QJGlXS3Ars

Запускаю первого робота на реале

- 12 февраля 2018, 07:47

- |

Давно не писал.

Уже было почти разочаровался в своей способности придумать удовлетворяющую меня систему, но где-то в ноябре 17 решил попробовать еще раз с начала, иии вот...

Немного технической части.

Был написан API для метатрейдера. «Советник» общается со внешним миром используя JSON HTTP, с обратной стороны находится питоновый скрипт который делает все самое основное. По сути советник только сообщает текущие цены и выполняет торговые операции от имени скрипта. Из-за того, что скрипт который всё решает написан на питоне, существенно увеличилась продуктивность исследования и разработки. Так же пришлось арендовать VPS, потому что домашний интернет consumer grade и иногда отваливается. Несмотря на то, что uptime SLA на VPS около 99.95%, отваливание интернета там я ни разу не заметил.

Немного об исследовании.

Идеи мне приходят в голову обычно рано утром после того как я просыпаюсь, да и вообще максимальная продуктивность у меня до 12 дня, после этого стараюсь не работать, а заниматься другими делами. Тестирование идей происходит в питоновом ноутбуке, что-то вроде такого:

( Читать дальше )

- комментировать

- 3.9К | ★6

- Комментарии ( 16 )

Курс Йельского университета на тему финансовых рынков

- 07 августа 2017, 20:04

- |

Очень понравилось, даже несмотря на то, что я не фанат теории.

www.youtube.com/playlist?list=PL8F7E2591EE283A2E

Список лекций для быстрого ознакомления о чем вообще речь:

1. Finance and Insurance as Powerful Forces in Our Economy and Society

2. The Universal Principle of Risk Management: Pooling and the Hedging of Risks

3. Technology and Invention in Finance

4. Portfolio Diversification and Supporting Financial Institutions (CAPM Model)

5. Insurance: The Archetypal Risk Management Institution

6. Efficient Markets vs. Excess Volatility

7. Behavioral Finance: The Role of Psychology

8. Human Foibles, Fraud, Manipulation, and Regulation

9. Guest Lecture by David Swensen

10. Debt Markets: Term Structure

11. Stocks

12. Real Estate Finance and its Vulnerability to Crisis

13. Banking: Successes and Failures

14. Guest Lecture by Andrew Redleaf

15. Guest Lecture by Carl Icahn

16. The Evolution and Perfection of Monetary Policy

17. Investment Banking and Secondary Markets

18. Professional Money Managers and Their Influence

19. Brokerage, ECNs, etc.

20. Guest Lecture by Stephen Schwarzman

21. Forwards and Futures

22. Stock Index, Oil and Other Futures Markets

23. Options Markets

24. Making It Work for Real People: The Democratization of Finance

25. Learning from and Responding to Financial Crisis I (Lawrence Summers)

26. Learning from and Responding to Financial Crisis II (Lawrence Summers)

Почему при обсуждении стратегий все спрашивают про "проскальзывание"? Если стопы прячет робот и ставит лимитники при приближении к уровням стопов - о каком проскальзывании может идти речь?

- 28 февраля 2016, 08:07

- |

Подводим итоги года пребывания на СЛ

- 23 февраля 2016, 15:43

- |

Написал первый пост тут

За прошедший год:

— доход от трейдинга всё еще составляет 0 руб\мес (радует, что слито пока тоже 0 руб)

— придумано название компании, которая будет основана и где у меня будут свои собственные рабы :)

— средневзвешенный доход увеличился до 400 000 руб\мес, всё еще мало...

— сильно изменилось отношение к рынку, теперь это просто набор цифр в котором можно выловить неэффективность

— устоялось внутреннее понимание, что рынок неслучаен. математешки надо мной смеются, т.к. «невозможно доказать». я продолжаю считать, что пока они не могут доказать — некоторые уносят бабло с рынка. им не говорю — всё равно засмеют :)

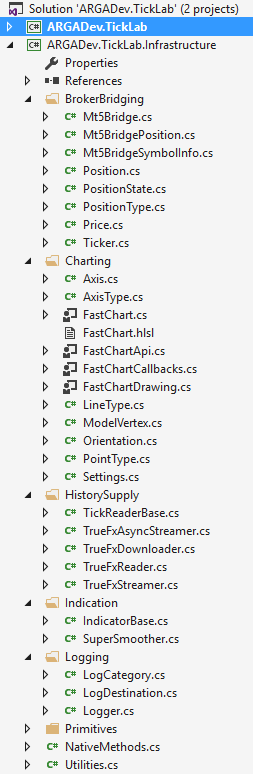

— оброс наработками кода (всё на C#) - имеется быстрая рисовалка графиков, кучка самописных индикаторов, нормальная обертка для терминала, асинхронный скармливатель истории тестеру, и т.д.

— прям в данный момент пишу обработку перехода состояний конечного автомата главного диспетчера своего робота

— избавился от свечь и иных способов сжатия биржевой информации. теперь только тики, просто аггрегирую по своим алгоритмам, которые урезают ненужную информацию… свечи вообще мало для чего годятся

— разочаровался в СЛ где-то после 3х месяцев пребывания..

