SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

QCAP

Успешная торговля похожа на беременность. Все поздравляют тебя с этим, но никто не спрашивает, сколько раз ты был трахнут.)

- 18 февраля 2019, 16:10

- |

Успешная торговля похожа на беременность. Все поздравляют тебя с этим, но никто не спрашивает, сколько раз ты был трахнут.)

- комментировать

- 5.8К | ★9

- Комментарии ( 29 )

Я обожаю пить. Пьянство сформировало мой характер. Джон Лефевр (John LeFevre)

- 17 февраля 2019, 17:27

- |

Я обожаю пить. Пьянство сформировало мой характер. Можно сказать, сделало меня профессионалом. Я даже написал об этом бестселлер.

Я вдребезги разбил новенькую «мазерати». Меня выкинули из отеля «Времена года», где я прожил полгода. Меня регулярно ссаживали с рейсов. Я просыпался в больницах, в чужих квартирах и даже чужих странах. Запустил вазой для фруктов в управляющего хеджевого фонда. Подрался с Уэйном Руни. И меня замели в Сингапуре с пакетом кокса в кармане. Но я и в ус не дул, гнул свое и извиняться не собирался.

Пить я пристрастился в школе-интернате

( Читать дальше )

FOMC Interest Rate Decision

- 19 декабря 2018, 22:02

- |

FOMC RAISES TARGET RANGE BY 25BPS TO 2.25-2.50%; AS EXPECTED — Raises IOER from 2.20% to 2.40%

10 МИНУТ до FOMC Interest Rate Decision expected at 14:00 ET (19:00 GMT) - 22:00 MSK

- 19 декабря 2018, 21:48

- |

Despite vociferous criticism from President Trump and some quarters of Wall Street, the FOMC is still expected to announce another 25 bps rate hike today, bringing the target range to 2.25-2.50%. Rising concerns about global growth in 2019 are expected to curtail the Fed’s ambitions for rate hikes next year, however, resulting in a ‘dovish hike’ today. Economic activity is still strong enough to justify a rate hike and the Fed needs to demonstrate its independence in the face of political pressure, but the central bank will make substantive changes to its statement today to show that rates are now near neutral and the future has gotten more uncertain in the face of changing sentiment around tariffs and global growth.

To reflect more caution about additional rate hikes, the policy statement is expected to remove the language on “further gradual increases” today. The November FOMC minutes also indicated that members are contemplating a new guidance statement that conveys the committee is becoming more “data dependent” in determining the policy outlook. That revision could come today or might be a work in progress to be announced at a future meeting. The statement will likely continue to say that risks to the economic outlook are “roughly balanced”, but some of the recent injection of uncertainty may be reflected in the commentary about the current economic environment.

Assuming the 25 bps hike in the key rate, the Fed is also expected to raise the IOER by only 20 bps, which would be the second 5 bps tweak after a similar one in June. That would take the IOER to 2.40%, leaving a 10 bps cushion under the top of the new Fed funds target range.

There has been some speculation that the Fed could consider slowing “quantitative tightening” by slowing the rate it is reducing its balance sheet. Bond maven Jeffrey Gundlach has noted that the amount of quantitative tightening undertaken to date is equivalent to another 50 bps of rate tightening. It doesn’t seem likely that the Fed would go to this extreme today, given that it’s stated goal for the balance sheet unwind to “operate in the background,” but it could be a future consideration if the Fed finds it needs more firepower.

The other outlying theory is that the Fed could keep rates on hold today. The arguments against this are that markets could take it as a signal the Fed sees dark clouds ahead and it would weaken the Fed's independence over the appearance of giving in to pressure from politicians. A dovish dissenting vote could give some solace to the 'no more hikes' theorists, but the Committee has been voting unanimously all year.

Updated SEP and Dot Plot In support of a ‘dovish hike’ today, the updated Summary of Economic Projections could trim growth expectations for next year. Inflation projections for 2019 may be tweaked lower too, reflecting the recent drop in oil prices.

The Dot Plot could be a primary tool for conveying a more dovish tone. The last update forecast 3 rate hikes in 2019, so it is expected that the Fed dots will trim that back to 2 hikes. That would bring the Fed forecast into better alignment with Fed funds futures – which are not fully pricing in even 1 hike for 2019 – while still showing more tightening could occur next year if the economy stays on track.

Chair Powell’s Press Conference Assuming there is a ‘dovish hike’ today, Powell will have to use the press conference to explain his rapid dovish turn. After declaring in October that we are a long way from ‘neutral’ and rates may go past 'neutral', just over a month later Powell said that rates are “just below the broad range of estimates of the level that would be neutral for the economy.

Powell will be working to wean the market off of forward guidance, while expressing some uncertainty about the future and creating flexibility for rate policy in 2019. Ultimately that means emphasizing that the Fed is going to be “data dependent” now that rates are in the vicinity of the ‘neutral’ range. The fact that the Fed Chair will hold a press conference after every FOMC meeting going forward will contribute to that policy flexibility, making it clear that every meeting is ‘live’ for meaningful policy changes. Powell is bound to be asked again about the yield curve flattening. Though he has indicated previously that he is not deeply concerned about this potential recession signal, he may be willing to say today that the Fed is monitoring the yield curve more closely given other uncertainties.

