Этот пролив скорее выкупят, а вот следующий...

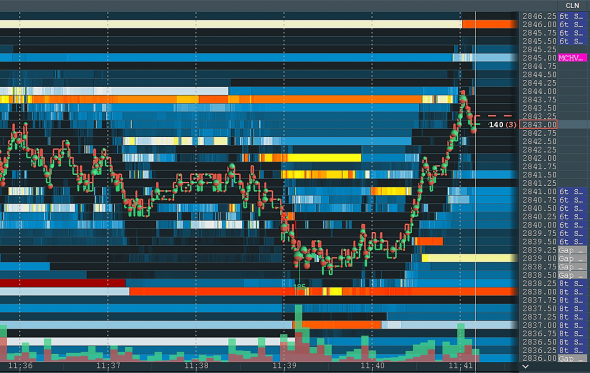

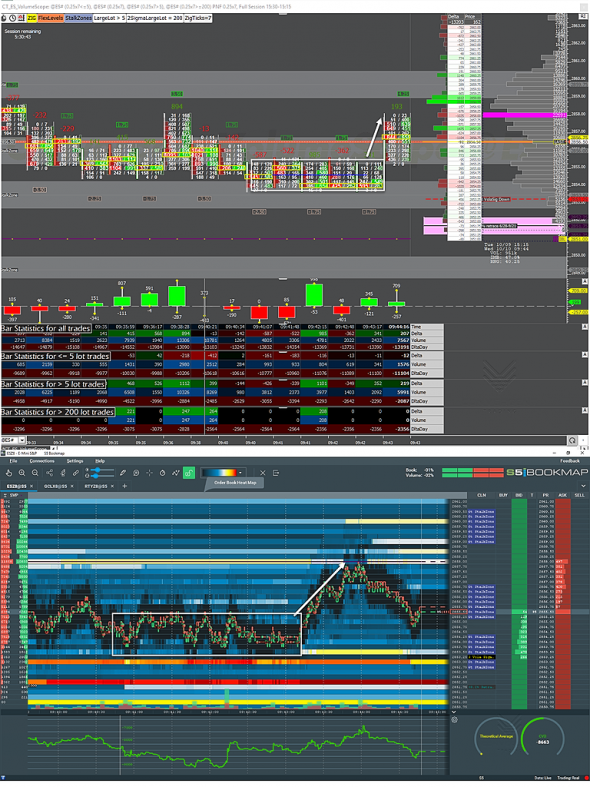

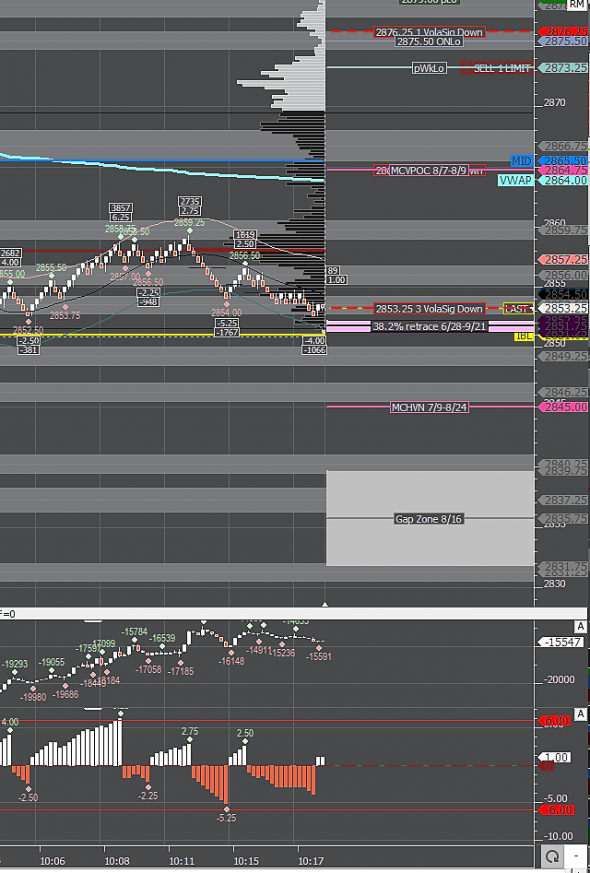

S&P500 фьючерс | SPX

-

Последнее время в Американской прессе очень сильно педалируют будущие перспективы Индии, мясо туда загоняют?

hals, первый раз слышу

Куда деньги идут? Взятое в кредит можно вернуть например)

Тимофей Мартынов, Вы считает фонды на заемные торгуют?

hals, погугли nyse margin debt

А я вчера обращал внимание:

smart-lab.ru/blog/498484.php

Тимофей Мартынов, ну Вы же знаете самого главного специалиста по падению, он наверно и причины знает )))

hals, главный специалист в начале медвежьего тренда обязательно закроет шорт и купит.

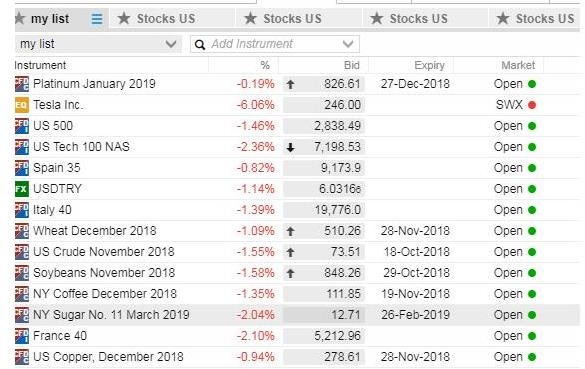

Индексы США снизились примерно на 1 процент в среду, поскольку опасения о Китае и влиянии роста доходности госбондов США на глобальный рост оказали давление на акции производителей товаров класса люкс и поставщиков чипов.

Индексы США снизились примерно на 1 процент в среду, поскольку опасения о Китае и влиянии роста доходности госбондов США на глобальный рост оказали давление на акции производителей товаров класса люкс и поставщиков чипов.

S&P500 фьючерс | SPX

Фьючерс S&P500Торгуется на CME, тикер ES

На Московской бирже есть аналогичный фьючерс US500

Спецификацию и котировки можно найти тут: https://smart-lab.ru/q/futures/ (Ищите наиболее ликвидный символ US)