SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

mio-my-mio

Too Big To Fail и иже с ними...

- 13 июля 2012, 17:52

- |

В связи с последними событиями, высветившими, в очередной раз, несостоятельность регулирующих организаций и сам процесс регуляции,

хочу перепечатать, на добрую память, истерическую тираду из блога некоей Ann Barhardt, владеющей «Barnhardt Capital Management, Inc.»

Топик озаглавлен «Ninety Miles An Hour Down a Dead End Street». 12.07.2012

"

People are emailing asking what firm I recommend.

NONE.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

The ENTIRE SYSTEM is totally, completely corrupt and therefore NO FIRM IS SAFE. Don't be stupid. Don't be obtuse. Snap yourself out of the Stockholm Syndrome that you are clearly stuck in. Get ALL MONEY out of the ENTIRE FINANCIAL SYSTEM, including stocks, bonds, retirement accounts, futures, EVERYTHING.

But what about.. .

What part of EVERYTHING are you not comprehending?

One. More. Time.

If you can't touch it, if it isn't physically on your property such that you can stand in front of it with an assault rifle and PHYSICALLY defend it, you don't own it, and it could be confiscated/stolen from you at any time, if it ever actually existed at all.

( Читать дальше )

хочу перепечатать, на добрую память, истерическую тираду из блога некоей Ann Barhardt, владеющей «Barnhardt Capital Management, Inc.»

Топик озаглавлен «Ninety Miles An Hour Down a Dead End Street». 12.07.2012

"

People are emailing asking what firm I recommend.

NONE.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

GET OUT.

The ENTIRE SYSTEM is totally, completely corrupt and therefore NO FIRM IS SAFE. Don't be stupid. Don't be obtuse. Snap yourself out of the Stockholm Syndrome that you are clearly stuck in. Get ALL MONEY out of the ENTIRE FINANCIAL SYSTEM, including stocks, bonds, retirement accounts, futures, EVERYTHING.

But what about.. .

What part of EVERYTHING are you not comprehending?

One. More. Time.

If you can't touch it, if it isn't physically on your property such that you can stand in front of it with an assault rifle and PHYSICALLY defend it, you don't own it, and it could be confiscated/stolen from you at any time, if it ever actually existed at all.

( Читать дальше )

This Is Only Money: Ларри Вильямс и 6 фигур в PFG

- 11 июля 2012, 17:03

- |

«By now you probably know all that I do about the PFG fiasco; but if not, here is the latest official lack of any real information, information:

http://www.nfa.futures.org/NFA-investor-information/PFG.HTML

Like many of you I am in same boat, Louise and I had two 6 figure accounts that have been liquidated and locked up. So what are we going to do?

I have hired a lawyer to see if we can sue the NFA for gross negligence in their monitoring of PFG. Ironically, PFG was found guilty for not responding „to obvious red flags“ regarding the Ponzi scheme that traded at the firm. Seems the same logic should apply to NFA; the $200,000,000 has been missing for 2 to 3 years.

We shall see and as my lawyer updates, I will advise you.

Next… we see no other choice---for now---than to take our lumps and await the outcomes from the bumbling regulators. Fretting, losing sleep and emails about it are not productive. Moving forward, after regrouping our thoughts, is the best plan of action. Things could be far worse; this is only money. It is not your health or a loved one dying. What you did once, you can do again.

We will open a new account at a new firm but have not made any choices at this time.

Larry

PS I appreciated all the emails today, but for now please hold them back unless you have breaking news. When the dust settles, I will send another update.»

http://www.nfa.futures.org/NFA-investor-information/PFG.HTML

Like many of you I am in same boat, Louise and I had two 6 figure accounts that have been liquidated and locked up. So what are we going to do?

I have hired a lawyer to see if we can sue the NFA for gross negligence in their monitoring of PFG. Ironically, PFG was found guilty for not responding „to obvious red flags“ regarding the Ponzi scheme that traded at the firm. Seems the same logic should apply to NFA; the $200,000,000 has been missing for 2 to 3 years.

We shall see and as my lawyer updates, I will advise you.

