QCAP

MORNING NEWS - FINANCIALS, METALS AND ENERGY - 6:15 EST

- 11 марта 2019, 14:56

- |

Июньские фьючерсы на акции E-mini сегодня утром выросли на +2,25 пункта (+ 0,08%), а европейские акции выросли на + 0,18%.

Рост цен на технологические акции, вызванный 2-процентным ростом Apple на премаркет торговле, ведет к росту рынка в целом после того, как Merrill Lynch из Bank of America повысил рейтинг Apple до «Buy».

Активность слияний и поглощений также стимулирует весь рынок после того, как Nvidia согласилась купить Mellanox Technologies Ltd за 6,9 млрд долларов.

Кроме того, энергетические запасы растут, поскольку апрельская нефть марки WTI выросла на 0,73%. Сырая нефть растет из-за опасений по поводу поставок после сообщения о том, что Саудовская Аравия будет поставлять нефтеперерабатывающим предприятиям менее 7 млн баррелей в сутки в апреле, что ниже запросов нефтеперерабатывающих предприятий на 7,6 млн баррелей в сутки.

Ограничением роста акций США является падение Boeing на 9% на предпродажных торгах после того, как Китай и Индонезия посадили все внутренние самолеты Boeing 737 Max после воскресного крушения 737 Max в Эфиопии.

( Читать дальше )

- комментировать

- 263

- Комментарии ( 0 )

MARKET RECAP - FINANCIALS, METALS & ENERGY

- 09 марта 2019, 02:05

- |

Regards

Dmitry

U.S. Feb non-farm payrolls rose +20,000, weaker than expectations of +180,000 and the smallest increase in 17 months. The Feb unemployment rate fell -0.2 to 3.8%, stronger than expectations of -0.1 to 3.9%.

U.S. Feb avg hourly earnings rose +0.4% m/m and +3.4% y/y, stronger than expectations of +0.3% m/m and +3.3% y/y with the +3.4% y/y gain the largest year-on-year increase in 10 years.

U.S. Jan housing starts rose +18.6% to 1.230 million, stronger than expectations of +10.9% to 1.195 million. Jan building permits unexpectedly rose +1.4% to 1.345 million, stronger than expectations of -2.9% to 1.287 million

Market closes

Stock Market — The S&P 500 on Friday dropped to a 3-1/2 week low and closed lower: S&P 500 -0.21%, Dow Jones -0.09%, Nasdaq 100 -0.16%. Bearish factors included (1) global growth concerns after China Feb exports fell -20.7% y/y, weaker than expectations of -5.0% y/y and the biggest decline in 3 years, and (2) the +20,000 increase in U.S. Feb non-farm payrolls, weaker than expectations of +180,000 and the smallest increase in 17 months.

Interest Rates — Jun 10-year T-notes on Friday jumped to a 2-month high and closed higher: TYH9 +3.50, FVH9 +1.75. Bullish factors included (1) the +20,00 increase in U.S. Feb non-farm payrolls, weaker than expectations of +180,000, which may keep the Fed from additional rate hikes, and (3) the decline in the S&P 500 to a 3-1/2 week low, which boosted the safe-haven demand for T-notes. T-notes fell back from their best levels after U.S. Feb avg hourly earnings rose +3.4% y/y, stronger than expectations of +3.3% y/y and the largest year-on-year increase in 10 years.

( Читать дальше )

ECB Monetary policy decisions

- 07 марта 2019, 15:52

- |

At today’s meeting the Governing Council of the European Central Bank (ECB) took the following monetary policy decisions:

(1) The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council now expects the key ECB interest rates to remain at their present levels at least through the end of 2019, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term.

(2) The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

(3) A new series of quarterly targeted longer-term refinancing operations (TLTRO-III) will be launched, starting in September 2019 and ending in March 2021, each with a maturity of two years. These new operations will help to preserve favourable bank lending conditions and the smooth transmission of monetary policy. Under TLTRO-III, counterparties will be entitled to borrow up to 30% of the stock of eligible loans as at 28 February 2019 at a rate indexed to the interest rate on the main refinancing operations over the life of each operation. Like the outstanding TLTRO programme, TLTRO-III will feature built-in incentives for credit conditions to remain favourable. Further details on the precise terms of TLTRO-III will be communicated in due course.

