11 мая 2012, 12:44

copy-paste: Why The Euro Is So Strong, Or Why The Market Expects $700bn Of Fed QE3

Copy-paste: www.zerohedge.com/news/why-euro-so-strong-or-why-market-expects-700bn-fed-qe3

The question puzzling currency markets is why the EUR is so strong. While we have argued that during the risk-off period of the last month or so post-LTRO2 (before Tuesday) EURUSD strength appeared to be driven by repatriation flows and balance sheet reduction, new information over the last couple of weeks driving the expectation that growth will be weak enough in the US to keep US policy very stimulative for a nice long time, we tend to agree with Steven Englander of Citigroup who argues that it looks very much as if QE3/Fed-stimulus anticipations are behind the EUR relative strength recently. Indeed the recent USD weakness is pretty much across the board, suggesting that it is less EUR attractiveness than USD unattractiveness that is driving the EUR’s gains. That said, I think the buzz around various euro zone measures to help out banks and ease the rigidities of the fiscal compact is also helping support the EUR by reducing tail risk, but right now the USD/Fed is the bigger story. Back of the envelope math based on the Fed/ECB balance sheets and EURUSD implies the market expects around $700bn of QE3 and given swap-spread differentials there appears to be little liquidity premium to reduce this expectation.

The current EURUSD rate implies a Fed/ECB ratio of around 1.2x which infers that the market expects around $700bn of liquidity from the Fed relative to the ECB in the short-run...

And there is little additional liquidity premium (over interest rate differential models) as swap-spreads and EURUSD begin to correlated more highly and also with risk...

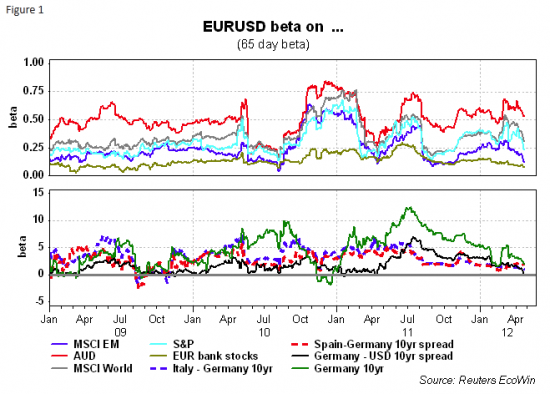

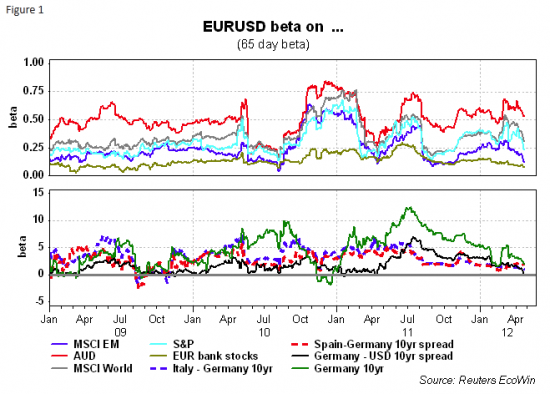

Consider first the evidence that the EUR is positively correlated with risk (Figure 1).

The chart above presents the euro’s beta on changes in other measures of risk appetite. The chart is scaled so that a positive value shows a risk-positive correlated and we use two-day changes to mitigate the impact of different closing times in different markets. What it shows is that the underlying correlation of the euro with risk is positive. It is not clear why this is the case, although I would argue that a risk-positive environment makes investors more willing to tolerate tail risk than a risk off environment and the reserves accumulation/diversification cycle probably is more intense when risk is on. Investors may be wrong in trading the EUR with a positive risk correlation but it is hard to argue that they do not do so.

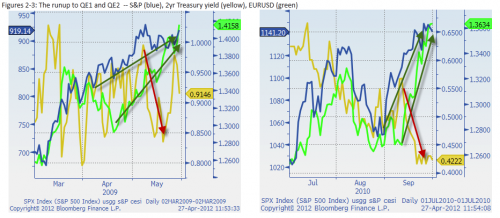

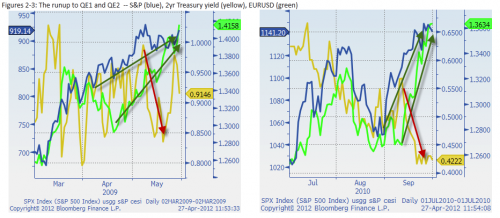

Now consider the charts below. In each case the blue line represents the S&P, the yellow line US two year yields and the green line EUR. What we see are episodes in March/April; 2009 and Aug/Sep 2010 when US 2 year yields fell and the S&P rallied. Presumably these are period when growth was disappointing (i.e. investors drop their expectations of policy rate hikes) but equity markets and the EUR rally because the low rates support valuations even in a low top-line growth environment. As a colleague expressed it, even a tiny stream of returns is worth a lot when the discount factor is close to zero. So we have a series of episodes in which risk is bid, and the euro with it, despite economic disappointment.

