S&P500 фьючерс | SPX

-

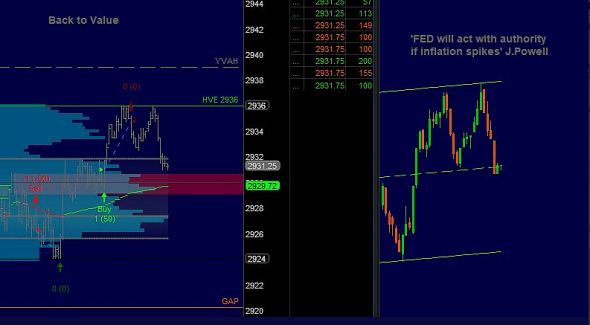

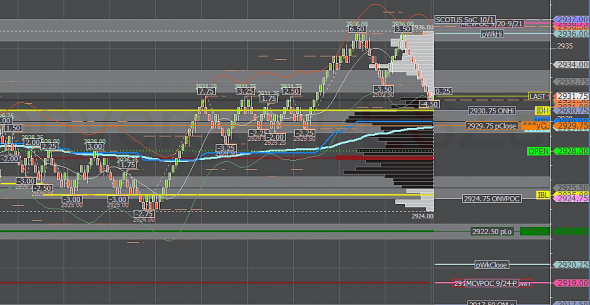

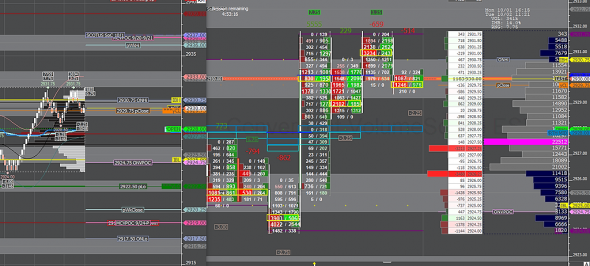

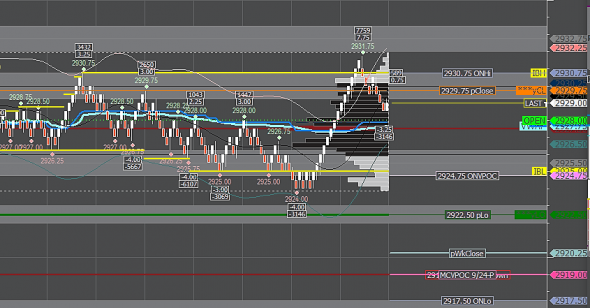

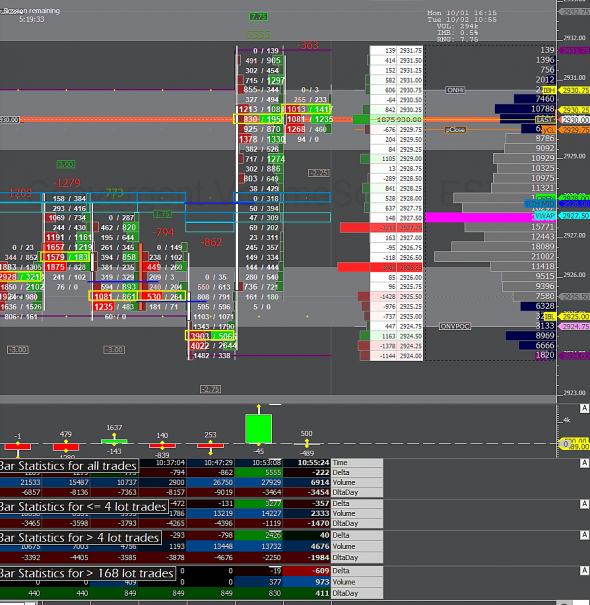

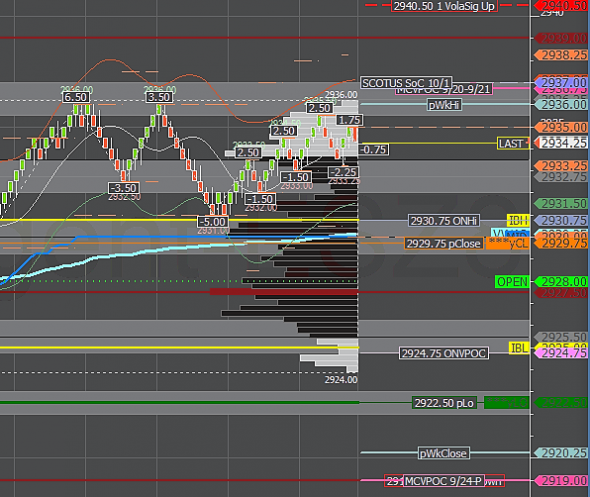

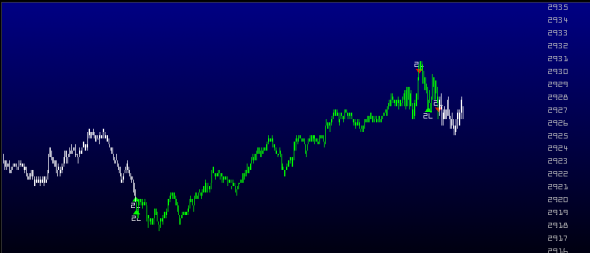

trading CME long ES

trading CME long ES

По мере времени и возможности делюсь сигналами ES GC CL 6E в трейдинг руме t.me/Trading_CME

читать дальше на смартлабе

CME Group Averaged 17.5 Million Contracts Per Day in September 2018, Up 3% from September 2017

CME Group Averaged 17.5 Million Contracts Per Day in September 2018, Up 3% from September 2017

www.cmegroup.com/media-room/press-releases/2018/10/02/cme_group_averaged175millioncontractsperdayinseptember2018up3fro.html

S&P500 фьючерс | SPX

Фьючерс S&P500Торгуется на CME, тикер ES

На Московской бирже есть аналогичный фьючерс US500

Спецификацию и котировки можно найти тут: https://smart-lab.ru/q/futures/ (Ищите наиболее ликвидный символ US)