Next… we see no other choice---for now---than to take our lumps and await the outcomes from the bumbling regulators. Fretting, losing sleep and emails about it are not productive. Moving forward, after regrouping our thoughts, is the best plan of action. Things could be far worse; this is only money. It is not your health or a loved one dying. What you did once, you can do again.

We will open a new account at a new firm but have not made any choices at this time.

Larry

PS I appreciated all the emails today, but for now please hold them back unless you have breaking news. When the dust settles, I will send another update.»

Beware of Greeks Bearing Bonds

- 28 сентября 2011, 09:07

- |

Накануне разрешения греческих проблем, в ту или иную сторону, предлагаю перечитать статью с указанным заголовком, опубликованную в журнале Vanity Fair целый год назад, 01.10.2010!

Лично я, укрепил своё мнение, что навести европейский порядок среди средиземноморской вакханалии абсолютно нереально.

А вы?

Источник(рекомендую именно его): http://www.vanityfair.com/business/features/2010/10/greeks-bearing-bonds-201010

Один из переводов: http://www.snob.ru/profile/9972/blog/29210?commentId=260880

Лично я, укрепил своё мнение, что навести европейский порядок среди средиземноморской вакханалии абсолютно нереально.

А вы?

Источник(рекомендую именно его): http://www.vanityfair.com/business/features/2010/10/greeks-bearing-bonds-201010

Один из переводов: http://www.snob.ru/profile/9972/blog/29210?commentId=260880

So... What About Those Next 20 Days?

- 23 сентября 2011, 11:00

- |

This is what happens when the market prices in $1+ trillion in loose money from the Chairman, and gets a sharp stick in the eye instead.

This is what happens when the market prices in $1+ trillion in loose money from the Chairman, and gets a sharp stick in the eye instead.The VWAP algo attractor comes through in the clutch:

Curve inversion has begun:

Stocks plunge, commodities collapse, Morgan Stanley refutes facts presented by a fringe blog, gold and precious metals are liquidated as margin calls explode, dollar soars as every bank in Europe scrambles to get its hands on every Benjamin it can get, Treasurys surge to never before seen prices even as CDS of the underlying countries soars, and the DJIA posts the third biggest weekly drop in history (and the week is not even over yet)...

...And beneath it is all is the creeping realization that the Fed's most recent global bailout action with the ECB, the SNB, the BOJ and the BOE does not start for another 20 days, or October 12, 2011. That's right: three weeks in which there is nothing in place to provide the much critical trillions of dollar that every bank in the world so desperately needs. We wish Europe all the best in pretending for 20 days that it can survive on its own, even as Greece is about to become the riotcam's favorite destination once again.

( Читать дальше )

