Блог им. QCAP |Биржа - CME вводит микро контракты на S&P500, Nasdaq, RUSSEL 2000 и DJIA.!

- 11 марта 2019, 16:49

- |

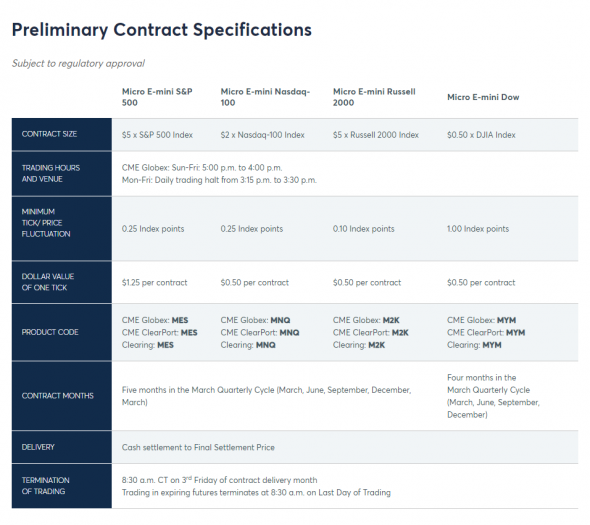

Микро контракты будут доступны для торговли в мае 2019 года.

Подробнее читайте на сайте биржи: https://www.cmegroup.com/cme-group-futures-exchange/micro-futures.html

youtu.be/eze9siYGDwM

- комментировать

- ★3

- Комментарии ( 18 )

Блог им. QCAP |Market Close Summary: Stocks regain some losses

- 05 марта 2019, 00:59

- |

US stocks ended the day off their lows, but saw a sharp drop from opening levels as the glow from the news of a potential trade deal between the US and China wore off. Most sectors ended in the red, with healthcare lagging and materials over performing. The Dollar firmed up, led by gains against the Euro, while rates weakened amid the market selloff as the 2/10-year spread narrowed slightly. Gold prices continued to retreat, falling nearly another 1%. WTI crude ended the session higher, helped by jawboning from Russia Energy Minister Novak.

Markets:

— Dow Jones -0.8%

— S&P500 -0.4%

— Nasdaq -0.2%

— Russell 2000 -0.9%

Блог им. QCAP |Previews and Perspectives for Monday, March 4

- 04 марта 2019, 07:40

- |

Weekly global market focus — The U.S. markets this week will focus on (1) any developments on the US/Chinese trade talks as reports continue that a final deal is not yet done but that a possible Trump-Xi summit is still being planned for later in March, (2) Friday's U.S. unemployment report which is expected to show a trend +185,000 increase in payrolls and a -0.1 point decline in the unemployment rate to 3.9% (i.e., 0.2 points above Sep's 49-year low of 3.7%), (3) Fedspeak with appearances by four Fed officials this week, and (4) and the tail end of Q4 earnings season with 10 of the S&P 500 companies reporting this week.

The dollar may see some weakness today after President Trump on Saturday again tried to talk the dollar down and launched new criticism of Fed Chair Powell. In his speech to the Conservative Party Action Conference (CPAC), Mr. Trump said that the dollar is too strong and that Fed Chair Powell «likes raising interest rates, „loves quantitative tightening,“ and „likes a very strong dollar.“

Washington politics will grab market attention again this week. There were reports two weeks ago that the Mueller report would be delivered to Attorney General Barr last week. The Justice Department denied those reports and the report in fact was not released last week. However, there is a possibility that the report could be released as soon as this week if the delivery of the report was delayed only because the Justice Department did not want to conflict with President Trump's summit overseas last week with North Korean leader Kim Jong Un. Under current rules, the Mueller report will be delivered privately to Attorney General Barr and Mr. Barr will then take whatever time he wishes to write a summary report to send to Congress. Mr. Barr can also determine exactly what information he will disclose about the investigation to the public.

( Читать дальше )

Блог им. QCAP |Трамр твитнул обращение к FED - Интересно послушают ли его?

- 18 декабря 2018, 15:25

- |

twitter.com/realDonaldTrump/status/1075001077576151041

Преревод гугла:

Я надеюсь, что люди из Федерального резерва прочитают сегодняшнюю редакцию Wall Street Journal перед тем, как совершить еще одну ошибку. Кроме того, не позволяйте рынку стать более неликвидным, чем он есть. Остановитесь с 50 B. Почувствуй рынок, не ходи по бессмысленным цифрам. Удачи!

Блог им. QCAP |FOMC Meeting Minutes - через 15 мин.

- 17 октября 2018, 20:44

- |

At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%.

The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020.

The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate.

An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive').

The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility)

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс