SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Rebis

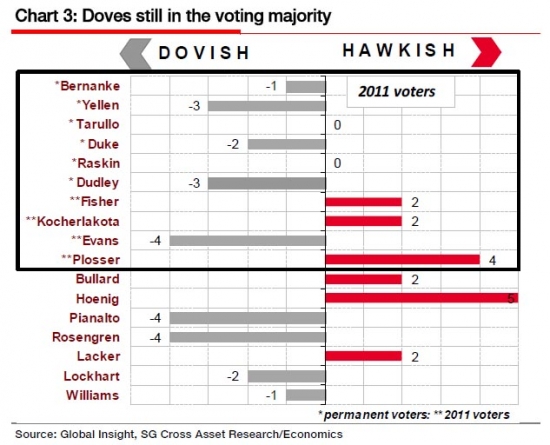

Ястребы и голуби ФРС

- 06 июня 2011, 20:31

- |

Из последних высказываний:

Bernanke – QE2 will be completed, but very little chance of QE3 as the trade-offs are unfavorable. Inflation expectations are still in comfort zone, but continue to watch very closely.

Pianalto – Labor market remains a long way from healthy. Looking at just above 3% GDP growth over next few years. Will take about 5 to 6 years for unemployment rate to reach NAIRU (5.5 to 6%).

Kocherlakota – Fed should raise the Fed funds rate by 50bps in 2011. Rate hikes hinge on his forecast for core inflation averaging 1.5% for rest of year. Rate hikes should be first move in exit strategy. Extended language means 2 to 4 meetings.

Lockhart – Extended period change hinges on Unemployment. Job progress slow and inflation transitory. QE3 probably unnecessary. Inflation will move to about 2% in two years.

Lacker – Inflation expectations at the upper end of the Fed’s comfort zone. Recent surge in commodity prices likely temporary. After QE2 focus shifts to timing and speed of stimulus withdrawal.

Bullard – Fed may put policy on hold to ensure economic recovery is gaining ground. Does not give judgment whether he agrees with this. US can weather recent oil price shock.

Dudley – Time to act is now. Current levels of inflation and unemployment and timeframe to return to mandate unacceptable. Showed support for price level targeting.

Evans – Believes that Fed needs to buy at a large scale several times. This would support a price level target to make up for the shortfall in Inflation. Strong support for price level targeting.

Шаги ФРС после QE2

1. End of QE2 The April FOMC statement confirmed that QE2 will end on schedule, after reaching the $600bn target. This will mark the official end of the Fed’s easing cycle. When? June 2011

2. Halting MBS reinvestments Bernanke noted in its April FOMC press conference that halting MBS reinvestments will most likely occur early in the exit process. Fed will probably wait a few months following the end of QE2 to assess the impact before taking this next step. When? September 2011

3. Liquidity draining operations We believe this has to be done ahead of rate hikes, or else the effective fed funds rate will trade away from the target. The Fed could use a combination of reverse repos, term deposits and possibly restore the Supplemental Financing Program (subject to Congress increasing debt ceiling). When? November 2011

4. End of “extended” language The Fed has previously suggested that the extended language means about 6-9 months. Given the timing of our rate call, the phrase should be dropped around the turn of the year. When? December 2011

5. Rate hikes Our call is for mid-2012, with a bias toward the third quarter. When? Q3’2012

6. Asset sales We believe that outright asset sales will begin around the time of the first rate hike. Fed has indicated a goal of returning the size and composition of its securities portfolio to pre-crisis trend over 5 years. We believe they will start by selling about $10bn per month. When? Q3’2012

теги блога Rebis

- Dow Jones Industrials

- Goldman Sachs

- LTRO

- MSCI Russia Standard

- PIMCO

- PMI

- QE 3

- QE3

- S&P

- S&P500

- акции

- арабы

- армагеддон

- банки

- Баффет

- безработица

- бензин

- Бернанке

- биржа

- бык

- валютные войны

- война

- выборы

- газ

- газпром

- геополитика

- госдолг США

- гособлигации РФ

- греция

- дефолт

- доллар

- евро

- еврозона

- европа

- ЕС

- ЕЦБ

- Жириновский

- золото

- Израиль

- инвесторы

- индекс РТС

- индикаторы

- инфляция

- Иран

- историческая аналогия

- казначейских облигаций США

- Катар

- Китай

- крах

- кризис

- курсы валют

- ликвидность

- медведь

- ммвб

- недвижимость США

- немцы

- нефть

- Нигерия

- обвал

- опек+

- оффтоп

- прогноз

- пузырь

- развивающиеся рынки

- реал

- рейтинг

- рецессия

- Роснефть

- Россия

- ртс

- рубль

- рынок

- сайт

- саммит

- Сбербанк

- сирия

- Соликамский магниевый завод

- Сорос

- ставки

- статистика

- стимулирование

- США

- теория Dow

- торги

- транснефть

- трежерис

- трейдер

- Ураган Сэнди

- фонда

- фондовые рынки

- фондовый биржа

- фондовый рынок

- фондовый рынок США

- фоновый рынок

- Франция

- ФРС

- ФСФР

- цена на золото

- экономика

- япония

я свою сводку веду по настроениям членов центробанков,

но здесь тема США раскрыта красиво