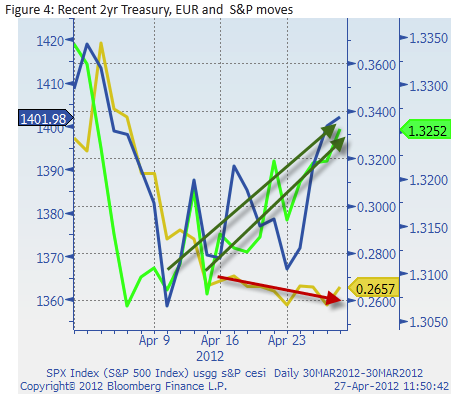

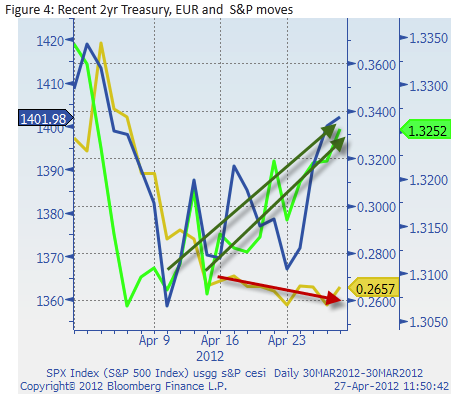

Now consider Figure 4 which shows the most recent moves in 2yr yields,the S&P and the EUR. We see a similar pattern – 2yr yields drifting down and the S&P and EUR running up. The scale of the rallies is not as big as in the other episodes but the family resemblance is there. For the USD risk-on is a negative and low rates are a negative, and that is what the market is focused on.

Bottom line for the last three years is that risk appetite can be positive on the whole, even with disappointing economic performance and this positive risk appetite and asset market environment supports the euro. From Figure 4 it is clear that the degree to which the EUR is positively correlated with risk diminished in H2 2011 when the sovereign debt crisis spread to Italy and Spain. However, no correlation that we run with respect to any indicator of risk (US S&P, EM MSCI, VIXC etc)shows a negative correlation of the euro and risk – the correlations show a diminished but still positive beta (back to Figure 1) and this is true whether the correlations are over shorter or longer spans.

The question puzzling currency markets is why the EUR is so strong. While we have argued that during the risk-off period of the last month or so post-LTRO2 (before Tuesday) EURUSD strength appeared to be driven by repatriation flows and balance sheet reduction, new information over the last couple of weeks driving the expectation that growth will be weak enough in the US to keep US policy very stimulative for a nice long time, we tend to agree with Steven Englander of Citigroup who argues that it looks very much as if QE3/Fed-stimulus anticipations are behind the EUR relative strength recently. Indeed the recent USD weakness is pretty much across the board, suggesting that it is less EUR attractiveness than USD unattractiveness that is driving the EUR’s gains. That said, I think the buzz around various euro zone measures to help out banks and ease the rigidities of the fiscal compact is also helping support the EUR by reducing tail risk, but right now the USD/Fed is the bigger story. Back of the envelope math based on the Fed/ECB balance sheets and EURUSD implies the market expects around $700bn of QE3 and given swap-spread differentials there appears to be little liquidity premium to reduce this expectation.

The current EURUSD rate implies a Fed/ECB ratio of around 1.2x which infers that the market expects around $700bn of liquidity from the Fed relative to the ECB in the short-run...

And there is little additional liquidity premium (over interest rate differential models) as swap-spreads and EURUSD begin to correlated more highly and also with risk...

Consider first the evidence that the EUR is positively correlated with risk (Figure 1).

The chart above presents the euro’s beta on changes in other measures of risk appetite. The chart is scaled so that a positive value shows a risk-positive correlated and we use two-day changes to mitigate the impact of different closing times in different markets. What it shows is that the underlying correlation of the euro with risk is positive. It is not clear why this is the case, although I would argue that a risk-positive environment makes investors more willing to tolerate tail risk than a risk off environment and the reserves accumulation/diversification cycle probably is more intense when risk is on. Investors may be wrong in trading the EUR with a positive risk correlation but it is hard to argue that they do not do so.

