SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 01.04.

- 01 апреля 2013, 17:00

- |

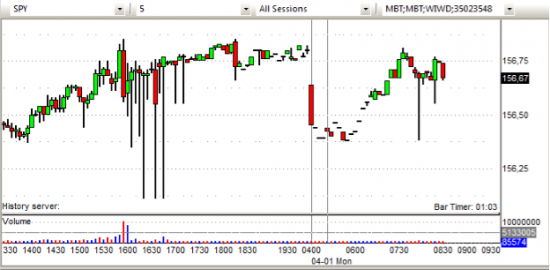

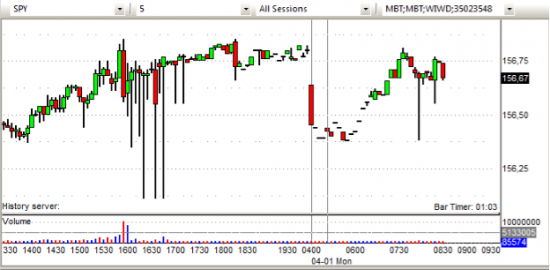

Спайдер торгуется почти без изменений после длинных выходных в США.

SPY (внутридневной график) рост на премаркете. Сопротивление 156.9. Поддержка: 156.40 – 156.00

Ожидаемая макроэкономическая статистика:

M&A related: CEDC +4.2% (thinly traded, Competing consortium withdraws restructuring proposal for CEDC; CEDC reaffirms support for RTL restructuring proposal), BXG +1.6% (Bluegreen shareholders approve previously announced merger with subsidiary of BFC Financial), CWH +1.4% (confirms receipt of unsolicited indication of interest from Corvex / Related), PAY +0.3% (Bloomberg discusses that PAY may be an attractive LBO target).

Other news: KWK +20% (Quicksilver Resrcs announces sale to Tokyo Gas of 25% interest in Barnett Shale assets), OCLS +7.1% (following 1-for-7 reverse split of its common stock will be effective at the open of business on Monday, April 1, 2013), RT +5.8% (positive mention in Barrons), CLF +4.2% (still checking), STM +3.8% (positive mention in Barrons), RDY +1.4% (appoints GV Prasad as Chairman and Satish Reddy as Vice-Chairman, announces the launch of Zenatane), HUM +0.6% (ticking higher following positive mention in Barron's).

Analyst comments: TAP +2.2% (Molson Coors Brewing upgraded to Buy from Neutral at Goldman), POT +1.9% (Potash upgraded to Overweight from Neutral at JPMorgan)

Analyst comments: DECK +2.2% (tgt to $100 from $65 at Jefferies), RYAAY +0.8% (ticking higher, upgraded to Buy from Neutral at Citigroup)

Select Japan related names showing early weakness: MTU -5%, NMR -4.4%, NTT -3.9%, SNE -2.9%, HMC -2.2% (light volume; also cautious Japan car sales WSJ article out over the weekend).

Other news: PC -4.5% (Panasonic unit is under investigation by US over bribery allegations, according to reports).

Analyst comments: ARII -1.6% (\downgraded to Equal Weight from Overweight at boutique firm), YHOO -0.9% (downgraded to Hold from Buy at Pivotal Research), ABBV -0.7% (downgraded to Market Perform from Outperform at BMO), INTC -0.6% (downgraded to Mkt Perform from Mkt Outperform at JMP Securities)

Торговые идеи NYSEи NASDAQ:

- Европейские фондовые площадки не работают.

- Nikkei на отрицательной территории, Shanghai Composite незначительно снижается.

SPY (внутридневной график) рост на премаркете. Сопротивление 156.9. Поддержка: 156.40 – 156.00

Ожидаемая макроэкономическая статистика:

- U.S. Market Manufacturing PMI- Final (9am)

- March ISM Index (10am)

- February Construction Spending (10am)

- Gapping up

M&A related: CEDC +4.2% (thinly traded, Competing consortium withdraws restructuring proposal for CEDC; CEDC reaffirms support for RTL restructuring proposal), BXG +1.6% (Bluegreen shareholders approve previously announced merger with subsidiary of BFC Financial), CWH +1.4% (confirms receipt of unsolicited indication of interest from Corvex / Related), PAY +0.3% (Bloomberg discusses that PAY may be an attractive LBO target).

Other news: KWK +20% (Quicksilver Resrcs announces sale to Tokyo Gas of 25% interest in Barnett Shale assets), OCLS +7.1% (following 1-for-7 reverse split of its common stock will be effective at the open of business on Monday, April 1, 2013), RT +5.8% (positive mention in Barrons), CLF +4.2% (still checking), STM +3.8% (positive mention in Barrons), RDY +1.4% (appoints GV Prasad as Chairman and Satish Reddy as Vice-Chairman, announces the launch of Zenatane), HUM +0.6% (ticking higher following positive mention in Barron's).

Analyst comments: TAP +2.2% (Molson Coors Brewing upgraded to Buy from Neutral at Goldman), POT +1.9% (Potash upgraded to Overweight from Neutral at JPMorgan)

Analyst comments: DECK +2.2% (tgt to $100 from $65 at Jefferies), RYAAY +0.8% (ticking higher, upgraded to Buy from Neutral at Citigroup)

- Gapping down

Select Japan related names showing early weakness: MTU -5%, NMR -4.4%, NTT -3.9%, SNE -2.9%, HMC -2.2% (light volume; also cautious Japan car sales WSJ article out over the weekend).

Other news: PC -4.5% (Panasonic unit is under investigation by US over bribery allegations, according to reports).

Analyst comments: ARII -1.6% (\downgraded to Equal Weight from Overweight at boutique firm), YHOO -0.9% (downgraded to Hold from Buy at Pivotal Research), ABBV -0.7% (downgraded to Market Perform from Outperform at BMO), INTC -0.6% (downgraded to Mkt Perform from Mkt Outperform at JMP Securities)

Торговые идеи NYSEи NASDAQ:

- CLF - движение на премаркете без значимых новостей. В прошлую среду было достаточно большое падение. Ниже 20.00 смотрим сетапы в шорт, выше 20.00 возможен лонг.

- EBAY - компания выпустила обзор на год, ряд аналитический агенств выпустила апргейды по акциям компании. Фундаментально компания очень сильная, смотрится чуть сильнее рынка. Выше 56.00 смотрим акцию в лонг.

- TSLA – утром вышел очень сильный Guidance, много позитива от модели S (компания занимается производством автомобилей). Лонг выше максимумов премаркета. Пробит ключевой уровень сопротивления – 40.00

25 |

1 комментарий

Хороший план достаточно — чувствуется школа мамки)

- 02 апреля 2013, 08:36

Читайте на SMART-LAB:

Золото и серебро — идеальное сочетание? Взгляд Heraeus на рынок драгоценных металлов

Когда инвесторы ищут ответы на вопросы о будущем, они нередко возвращаются к золоту и серебру — одним из старейших активов за всю историю...

12:09

Встречаемся на Smart-Lab & Cbonds PRO облигации 2026

Встречаемся на Smart-Lab & Cbonds PRO облигации 2026

💼 Уже в эту субботу, 28 февраля , в Москве пройдёт конференция по вопросам...

10:08

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы