12 августа 2013, 18:19

MUX Long.

McEwen Mining Inc. (MUX)(MUX.TO) is pleased to provide a summary of the Company's Q2 operating results. During the quarter the Company delivered record production at lower costs.

Q2 Summary Highlights

Gold equivalent production increased to 35,955 ounces (20,988 gold ounces and 778,308 silver ounces). This is approximately 44% higher than Q2 2012 and 20% higher than Q1 2013.

On target to produce 130,000 gold equivalent* ounces in 2013.

Total cash costs and all-in sustaining costs were $744 and $1,108 per gold equivalent ounce. Total cash costs were 9% lower than Q2 2012 and 22% lower than Q1 2013. All-in sustaining costs were 33% lower than Q1 2013.

El Gallo 1 and 2 Measured and Indicated gold equivalent resources increased by 34% to 2.1 million ounces (48.2 million tonnes at 1.37 gpt AuEvq).

At June 30, 2013 Financials: $39.3 million in liquid assets and no debt.

The Company recorded a non-cash impairment charge of $123.6 million related to the decline in metal prices and an associated tax being proposed in Argentina.

* Gold equivalent calculated by converting silver into gold using a 52:1 exchange ratio. This ratio was established on January 30, 2013 and was used to budget the company's 2013 gold equivalent production. The silver/gold ratio does not take into account metallurgical recoveries.

«Our two mines performed well in Q2. Production was up and costs were down. We are expecting similar performance during the second half of the year and remain on target to reach our 2013 production goals. All of our permits for El Gallo 2 have been submitted (for the mill scenario outlined in the El Gallo 2 section below) and we expect approval by the end of 2013. In addition, our exploration in Mexico continues to grow the size of the resource with a 34% increase in the Measured and Indicated categories at El Gallo 1 and 2,» stated Rob McEwen, Chief Owner.

Balance Sheet

At June 30, 2013, McEwen Mining had cash and liquid assets of $39.3 million, comprised of cash totaling $34.8 million with gold and silver bullion valued at $4.5 million. The Company remains debt free. In addition, McEwen Mining is owed $9.0 million from the Mexican government in the form of a tax refund. It is anticipated that a majority of this amount will be received by Q4.

The Company did not receive any dividends from its 49% owned San José mine in Argentina due to low precious metal prices. The El Gallo 1 mine generated $2.4 million in operating cash flow, after sustaining capital expenses.

The decline in metal prices and potential costs associated with a proposed mineral reserve tax in the Santa Cruz province in Argentina has caused the Company to perform an impairment test on its 49% interest in the San José mine and other mineral property interests in Argentina. As a result the Company recorded an after tax non-cash charge of $123.6 million. Of that amount $95.9 and $27.7 million was related to the carrying value of the San José mine and mineral property interests in Santa Cruz province, Argentina, respectively.

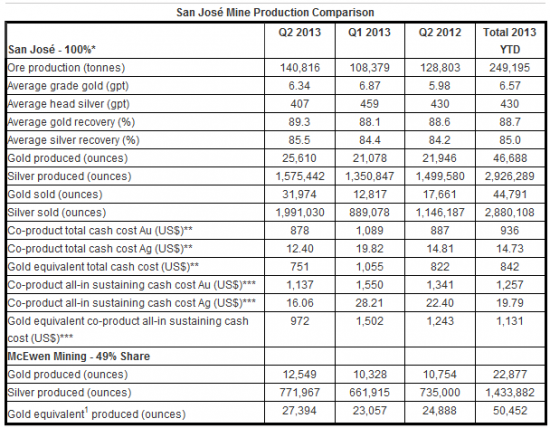

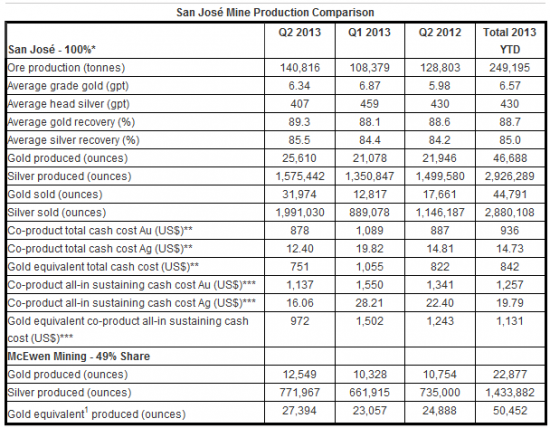

San José Mine, Argentina (49%)

Production results for McEwen Mining's share in San José during Q2 was 12,549 gold ounces and 771,967 silver ounces, representing 27,394 gold equivalent ounces (converting silver into gold using a 52:1 ratio). During the first six months of 2013, San José produced 50,452 gold equivalent ounces. Production during the second half of 2013 is forecasted to be slightly higher than in the first half of 2013. The mine is on track to meet its 2013 production guidance of 102,700 gold equivalent ounces.

Gold equivalent total cash costs equaled $751 per ounce. This is 9% less than Q2 2012 and 29% lower than Q1 2013. Total cash costs were lower for several reasons: 1) it was the first full quarter operating the mill at its expanded rate of 1,650 tonnes per day (versus 1,500 tonnes) and 2) cost savings initiatives being deployed at the mine. Total cash costs for Q2 were inline with full year guidance of between $725 and $825 per gold equivalent ounce.