Now consider the charts below. In each case the blue line represents the S&P, the yellow line US two year yields and the green line EUR. What we see are episodes in March/April; 2009 and Aug/Sep 2010 when US 2 year yields fell and the S&P rallied. Presumably these are period when growth was disappointing (i.e. investors drop their expectations of policy rate hikes) but equity markets and the EUR rally because the low rates support valuations even in a low top-line growth environment. As a colleague expressed it, even a tiny stream of returns is worth a lot when the discount factor is close to zero. So we have a series of episodes in which risk is bid, and the euro with it, despite economic disappointment.

Now consider Figure 4 which shows the most recent moves in 2yr yields,the S&P and the EUR. We see a similar pattern – 2yr yields drifting down and the S&P and EUR running up. The scale of the rallies is not as big as in the other episodes but the family resemblance is there. For the USD risk-on is a negative and low rates are a negative, and that is what the market is focused on.

Bottom line for the last three years is that risk appetite can be positive on the whole, even with disappointing economic performance and this positive risk appetite and asset market environment supports the euro. From Figure 4 it is clear that the degree to which the EUR is positively correlated with risk diminished in H2 2011 when the sovereign debt crisis spread to Italy and Spain. However, no correlation that we run with respect to any indicator of risk (US S&P, EM MSCI, VIXC etc)shows a negative correlation of the euro and risk – the correlations show a diminished but still positive beta (back to Figure 1) and this is true whether the correlations are over shorter or longer spans.

Putting this together we have a currency that is risk positive through tail risk shrinkage when risk appetite is strong and a Fed that supports asset markets via low rates, despite disappointing economic asset market performance. It adds up to a weak euro when risk is off and investors do not yet anticipate a policy response and a stronger euro when the policy response arrives (carrying with it extremely unattractive yields in US asset markets).

What can go wrong? It seems to me that the market bias to buying EUR in periods of risk appetite can easily disappear if it looks as if European policymakers have lost control over the euro crisis. I would stress that recent experience suggests that investors do not care much how the euro zone deals with the tail risk as long as they find a mechanism for doing so. If not the euro and the euro zone could easily fall. It is also the case that if the euro situation becomes sufficiently dire, there will be a negative global impact both on activity and risk appetite. Our betas may not change but we can have positive betas as asset markets collapse, as easily as when they rise. To be sure the Fed has not announced, let alone implemented, an additional easing round so it is possible that the new found positive asset market environment will fade, taking the euro down with it.

Net, net I would argue that the new information over the last couple of weeks is the expectation that growth will be weak enough in the US to keep US policy very stimulative for a nice long time. Whether you like it or not, the euro remains sufficiently correlated with risk for this to be a plus.

As a footnote, earlier this week, I presented some evidence that in H2 2012, balancing sheet cutting and repatriation of foreign assets may have also helped the euro. The two explanations are not necessarily inconsistent, but I would argue that in a positive risk environment the dominant factor would be investors risk appetite, provided that the sovereign debt crisis was not in an acute stage.

Читайте на SMART-LAB:

Amazon: картину роста ухудшат рекордные инвестиции в ИИ-инфраструктуру

Теперь клиенты БКС могут инвестировать в акции США и получать «дивиденды» без риска блокировки с помощью CFD. О возможностях продукта можно узнать здесь . → Открыть счет CFD У нас...

11:16

Более половины россиянок считают ювелирные украшения инвестицией

Каждая пятая считает покупку ювелирных украшений надежным способом вложения денег, а 26% рассматривают подобный вариант накопления, однако относят его к списку рискованных. При этом свыше...

10:09

Ключевые тезисы по итогам раскрытия финансовых результатов за 2025 г. и ожидания на 2026

☝️На днях мы опубликовали финансовые результаты по итогам 2025 г., а также провели коммуникацию с участниками рынка, в рамках которой обсудили наши текущие результаты и ситуацию в российской...

10:17

Норникель: отчет за 2025 год вселяет оптимизм, хорошо поработали с расходами и отчитались лучше прогноза, впереди рост прибыли и высокие цены на металлы

Норникель сегодня выпустил отчет за 2025 год

Компания заработала 10 рублей чистой прибыли на 1 акцию (за 1-е полугодие 2025 года было 4 рубля). Неплохо!

Сразу сравниваю со своим...

11.02.2026

smart-lab.ru/blog/52703.php

было уже и в переводе

я могу сам туда зайти и прочитать, а тому кто не заходит нужен перевод, мне кажется.