Америка сегодня. ВВП, Мичиган и заказы на товары длительного пользования.

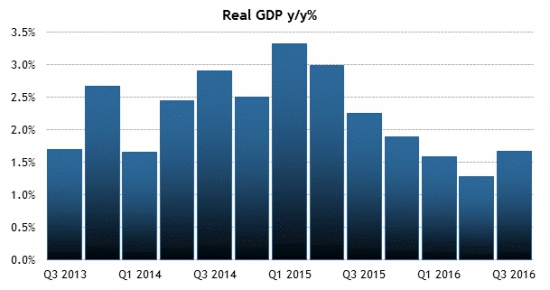

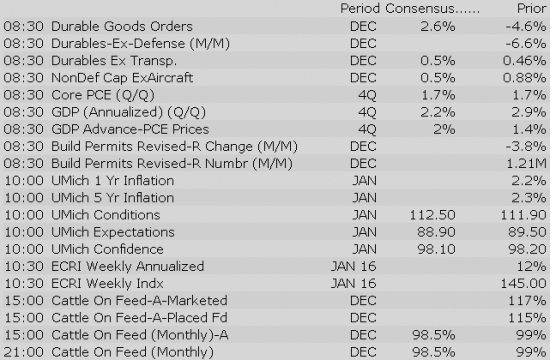

После предыдущего восхитительного квартала, показавшего рост ВВП на 3,5%, в данных за последний квартал 2016-го года аналитики настроены менее оптимистично и прогнозируют рост на уровне 2,2%:

Дальнейший потенциал роста ВВП является открытым и ближайшие несколько кварталов ожидается его продолжение:

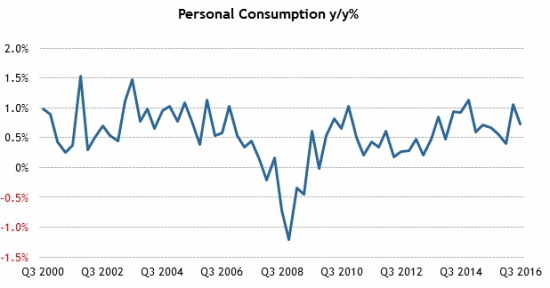

Потребительские расходы при этом подтверждают общий оптимизм, люди склонны тратить больше, когда вокруг всё хорошо и расходы растут:

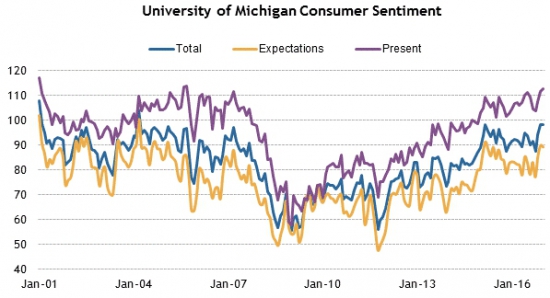

Также оптимизм подтверждается индексом доверия университета Мичиган, который находится и прогнозируется вблизи своих максимальных отметок:

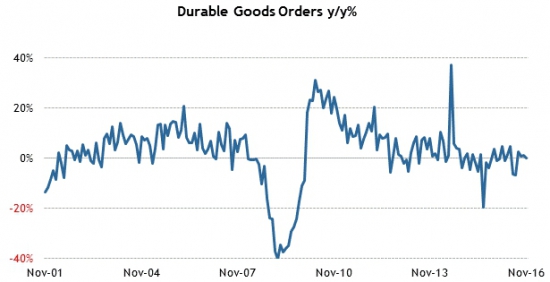

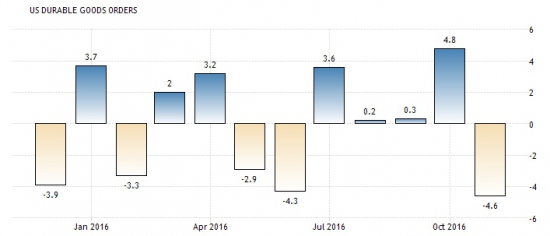

Под влиянием общего оптимизма также ожидается рост в заказах на товары длительного пользования:

Всплеск заказов ожидается к отметке в диапазоне 2.6 — 4%, на уровне прошлогоднего зимнего показателя:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources