SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 21 мая.

- 21 мая 2013, 16:40

- |

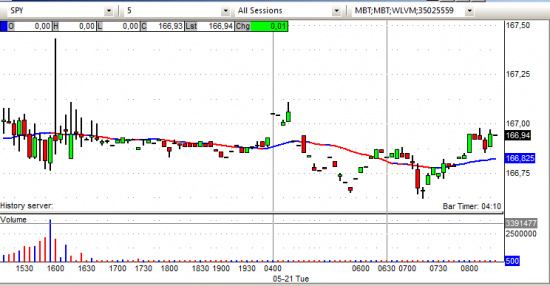

Спайдер незначительно изменяется перед открытием торгов на NYSE.

SPY (внутридневной график) боковое движение на премаркете. Сопротивление: 167.00 Поддержка: 166.50

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: NM +6%, MDT +4.2%, HD +3.6%, SKS +2.2%, TIVO +1.1%.

M&A related: SDBT +52.2% (Genesys to Acquire co for $5.00 per share), S +1.4% (light volume, Softbank is planning on JPY 400 bln bond sale related to Sprint (S) bid, according to reports out yesterday; also Sprint Nextel provides transaction update; receives waiver from SoftBank; Sprint's Board will proceed with providing non-public information to DISH and engage in negotiations), FCX +1.2% (Freeport-McMoRan Copper & Gold Inc. and Plains Exploration & Production Company confirmed yesterday afternoon that the PXP shareholders approve acquisition).

Select solar related names showing continued strength: RSOL +8.2%, ASTI +7.7%, JASO +4.6%, JKS +3.8%, CSIQ +3.5%, LDK +3.3%, SOL +2.4%, TSL +1.5%, SPWR +1.3%, FSLR +1.3%, WFR +0.7%, .

A few miners are trading modestly higher: RIO +2.3%, BHP +1.1%, BBL +1%, VALE +0.3%, .

A few coal related names showing strength: WLT +1.9%, ANR +1.3%, ACI +1.0%.

LED names are seeing early strength: AIXG +5.3%, LEDS +3.4%, CREE +0.5%

Other news: ACRX +23.8% (Top-line data demonstrate primary endpoint achieved in final pivotal phase 3 study of Sufentanil NanoTab PCA system for management of post-operative pain), MCP +3.4% (WSJ report that China rare earth exports grew 28% YoY in April), ERJ +3.4% (Embraer and SkyWest Inc. Sign a Contract for 40 firm E-Jets), REN +2.2% ( Sageview Capital discloses 6.3% active stake in 13D filing), REGN +1.8% (entered into agreements with Genentech (RHHBY) and Sanofi (SNY) for Eylea and Zaltrap), YHOO +1% (to offer free terabyte of storage for photos on Flickr; co consolidating NY offices), CBST +0.4% ( CBST receives favorable patent court ruling versus Hospira, according to reports, upgraded at Cantor).

Analyst comments: BA +1.1% (light volume, Hearing tgt to $100 from $75 at UBS), TROW +0.6% (upgraded to Outperform from Mkt Perform at Bernstein), UIL +0.6% (upgraded to Outperform at Robert W. Baird)

Gapping down:

In reaction to disappointing earnings/guidance: HGG -9.7%, CCL -7.1%, URBN -2.8%, BBY -1.8%, DKS -1.4%.

Financial related names showing weakness: RBS -4.6%, ING -3.9%, BCS -2.2%, CS -1.9%, SAN -1.8%, UBS -1.8%, DB -1.4% (downgraded to Neutral from Overweight at JPMorgan, downgraded to Underperform from Neutral at Macquarie), HBC -1.4%.

Select metals stocks trading lower: GFI -4.8%, RGLD -3.8%, NEM -3.3%, SLV -3.1%, SLW -2.5%, EGO -1.8%, GG -1.8%, GDX -1.5%.

