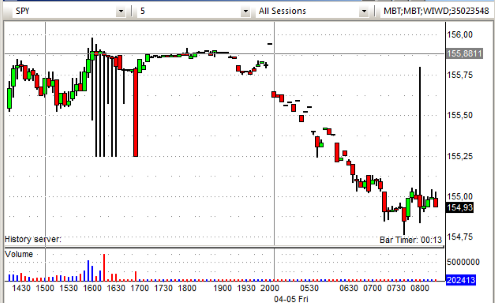

Спайдер торгуется на премаркете ниже ключевого уровня 155.00.

SPY (внутридневной график) падение на премаркете. Сопротивление 155.25. Поддержка: 154.75

Ожидаемая макроэкономическая статистика:

Other news:

Analyst comments: BBG +1.8% (ticking higher, upgraded to Buy from Neutral at Goldman), CELG +0.9% (upgraded to Buy from Hold at Deutsche Bank), MBT +0.3% (upgraded to Overweight from Neutral at JP Morgan)

Financial related names showing weakness: NBG -9%, BCS -2.6%, ING -2.6%, HBC -1.5%, C -1.2%, DB -1.1%, BAC -0.9%, .

Select metals/mining stocks trading lower: MT -3.4%, RIO -1.4%, BBL -1%, BHP -0.7%.

Select oil/gas related names showing early weakness: PTR -1.9%, RIG -1.4%, E -1.2%, SDRL -0.8%, RDS.A -0.8% (Royal Dutch Shell to sign Russian Artic drilling deal, according to reports), BP -0.7%, TOT -0.6%, STO -0.5%.

Several FFIV/RDWR related names are under pressure: JNPR -5.6%, CTXS -3.6%, CSCO -3.3%, VMW -2.5%, RAX -2.3%, CRM -1.9%, XLNX -1%,

Other news: RIGL -29.6% (AstraZeneca reports top-line results from OSKIRA-1 Phase 3 study of Fostamatinib in Rheumatoid Arthritis, Rigel Pharma downgraded to Market Perform from Outperform at BMO Capital Mkts), SABA -12% (announced anticipated delisting from NASDAQ global select market; disclosed SEC investigation), ETP -3.5% (announces 12 mln common unit offering), SAP -2.5% and DEO -1.7% (still checking), BDN -1.1% (announces offering of 10 mln common shares), UL -0.9% (still checking), LVS -0.5% (Las Vegas Sands CEO Sheldon Adelson says Richard Suen did not help co get Macau license, according to reports).

Analyst comments: KMB -0.6% (downgraded to Underperform from Market Perform at BMO Capital)

Торговые идеи NYSEи NASDAQ:

NIHD– компания анонсировала продажу подразделение Nextel Peru за 400 млн долларов. Акции слабее рынка. Ключевые уровни – 4.50 и 5.00. Работаем исходя из цены открытия.

VLO – совет директоров одобрил Spin off CST Brands. Смотрим акцию в лонг выше 43.00. Ориентируемся на уровень 43.50.

CSCO – компания торгуется на премаркете ниже вчерашнего закрытия. Причина – реакция на conference call F5 Networks(FFIV). Выше 20.50 смотрим акцию в лонг с потенциалом в 50 центов. Другие компании отреагировавшие аналогично: JNPR(лонг выше 17.25, шорт ниже 17.00), CRM, CTXS, VMW.

ETP– дополнительное размещение 12 млн. акций. Ниже 48.00 смотрим акцию на шорт, выше 48.50 можно искать точку входа на лонг.

Оригинал статьи: http://shark-traders.com/blog/analitika-na-05-04/

- Европейские индексы на отрицательной территории.

- Nikkei +1,6 %, Shanghai — закрыт.

