SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. Shark_Traders

Аналитика на 11 апреля

- 11 апреля 2013, 17:05

- |

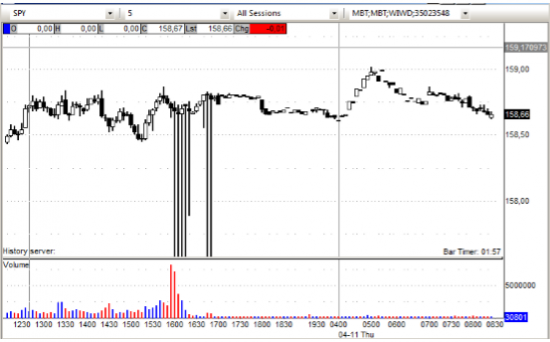

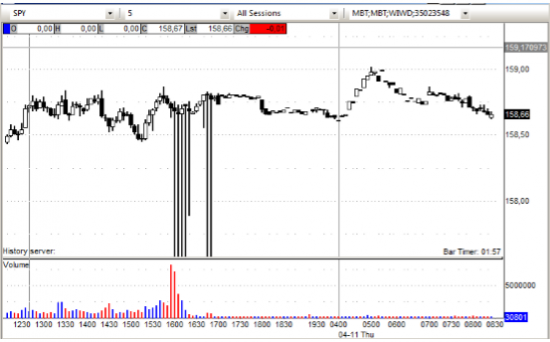

Спайдер торгуется на премаркете около уровня вчерашнего закрытия.

SPY (внутридневной график) боковое движение на премаркете. Сопротивление 159.00 Поддержка: 158.50

Ожидаемая макроэкономическая статистика:

Gapping up:

In reaction to strong earnings/guidance/SSS: RAD +12.8%, ZUMZ +8%, BBBY +1.5%, COST +0.9% (light volume).

M&A news: LIFE 1.1% (continued M&A related speculation, WSJ discusses ongoing M&A speculation in LIFE as PE firms BX, KKR, and CG remain as possible buyout group).

Other news:

ACAD +25.5% (announces expedited path to NDA Filing for Pimavanserin following meeting with FDA), AEZS +25.3% (presents encouraging updated data on its LHRH receptor-targeted Disorazol Z Cytotoxic Conjugates at AACR Meeting), AMRS +18.5% (describe breakthrough in development of anti-malarial drug precursor; Sanofi (SNY) utilizing Amyris engineered yeast strains to produce drug ingredient at scale), NMR +8.2% and TM +3.9% (following strength in overseas trading — Nikkei 2.0%), CTIC +5.3% (announces NICE issue draft guidance on PIXUVRI), PSTI +3% (United Therapeutics receives regulatory approval to commence Phase I study of Pluristem's PLX-PAD cells for pulmonary arterial hypertension), TI +2.4% (Telecom Italia Board considering to allow Hutchison Whampoa to purchase stake in TI, according to reports), ELN +1.5% (still checking), UL +1.1% (still checking), NBL +1.1% (trading higher following CEO comments, see company as doubling), IP +1% (reports out indicate Dan Loeb's Third Point LLC has increased its stake in International Paper).

Analyst comments: BYD +3% (upgraded to Overweight from Equal-Weight at Morgan Stanley), DGX +1.2% (upgraded to Buy from Neutral at Goldman), XRX +0.4% (Xerox initiated with an Overweight at Piper Jaffray), AMGN +0.3% ($125 from $106 at Lazard)

Gapping down:

In reaction to disappointing earnings/guidance/SSS: FTNT -17.7% (also downgraded by multiple analysts), APOG -7.5%, IART -7% (issues voluntary recall of certain products manufactured in its Anasco, Puerto Rico facility; expects revs lower by ~$8-11 mln in Q1, also downgraded by ,ultiple analysts), PIR -3.6%, YUM -3%, PFMT -1.1%, LTD -1%.

Select metals/mining stocks trading lower: MT -1.8%, GOLD -1.5%, AU -1.1% (downgraded to Hold from Buy at Societe Generale), BBL -0.7%, BHP -0.5%, SLV -0.3%,.

PC/tech names lower following disappointing IDC report: HPQ -5.5%, MSFT -3.9% (also downgraded at Goldman and Nomura), INTC -2.3%, TDC -0.8%

A few FTNT/security tech companies under pressure: FIRE -3.6%, PANW -2.8%, CHKP -1.6%

Other news: AFFY -17% (disclsoed that AFFY and Takeda Pharmaceutical entered into the Fourth Amendment to the February 13, 2006 and June 27, 2006 collaboration andlLicense agreements), SSH -8.2% (has commenced underwritten public offering of common stock pursuant to effective shelf registration previously filed with the SEC), SGYP -5.2% (prices 16.375 mln shares of common stock for gross proceeds of ~$90 mln ), INFI -4% (announces pricing of secondary offering of common stock by existing shareholders Beacon Company and Rosebay Medical Company ), FSC -3.8% (commences public offering of 13.5 mln shares of common stock), ROYL -2.4% (modestly pulling back), PKX -1.6% (still checking), RLGY -0.6% (prices 35 mln share offering by certain funds affiliated with Apollo Global Management (APO) at $44.00 per share ).

Отчеты компаний:

Вчера после закрытия: RT RELL APOG CHC

Сегодня перед открытием: NTIC CBSH IGTE PIR RAD LEDS

Торговые идеи NYSEи NASDAQ:

FTNT– очень сильное падение на постмаркете и премаркете, реакция на Guidance. Ключевые уровни 18.00 и 19.00, работаем от них.

BBBY– отчет и гайденс на текущий год. При закрепелнии 67.00 смотрим акцию в лонг, ниже 66.00 – шорт.

YUM– опубликовали результаты по продажам на фоне птичьего гриппа в Китае. Снижение продаж примерно на 13%, смотрим акцию в шорт ниже 64.00, выше 65.50 – лонг.

ACAD– опубликован новый документ FDA по результатам 3его этапа испытаний препарата компании. Очень сильный рост на премаркете, ниже 12.00 смотрим сетапы в шорт с потенциалом от 50 центов до доллара.

Оригинал статьи: http://shark-traders.com/blog/analitika-na-11-aprelya/

- Европейские индексы на положительной территории.

- Nikkei +1,96 %

SPY (внутридневной график) боковое движение на премаркете. Сопротивление 159.00 Поддержка: 158.50

Ожидаемая макроэкономическая статистика:

- Initial Claims (8:30am)- Briefing.com consensus 365K

- March Import/Export Prices (8:30am)- Prior 0.0%, +0.6%, respectively

- Natural as Inventories (10:30am)

- 30-year Bond Auction (1pm)

Gapping up:

In reaction to strong earnings/guidance/SSS: RAD +12.8%, ZUMZ +8%, BBBY +1.5%, COST +0.9% (light volume).

M&A news: LIFE 1.1% (continued M&A related speculation, WSJ discusses ongoing M&A speculation in LIFE as PE firms BX, KKR, and CG remain as possible buyout group).

Other news:

ACAD +25.5% (announces expedited path to NDA Filing for Pimavanserin following meeting with FDA), AEZS +25.3% (presents encouraging updated data on its LHRH receptor-targeted Disorazol Z Cytotoxic Conjugates at AACR Meeting), AMRS +18.5% (describe breakthrough in development of anti-malarial drug precursor; Sanofi (SNY) utilizing Amyris engineered yeast strains to produce drug ingredient at scale), NMR +8.2% and TM +3.9% (following strength in overseas trading — Nikkei 2.0%), CTIC +5.3% (announces NICE issue draft guidance on PIXUVRI), PSTI +3% (United Therapeutics receives regulatory approval to commence Phase I study of Pluristem's PLX-PAD cells for pulmonary arterial hypertension), TI +2.4% (Telecom Italia Board considering to allow Hutchison Whampoa to purchase stake in TI, according to reports), ELN +1.5% (still checking), UL +1.1% (still checking), NBL +1.1% (trading higher following CEO comments, see company as doubling), IP +1% (reports out indicate Dan Loeb's Third Point LLC has increased its stake in International Paper).

Analyst comments: BYD +3% (upgraded to Overweight from Equal-Weight at Morgan Stanley), DGX +1.2% (upgraded to Buy from Neutral at Goldman), XRX +0.4% (Xerox initiated with an Overweight at Piper Jaffray), AMGN +0.3% ($125 from $106 at Lazard)

Gapping down:

In reaction to disappointing earnings/guidance/SSS: FTNT -17.7% (also downgraded by multiple analysts), APOG -7.5%, IART -7% (issues voluntary recall of certain products manufactured in its Anasco, Puerto Rico facility; expects revs lower by ~$8-11 mln in Q1, also downgraded by ,ultiple analysts), PIR -3.6%, YUM -3%, PFMT -1.1%, LTD -1%.

Select metals/mining stocks trading lower: MT -1.8%, GOLD -1.5%, AU -1.1% (downgraded to Hold from Buy at Societe Generale), BBL -0.7%, BHP -0.5%, SLV -0.3%,.

PC/tech names lower following disappointing IDC report: HPQ -5.5%, MSFT -3.9% (also downgraded at Goldman and Nomura), INTC -2.3%, TDC -0.8%

A few FTNT/security tech companies under pressure: FIRE -3.6%, PANW -2.8%, CHKP -1.6%

Other news: AFFY -17% (disclsoed that AFFY and Takeda Pharmaceutical entered into the Fourth Amendment to the February 13, 2006 and June 27, 2006 collaboration andlLicense agreements), SSH -8.2% (has commenced underwritten public offering of common stock pursuant to effective shelf registration previously filed with the SEC), SGYP -5.2% (prices 16.375 mln shares of common stock for gross proceeds of ~$90 mln ), INFI -4% (announces pricing of secondary offering of common stock by existing shareholders Beacon Company and Rosebay Medical Company ), FSC -3.8% (commences public offering of 13.5 mln shares of common stock), ROYL -2.4% (modestly pulling back), PKX -1.6% (still checking), RLGY -0.6% (prices 35 mln share offering by certain funds affiliated with Apollo Global Management (APO) at $44.00 per share ).

Отчеты компаний:

Вчера после закрытия: RT RELL APOG CHC

Сегодня перед открытием: NTIC CBSH IGTE PIR RAD LEDS

Торговые идеи NYSEи NASDAQ:

FTNT– очень сильное падение на постмаркете и премаркете, реакция на Guidance. Ключевые уровни 18.00 и 19.00, работаем от них.

BBBY– отчет и гайденс на текущий год. При закрепелнии 67.00 смотрим акцию в лонг, ниже 66.00 – шорт.

YUM– опубликовали результаты по продажам на фоне птичьего гриппа в Китае. Снижение продаж примерно на 13%, смотрим акцию в шорт ниже 64.00, выше 65.50 – лонг.

ACAD– опубликован новый документ FDA по результатам 3его этапа испытаний препарата компании. Очень сильный рост на премаркете, ниже 12.00 смотрим сетапы в шорт с потенциалом от 50 центов до доллара.

Оригинал статьи: http://shark-traders.com/blog/analitika-na-11-aprelya/

31

Читайте на SMART-LAB:

Алексей Миллер вновь возглавит Газпром: ждём новых пяти успешных лет?

Совет директоров Газпрома 13 февраля принял решение продлить полномочия председателя правления корпорации Алексея Миллера ещё на пять лет, до мая...

11:36

ПИК уходит с биржи? VK, ВТБ и новая ставка ЦБ

Что задумал ПИК и как это связано с «Самолетом»? Разобрали бумаги «Новатэка», VK и ВТБ — и выяснили, почему среди акционеров почти не видно...

11:07

теги блога Shark Traders

- AMEX

- CME

- forex

- multicharts

- NASDAQ

- NYSE

- research

- spin off

- sterling

- stocks in play

- stocks inplay

- support

- алготрейдинг

- аналитика

- бинарные опционы

- брокеры

- вакансия

- дейтрейдинг

- котировки

- Московская биржа

- Московская биржа ММВБ-РТС

- отбор акций

- оффтоп

- программирование торговых роботов

- стратегия

- торговые алгоритмы

- торговые идеи

- Торговые роботы

- фьючерсы