(4) The Eurosystem’s lending operations will continue to be conducted as fixed rate tender procedures with full allotment for as long as necessary, and at least until the end of the reserve maintenance period starting in March 2021.

Market Close Summary: Stocks regain some losses

- 05 марта 2019, 00:59

- |

US stocks ended the day off their lows, but saw a sharp drop from opening levels as the glow from the news of a potential trade deal between the US and China wore off. Most sectors ended in the red, with healthcare lagging and materials over performing. The Dollar firmed up, led by gains against the Euro, while rates weakened amid the market selloff as the 2/10-year spread narrowed slightly. Gold prices continued to retreat, falling nearly another 1%. WTI crude ended the session higher, helped by jawboning from Russia Energy Minister Novak.

Markets:

— Dow Jones -0.8%

— S&P500 -0.4%

— Nasdaq -0.2%

— Russell 2000 -0.9%

Previews and Perspectives for Monday, March 4

- 04 марта 2019, 07:40

- |

Weekly global market focus — The U.S. markets this week will focus on (1) any developments on the US/Chinese trade talks as reports continue that a final deal is not yet done but that a possible Trump-Xi summit is still being planned for later in March, (2) Friday's U.S. unemployment report which is expected to show a trend +185,000 increase in payrolls and a -0.1 point decline in the unemployment rate to 3.9% (i.e., 0.2 points above Sep's 49-year low of 3.7%), (3) Fedspeak with appearances by four Fed officials this week, and (4) and the tail end of Q4 earnings season with 10 of the S&P 500 companies reporting this week.

The dollar may see some weakness today after President Trump on Saturday again tried to talk the dollar down and launched new criticism of Fed Chair Powell. In his speech to the Conservative Party Action Conference (CPAC), Mr. Trump said that the dollar is too strong and that Fed Chair Powell «likes raising interest rates, „loves quantitative tightening,“ and „likes a very strong dollar.“

Washington politics will grab market attention again this week. There were reports two weeks ago that the Mueller report would be delivered to Attorney General Barr last week. The Justice Department denied those reports and the report in fact was not released last week. However, there is a possibility that the report could be released as soon as this week if the delivery of the report was delayed only because the Justice Department did not want to conflict with President Trump's summit overseas last week with North Korean leader Kim Jong Un. Under current rules, the Mueller report will be delivered privately to Attorney General Barr and Mr. Barr will then take whatever time he wishes to write a summary report to send to Congress. Mr. Barr can also determine exactly what information he will disclose about the investigation to the public.

( Читать дальше )

MARKET RECAP - FINANCIALS, METALS & ENERGY

- 02 марта 2019, 02:31

- |

The U.S. Feb ISM manufacturing index fell -2.4 to 54.2, weaker than expectations of -0.8 to 55.8 and the slowest pace of expansion in 2-1/4 years. The Feb ISM prices paid unexpectedly fell -0.2 to 49.4, weaker than expectations of +2.2 to 51.8 and the steepest pace of contraction in 3 years.

The University of Michigan U.S. Feb consumer sentiment unexpectedly fell -1.7 to 93.8, weaker than expectations of +0.4 to 95.9.

Market closes

Stock Market --The S&P 500 on Friday closed higher: S&P 500 +0.69%, Dow Jones +0.43%, Nasdaq 100 +0.77%. Bullish factors included (1) carry-over support from a sharp rally in Chinese stocks after the China Feb Caixin manufacturing PMI rose +1.6 to 49.8, stronger than expectations of +0.2 to 48.5, and (2) optimism that China and the U.S. were close to signing a new trade accord after a report said U.S. officials are preparing a final trade deal that U.S. President Trump and Chinese President Xi Jinping could sign in weeks. A bearish factor was the -2.4 point fall in the U.S. Feb ISM manufacturing index to 54.2, weaker than expectations of -0.8 to 55.8 and the slowest pace of expansion in 2-1/4 years.

