COT reports

Hello Traders!

It was a volatile but not so good week, eventually for me. My expectations about US Treasury Bonds, the Australian dollar have not been realized and the Japanese Yen made a hard rock falling, without any correction, because of the very dovish monetary policy of the central bank compared with FED.

🔺 But still, Ultra US Treasury Bonds (UB) can show us buying opportunities on this level

It was my plan and I traded it, of course, the most important thing is to manage your risk, not to be suffered very much because of unexpected movements.

🔺 Even the Mexican peso (6M) returned to breakeven. Of course, I expect a further continuation, but it is not the proper picture.

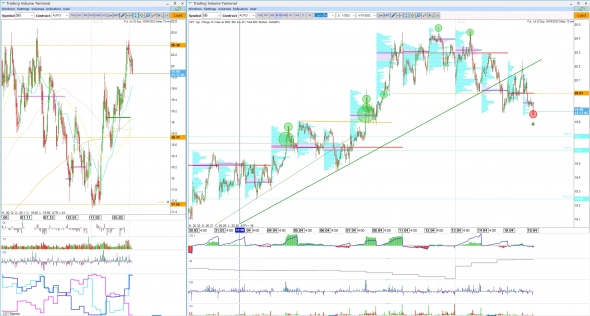

🔺 As you remember, I made a bullish forecast on Gold (GC), and it is really realized. But tomorrow we saw the block trades in call options the price stopped on the commercial level. Without doughts, for me, it is a sell priority.

🔺 Silver (SI) also has potential for short after Call buying orders activation by market orders and also by block trades.

🔺 The Canadian dollar (6C) proceeded to fall that week and I expect will continue this week. Funds increased their positions, but if fact I appreciate looking and following for hedgers' efforts in range (especially on the borders) and for funds intentions in trend, I think you understand why…

🔺 For now, I see the local buying opportunity in Sugar (SB) contracts. I plan to trade this involvement to the upper boundary of the current flat movement.

As a result:

US treasuries (UB) — buy

Gold (GC) - sell

Silver (SI) — sell

Mexican peso (6M) — keep sales

Sugar (SB) — intraday buy

Canadian dollar (6C) — sell

Do not accept this information as financial, investment, trading, or other advice or recommendation. Manage your risk and be very attentive to your decisions and make them by yourself!

Sincerely, Taras Sviatun

Дюша Метелкин20 апреля 2022, 01:58and turn around, son, what a funny you are0

Дюша Метелкин20 апреля 2022, 01:58and turn around, son, what a funny you are0