SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. billikid

апдейт армагедона свопов

- 30 сентября 2016, 16:05

- |

38 |

Читайте на SMART-LAB:

Инвестиции без спешки: торгуем в выходные

Рынок часто движется импульсами, тем важнее оценивать активы без спешки, не отвлекаясь на инфошум. Для этого отлично подходят выходные дни. В...

16:39

💼 Хэдхантер: дивиденды съедают проценты

Крупнейшая онлайн-платформа по поиску работы отчиталась по МСФО за 4 квартал и весь прошлый год Хэдхантер (HEAD) ➡️ Инфо и показатели...

14:37

Итоги первичных размещений ВДО и некоторых розничных выпусков на 6 марта 2026 г.

Следите за нашими новостями в удобном формате: Telegram , Youtube , RuTube, Smart-lab , ВКонтакте , Сайт

18:35

Нефтяной срез: выпуск №8. Перекрытие Ормузского пролива + рост цен на нефть против слабых отчетов за 4-й квартал 2025 и 1-й квартал 2026? Ищем лучших в все еще слабом секторе

Продолжаю выпускать рубрику — Нефтяной срез. Цель: отслеживать важные бенчмарки в нефтяной отрасли, чтобы понимать куда дует ветер. Прошлый пост:...

19:45

теги блога Александр Строгалев

- EPFR Global

- ETF

- Euroclear

- FOMC

- QE

- акции

- анализ

- АСВ

- атон

- банк

- банки

- Бернанке

- биржа

- бкс

- Блумберг

- бюджет

- валюта

- внешний долг

- война

- ВТБ

- ВТБ-Капитал

- ВЭБ

- газпром

- Газпромбанк

- греция

- девальвация

- депозит

- дефицит

- дефолт

- дивиденды

- долг

- долги

- доллар

- доходность

- евробонд

- Евроклир

- еврооблигации

- жулики

- ЗВР

- инвестиции

- инфляция

- испания

- кипр

- Китай

- книга

- книги

- кредит

- крым

- ликвидность

- Магнит

- манипуляция

- Мечел

- Минфин

- ммвб

- налоги

- нерезиденты

- нефть

- НПФ

- нрд

- облигации

- облигация

- ОФЗ

- оффтоп

- оффшор

- пенсия

- пересвет

- продажи

- Промсвязьбанк

- райфайзен

- райфайзенбанк

- рейтинг

- репо

- рецензия на книгу

- Росбанк

- роснефть

- рубль

- Русал

- санкции

- сбербанк

- своп

- связной

- ставки

- статистика

- стратегия

- сша

- ТГК2

- ТКС

- ТНК

- Трежери

- трежеря

- украина

- Улюкаев

- уралкалий

- уралсиб

- фед

- ФРС

- ЦБ

- ЦБ РФ

- шадрин

- экономика

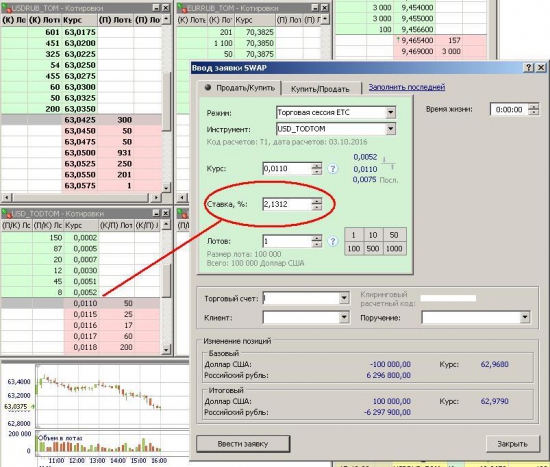

Так интересно, а физик может поучаствовать в банкете? От 15000р за выходные что отказываться-то?

The European Central Bank has been holding U.S. dollar-providing operations since the weeks after the collapse of Lehman Brothers Inc., as part of its liquidity operations for European lending.

The totals drawn by banks from the operation have been relatively low for the past couple of years. That changed this week when 12 banks sought $6.348 billion in liquidity.

So what's going on? With German banks under pressure this week as Deutsche Bank AG, the nation's biggest lender, faces U.S. legal penalties, they might be viewed as the likely source of the increased demand.

However, there were no German bidders at the operation, according to a person familiar with the matter, who asked not to be named because the details of the operations are confidential. That suggests a possible squeeze on market liquidity may be a wider problem for banks in Europe.

A spokesman for the ECB declined to comment.

The operation does cover the end of quarter period, a typically volatile time. There was also a spike in operation size and number of bidders at the end of June, but that was far smaller.

Details of the next dollar operation will be published on the ECB website on Oct. 5.

а в целом 2/3 сделок (по рублю уже, имею ввиду) прошли «не ниже 6%». ценник ср.взвеш на usd_todtom= ,0345.

http://smart-lab.ru/q/currencies/