Other news: KOS -8.6% (announces results from Sipo-1 exploration well; oil and gas shows evidenced during drilling indicated a working petroleum system; however, the well failed to encounter commercial reservoirs), CUK -8.4% and RCL -2.4% (following CCL guidance), TCPC -4% (commenced a public offering of 4.0 million shares of its common stock), CIMT -3.2% (announces proposed secondary public offering of ordinary shares; no amount given), LG -2.7% (plans to commence a registered underwritten public offering of up to 8,700,000 shares of its common stock), WAIR -2.3% (announced the commencement of a public offering of 15,000,000 shares of common stock by affiliates of The Carlyle Group), FPO -2.2% (commenced an underwritten public offering of 6,000,000 common shares of beneficial interest), OAK -1.8% (announced a public offering of 6,000,000 Class A unit), IRWD -0.9% (announced that it has commenced an underwritten public offering of 10,500,000 shares of its Class A common stock), AAPL -0.9% (Senator Levin says they plan to highlight the AAPL tax gimmick and other AAPL offshore tax avoidance tactics, so Americans understand why those tax loopholes need to be closed ), NPSP -0.8% (announces proposed public offering of 6 mln shares of common stock).

Торговые идеи NYSEи NASDAQ:

MDT– лонг выше уровней премаркета.

HD– если цена открытия будет выше 79.50 и ее будут удерживать – лонг, возможен шорт при тестировании максимума 80.50, ниже 79.00 – смотрим акцию в шорт.

MCP– лонг выше максимумов премаркета.

HGG– лонг выше 14.35, ниже 14.00 возможен шорт.

CCL– лонг выше 33.00

RCL– лонг выше 37.00

Оригинал в блоге: http://shark-traders.com/blog/analitika-na-21-maya/

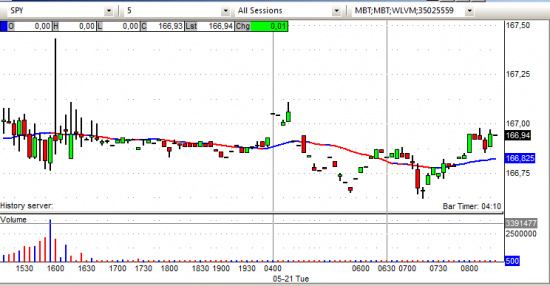

- Европейские индексы изменяются разнонаправленно.

SPY (внутридневной график) боковое движение на премаркете. Сопротивление: 167.00 Поддержка: 166.50

ПремаркетNYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: NM +6%, MDT +4.2%, HD +3.6%, SKS +2.2%, TIVO +1.1%.

M&A related: SDBT +52.2% (Genesys to Acquire co for $5.00 per share), S +1.4% (light volume, Softbank is planning on JPY 400 bln bond sale related to Sprint (S) bid, according to reports out yesterday; also Sprint Nextel provides transaction update; receives waiver from SoftBank; Sprint's Board will proceed with providing non-public information to DISH and engage in negotiations), FCX +1.2% (Freeport-McMoRan Copper & Gold Inc. and Plains Exploration & Production Company confirmed yesterday afternoon that the PXP shareholders approve acquisition).

Select solar related names showing continued strength: RSOL +8.2%, ASTI +7.7%, JASO +4.6%, JKS +3.8%, CSIQ +3.5%, LDK +3.3%, SOL +2.4%, TSL +1.5%, SPWR +1.3%, FSLR +1.3%, WFR +0.7%, .

A few miners are trading modestly higher: RIO +2.3%, BHP +1.1%, BBL +1%, VALE +0.3%, .

A few coal related names showing strength: WLT +1.9%, ANR +1.3%, ACI +1.0%.

