SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Scorpio0

Трамп двигает энергетику

- 27 января 2017, 01:47

- |

www.zerohedge.com/news/2017-01-26/trump-setting-oil-markets-another-bust

President Donald Trump signed several executive orders this week intended to juice the American energy sector, calling for expedited environmental reviews and the advancement of the Keystone XL and Dakota Access Pipelines.

It is not a coincidence then that North Dakota oil output has declined roughly 200,000 bpd from a peak of 1.22 mb/d at the end of 2014. The absence of adequate pipeline capacity has helped trim the growth of the Bakken, and it has also deepened its losses since the market downturn over two years ago.

The result could be a price premium of about 25 percent immediately for WTI relative to international benchmarks, according to Goldman Sachs, or $10 per barrel. Higher prices will attract global capital, which could boost oil production. Goldman Sachs estimates the border tax could lead to an increase in U.S. oil production by about 1.5 million barrels per day by 2018, twice as much as the investment bank’s forecast without the border tax.

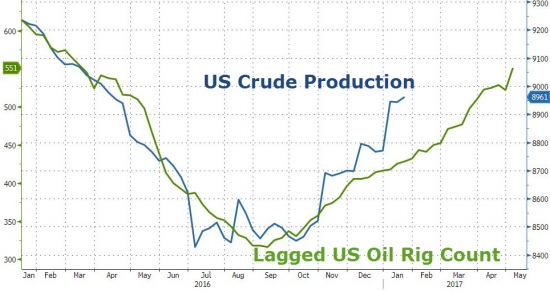

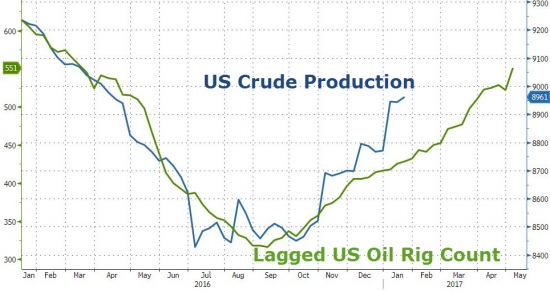

While that seems great for U.S. oil producers, such a scenario would not play out in a vacuum. Higher U.S. output could push down global oil prices, just as the surge in shale caused a price meltdown in 2014, as Liam Denning of Bloomberg Gadfly argues. The appreciation of the U.S. dollar from President Trump’s “America First” economic/energy policies would also push down oil prices. The end result could be higher oil production, but also another market downturn because of oversupply.

President Donald Trump signed several executive orders this week intended to juice the American energy sector, calling for expedited environmental reviews and the advancement of the Keystone XL and Dakota Access Pipelines.

It is not a coincidence then that North Dakota oil output has declined roughly 200,000 bpd from a peak of 1.22 mb/d at the end of 2014. The absence of adequate pipeline capacity has helped trim the growth of the Bakken, and it has also deepened its losses since the market downturn over two years ago.

The result could be a price premium of about 25 percent immediately for WTI relative to international benchmarks, according to Goldman Sachs, or $10 per barrel. Higher prices will attract global capital, which could boost oil production. Goldman Sachs estimates the border tax could lead to an increase in U.S. oil production by about 1.5 million barrels per day by 2018, twice as much as the investment bank’s forecast without the border tax.

While that seems great for U.S. oil producers, such a scenario would not play out in a vacuum. Higher U.S. output could push down global oil prices, just as the surge in shale caused a price meltdown in 2014, as Liam Denning of Bloomberg Gadfly argues. The appreciation of the U.S. dollar from President Trump’s “America First” economic/energy policies would also push down oil prices. The end result could be higher oil production, but also another market downturn because of oversupply.

20

1 комментарий

+1

Трамп в своей предвыборной программе и тезисах совершенно четко озвучивал направленность на развитие традиционной энергетики и сворачивание «зеленых» проектов. Он двинул рынок, и, теперь, даже без каких-либо действий Трампа, традиционная энергетика обречена расти по инерции, на ожиданиях:)

- 27 января 2017, 02:07

Читайте на SMART-LAB:

Что покупал самый успешный хедж-фонд в IV квартале 2025?

На днях Citadel Advisors, один из самых успешных хедж-фондов, опубликовал очередной отчет по форме 13F за IV квартал 2025 г., в котором раскрыл...

12:44

📃 Размещение облигаций «ФосАгро» в юанях

«ФосАгро» — один из ведущих мировых производителей фосфорных удобрений, №1 по производству высокосортного фосфатного сырья. Кредитные...

12:20

теги блога Scorpio

- 50

- 2017

- API

- Baker

- Baker Hughes

- Bitcoin

- Bloomberg

- brent

- CFTC

- Crude

- DOE

- Dow

- EIA

- GOLD

- Hughes

- light

- MICEX

- MOEX

- Oil

- RBOB

- Rigs

- S&P500

- USD

- usdrub

- VIX

- wti

- ZeroHedge

- Акции

- Бензин

- Буровые

- Вена

- волатильность

- вопрос

- Встреча

- Гусев

- Дистилляты

- Добыча

- доллар

- Евро

- ЕС

- Запасы

- Золото

- индекс доллара

- Ирак

- Италия

- Китай

- коррекция

- Кукл

- Курдистан

- Курс

- курс доллара

- Кушинг

- Ливия

- Лица

- ЛЧИ

- Маркидонова

- Минфин

- Михеев

- Москва

- Набиуллина

- нефть

- Новый год

- Обвал

- опек+

- опрос

- оффтоп

- Падение

- прогноз

- Путин

- Резервы

- референдум

- Роснефть

- Россия

- Рост

- рубль

- Русские

- РФ

- Санкции

- Саудовская Аравия

- Сделка

- Сенаторы

- сентимент

- Силуанов

- СмартЛаб

- Смешинка

- сокращение

- Ставка

- США

- Трамп

- Тренд

- Улюкаев

- Физические

- ФРС

- Фьючерс

- Хай

- Хакеры

- ЦБ

- Цена

- Шип

- Юридические