Тимофей Мартынов, Я новость получил в телеграмьканале БКСКупил пот340, продал по 360 Может по дивам тоже сделать телеграммканал?

Neznaika1975, можно конечно нам всё сделать.

но не успеваем все хотелки сразу)

| Число акций ао | 2 179 млн |

| Число акций ап | 148 млн |

| Номинал ао | 1 руб |

| Номинал ап | 1 руб |

| Тикер ао |

|

| Тикер ап |

|

| Капит-я | 1 291,4 млрд |

| Выручка | 1 977,0 млрд |

| EBITDA | 396,0 млрд |

| Прибыль | 212,7 млрд |

| Дивиденд ао | 65,63 |

| Дивиденд ап | 65,63 |

| P/E | 6,1 |

| P/S | 0,7 |

| P/BV | 1,0 |

| EV/EBITDA | 3,3 |

| Див.доход ао | 11,8% |

| Див.доход ап | 12,4% |

| Татнефть Календарь Акционеров | |

| Прошедшие события Добавить событие | |

Тимофей Мартынов, Я новость получил в телеграмьканале БКСКупил пот340, продал по 360 Может по дивам тоже сделать телеграммканал?

Тимофей Мартынов, в год раза 3 такие возможности предоставляются, и как мне их поймать? а смартлаб мог помочь, но как сейчас — помощь минимальная, я же говорю о специальном выделении именно таких важных новостейIgr, да кто ж знал что они прям важные? Ну да, была 10%+ дивдоха на преф. Но кто думал что бумага так выстрелит

Тимофей, вот сегодня на новости про дивы можно было хорошо подзаработать, на смартлабе оперативно новость вышла, но её так просто не увидеть, надо форум мониторить, а ведь можно было такую новость показать на главной, красным выделить, думаю люди бы оценили и заходили ради таково чаще сюда

Igr, во всем виноват Редактор Боб! Это он новость на главную не пульнул.

Ну а вам кто мешает читать новости в разделе: smart-lab.ru/allnews/

Тем более ссылка на новости прямо на главной есть

Тимофей Мартынов,

Я новость получил в телеграмьканале БКС

Купил пот340, продал по 360

Может по дивам тоже сделать телеграммканал?

Тимофей, вот сегодня на новости про дивы можно было хорошо подзаработать, на смартлабе оперативно новость вышла, но её так просто не увидеть, надо форум мониторить, а ведь можно было такую новость показать на главной, красным выделить, думаю люди бы оценили и заходили ради таково чаще сюда

Igr, во всем виноват Редактор Боб! Это он новость на главную не пульнул.

Ну а вам кто мешает читать новости в разделе: smart-lab.ru/allnews/

Тем более ссылка на новости прямо на главной есть

Тимофей, вот сегодня на новости про дивы можно было хорошо подзаработать, на смартлабе оперативно новость вышла, но её так просто не увидеть, надо форум мониторить, а ведь можно было такую новость показать на главной, красным выделить, думаю люди бы оценили и заходили ради таково чаще сюда

Igr, во всем виноват Редактор Боб! Это он новость на главную не пульнул.

Ну а вам кто мешает читать новости в разделе: smart-lab.ru/allnews/

Тем более ссылка на новости прямо на главной есть

Тимофей, вот сегодня на новости про дивы можно было хорошо подзаработать, на смартлабе оперативно новость вышла, но её так просто не увидеть, надо форум мониторить, а ведь можно было такую новость показать на главной, красным выделить, думаю люди бы оценили и заходили ради таково чаще сюда

Татнефть объявила дивиденды на обычные и привилегированные акции в размере 2778% к номинальной стоимости акции, то есть 27,78рубля на акцию!

www.e-disclosure.ru/portal/event.aspx?EventId=U5m9fqe7xUaAqfUSO55BjQ-B-B

Кот Баюн, спасибо за оперативную информацию!

Татнефть объявила дивиденды на обычные и привилегированные акции в размере 2778% к номинальной стоимости акции, то есть 27,78рубля на акцию!

www.e-disclosure.ru/portal/event.aspx?EventId=U5m9fqe7xUaAqfUSO55BjQ-B-B

Меня это разочаровало, я вышел из акций Татнефть.

Татнефть разочаровывает инвесторов

26 октября 2017 года в г. Казань состоялось очередное заседание Совета директоров Компании «Татнефть» под председательством Президента Республики Татарстан Р.Н. Минниханова.

Основной вопрос который обсуждался на повестке дня, перспективы дальнейшего развития проекта «П-Д Татнефть — Алабуга Стекловолокно». В настоящее время предприятие является одним из крупнейших в отрасли и обеспечивает выпуск 32% продукции, производимой на территории РФ.

Что производит Алабуга?

— Ровинг;

— Стеклосетка;

— Стекломаты;

— Стеклоткань;

— Стеклонити.

Я не хочу сказать, что это не нужное производство и продукция. Нужно даже отметить, что Китай очень активно развивается по данному направлению.

Просто сырье для изготовления это битое стекло. Продукция что то вроде полиэтилена или пластмассы. Причем тут нефть?

Меня это разочаровало, я вышел из акций Татнефть.

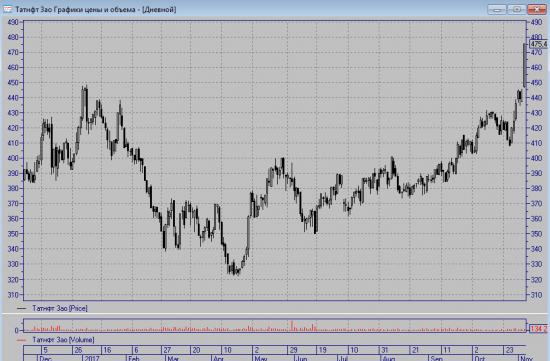

Татнефть — может выплатить дивиденды за 9 месяцев в размере 27,78 рубля на акцию

Совет директоров Татнефти рекомендовал дивиденды по результатам 9 месяцев 2017 года в размере 27,78 руб. на одну привилегированную и обыкновенную акцию

ВОСА — 12 декабря

закрытие реестра для ВОСА — 17 ноября

закрытие реестра под дивиденды — 23 декабря

сообщение

сегодня ожидаем: Татнефть: СД рассмотрит дивиденды за 9 мес

см. календарь по акциям