Блог им. Farmabear

MOODY отправило на пересмотр рейтинг Deutsche Bank

- 22 марта 2016, 01:11

- |

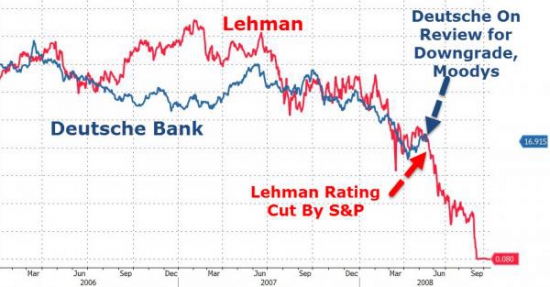

Будет ли пересмотр той каплей что превратит Deutsche Bank в Black Swan inc. ?

честно сжижено с ZH

UPD немного жути на ночь =) (из статьи от 25.06.2015)

Let’s see what was happening in DB last year:

— April 2014 – Deutsche Bank is forced to increase its capital by 1.5 billion EUR by (organy nadzoru)

— May 2014 – DB is selling 8 billion EUR of assets with 30% rebate to maintain liquidity. Losing cash flow and money is the quickest way to bankruptcy.

— March 2015 – DB fails stress tests. Even Belgian DEXIA who days afterwards was insolvent did pass.

— April 2015 – DB has to pay 2.5 billion USD settlement after LIBOR manipulation scandal investigation comes to conclusion (conspiracy theory about markets manipulation anyone?)

— May 2015 – Authority of one of the DB chairman — Anshu Jain — were broadened to unsurpassed levels, this happens only in the dire conditions of deep crisis.

— 5 June 2015 – Greece falls behind on its payments to the IMF, this has consequences for the DB.

— 6 June 2015 (day after) – Two chairmen – Jain and Fitshen – resign of their post. It is clear situation of abandoning already sinking ship. Jain’s resignation is postponed till end of June while Fitshen agreed to stay till the end of May 2016.

— 9 June 2015 – Rating agency Standard & Poor’s lowers DB rating to BBB+ (lower than the Lehman’s rating on the day of its bankruptcy and only 3 levels higher than ‘junk bonds’).

теги блога FrBr

- Black Swan

- Br

- Brent

- DX

- Fitch

- flat

- forex

- HFT

- interactive brokers

- QUIK

- S&P500

- SECRET

- Si

- usd

- usd rub

- USD-RUB

- USDRUB

- Акции

- банки

- Бастрыкин

- Безработица

- БКС

- брент

- Брокеры

- бюджет 2015

- вопрос

- вывод средств

- выходной

- ГО

- Греки

- дефолт

- ДНР

- Доллар

- Доллар рубль

- Донбасс

- Доолар

- Дядя коля

- Евро

- ЗВР

- Интервенции

- Иран

- Исторические данные

- клиринг

- Конец нефтяной эры

- красота

- кризис

- кукл

- кухни

- Лаги

- лчи

- ЛЧИ 2015

- маржиналка

- Минфин

- ММВБ

- Нефть

- Объемы

- опек+

- опрос

- опцин Si

- опционы

- оффтоп

- пари

- планка

- плечо

- Порошенко

- Праздники

- Производство

- Профит

- РБК

- РЕПО

- Роботы

- роботы Quik

- РТС

- руб доллар

- рубель

- рублебочка

- рубль

- Рубль рост

- санкции

- сбербанк

- Сбербанк брокер

- Сечин

- Си

- Сирия

- спред

- ставка

- ставка фрс

- Т-Банк инвестиции

- торговые сигналы

- трамп

- Траст

- украина

- форекс

- ФОРТС

- ФРС

- ЦБ

- ЦБ интервенция рубль

- экспирация

- юмор

- япония

Похоже санкции против России не довели до добра.