Блог им. st-travich |☝🏻 Today I want to highlight a Canadian dollar (6C)

- 27 августа 2023, 12:00

- |

Good day, traders!

Today I want to highlight a Canadian dollar (6C). On Friday, it closed above the strong volumetric and technical support according to the Daily chart. But hedge funds continue to accumulate their shorts. (Watch)

A large quantity of buyers are going to buy cheap. We see that call volumes are also more preferred. Moreover ask HFTt’s imbalance was created, but met a limit seller. (Watch)

I assume that despite the strong level of support we have more chances to break the level 0,7350 than to bounce from it. The target of the downside movement is at a 0,73 price level.

Have a nice week and a pleasant Sunday!

- комментировать

- Комментарии ( 0 )

Блог им. st-travich |Ufavorable market predictions, how to avoid losses ☝️

- 15 июля 2023, 22:00

- |

Good evening, traders!

This week was good for trend following strategies, but bad for reversals. Trends make up 20-30% of market movements and exist only on historical charts, so it is very difficult to predict when they will occur.

Today I want to overview my unfavorable predictions and take your attention to the topic of how to avoid losses on the examples of the previous week.

Блог им. st-travich |⚡️ ASK imbalances on currencies

- 09 июля 2023, 15:33

- |

Good evening traders ☀️

One week passed and today I see interesting ASK imbalances in such currencies as British Pound (6B), Canadian Dollar (6C), Mexican Peso (6M), and they can be realized as shorting opportunities during the next week. Also, I see BID imbalance and potential buying opportunity in Natural Gas (NG) if the price will fix above HFTs’.

I won’t take much time, I managed to talk about everything in 5 minutes

Блог им. st-travich |⚡️ Today I want to measure a Canadian Dollar (6C)

- 26 февраля 2023, 21:23

- |

Good evening, traders!👋

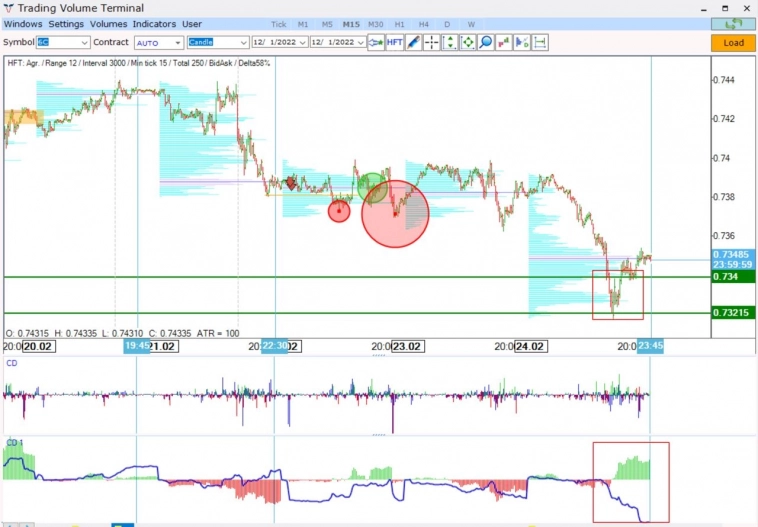

Today I want to measure a Canadian Dollar (6C).

▪️ So we see how the price came to the solid technical support on the daily chart. (watch)

But look at significant block trades on the options market passed on strike 0,74.

▪️ Moreover, on the 15M chart, we also came to double strong volumetric support zone. (watch)

( Читать дальше )

Блог им. st-travich |Robbins World Cup 2022 participation

- 02 октября 2022, 15:05

- |

Hello friends, finally I entered the list of the world 🌎 best traders according to famous world cup trading championship in which Larry Williams participated. This is the futures and forex section combined.

www.worldcupchampionships.com/world-cup-trading-championship-standings

This year I started this competition which began on June 1, and honestly, I am very happy to see my result on this list today. 🥳

During this competition of course I use the same methods and tools of volume analysis and order flow analysis that I give you in my market reviews and forecasts.

And today I also want to present you with such a forecast. That week was very volatile, very liquid, with a lot of strong movements, and I want to discuss with you some imbalances on the futures market which happened by the end of the week.

We will measure the Canadian dollar (6C), Japanese yen (6J), S&P 500 (ES), US Treasuries (UB) .

This 8-minute video is for you today

( Читать дальше )

Блог им. st-travich |NEW buying opportunities in 6N, 6C, 6A and Corn

- 21 августа 2022, 18:03

- |

Good day, Traders, NEW video analysis is ready!

Today we will speak about Corn (ZC) and buying opportunities in the New Zealand dollar (6N), Canadian dollar (6C), and Australian dollar (6A).

Hope this information will be very helpful for you!

This time it’s a 10-minute video to watch

( Читать дальше )

Блог им. st-travich |СME Futures Analysis 12.06.2022

- 13 июня 2022, 01:22

- |

Hello Traders!

🔻 I see a very peculiar picture in Platinum (PL). As always: stops — rejection — involvement — rejection. And here we have 2 targets: 1020 — short term target on the 15M chart and 1060 target on the daily chart. We see how OI decrease during the last down wave. Sellers and buyers close their positions. But from the previous COT report Funds even doubled their longs from 3K to almost 7K longs, and I hope they will continue to do this at this discount. (See)

🔻Next, I expect a short continuation in Soybeans (ZS). 1770 was a beautiful sell entry point under the stopping HFT volumes level. But according to the strong effort and the low result of the delta, it was necessary to ensure who will win in this battle and somehow join the winner. Honestly, I could not do it, but it was worth it. The peak of growth in volatility and purchases of call options has already been passed and traders will continue to close their hedges. (See)

( Читать дальше )

Блог им. st-travich |COT reports

- 25 апреля 2022, 23:03

- |

Let's overview and discuss potential scenarios for the futures market.

The previous week was very powerful for predictions, especially on gold, silver, and Mexican peso. Let's see and try to find what to do next.

( Читать дальше )

Блог им. st-travich |COT reports

- 19 апреля 2022, 22:36

- |

Hello Traders!

It was a volatile but not so good week, eventually for me. My expectations about US Treasury Bonds, the Australian dollar have not been realized and the Japanese Yen made a hard rock falling, without any correction, because of the very dovish monetary policy of the central bank compared with FED.

🔺 But still, Ultra US Treasury Bonds (UB) can show us buying opportunities on this level

It was my plan and I traded it, of course, the most important thing is to manage your risk, not to be suffered very much because of unexpected movements.

🔺 Even the Mexican peso (6M) returned to breakeven. Of course, I expect a further continuation, but it is not the proper picture.

( Читать дальше )

Блог им. st-travich |⚡️ Дивергенция дельт + HFT объемы, примеры на разных активах

- 27 апреля 2021, 10:59

- |

На каких активах товарного, валютного рынка, а также индексах, работает стратегия дивергенции кумулятивной дельты по объему КД и агрегированной дельты по количеству тиков (сделок) КДК?

Практически на всех, лучше дождаться своего рынка и своей ТВХ, которую видно невооруженным увеличительными приборами глазом.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- экономика

- юмор

- яндекс