SPY (внутридневной график) падение на премаркете. Сопротивление 155.25. Поддержка: 154.75

Ожидаемая макроэкономическая статистика:

- Fed's Yellen speaks (5pm)

- March Nonfarm Payrolls (8:30am)- Briefing.com consensus 192K

- March Nonfarm Private Payrolls (8:30am)- Briefing.com consensus 210K

- March Unemployment Rate (8:30am)- Briefing.com consensus 7.7%

- March Hourly Earnings (8:30am)- Briefing.com consensus +0.2%

- March Average Workweek (8:30am)- Briefing.com consensus 34.5

- February Trade Balance (8:30am)- Briefing.com consensus -$44.7 bln

- February Consumer Credit (8:30am)- Briefing.com consensus $14 bln

- Gapping up

Other news:

Analyst comments: BBG +1.8% (ticking higher, upgraded to Buy from Neutral at Goldman), CELG +0.9% (upgraded to Buy from Hold at Deutsche Bank), MBT +0.3% (upgraded to Overweight from Neutral at JP Morgan)

- Gapping down

Financial related names showing weakness: NBG -9%, BCS -2.6%, ING -2.6%, HBC -1.5%, C -1.2%, DB -1.1%, BAC -0.9%, .

Select metals/mining stocks trading lower: MT -3.4%, RIO -1.4%, BBL -1%, BHP -0.7%.

Select oil/gas related names showing early weakness: PTR -1.9%, RIG -1.4%, E -1.2%, SDRL -0.8%, RDS.A -0.8% (Royal Dutch Shell to sign Russian Artic drilling deal, according to reports), BP -0.7%, TOT -0.6%, STO -0.5%.

Several FFIV/RDWR related names are under pressure: JNPR -5.6%, CTXS -3.6%, CSCO -3.3%, VMW -2.5%, RAX -2.3%, CRM -1.9%, XLNX -1%,

Other news: RIGL -29.6% (AstraZeneca reports top-line results from OSKIRA-1 Phase 3 study of Fostamatinib in Rheumatoid Arthritis, Rigel Pharma downgraded to Market Perform from Outperform at BMO Capital Mkts), SABA -12% (announced anticipated delisting from NASDAQ global select market; disclosed SEC investigation), ETP -3.5% (announces 12 mln common unit offering), SAP -2.5% and DEO -1.7% (still checking), BDN -1.1% (announces offering of 10 mln common shares), UL -0.9% (still checking), LVS -0.5% (Las Vegas Sands CEO Sheldon Adelson says Richard Suen did not help co get Macau license, according to reports).

Analyst comments: KMB -0.6% (downgraded to Underperform from Market Perform at BMO Capital)

Торговые идеи NYSEи NASDAQ:

NIHD– компания анонсировала продажу подразделение Nextel Peru за 400 млн долларов. Акции слабее рынка. Ключевые уровни – 4.50 и 5.00. Работаем исходя из цены открытия.

VLO – совет директоров одобрил Spin off CST Brands. Смотрим акцию в лонг выше 43.00. Ориентируемся на уровень 43.50.

CSCO – компания торгуется на премаркете ниже вчерашнего закрытия. Причина – реакция на conference call F5 Networks(FFIV). Выше 20.50 смотрим акцию в лонг с потенциалом в 50 центов. Другие компании отреагировавшие аналогично: JNPR(лонг выше 17.25, шорт ниже 17.00), CRM, CTXS, VMW.

ETP– дополнительное размещение 12 млн. акций. Ниже 48.00 смотрим акцию на шорт, выше 48.50 можно искать точку входа на лонг.

Оригинал статьи: http://shark-traders.com/blog/analitika-na-05-04/

16 |

Читайте на SMART-LAB:

Как заработать на росте цен на удобрения

Дарья Фёдорова Конфликт на Ближнем Востоке и перекрытие Ормузского пролива вызвали ралли не только цен на нефть и газ, но также алюминий и...

18:38

Как устроен бизнес ДОМ.PФ? Рассказываем в интервью

☝️ Говорим на сложные темы простым языком 🔵Как устроен бизнес ДОМ.PФ? 🔵Кто сегодня инвестирует в компанию? 🔵Что в планах на ближайшее...

14:19

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы