11 августа 2013, 21:57

When preparation meets opportunity – Long QCOR by Igor D

Небольшая статья на английском о моей самой прибыльной сделке в этом году. Надеюсь вам будет интересно её прочитать.

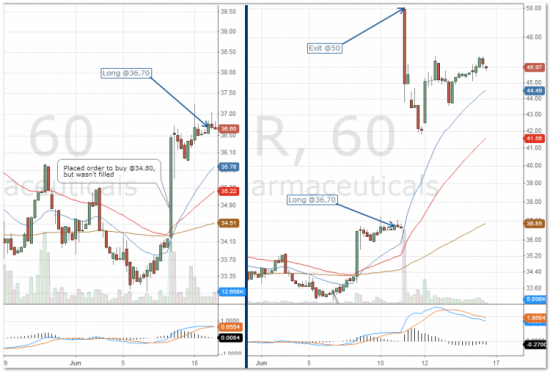

After QCOR made its new high around 42 back in May and started to decline, I watched it carefully, waiting for pullback to develop and looking for a good entry point in my private account. At the end of May and during the first days of June price started to form a bottom near EMA22 on the daily chart. After the Impulse turned blue on the daily on June 6, I decided to go long the next day, unless the signal reversed. The next day price rallied, and while I was placing my limit order to buy at 34.80, it ran up to 36.50, with my order left unfilled. As I try not to chase prices, I waited for another pullback. I also decided to submit this pick in SpikeTrade.

For my trading plan I wrote: “I would like to see a pullback and the formation of a higher low on intraday charts — this will be my primary entry trigger. The second entry trigger will be breaking above Friday’s high.” On Monday price rallied above previous Friday’s high at the open, allowing me to go long on my secondary entry trigger, but I decided to wait a bit more, in case there will be pullback, because I really wanted to go long on my primary entry trigger. Price did pull back during the next hour, but only very slightly, and started to consolidate in a very tight channel. As hourly EMA22 was rising, and price was holding at highs, I decided to go long if price started moving higher from that consolidation range.

As I wrote in my pick description, short interest in QCOR was a massive 42.52% of its float. This meant that there was a high probability of a short squeeze – a strong price rally without pullbacks. Price action suggested that maybe the short squeeze had already started, and if prices started rising again, then shorts would be forced to exit at higher prices, driving price even higher. So as price moved out of tight consolidation range, I placed order to buy at 36.70, which was filled. For the rest of the day price did not moved significantly, closing near my entry level. I decided to keep this position overnight as the daily chart looked good, and my stop-loss was quite wide, allowing me calmly to wait and see.

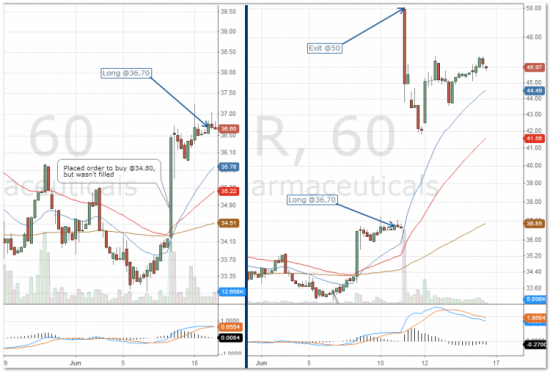

On Tuesday I turned on my terminal 2 hours before the open and saw that QCOR was up 5% in pre-market trading, with quite a good volume. I checked the news, and the only one I saw was saying that “Questcor Pharmaceuticals Acquires Rights to Synacthen® drug from Novartis”. (Btw my sister works for Novartis office here in Estonia, but she doesn’t have access to this kind of information, so there was no inside information for me :) ) As it turned out, this was the catalyst for the final short squeeze and capitulation. As the opening neared, the price kept rising higher and higher. At a point when price was showing gain of 14%, I thought that this was going to be enough for me, and I should cover at least half of my position at the open, and also close my SpikeTrade position. But price kept moving higher and higher and volume was already the same as the average for the QCOR trading day. When price was at 50 right before the open, I took a look at a profit I had in my account, and thought that I surely have to grab it. So I changed my plan a bit, placing order to sell ¾ of my shares at 50, also placing order to sell at 50 on SpikeTrade. I left ¼ of position open, in case price will continue going higher straight after market opens. As price failed to go straight up, and moved below 50, I quickly sold my remaining shares at 49.52.

So my trade was closed with the best gain I ever had, both in SpikeTrade and in my personal account. As Alex mentioned in his NH-NL post this week, this trade definitely had the element of luck. One of my favorite sayings is “Good luck is what happens when preparation meets opportunity.” I was definitely prepared for this trade, and traded according to my plan, and that makes that luck even sweeter for me.

Best wishes from Estonia,

Igor D

Оригинал: http://www.spiketrade.com/weeklygold.php?id=245

After QCOR made its new high around 42 back in May and started to decline, I watched it carefully, waiting for pullback to develop and looking for a good entry point in my private account. At the end of May and during the first days of June price started to form a bottom near EMA22 on the daily chart. After the Impulse turned blue on the daily on June 6, I decided to go long the next day, unless the signal reversed. The next day price rallied, and while I was placing my limit order to buy at 34.80, it ran up to 36.50, with my order left unfilled. As I try not to chase prices, I waited for another pullback. I also decided to submit this pick in SpikeTrade.

For my trading plan I wrote: “I would like to see a pullback and the formation of a higher low on intraday charts — this will be my primary entry trigger. The second entry trigger will be breaking above Friday’s high.” On Monday price rallied above previous Friday’s high at the open, allowing me to go long on my secondary entry trigger, but I decided to wait a bit more, in case there will be pullback, because I really wanted to go long on my primary entry trigger. Price did pull back during the next hour, but only very slightly, and started to consolidate in a very tight channel. As hourly EMA22 was rising, and price was holding at highs, I decided to go long if price started moving higher from that consolidation range.

As I wrote in my pick description, short interest in QCOR was a massive 42.52% of its float. This meant that there was a high probability of a short squeeze – a strong price rally without pullbacks. Price action suggested that maybe the short squeeze had already started, and if prices started rising again, then shorts would be forced to exit at higher prices, driving price even higher. So as price moved out of tight consolidation range, I placed order to buy at 36.70, which was filled. For the rest of the day price did not moved significantly, closing near my entry level. I decided to keep this position overnight as the daily chart looked good, and my stop-loss was quite wide, allowing me calmly to wait and see.

On Tuesday I turned on my terminal 2 hours before the open and saw that QCOR was up 5% in pre-market trading, with quite a good volume. I checked the news, and the only one I saw was saying that “Questcor Pharmaceuticals Acquires Rights to Synacthen® drug from Novartis”. (Btw my sister works for Novartis office here in Estonia, but she doesn’t have access to this kind of information, so there was no inside information for me :) ) As it turned out, this was the catalyst for the final short squeeze and capitulation. As the opening neared, the price kept rising higher and higher. At a point when price was showing gain of 14%, I thought that this was going to be enough for me, and I should cover at least half of my position at the open, and also close my SpikeTrade position. But price kept moving higher and higher and volume was already the same as the average for the QCOR trading day. When price was at 50 right before the open, I took a look at a profit I had in my account, and thought that I surely have to grab it. So I changed my plan a bit, placing order to sell ¾ of my shares at 50, also placing order to sell at 50 on SpikeTrade. I left ¼ of position open, in case price will continue going higher straight after market opens. As price failed to go straight up, and moved below 50, I quickly sold my remaining shares at 49.52.

So my trade was closed with the best gain I ever had, both in SpikeTrade and in my personal account. As Alex mentioned in his NH-NL post this week, this trade definitely had the element of luck. One of my favorite sayings is “Good luck is what happens when preparation meets opportunity.” I was definitely prepared for this trade, and traded according to my plan, and that makes that luck even sweeter for me.

Best wishes from Estonia,

Igor D

Оригинал: http://www.spiketrade.com/weeklygold.php?id=245

3 Комментария

MALINI11 августа 2013, 22:04а на китайском?0

MALINI11 августа 2013, 22:04а на китайском?0

Читайте на SMART-LAB:

🛒 Фикс Прайс остался без "органики"

Ретейлер представил отчет по МСФО за 4 квартал и весь прошлый год Фикс Прайс (FIXR) ➡️ Инфо и показатели Результаты за 4 квартал — выручка: ₽85,5 млрд (+2,6%) — скорр....

13:00

⚡️ Как прошёл январь: подводим финансовые итоги первого месяца 2026 года

Публикуем финансовые результаты по итогам января 2026 года

12:42