To reflect more caution about additional rate hikes, the policy statement is expected to remove the language on “further gradual increases” today. The November FOMC minutes also indicated that members are contemplating a new guidance statement that conveys the committee is becoming more “data dependent” in determining the policy outlook. That revision could come today or might be a work in progress to be announced at a future meeting. The statement will likely continue to say that risks to the economic outlook are “roughly balanced”, but some of the recent injection of uncertainty may be reflected in the commentary about the current economic environment.

Assuming the 25 bps hike in the key rate, the Fed is also expected to raise the IOER by only 20 bps, which would be the second 5 bps tweak after a similar one in June. That would take the IOER to 2.40%, leaving a 10 bps cushion under the top of the new Fed funds target range.

There has been some speculation that the Fed could consider slowing “quantitative tightening” by slowing the rate it is reducing its balance sheet. Bond maven Jeffrey Gundlach has noted that the amount of quantitative tightening undertaken to date is equivalent to another 50 bps of rate tightening. It doesn’t seem likely that the Fed would go to this extreme today, given that it’s stated goal for the balance sheet unwind to “operate in the background,” but it could be a future consideration if the Fed finds it needs more firepower.

The other outlying theory is that the Fed could keep rates on hold today. The arguments against this are that markets could take it as a signal the Fed sees dark clouds ahead and it would weaken the Fed's independence over the appearance of giving in to pressure from politicians. A dovish dissenting vote could give some solace to the 'no more hikes' theorists, but the Committee has been voting unanimously all year.

Updated SEP and Dot Plot In support of a ‘dovish hike’ today, the updated Summary of Economic Projections could trim growth expectations for next year. Inflation projections for 2019 may be tweaked lower too, reflecting the recent drop in oil prices.

The Dot Plot could be a primary tool for conveying a more dovish tone. The last update forecast 3 rate hikes in 2019, so it is expected that the Fed dots will trim that back to 2 hikes. That would bring the Fed forecast into better alignment with Fed funds futures – which are not fully pricing in even 1 hike for 2019 – while still showing more tightening could occur next year if the economy stays on track.

Chair Powell’s Press Conference Assuming there is a ‘dovish hike’ today, Powell will have to use the press conference to explain his rapid dovish turn. After declaring in October that we are a long way from ‘neutral’ and rates may go past 'neutral', just over a month later Powell said that rates are “just below the broad range of estimates of the level that would be neutral for the economy.

Powell will be working to wean the market off of forward guidance, while expressing some uncertainty about the future and creating flexibility for rate policy in 2019. Ultimately that means emphasizing that the Fed is going to be “data dependent” now that rates are in the vicinity of the ‘neutral’ range. The fact that the Fed Chair will hold a press conference after every FOMC meeting going forward will contribute to that policy flexibility, making it clear that every meeting is ‘live’ for meaningful policy changes. Powell is bound to be asked again about the yield curve flattening. Though he has indicated previously that he is not deeply concerned about this potential recession signal, he may be willing to say today that the Fed is monitoring the yield curve more closely given other uncertainties.

Трамр твитнул обращение к FED - Интересно послушают ли его?

- 18 декабря 2018, 15:25

- |

I hope the people over at the Fed will read today’s Wall Street Journal Editorial before they make yet another mistake. Also, don’t let the market become any more illiquid than it already is. Stop with the 50 B’s. Feel the market, don’t just go by meaningless numbers. Good luck!

twitter.com/realDonaldTrump/status/1075001077576151041

Преревод гугла:

Я надеюсь, что люди из Федерального резерва прочитают сегодняшнюю редакцию Wall Street Journal перед тем, как совершить еще одну ошибку. Кроме того, не позволяйте рынку стать более неликвидным, чем он есть. Остановитесь с 50 B. Почувствуй рынок, не ходи по бессмысленным цифрам. Удачи!

twitter.com/realDonaldTrump/status/1075001077576151041

Преревод гугла:

Я надеюсь, что люди из Федерального резерва прочитают сегодняшнюю редакцию Wall Street Journal перед тем, как совершить еще одну ошибку. Кроме того, не позволяйте рынку стать более неликвидным, чем он есть. Остановитесь с 50 B. Почувствуй рынок, не ходи по бессмысленным цифрам. Удачи!

Торги акциями в США будут остановлены. 5 декабря 2018г

- 03 декабря 2018, 17:07

- |

The NYSE, NASDAQ, NYSE American, NYSE National, NYSE Arca, and the Chicago Stock Exchange will be closed on Wednesday, December 5, 2018 in observance of the National Day of Mourning for President George H. W. Bush

CME Update:

CME Group today announced that it will observe the passing of President George H. W. Bush with a moment of silence at 7:18 a.m. Central Time on Monday, Dec. 3, 2018, and closure of its U.S.-based equity and interest rate futures and options products on Wednesday, Dec. 5, 2018, the national day of mourning.

