16 июля 2013, 23:20

Голдман предполагает снижение цены акций Тесла Моторс до 84$

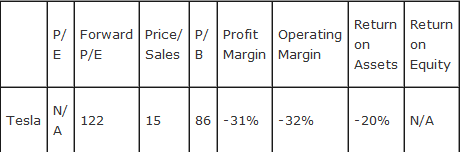

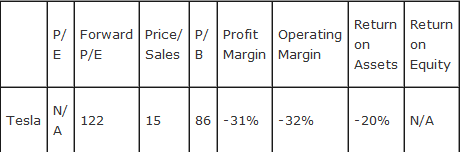

We now value Tesla by taking the average of 3 scenarios. In the first scenario, we assume total sales of 105K (Model S: 50K units, Next Gen: 55K) and operating margins of 14.6% implying an EPS of $5.99. Layering on a 20x multiple given the growth prospects implies a value of $120 which discounted at 20% implies a stock price of $58. We then look at a bull case where we assume that TSLA will be able to get approximately 3.5% global market share in the entry lux and mid-lux category suggesting total volumes of 200K units. The 3.5% market share assumption is consistent with the typical 3-5 year share gains seen by the most successful industry players across multiple luxury sub-segments over the past decade. We assume an operating margin of 15.2% in this scenario, which is slightly better than the 15% guidance that TSLA has provided as we see TSLA benefitting from better operating leverage given higher volumes. The implied stock price in this scenario comes at $113. We also value Tesla in a mid-case where we assume volumes of 150K units and operating margins of 14.8% which is broadly the mid-point of the two scenarios. The implied price in this scenario is $83. Finally, we take the average of these three scenarios to get our target price of $84.

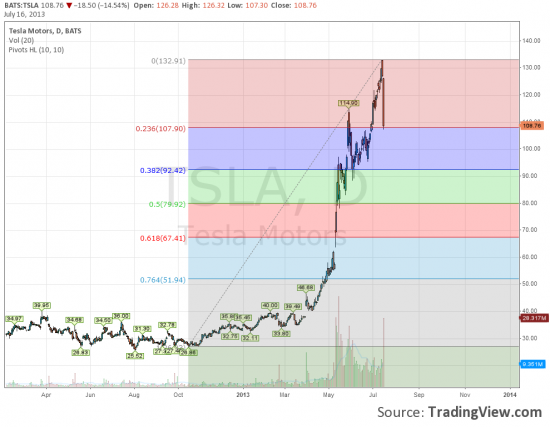

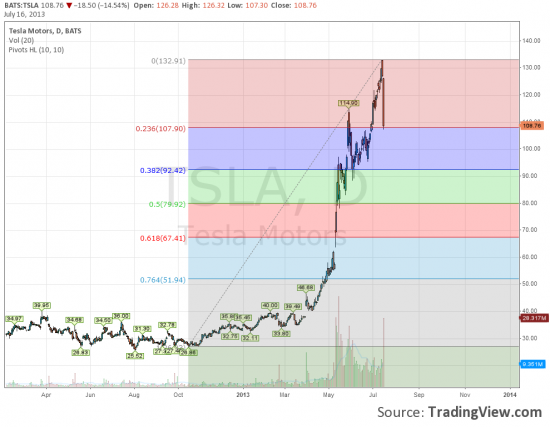

Мой целевой уровень по акциям данной компании 80-79

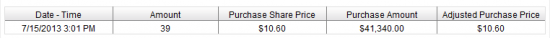

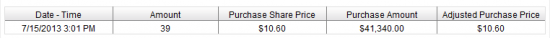

Вчера были набраны

августовские путы 125 страйка

и

сентябьские путы 120 страйка

Сегодня их скину далее буду ожидать пробоя уровня в 108 дол

После этого шорты будут возобновлены.

p.s.

На текущий момент акции компании явно раздуты сильно.

Пузырь начал сдуваться.

Мой целевой уровень по акциям данной компании 80-79

Вчера были набраны

августовские путы 125 страйка

и

сентябьские путы 120 страйка

Сегодня их скину далее буду ожидать пробоя уровня в 108 дол

После этого шорты будут возобновлены.

p.s.

На текущий момент акции компании явно раздуты сильно.

Пузырь начал сдуваться.

Читайте на SMART-LAB:

Софтлайн полностью погасил пятый выпуск облигаций

Друзья, рады сообщить, что сегодня мы полностью погасили выпуск облигаций серии 002Р-01 на сумму 6 млрд рублей. Все обязательства перед держателями облигаций SOFL выполнены в полном объеме и в...

13:44

Вышел эфир RENI для Bazar

Благодарим платформу Bazar за приглашение на разговор! Хотя, видео вышло с заголовком «Шокирующая правда о рынке страхования в 2026 году | Ренессанс Страхование», единственное, чем мы хотели...

11:59

Обновление терминала БКС: ускорение стакана и сохранение шаблонов рабочих столов

Мы продолжаем развивать терминал для более комфортной и быстрой торговли. В очередном обновлении — два заметных улучшения, которые экономят время, повышают персонализацию и помогают безопасно...

12:43

Россети Центр и Приволжье. Отчет об исполнении инвестпрограммы за Q4 2025г. Дивидендная база по РСБУ удивляет.

Компания Россети Центр и Приволжье (сокр. ЦиП) опубликовала отчет об исполнении инвестпрограммы за Q4 2025г., где показаны финансовые показатели компании по РСБУ в 4 квартале (ну и понятно...

18.02.2026

Такой тайминг — это невероятно круто :)

ЗЫ. В каких еще акциях есть подобная идея?