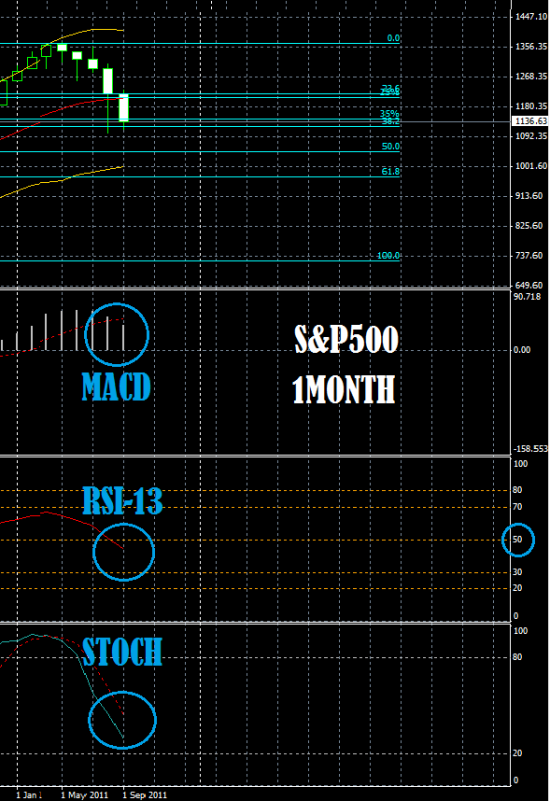

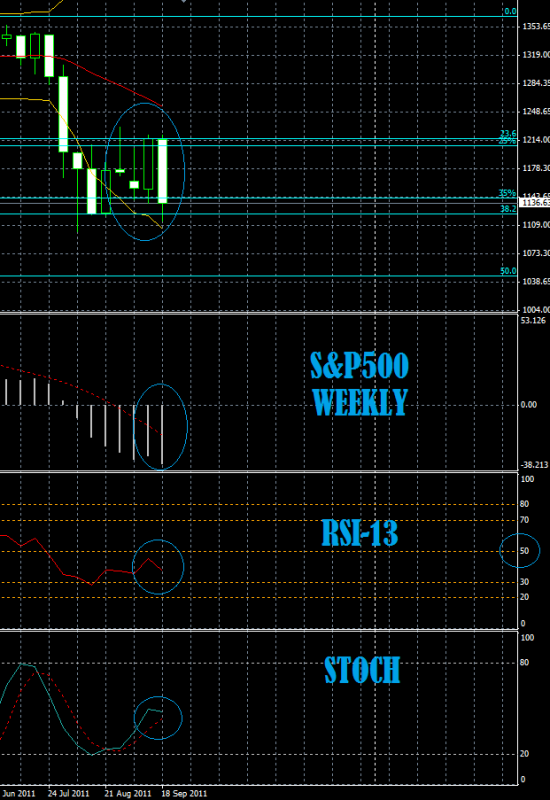

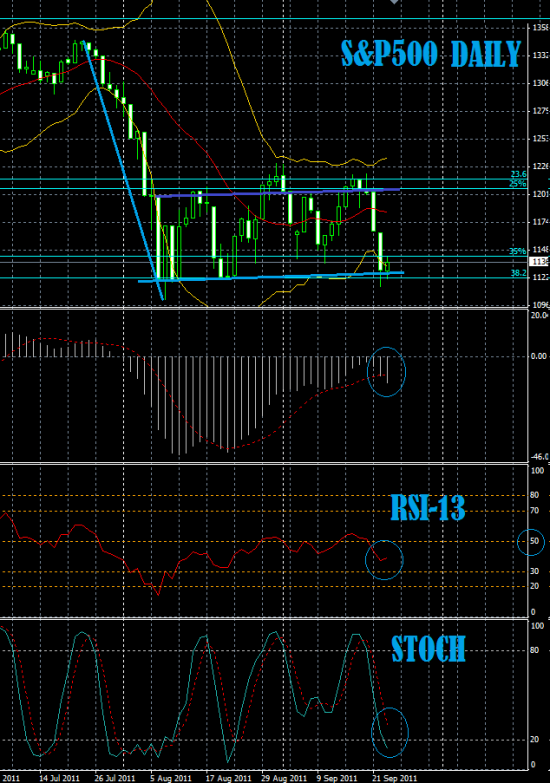

Как, самым эффективным образом, можно торговать подобные апокалиптические сценарии?

- 22 сентября 2011, 21:37

- |

Только при помощи опционных стратегий.

Только графики, примитивный анализ price-action, без заумных индикаторов.

И никаких стандартных новостных сайтов.

И вообще, новости необходимо черпать из Источника, а не ожидать их корявого перевода.

Обратите внимание, на «новую» тенденцию.

Валится АБСОЛЮТНО всё, и нефть и золото, и иные коммоды.

Есть мнение о репатриации американского Капитала домой, со всех площадок, преимущественно из Европы.

QE3 было невозможно осуществить ранее марта-апреля 2012 года, из-за опасений инфляционного всплеска, который мог бы свести «на нет» весь эффект QE3, и не дотянуть до выборов 2012.

Более того, мощный SellOff позволяет FED осуществлять аукционы по размещению новых treasuries, по абсолютно смехотворным ставкам.

Кто же будет рубить под собой сук, сейчас?

Только графики, примитивный анализ price-action, без заумных индикаторов.

