05 мая 2014, 14:06

Article: Volumes after the news.

Today's article focuses on how to interpret the volume futures after the news. The trend is formed when large volume goes the market. Most often, strong accumulation of large volumes place after release of important news, as well as news releases, when current value is very different from the previous value. I do not consider the specific values published news and speech at the meetings.

MM (market maker) — is a major dealer or the player who support liquidity and regulates the prices of a trading floor in agreement with the exchange. After the release of the news MM often have to provide liquidity to the market, so I will consider that these volume accumulations are the true. Because the number of bulls and bears is the highest on the highs and lows of the market, so MM forced to participate, providing liquidity all market participants. It proves that MM present at the extremums of the market. Therefore, the price goes in the opposite direction, when liquidity is fully provided to all participants, that is, the market is saturated and there are not willing market participants, which want to buy or sell at the disadvantageous prices. But there are situations when the price goes above / below the extremum, again showing large amounts. In this case, we can expect when the price will return to the previous level of accumulation of large volumes.

Therefore the main task — to open positions in the direction of movement of a market maker.

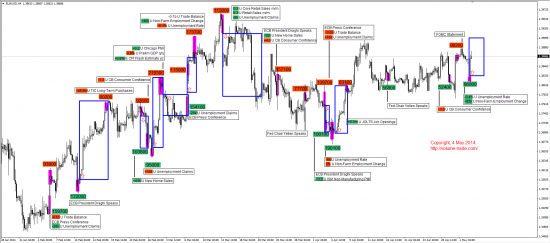

We examine the impact of news and volumes on price movement, for example chart of the futures E6 01.02.2014-03.05.2014. There are all large volumes (total volume at highlighted areas) and news. As you can see, a large volume clusters are concentrated after published news. Therefore, it proves once again that this volume is the key to work in the direction of MM.

List of significant news and speeches: ECB President Draghi Speaks, Fed Chair Yellen Speaks, ECB Press Conference, FOMC Statement, Unemployment Rate, Non-Farm Employment Change, Unemployment Claims, CB Consumer Confidence, Prelim GDP, Trade Balance, New Home Sales.

I propose algorithm of works with the volume after the news. First of all I define the last accumulation of large amounts and calculate its value. If it is much greater than the previous accumulation, it is likely that the price will go in the opposite direction. If the value is less than the previous accumulation, the movement will continue in the same direction as before the release of the latest news.

The next step — defining objectives. I define a target in time — before the next important news, and on volume — I close position on the formation volume, if it is greater than the on the level of opening positions. Of course do not forget about the risks. Most often stoploss exhibit for provocation on previous news, or in the previous formation of large volumes.

Источник статьи: http://volume-trade.com/articles/

Сегодняшняя статья посвящена тому, как интерпретировать объем фьючерсных после новостей. Тенденция образуется, когда большой объем идет на рынок. Чаще всего, сильный накопление больших объемов разместить после выхода важных новостей, а также пресс-релизов, когда текущее значение очень сильно отличается от предыдущего значения. Я не считаю конкретные значения опубликованные новости и речь на заседаниях.

ММ ( маркет-мейкер ) — является одним из основных дилеров или игрок, который поддерживает ликвидность и регулирует цены на торговой площадке в соответствии с обменом. После выпуска новостей ММ часто приходится предоставлять ликвидность на рынок, поэтому я буду считать, что эти объемные скопления являются правдой. Поскольку количество быков и медведей является самой высокой на взлеты и падения рынка, поэтому ММ вынуждены участвовать, обеспечение ликвидности всех участников рынка. Это доказывает, что ММ представит на экстремумов рынка. Таким образом, цена идет в противоположном направлении, когда ликвидности в полном объеме резерв для всех участников, то есть, рынок насыщен и нет желающих участников рынка, которые хотят купить или продать на невыгодных цен. Но бывают ситуации, когда цена поднимается выше / ниже экстремума, снова показывая большие объемы. В этом случае, мы можем ожидать, когда цена вернется на прежний уровень накопления больших объемов.

Поэтому главная задача — открывать позиции в направлении движения маркет-мейкера.

Мы изучить влияние новостей и объемов на ценовом движении, например графике фьючерсов E6 01.02.2014-03.05.2014. Есть все большие объемы ( общий объем на выделенных участках ) и новости. Как вы можете видеть, большая кластеры объем сосредоточены после опубликованной новости. Таким образом, это еще раз доказывает, что этот объем является ключевым для работы в направлении ММ.

Список значимых новостей и выступлений: Президент ЕЦБ Драги говорит, ФРС Председатель Йеллен Говорит, пресс-конференции ЕЦБ, ФРС себе, безработицы, Non-Farm Изменение занятости, безработицы Претензии, CB Consumer Confidence, Предварительный ВВП, торговый баланс, продажи новых домов.

Я предлагаю алгоритм работ с объемом после новостей. Прежде всего, я определить последнюю накопление больших количествах и рассчитать его стоимость. Если это намного больше, чем в предыдущем накопления, вполне вероятно, что цена пойдет в обратном направлении. Если значение меньше, чем в предыдущем накопления, движение будет продолжать в том же направлении, что и до выхода последних новостей.

Следующий шаг — определение целей. Я определяю цель во времени — до следующего важных новостей, а по объему — я закрываю позицию по объему пласта, если она больше, чем на уровне открытия позиций. Конечно не стоит забывать о рисках. Чаще стоп-лосс выставляется на провокации предыдущей новости, или в предыдущем формирования больших объемах.