All-in sustaining costs were lower than Q1 2013 by 35% at $972 per gold equivalent ounce. All-in sustaining costs were lower due to lower total cash costs (outlined above), more ounces sold during the quarter than produced, which reduced the cost on a per ounce basis and is the opposite to what occurred in Q1 (development costs in a quarter are expensed against ounces sold and not produced) and reduced exploration drilling.

* McEwen Mining holds a 49% attributable interest in the San José mine.

** In the second quarter of 2013, the Company revised its allocation of general and administrative expenses to total cash costs to conform to the Gold Institute Production Cost standard. Prior period figures have been adjusted to conform to the current methodology.

*** In the second quarter of 2013, the Company adopted the new guidance on all-in sustaining and all-in costs published by the World Gold Council on June 27, 2013. Prior period figures have been adjusted to conform to the current methodology.

Полную статью можно прочитать на YAHOO Finance

Q2 Summary Highlights

Gold equivalent production increased to 35,955 ounces (20,988 gold ounces and 778,308 silver ounces). This is approximately 44% higher than Q2 2012 and 20% higher than Q1 2013.

On target to produce 130,000 gold equivalent* ounces in 2013.

Total cash costs and all-in sustaining costs were $744 and $1,108 per gold equivalent ounce. Total cash costs were 9% lower than Q2 2012 and 22% lower than Q1 2013. All-in sustaining costs were 33% lower than Q1 2013.

El Gallo 1 and 2 Measured and Indicated gold equivalent resources increased by 34% to 2.1 million ounces (48.2 million tonnes at 1.37 gpt AuEvq).

At June 30, 2013 Financials: $39.3 million in liquid assets and no debt.

The Company recorded a non-cash impairment charge of $123.6 million related to the decline in metal prices and an associated tax being proposed in Argentina.

* Gold equivalent calculated by converting silver into gold using a 52:1 exchange ratio. This ratio was established on January 30, 2013 and was used to budget the company's 2013 gold equivalent production. The silver/gold ratio does not take into account metallurgical recoveries.

«Our two mines performed well in Q2. Production was up and costs were down. We are expecting similar performance during the second half of the year and remain on target to reach our 2013 production goals. All of our permits for El Gallo 2 have been submitted (for the mill scenario outlined in the El Gallo 2 section below) and we expect approval by the end of 2013. In addition, our exploration in Mexico continues to grow the size of the resource with a 34% increase in the Measured and Indicated categories at El Gallo 1 and 2,» stated Rob McEwen, Chief Owner.

Balance Sheet

At June 30, 2013, McEwen Mining had cash and liquid assets of $39.3 million, comprised of cash totaling $34.8 million with gold and silver bullion valued at $4.5 million. The Company remains debt free. In addition, McEwen Mining is owed $9.0 million from the Mexican government in the form of a tax refund. It is anticipated that a majority of this amount will be received by Q4.

The Company did not receive any dividends from its 49% owned San José mine in Argentina due to low precious metal prices. The El Gallo 1 mine generated $2.4 million in operating cash flow, after sustaining capital expenses.

The decline in metal prices and potential costs associated with a proposed mineral reserve tax in the Santa Cruz province in Argentina has caused the Company to perform an impairment test on its 49% interest in the San José mine and other mineral property interests in Argentina. As a result the Company recorded an after tax non-cash charge of $123.6 million. Of that amount $95.9 and $27.7 million was related to the carrying value of the San José mine and mineral property interests in Santa Cruz province, Argentina, respectively.

San José Mine, Argentina (49%)

Production results for McEwen Mining's share in San José during Q2 was 12,549 gold ounces and 771,967 silver ounces, representing 27,394 gold equivalent ounces (converting silver into gold using a 52:1 ratio). During the first six months of 2013, San José produced 50,452 gold equivalent ounces. Production during the second half of 2013 is forecasted to be slightly higher than in the first half of 2013. The mine is on track to meet its 2013 production guidance of 102,700 gold equivalent ounces.

Gold equivalent total cash costs equaled $751 per ounce. This is 9% less than Q2 2012 and 29% lower than Q1 2013. Total cash costs were lower for several reasons: 1) it was the first full quarter operating the mill at its expanded rate of 1,650 tonnes per day (versus 1,500 tonnes) and 2) cost savings initiatives being deployed at the mine. Total cash costs for Q2 were inline with full year guidance of between $725 and $825 per gold equivalent ounce.

All-in sustaining costs were lower than Q1 2013 by 35% at $972 per gold equivalent ounce. All-in sustaining costs were lower due to lower total cash costs (outlined above), more ounces sold during the quarter than produced, which reduced the cost on a per ounce basis and is the opposite to what occurred in Q1 (development costs in a quarter are expensed against ounces sold and not produced) and reduced exploration drilling.

* McEwen Mining holds a 49% attributable interest in the San José mine.

** In the second quarter of 2013, the Company revised its allocation of general and administrative expenses to total cash costs to conform to the Gold Institute Production Cost standard. Prior period figures have been adjusted to conform to the current methodology.

*** In the second quarter of 2013, the Company adopted the new guidance on all-in sustaining and all-in costs published by the World Gold Council on June 27, 2013. Prior period figures have been adjusted to conform to the current methodology.

Полную статью можно прочитать на YAHOO Finance

статья если в двух словах об отчете за второй квартал MUX

В целом я плотно начал на прошлой неделе набирать производителей золота и серебра MUX, AU, ABX и тд.

Вижу очень неплохой потенциал. Тем более квартальные отчеты это подтверждают…