Блог им. st-travich |⚡️ ASK imbalances on currencies

- 09 июля 2023, 15:33

- |

Good evening traders ☀️

One week passed and today I see interesting ASK imbalances in such currencies as British Pound (6B), Canadian Dollar (6C), Mexican Peso (6M), and they can be realized as shorting opportunities during the next week. Also, I see BID imbalance and potential buying opportunity in Natural Gas (NG) if the price will fix above HFTs’.

I won’t take much time, I managed to talk about everything in 5 minutes

- комментировать

- Комментарии ( 0 )

Блог им. st-travich |DXY is tired to rise + video

- 18 июля 2022, 03:25

- |

Good evening, Traders!

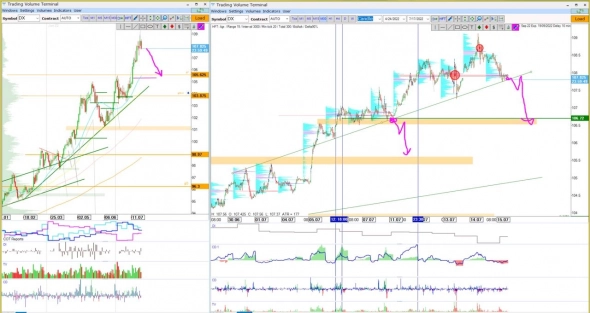

🔻 Let's start from the leader of markets — DXY. From the previous analysis, we have designated a key level 106.72 and the price did not brokedown this level even by 1 tick. It became a real growing point from the start of the week. On Friday the price closed on the uptrend line and after its breakdown, I expect to see correctional movement to this magnet. (See)

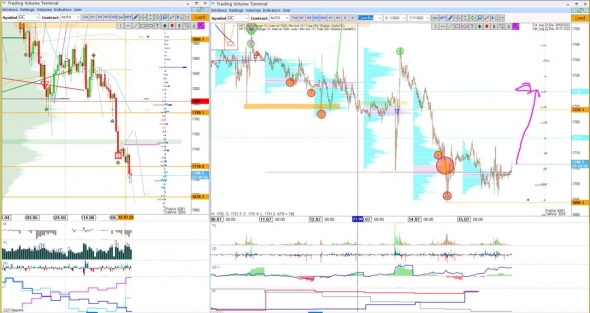

🔻 What about Gold (GC), I really expected that the price will go up from Tuesday's bottom, but the unbelievable record inflation in the USA created high volatility. Funds opened a record short position, and OI rose by 8% during the reported week. Now according to the big amount of ask HFTs here reversal is also rather possible. (See)

( Читать дальше )

Блог им. st-travich |СME Futures Analysis 26.06.2022 + video

- 26 июня 2022, 15:13

- |

🔻 In the previous analysis, we made a bet to follow shorts in Gold (GC), but for now, I see local buying opportunities according to the last HFTs’ bid imbalances. Ask delta on bid HFTs’ and close below this descending triangle is comfortable for bears but can be used by market makers to accumulate a bigger long position. For me the key level is volume level Feb21, if the price will break this level, it will be a bukkish signal for buyers. (See)

🔻 While if we look at Swiss frank (6S) it can still bounce back. As you remember I said if the price break this HFTs’ level, it will go down. It did not, but now the magnet zone is on the 1.025 price level. (See)

( Читать дальше )

Блог им. st-travich |CME Futures Analysis 29.05.2022

- 29 мая 2022, 18:41

- |

Hello, traders! Let's look how amazing the second week in raw was with settled priorities and predictions.

🔻 Look at S&P500 (ES)! During 5 days our target was absolutely achieved. The strong imbalance that occurred after the breakdown of the 3850 support level was greatly respected. For now, we observe new ask imbalances, which moved the price higher. I want you to measure the divergence of CD and CDQ on May 17. The quantitative delta +6,5K of market buys but at the same time the volume of CD was -13K shorts. It is often called advance purchases, which work like a magnet for future recovery and the price can go even higher. The second chance to enter longs was after returning to 3900 and stopping HFT volumes and hedging in Put options. The only way to enter with a high risk-reward ratio is to accept the local fear.

🔻 Our next target was 1.07 in Euro (6E) and it was violated no worse than the previous one1.06. And as I told you in my previous video, the levels on which we see huge block trades are very important for the price. And 1.075 was really respected this week. Also now we are in the zone of the least options payouts and the price came here and I think till July 3 it will stay near this zone.

All this movement before was thanks to funds, which accumulated 36K contracts long position, and we — swing traders can use this market inefficiencies to make our profit.

🔻 Only Oil (CL) gives us an opportunity according to the scenario which we predicted before. After the move to the upside we have a very very strong

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- экономика

- юмор

- яндекс