— постарался максимально избавиться от нелицензионного софта… сейчас только офис того (планирую купить). стало как-то легче на душе

Планы на этот год:

— запустить робота на реале в случае удачных тестов

— продолжать увеличивать доход… на меньше $10k\мес не имея в собственности нормального жилья и машины особо не прожить даже одному

— т.к. лудоманией из-за наличия робота не смогу пострадать — то необходимость публично вести сделки отпадает, но может быть попробую..

Немножко картинок

Текущая иерархия проекта

Тестируем самописный осциллятор:

( Читать дальше )

Отправляет ли MT5 исходники или бинарники индикаторов куда-либо? Написал хорошую систему, не хочу чтобы она оказалась у брокера

- 07 сентября 2015, 12:21

- |

- ответить

- 46 |

- Ответы ( 6 )

Продолжаем срач про баны

- 17 августа 2015, 10:34

- |

Здравствуйте! Хорошего вам дня!

Я удивлен количеству топиков про «а почему банят Х, а не банят Y». «Забаньте A, он(а) написал(а) B!».

Попробуем разобраться.

Мне, как программисту, всегда бросается в глаза, что некто Тимофей довольно часто упоминает хабрахабр как пример. Возникает вопрос: что такого есть у хабрахабра, чего нет у смартлаба. Я могу представить себе 2 возможных ответа:

1. Посещаемость ресурса = деньги = моральное удовлетворение создателя

2. Качество ресурса = моральное удовлетворение создателя

Давайте на минутку представим, что основная цель Тимофея не №1. Назовем цель №1 побочной целью. Даже если это не так (скорее всего), то постараемся видеть в людях только лучшее :)

Что же нужно сделать чтобы вытянуть смартлаб до уровня хабрахабра? Речь не идет про качество обертки, а про качество самой конфеты.

Когда я впервые узнал о хабрахабре, его идея для меня показалась довольно необычной. Мало было зарегистрироваться и перейти по ссылке активации аккаунта и начать удлинять свою пиписку (путем увеличения рейтинга). Необходимо было получить приглашение на сайт от участника с уже достаточно большим, эээмм… рейтингом! Это можно было сделать двумя способами: 1. выклянчить, 2. написать пост, который понравится участнику сообщества. Таким образом хабрахабр отсеивал посторонних людей, не заинтересованных в том, чтобы сделать ресурс лучше.

( Читать дальше )

Играемся с НЧ-фильтрами и уровнями поддержки/сопротивления

- 06 апреля 2015, 11:56

- |

Все знают про торговую систему основаную на скользящей средней. Цена пересекает СС (уж простите за каламбур) с нижней стороны — покупаем, с верхней — продаем. На глаз выглядит идеально, но в итоге — тихонечко сливает на боковом тренде оставляя вас с дырявыми штанами. Все также знают про торговлю на пробой горизонтального уровня. Проблемка в том, что этих уровней можно построить, как у персептрона классификаторов одного датасета, — бесконечное множество. Итог — те же дырявые штаны.

Подождите. Мы не хотим просто так сдаваться и верим в простые вещи, просто хотим немного их оптимизировать.

Что есть скользящая средняя? Типичный пример аналогового фильтра низких частот. Но она немного устарела. Примерно на пару-тройку десятков лет. С тех пор прикладная математика продвинулась к EMA, T3, JMA (ксати, лучшая на сегодня), без-названия основанная на полиномах Лежандра и т.д. Но мы хотим что-нибудь, что просто реализуется и лучше приблизит нас к скользящей, как будто она есть тригонометрический полином (почему — позже :)). Сразу на ум приходит простейший FIR-фильтр с характеристикой основанной на косинусоидальных затухающий колебаниях. Схема такого фильтра:

( Читать дальше )

О подходе к рынку одного новичка

- 09 марта 2015, 09:59

- |

В году 2010 начали появляться зачатки разума, я перестал интересоваться ТВ, посиделками с друзьями, всем что интересно молодежи сейчас. За время своей учебы в университете я превратился в то, чем я являюсь по сей день: мизантропично-нигилистичное существо с большим самомнением (считаю, обоснованным :) ). Я стал больше интересоваться профильными форумами, прочитал про то как работают кухни, начал изучать психологию людей. Сейчас мне 23 и я очень сильно изменился с 2008 года, за исключением одного: мною всё еще овладевает желание обогатиться. Оно осознанно, я прекрасно понимаю, что вмиг этого сделать не удастся, но и стоять у станка на МТЗ клепая подшипники бок о бок с Васей меня не прельщает. На данный момент у меня за душой нет ничего, кроме USD 30k (учитывая машину стоимостью в 10 тысяч). Я осознаю, но всё еще боюсь поставить перед собой цель: USD 10k net income/мес при условии уже имеющейся недвижимости тут и в какой-нибудь Испании для отдыха. Довольно амбициозная цель, учитывая что мой средневзвешенный доход за последний год составил USD 3k/мес (около RUR 180k). Но это всё лирика!

( Читать дальше )