Interest Rates — Jun 10-year T-notes on Friday tumbled to a 1-month low and closed lower: TYH9 -11.50, FVH9 -7.75. Bearish factors included (1) the rally in global stock markets on optimism the U.S. and China were close to a trade deal, which curbed safe-haven demand for T-notes, and (2) increased inflation expectations after the 10-year T-note breakeven inflation rate rose to a 2-3/4 month high.

( Читать дальше )

теги блога QCAP

- 6e

- ADR

- Alcoa

- AMEX

- Brexit

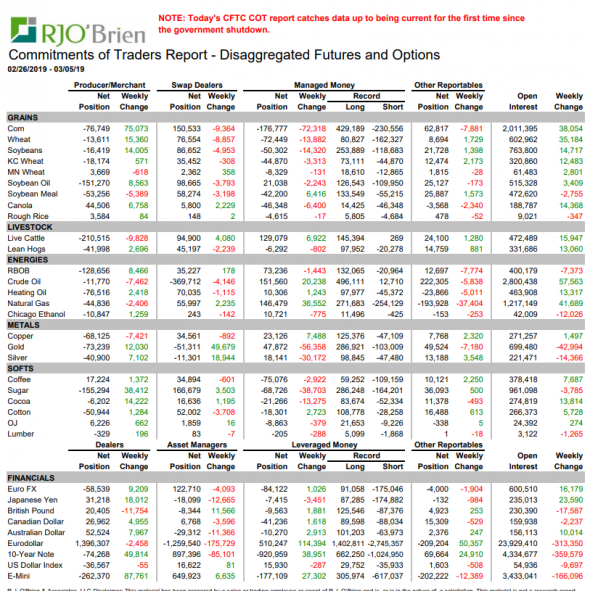

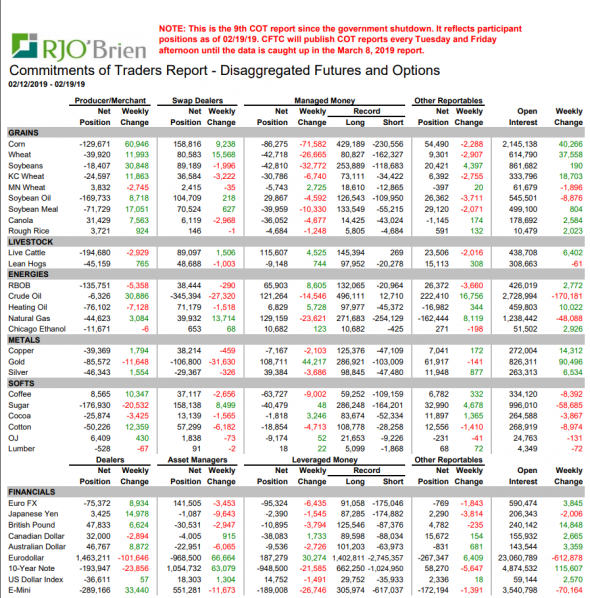

- CFTC

- Cftc cot

- CL

- CME

- COVID-19

- Crude Oil Light Sweet

- DJIA

- ECB LTRO Bank loans

- ES E-mini

- ES futures

- Es mini

- FED

- fed reserve

- FOMC Meeting Minutes

- FOMC rates

- futures

- GDR

- Interactive Brokers

- MOEX

- NASDAQ

- NYSE

- Ozon

- Putin

- RSX

- RTS

- RTS si

- Russel 2000

- S&P500

- S&P500 фьючерс

- stock

- TD Ameritrade

- trump

- TSLA

- US stocks

- USA

- USDRUB

- WTI

- WTI - CL

- Алкоголь

- аналитика

- банки

- биржа

- брокеры

- Игры в интернете

- корея

- коронавирус

- коронавирус борьба

- криптобиржа

- криптовалюта

- Нефть

- опрос

- оффтоп

- Путин

- рейтиги

- Россия

- русал

- рынок США

- Страх

- торговля

- торговые сигналы

- Трамп

- трейдинг

- Украина

- физика фондового рынка

- фьючерс ртс

- фьючесы