И никаких стандартных новостных сайтов.

И вообще, новости необходимо черпать из Источника, а не ожидать их корявого перевода.

Обратите внимание, на «новую» тенденцию.

Валится АБСОЛЮТНО всё, и нефть и золото, и иные коммоды.

Есть мнение о репатриации американского Капитала домой, со всех площадок, преимущественно из Европы.

QE3 было невозможно осуществить ранее марта-апреля 2012 года, из-за опасений инфляционного всплеска, который мог бы свести «на нет» весь эффект QE3, и не дотянуть до выборов 2012.

Более того, мощный SellOff позволяет FED осуществлять аукционы по размещению новых treasuries, по абсолютно смехотворным ставкам.

Кто же будет рубить под собой сук, сейчас?

Buckle Up... Because It's Game Over For the Fed

- 22 сентября 2011, 21:23

- |

«The Fed is done. Finished. Kaput. It literally has nothing left in its arsenal save a massive QE plan. And that will only come if there’s systemic collapse or a major bank goes under (announcing a massive QE program without catastrophe will insure that everyone, including Congress turns against the Fed in a major way).

We’ve had ZIRP, we had QE 1, we had QE lite and QE 2. We now have the Fed trying to lower long-term interest rates… at a time when Treasuries are trading at all time highs.

This is akin to buying Tech stocks in late 2000 or buying Housing stocks in late 2007. The US debt market is officially in a bubble… and the Fed wants to spend $400 billion trying to make it bigger.

This will end the way all bubbles end: with a BANG. Only this time around the BANG will involve the US, the largest economy in the world, defaulting on its debts.

Bernanke will be the one they pin this on. He and possibly even the Fed itself are finished. Bernanke willfor certain be stepping down within 12 months. Whether or not the Fed is dissolved depends on how much the politicians try to pin everything on the Fed.

Remember, only one thing kept us back from the abyss in 2008. That was the Fed. The Fed is now out of ammo for this round of the Crisis. Indeed, one could easily argue that the Fed itself is insolvent: with $50 billion in capital and $2.8 trillion in assets, the Fed is leveraged at 56 to 1. Lehman Brothers was leveraged at 30 to 1 when it went bust.

Again, the Fed is finished. The primary backstop for stocks and the financial system in general is gone. We’ve already wiped out one year’s worth of gains in a matter of weeks. And this is just the beginning. The markets are realizing that it’s Game. Set. Match for Central Bank intervention.

What’s coming will see stock market Crashes, sovereign defaults, bank holidays and bank runs, civil unrest, and more. This mess is going to make 2008 look like a picnic.»

We’ve had ZIRP, we had QE 1, we had QE lite and QE 2. We now have the Fed trying to lower long-term interest rates… at a time when Treasuries are trading at all time highs.

This is akin to buying Tech stocks in late 2000 or buying Housing stocks in late 2007. The US debt market is officially in a bubble… and the Fed wants to spend $400 billion trying to make it bigger.

This will end the way all bubbles end: with a BANG. Only this time around the BANG will involve the US, the largest economy in the world, defaulting on its debts.

Bernanke will be the one they pin this on. He and possibly even the Fed itself are finished. Bernanke willfor certain be stepping down within 12 months. Whether or not the Fed is dissolved depends on how much the politicians try to pin everything on the Fed.

Remember, only one thing kept us back from the abyss in 2008. That was the Fed. The Fed is now out of ammo for this round of the Crisis. Indeed, one could easily argue that the Fed itself is insolvent: with $50 billion in capital and $2.8 trillion in assets, the Fed is leveraged at 56 to 1. Lehman Brothers was leveraged at 30 to 1 when it went bust.

Again, the Fed is finished. The primary backstop for stocks and the financial system in general is gone. We’ve already wiped out one year’s worth of gains in a matter of weeks. And this is just the beginning. The markets are realizing that it’s Game. Set. Match for Central Bank intervention.

What’s coming will see stock market Crashes, sovereign defaults, bank holidays and bank runs, civil unrest, and more. This mess is going to make 2008 look like a picnic.»