Нефть падает ниже 50$ после самых больших запасов в Кушинге с января 2009

http://www.zerohedge.com/news/2016-12-07/crude-tumbles-below-50-after-biggest-cushing-build-2008

Crude prices are lower this morning following API's huge reported build at Cushing (biggest since 2008) and fears over OPEC deal realities. With expectations for a crude draw (on lower imports), DOE confirmed a bigger than expected overall draw but also Cushing saw a 3.78mm barrel build — the biggest since Jan 2009. Both Distillates and Gasoline (most since Jan) also saw bigger than expected builds as US production dropped very modestly.

API

- Crude -2.21mm (-1.37mm exp)

- Cushing +4.01mm (+2.87mm exp) — biggest since 2008

- Gasoline +828k (+1.59mm exp)

- Distillates +4.08mm (+1.24mm exp)

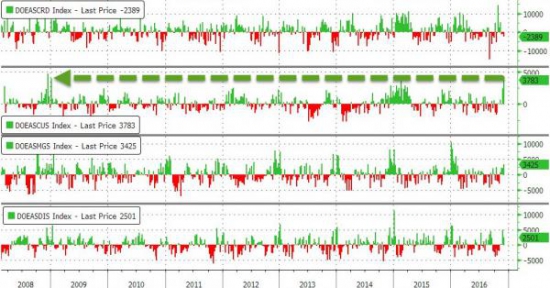

- Crude -2.389mm (-1.37mm exp)

- Cushing +3.783mm (+2.87mm exp) — biggest since Jan 2009

- Gasoline +3.425mm (+1.59mm exp) — biggest since Jan 2016

- Distillates +2.501mm (+1.24mm exp)

Biggest Cushing build since Jan 2009 offsets the bigger than expected draw in crude overall...

Here is the breakdown, courtesy of Reuters.

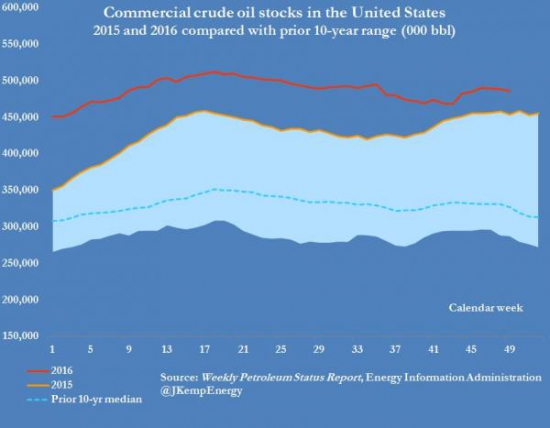

Commercial crude stocks -2.4 million bbl to 486 million bbl last week, now +32 million bbl (+7.1%) above prior year level

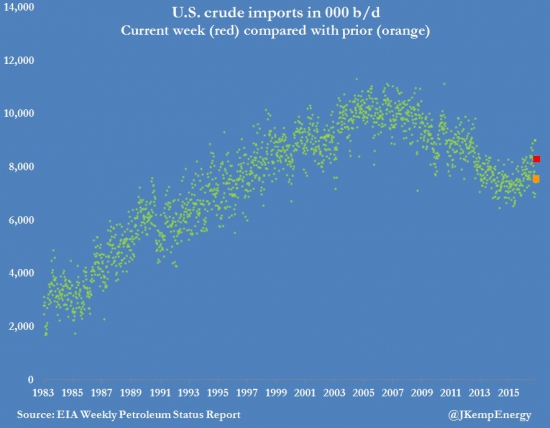

Crude imports jumped last week to 8.3 million b/d, up from 7.5 million b/d the prior week.

