07 марта 2017, 16:24

Америка сегодня. Торговый баланс и потребительские кредиты.

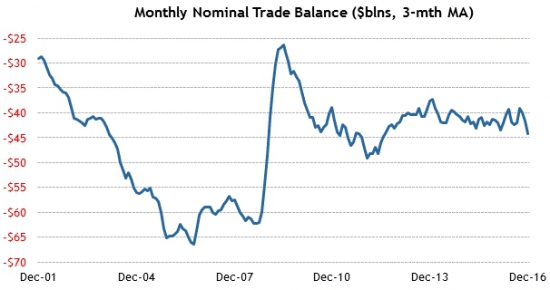

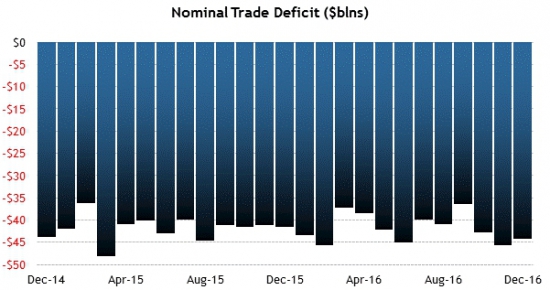

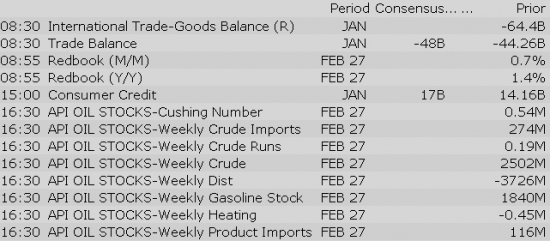

Ожидается значительное снижение торгового баланса до отметки -49 млрд:

Это приблизит торговый дефицит к своим своим максимальным отметкам:

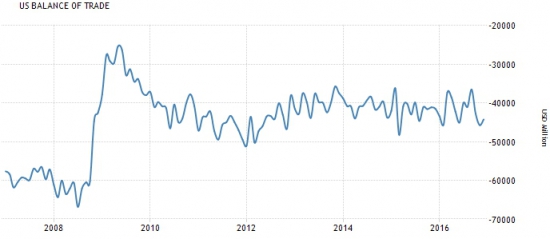

На десятилетней картине это значение приближает нас к отметкам 2008-го года:

Разрыв начинает увеличиваться из-за значительного увеличения импортной составляющей, которая в этом месяце прибавит по ожиданиям аналитиков до 5 млрд и приблизится к отметке 240:

При этом экспорт также увеличивается, но более медленными темпами:

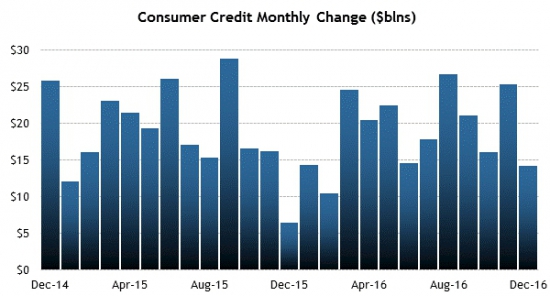

Прирост в кредитах потребителей ожидается на уровне прошлого значения, около отметки $15 млрд:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

Market Updates:

US Econ Data

Stocks with favorable mention: BAC, DPZ, ROP, T, WBT, WDC

Stocks with unfavorable mention: CAB, FTR, WRD

Gapping down: KTWO -8%, AKBA -6.3%, CASY -6.3%, PCRX -4.9%, LPCN -4.6%, ALOG -4.2%, SNAP -4%, HASI -3.9%, P -3.8%, FTR -3.3%, THO -3%, DAVE -2.7%, KFY -2.7%, STAY -2.6%, RIG -2.6%, FRC -2%, DB -1.7%, TOT -1.3%, ASNA -1.3%, NVS -1.1%, NEWT -1%, JBT -0.9%, CS -0.9%, SNY -0.9%, CLLS -0.8%, BBVA -0.7%, ABX -0.7%, RDS.A -0.6%, AMID -0.6%, URRE -0.5%

Equity indices in the Asia-Pacific region ended Tuesday on a mixed note. The Reserve Bank of Australia left its key interest rate unchanged at 1.50%, but did upgrade its economic assessment, noting that exports have improved and non-mining business investment has increased over the past year. Separately, the U.S. began shipping THAAD missiles to South Korea in response to the latest missile test by North Korea. The deployment of the THAAD system has been opposed by China.

---Equity Markets---

---FX---

«We posted the 12th consecutive quarter of record revenues and record net income from continuing operations. We posted strong growth in revenues, both organically and from acquisitions, in the second quarter with double-digit organic growth in both segments — towables and motorized. We are optimistic about Thor's future prospects, as we continue to see new consumers entering the market and experiencing the RV lifestyle.»

THO -4.7% testing support near 110 premarket.

Upgrades:

Downgrades:

Miscellaneous:

Major European indices trade near their flat lines while the euro (1.0570) and pound (1.2191) hold respective losses of 0.1% and 0.4% against the dollar. Disappointing factory orders data from Germany has been cited as the reason for the cautious tone. German Chancellor Angela Merkel made a case for a «multi-speed» European Union in order to allow member states to confront issues at their own speed. Chancellor Merkel will stand for a fourth term this fall. In other political news, France's Conservative Political Committee backed Francois Fillon's candidacy after Alan Juppee ruled out running for office.

---Equity Markets---

Treasuries Unchanged Ahead of 3-Year Note Auction

Monday's selling pressure has extended into Tuesday morning as equity futures point to a slightly lower open on Wall Street. The S&P 500 futures trade three points (0.1%) below fair value.

It is worth noting that the House Republicans unveiled their first attempt at replacing the Affordable Care Act on Monday evening. The bill is expected to be voted on in House committees later this week.

U.S. Treasuries trade relatively flat this morning as fixed-income markets continue to digest last week's aggressive campaign by Fed officials to prepare markets for the possibility of a March 15 rate hike. The benchmark 10-yr yield is currently unchanged at 2.50%.

Crude oil shows a gain of 0.5% in early action as investors continue to weigh OPEC supply cuts against increased U.S. production. The energy component currently trades at $53.47/bbl.

Today's economic data will include January Trade Balance (Briefing.com consensus -$48.5 billion) at 8:30 ET and January Consumer Credit (Briefing.com consensus $17.0 billion) at 15:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select EU financial names showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select EU financial names showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

The S&P 500 futures trade four points (0.2%) below fair value.

Just in, the January trade balance showed a deficit of $48.5 billion, which is in line with the Briefing.com consensus. The previous month's deficit was left unrevised at $44.3 billion.