All other markets on CME Globex, CME ClearPort and the trading floor will remain open for regular trading hours on Dec. 5.

investor.cmegroup.com/news-releases/news-release-details/cme-group-us-equity-interest-rate-markets-close-national-day

CME Update:

CME Group today announced that it will observe the passing of President George H. W. Bush with a moment of silence at 7:18 a.m. Central Time on Monday, Dec. 3, 2018, and closure of its U.S.-based equity and interest rate futures and options products on Wednesday, Dec. 5, 2018, the national day of mourning.

All other markets on CME Globex, CME ClearPort and the trading floor will remain open for regular trading hours on Dec. 5.

investor.cmegroup.com/news-releases/news-release-details/cme-group-us-equity-interest-rate-markets-close-national-day

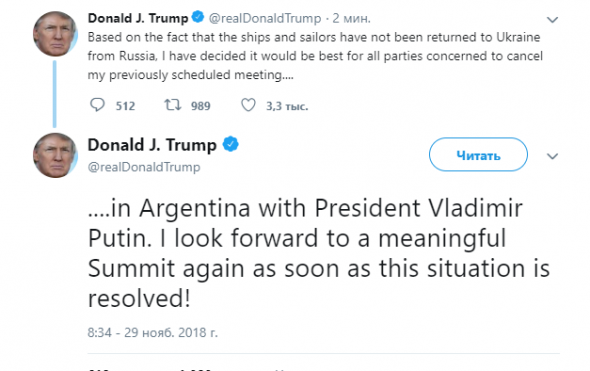

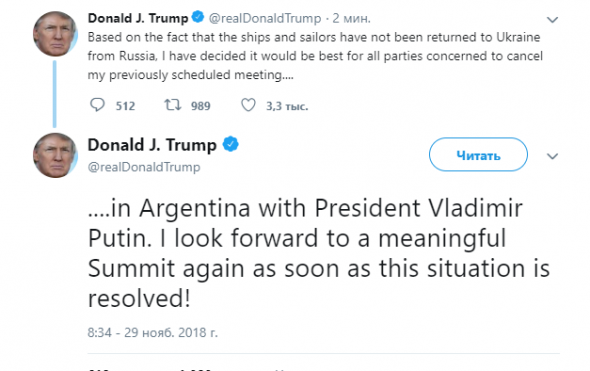

Трамп отменил встречу с Путиным

- 29 ноября 2018, 19:37

- |

Based on the fact that the ships and sailors have not been returned to Ukraine from Russia, I have decided it would be best for all parties concerned to cancel my previously scheduled meeting....

twitter.com/realDonaldTrump/status/1068181371883909121

Перевод Гугла: Исходя из того, что корабли и моряки не были возвращены в Украину из России, я решил, что было бы лучше, если бы все заинтересованные стороны отменили мою ранее запланированную встречу ....

twitter.com/realDonaldTrump/status/1068181371883909121

Перевод Гугла: Исходя из того, что корабли и моряки не были возвращены в Украину из России, я решил, что было бы лучше, если бы все заинтересованные стороны отменили мою ранее запланированную встречу ....

FOMC Meeting Minutes - через 15 мин.

- 17 октября 2018, 20:44

- |

(US) Preview: FOMC Meeting Minutes expected at 14:00 ET (21:00 MSK)

At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%.

The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020.

The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate.

An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive').

The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility)

At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%.

The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020.

The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate.

An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive').

The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility)

Коментарии Трампа по рынку

- 11 октября 2018, 00:34

- |

(US) Pres Trump: I think the Fed has «gone crazy» and is too tight; the Fed is making a mistake — Market selloff is a correction that we've been waiting for, for a long time**

NOTE: 10/09 (US) President Trump: Reiterates view that doesn't like what the Fed is doing; I think we don't have to go as fast on rates-

NOTE: 10/09 (US) President Trump: Reiterates view that doesn't like what the Fed is doing; I think we don't have to go as fast on rates-

теги блога QCAP

- 6e

- ADR

- Alcoa

- AMEX

- Brexit

- CFTC

- Cftc cot

- CL

- CME

- COVID-19

- Crude Oil Light Sweet

- DJIA

- ECB LTRO Bank loans

- ES E-mini

- ES futures

- Es mini

- FED

- fed reserve

- FOMC Meeting Minutes

- FOMC rates

- futures

- GDR

- Interactive Brokers

- MOEX

- NASDAQ

- NYSE

- Ozon

- Putin

- RSX

- RTS

- RTS si

- Russel 2000

- S&P500

- S&P500 фьючерс

- stock

- TD Ameritrade

- trump

- TSLA

- US stocks

- USA

- USDRUB

- WTI

- WTI - CL

- Алкоголь

- аналитика

- банки

- биржа

- брокеры

- Игры в интернете

- корея

- коронавирус

- коронавирус борьба

- криптобиржа

- криптовалюта

- Нефть

- опрос

- оффтоп

- Путин

- рейтиги

- Россия

- русал

- рынок США

- Страх

- торговля

- торговые сигналы

- Трамп

- трейдинг

- Украина

- физика фондового рынка

- фьючерс ртс

- фьючесы