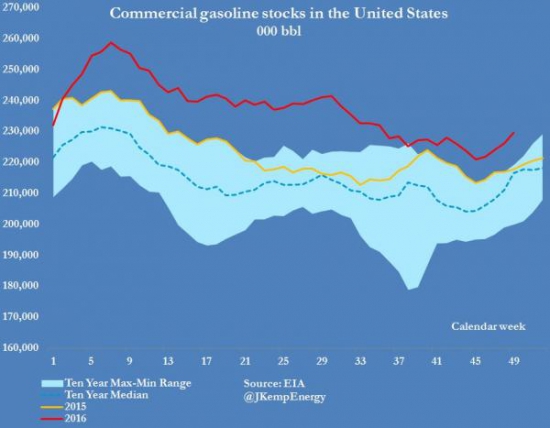

Gasoline stocks rose +3.4 million bbl to 230 million bbl last week and are now +11.9 million bbl (+5.4%) above 2015 level:

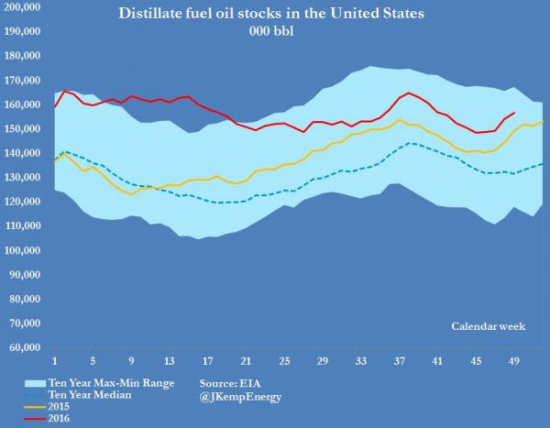

Distillate stocks rose +2.5 million bbl to 157 million last wk at time of year when they would normally be falling thanks to warm weather

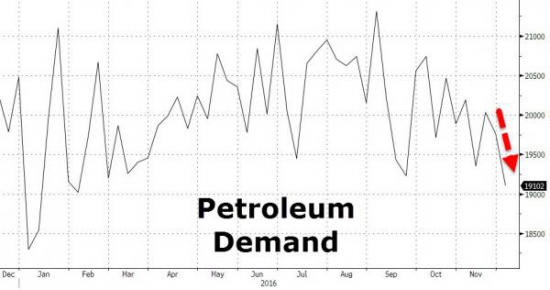

As Bloomberg notes, demand for petroleum products fell to the lowest levels since February. Not uncommon for this time of year.

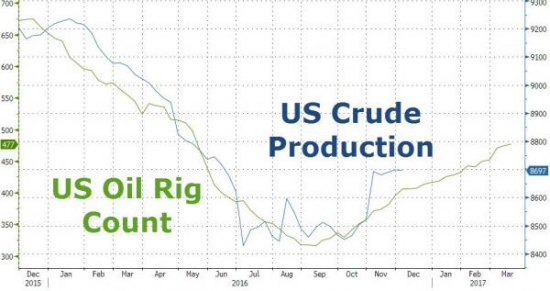

As the US rig count continues to rise so the trend of US crude production has turned, but it dropped very modestly over the last week...

And the reaction in crude (after overnight weakness but energy stock strength) was evident, breaking back below $50...

Energy stocks — which were up almost 1% with oil already lower — have tumbled back to unch...

In context, OPEC deal gains are disappearing..

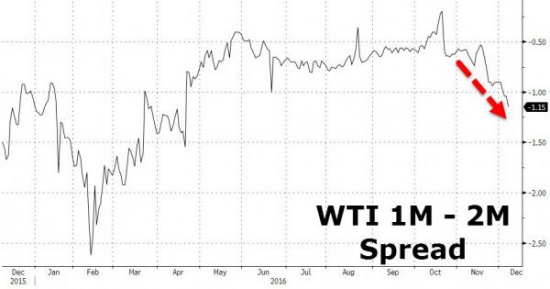

Notably the surge in Cushing inventories has put more pressure on the front-month spread...

это ж надо проглотить такое фуфло — если инопланетяне неОПЕК сократят на 600, то мы сократим на 1200… бугагашки!