Блог им. JohnHard

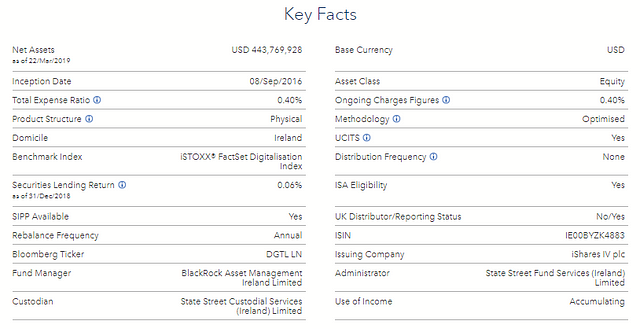

iShares Digitalization UCITS ETF

- 11 апреля 2019, 16:29

- |

The Fund seeks to track the performance of an index composed of developed and emerging market companies which are generating significant revenues from digitally focused services.

KEY BENEFITS

1 Competitively priced and diversified access to companies that offer digitally focused services across both developed and emerging markets.

2 Growth potential due to the increasing prevalence and application of digital services.

3 Express a long-term view within your equity allocation.

Benchmark Index The iSTOXX® FactSet Digitalisation Index aims to reflect the performance of a subset of equity securities within the STOXX Global Total Market Index (TMI) (“Parent Index”) which derive significant revenues from digitalisation in accordance with the STOXX Factset Revere Hierarchy methodology, with each security being equally weighted within the Benchmark Index.

Investment Policy In order to achieve this investment objective, the investment policy of the Fund is to invest in a portfolio of equity securities that as far as possible and practicable consists of the component securities of the iSTOXX® FactSet Digitalisation Index, this Fund’s Benchmark Index. The Fund intends to use optimisation techniques in order to achieve a similar return to the Benchmark Index and it is therefore not expected that the Fund will hold each and every underlying constituent of the Benchmark Index at all times or hold them in the same proportion as their weightings in the Benchmark Index.

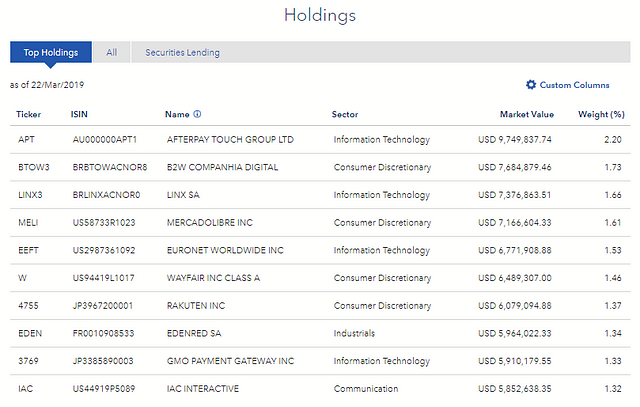

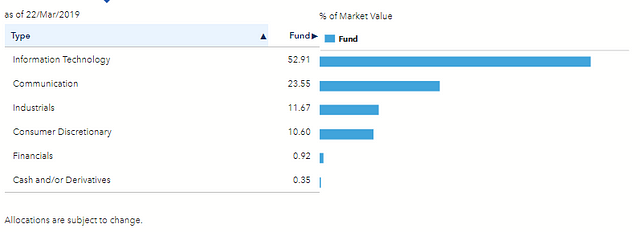

SECTOR

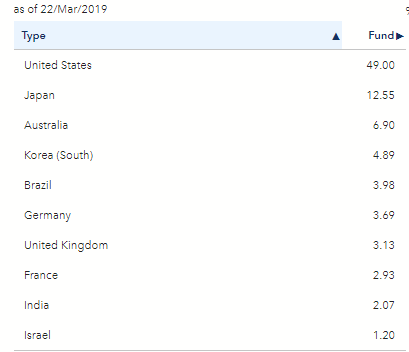

Geography

Ticker: DGTL LN

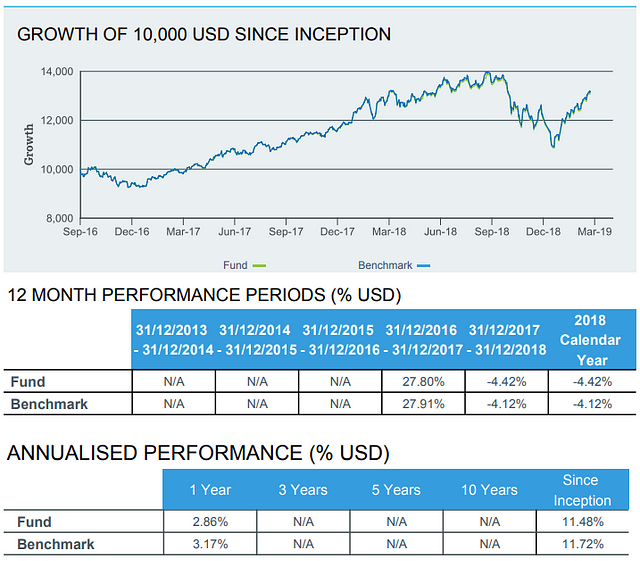

Upside: 20–25%

Time range: 6–12 month

теги блога Юрий Ломов

- Activision Blizzard

- analytics

- BCH

- bchusd

- bitcoin

- Br

- brent

- btc

- BTCUSD

- EOS

- EOSUSD

- ETF

- eth

- ethereum

- etherium

- ETHUSD

- eur

- EUR USD

- gaz

- Gold

- Inc

- IPO

- JD.com

- news

- or group (обувь россии)

- Ri

- RIM

- ripple

- Ripple Криптовалюта

- SB

- Sber

- si

- spacex

- SPCE

- STELLAR

- stock

- Virgin

- Virgin Galactic

- Vodafone

- XRP

- XRPUSD

- акции

- акции РФ

- АФК Система облигации

- биржа

- бюджет 2013

- бюджет 2016

- идея

- израиль

- ИПО

- КАНАДА

- Китай

- криптовалюта

- мир

- ММВБ

- мнение по рынку

- МосБиржа

- мысли

- мысли в слух

- Новости

- новости рынков

- новость

- облгации

- Облигации

- Обувь России

- опционы

- прогноз по акциям

- ртс

- руб доллар

- рубль

- рф

- санкии против России

- сбер

- сбербанк

- система

- ставка

- статистика

- США

- ТМК

- торговые роботы

- торговые сигналы

- трейдинг

- фьюерс ртс

- ЦБ