LED names are seeing early strength: AIXG +5.3%, LEDS +3.4%, CREE +0.5%

Other news: ACRX +23.8% (Top-line data demonstrate primary endpoint achieved in final pivotal phase 3 study of Sufentanil NanoTab PCA system for management of post-operative pain), MCP +3.4% (WSJ report that China rare earth exports grew 28% YoY in April), ERJ +3.4% (Embraer and SkyWest Inc. Sign a Contract for 40 firm E-Jets), REN +2.2% ( Sageview Capital discloses 6.3% active stake in 13D filing), REGN +1.8% (entered into agreements with Genentech (RHHBY) and Sanofi (SNY) for Eylea and Zaltrap), YHOO +1% (to offer free terabyte of storage for photos on Flickr; co consolidating NY offices), CBST +0.4% ( CBST receives favorable patent court ruling versus Hospira, according to reports, upgraded at Cantor).

Analyst comments: BA +1.1% (light volume, Hearing tgt to $100 from $75 at UBS), TROW +0.6% (upgraded to Outperform from Mkt Perform at Bernstein), UIL +0.6% (upgraded to Outperform at Robert W. Baird)

Gapping down:

In reaction to disappointing earnings/guidance: HGG -9.7%, CCL -7.1%, URBN -2.8%, BBY -1.8%, DKS -1.4%.

Financial related names showing weakness: RBS -4.6%, ING -3.9%, BCS -2.2%, CS -1.9%, SAN -1.8%, UBS -1.8%, DB -1.4% (downgraded to Neutral from Overweight at JPMorgan, downgraded to Underperform from Neutral at Macquarie), HBC -1.4%.

Select metals stocks trading lower: GFI -4.8%, RGLD -3.8%, NEM -3.3%, SLV -3.1%, SLW -2.5%, EGO -1.8%, GG -1.8%, GDX -1.5%.

Other news: KOS -8.6% (announces results from Sipo-1 exploration well; oil and gas shows evidenced during drilling indicated a working petroleum system; however, the well failed to encounter commercial reservoirs), CUK -8.4% and RCL -2.4% (following CCL guidance), TCPC -4% (commenced a public offering of 4.0 million shares of its common stock), CIMT -3.2% (announces proposed secondary public offering of ordinary shares; no amount given), LG -2.7% (plans to commence a registered underwritten public offering of up to 8,700,000 shares of its common stock), WAIR -2.3% (announced the commencement of a public offering of 15,000,000 shares of common stock by affiliates of The Carlyle Group), FPO -2.2% (commenced an underwritten public offering of 6,000,000 common shares of beneficial interest), OAK -1.8% (announced a public offering of 6,000,000 Class A unit), IRWD -0.9% (announced that it has commenced an underwritten public offering of 10,500,000 shares of its Class A common stock), AAPL -0.9% (Senator Levin says they plan to highlight the AAPL tax gimmick and other AAPL offshore tax avoidance tactics, so Americans understand why those tax loopholes need to be closed ), NPSP -0.8% (announces proposed public offering of 6 mln shares of common stock).

Торговые идеи NYSEи NASDAQ:

MDT– лонг выше уровней премаркета.

HD– если цена открытия будет выше 79.50 и ее будут удерживать – лонг, возможен шорт при тестировании максимума 80.50, ниже 79.00 – смотрим акцию в шорт.

MCP– лонг выше максимумов премаркета.

HGG– лонг выше 14.35, ниже 14.00 возможен шорт.

CCL– лонг выше 33.00

RCL– лонг выше 37.00

Оригинал в блоге: http://shark-traders.com/blog/analitika-na-21-maya/

21

Читайте на SMART-LAB:

S&P 500: Нефтяная паника разбилась о железный молот — быки перехватывают инициативу

Индекс S&P 500 протестировал медиану, проведенную через ключевые точки коррекции (1-2-3), оформив при этом выразительный «молот» с очень длинной...

22:59

Стоимость нефти обновила максимум с июня 2022 года

Цена на нефть марки Brent 9 марта в моменте поднималась выше $119 за баррель, что в последний раз наблюдалось в июне 2022 года. Основным драйвером...

19:07

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы