Big Picture фондового рынка америкиПривет, Друзья!

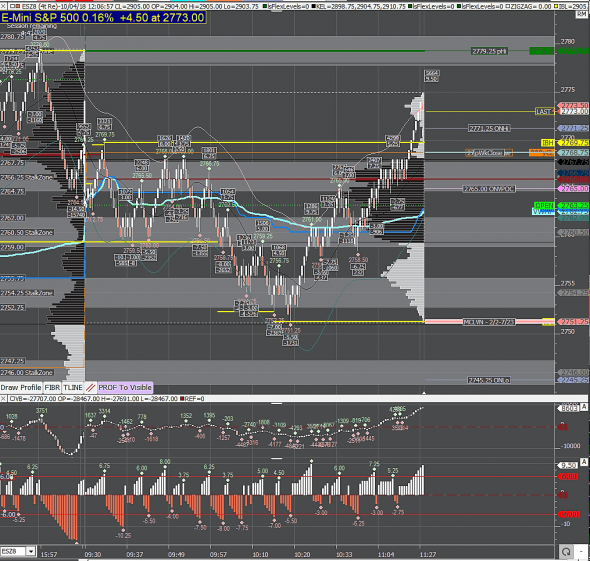

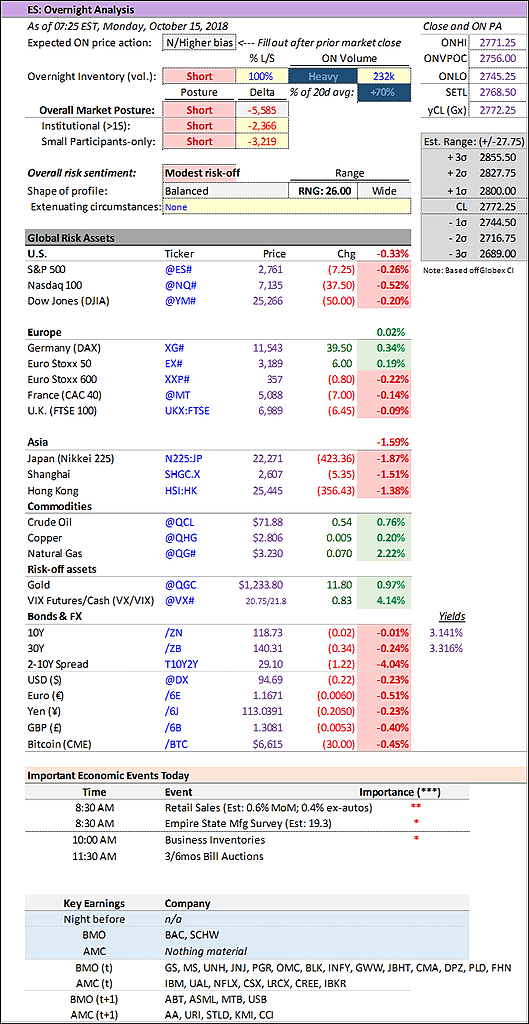

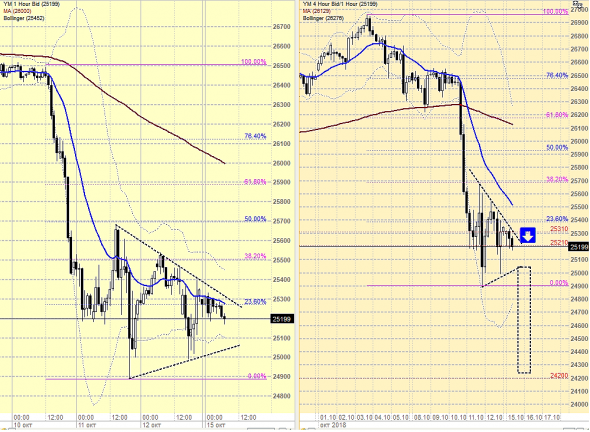

Итак, это была не самая лучшая неделя для фондовых рынков и многих, особенно краткосрочных трейдеров, рынок заставил понервничать. Давайте оценим общую ситуацию на рынках и потом я покажу вам некоторые торговые идеи и заготовки на предстоящую торговую неделю.

Несмотря на панику, которая буквально физически ощущается, когда сканируешь новостные потоки, я по прежнему спокоен за свои открытые позиции. Есть план Б, который я готов реализовывать в случае усиления падения в понедельник.

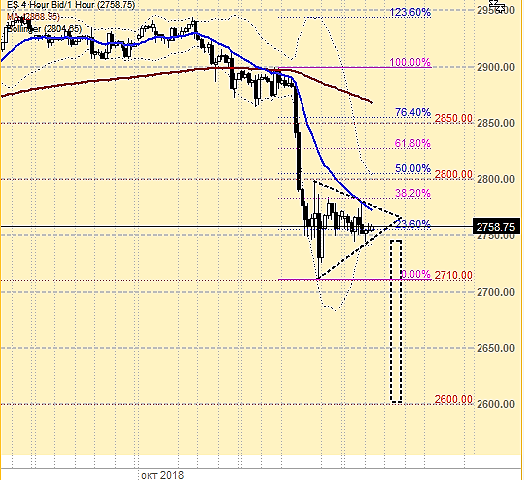

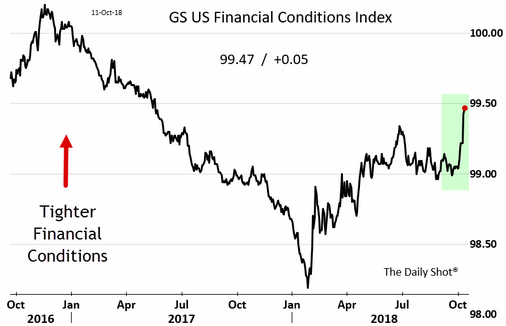

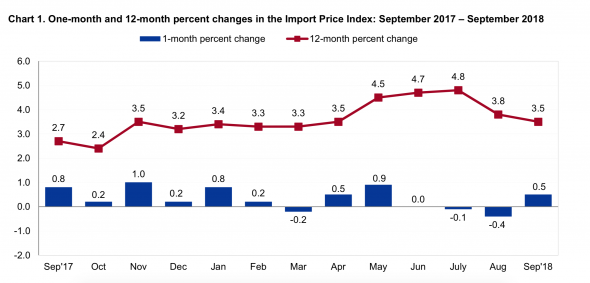

На фоне отсутствия явного негативного драйвера, панические распродажи на той неделе, заинтересовали меня скоростью и широтой падения.

Падали все, large, mid – caps из S&P-500 и Nasdaq, но больше всех досталось сегменту акций из small – cap. И я думаю ближайшие несколько недель, даже если рынок начнет восстанавливаться, акций малой капитализации стоит избегать.

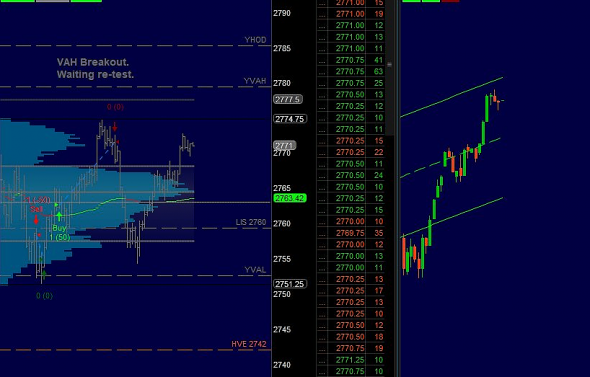

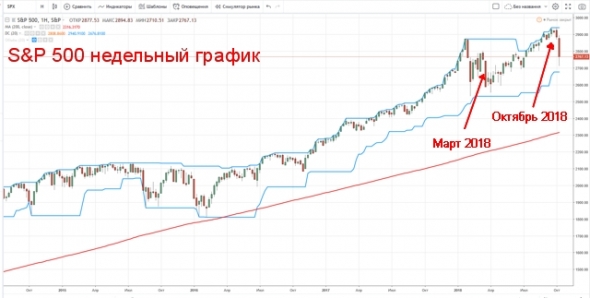

Но все же в конце недели покупатели поддержали долгосрочный восходящий тренд.

Так куда же пойдет рынок?

читать дальше на смартлабе